Olesia Shadrina/iStock via Getty Images

More often than not, investing can be a complicated process that doesn’t always go the way you would like it to. These past few months in particular, we have seen a tremendous amount of volatility that has largely ended in significant downside for most companies and the investors who own shares in them. It is especially interesting, then, when you find a firm that has not only outperformed the market but also seen significant upside during this timeframe. One great example of this can be seen by looking at Mission Produce (NASDAQ:AVO), a global leader in the sourcing, producing, and distribution of fresh avocados for retail, wholesale, and food service customers. From a purely fundamental perspective, the company’s fortunes are looking up. Having said that, I do believe that the time for upside has now passed. Although it has been a good ride, shares likely don’t offer any additional upside for the foreseeable future unless something else changes fundamentally. For this reason, I have decided to decrease my rating on the company from a ‘buy’ to a ‘hold’, reflecting my belief that it’s likely to generate performance that more or less matches the market moving forward.

That was tasty

The last time I wrote an article about Mission Produce was back in late March of this year. In that article, I talked about some of the fundamental struggles the company had experienced, driven largely by a poor ERP implementation experience and unfavorable industry conditions. I made clear that, at some point, these issues would resolve themselves and that the long-term outlook, given how shares were priced, was definitely favorable for investors. This led me to rate the company a ‘buy’, which means that I felt then that upside potential for the company was likely greater than what the broader market would generate. Since then, the company has outperformed even my own expectations. While the S&P 500 has dropped by 18.7%, shares of Mission Produce have generated upside of 20.5%. To put this in perspective, $1,000 invested in Mission Produce would be worth $1,205, while that same amount put in the S&P 500 would be worth only $813.

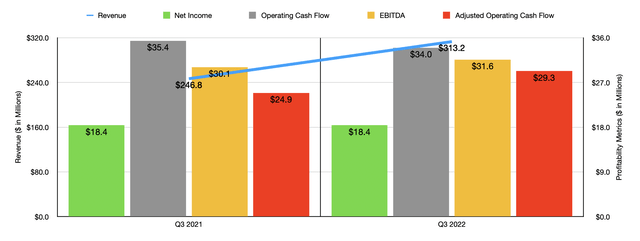

Truth be told, the picture for Mission Produce has definitely improved since I wrote about it. But I don’t think that the improvement was great enough to warrant that significant of a return disparity. To understand what I mean, we should first dig into how the company performed during the third quarter of its 2022 fiscal year. This is the most recent quarter for which data is available. During that time, revenue came in strong at $313.2 million. That represents an increase of 26.9% compared to the $246.8 million generated the same quarter one year earlier. The key driver behind this sales growth was a 42% rise in average per unit avocado pricing. This was driven, in turn, probably lower industry supply out of Mexico and by other inflationary pressures. Those same supply constraints and the higher pricing also resulted in avocado volume declining by 11% year over year.

Although it’s nice to see this revenue figure increase so much, it is also true that the company’s bottom line did not see a significant improvement. In fact, net income remained flat year over year at $18.4 million. Despite the higher sales, the company saw its gross profit margin decline from 16.6% to 13.6%. Lower avocado volume and the impact it had on fixed cost absorption negatively affected the company. There were also other issues such as the timing of costs incurred and the impact of pricing at early-stage mango farms for the company’s International Farming segment. As a result of these issues, operating cash flow dropped from $35.4 million in the third quarter of 2021 to $34 million at the same time this year. If we adjust for changes in working capital, however, it would have risen from $24.9 million to $29.3 million, while EBITDA inched up from $30.1 million to $31.6 million.

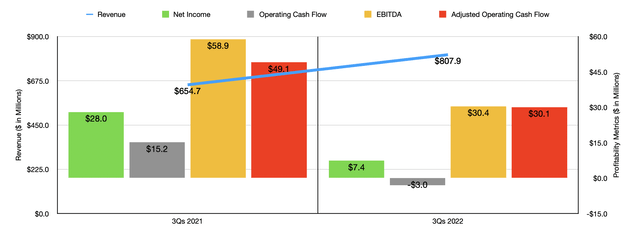

It is true that the third quarter was great from a revenue perspective but not necessarily from a profitability perspective. Even so, is worth pointing out that the third quarter was definitely better than the other quarters of the fiscal year. Yes, revenue in the first three quarters of 2022 is still up an impressive 23.4%, driven by the same factors that influenced revenue in the third quarter alone. But net income of $7.4 million is still lower than the $28 million experienced the same time last year. Operating cash flow went from $15.2 million to negative $3 million. If we adjust for changes in working capital, it would have gone from $49.1 million to $30.1 million. Even EBITDA has declined, dropping from $58.9 million to $30.4 million. But once again, we do have the aforementioned ERP implementation issues and highly irregular industry conditions affecting the business.

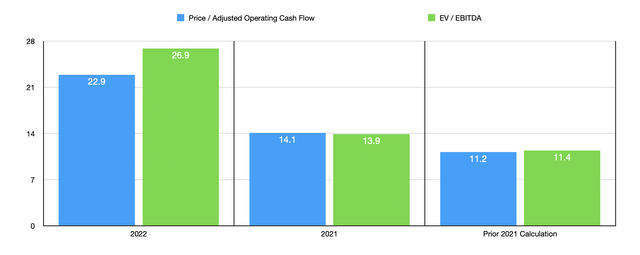

If we were to annualize results covering the first three quarters of the year, we should anticipate adjusted operating cash flow of $45.8 million for the 2022 fiscal year and its entirety. Meanwhile, the EBITDA for the firm should come in at $44 million. These members imply a price to adjusted operating cash flow multiple of 22.9 and an EV to EBITDA multiple of 26.9. But keeping in mind that we should eventually return to the level of profitability seen in 2021 or earlier, we should use data from that year instead. Doing so brings these multiples down to 14.1 and 13.9, respectively. To put this in perspective, when I last wrote about the company, these figures, using 2021 data, stood at 11.2 and 11.4, respectively. Also as part of my analysis, I compared Mission Produce to five similar firms. On a price to operating cash flow basis, these companies ranged from a low of 2.7 to a high of 68.7. Two of the five companies were cheaper than our prospect. Meanwhile, using the EV to EBITDA approach, the range was between 2.9 and 100.4. In this case, three of the five companies were cheaper than our target.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Mission Produce | 22.9 | 26.9 |

| SunOpta (STKL) | 25.3 | 28.3 |

| Adecoagro SA (AGRO) | 2.7 | 2.9 |

| B&G Foods (BGS) | 24.9 | 13.5 |

| Dole (DOLE) | 68.7 | 19.6 |

| Calavo Growers (CVGW) | 13.4 | 100.4 |

Takeaway

At this point in time, I have no doubt that Mission Produce will eventually see its bottom line results revert back to what they were in prior years. If they don’t, shares would end up being overvalued. Having said that, even a return to results from prior years would show a company that looks more or less fairly valued, both on an absolute basis and relative to similar firms. Because of this, I do believe that a more appropriate rating for the company is a ‘hold’ as opposed to the ‘buy’ I had it at earlier this year.

Be the first to comment