Investment Thesis

Last week’s swift correction in equities saw investors abandoning virtually all risky assets, even low volatility stocks and gold. The only asset class posting solid returns was Treasuries. While government bonds are a natural landing spot in a rapid “flight to safety” environment, I want to make the case for why short-term investment-grade corporate bonds still make a good choice despite the recent risk-off pivot.

Background

Last week’s sudden market correction reminds us why it’s important to have defensive portfolio positioning in mind, even when it seems like the Fed’s money printing machine will cure all of our ills. While we can sometimes see an economic contraction coming down the road, black swan type events, such as the coronavirus, come with little warning but can have a big impact.

A few weeks ago, I wrote about the iShares Short Maturity Bond ETF (NEAR) and how it can be used as both a quasi-cash alternative in a portfolio or a diversification tool to round out long-term portfolio risk. It turned out to be one of my more popular articles in recent memory and the comment thread (more than 160 in all) brought up a number of similar fixed income ETFs that could serve a similar purpose.

The one I want to look at today is the PIMCO Enhanced Short Maturity Active ETF (MINT). Like NEAR, it focuses on investment-grade short-term corporate bonds of varying maturities that have an overall portfolio duration of less than one year. I find this duration range to be an ideal target for conservative fixed income investors since it provides a solid combination of above-average dividend yield at minimal additional risk.

Overview

MINT is an actively-managed ultra-short-term investment-grade corporate bond fund that aims to maintain an overall portfolio duration of less than one year. PIMCO itself describes MINT as a cash alternative and I’d agree with its viability as such. In its current iteration, MINT has an overall duration of just 0.25 years. In comparison to a money market and its steady $1 share price, it comes with very little additional interest rate risk, an attractive feature for income seekers looking to improve their risk/return profiles.

In the current environment where the Fed is expected to continue dropping interest rates throughout the year, MINT could be in a position to tack on a modest amount of share price appreciation in addition to the higher yield.

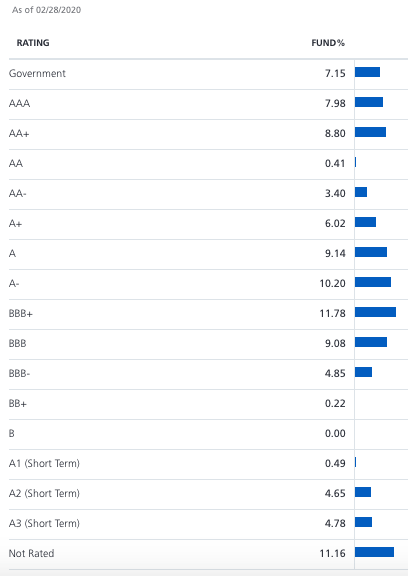

Source: PIMCO

I’ve noted many times over the past several months that investors should be avoiding the high yield bond space completely and focus solely on a higher quality fixed income. MINT eschews high yield bonds completely and the splash of government bonds it does carry in the portfolio (about 7% of assets) helps improve overall credit quality. The “Net Other Short Duration Instruments” mostly included cash positions and unrated bonds in the portfolio.

Like many other investment-grade bond portfolios, MINT overweights in the BBB category although not the degree that I think it exposes itself to undue risk.

Source: PIMCO

The 25% allocation to BBB-rated bonds actually compares favorably to other corporate bond ETFs. The iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD), one of the biggest bond funds in the industry, has nearly half of its assets in the BBB bucket and another 40% in A-rated bonds.

Most of these funds dip down into poorer quality bonds in order to boost yield, but in the current economic environment, I’d much prefer MINT’s focus higher credit quality even if it comes at the expense of yield.

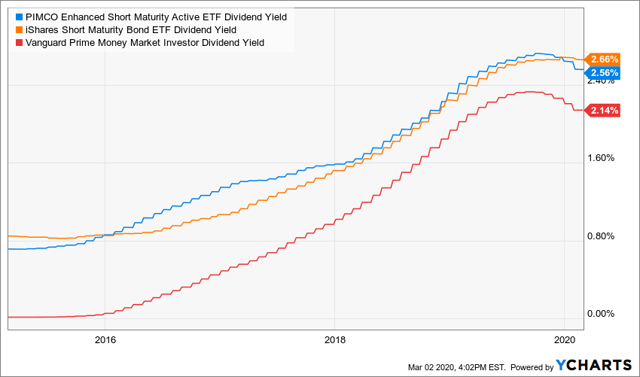

Putting MINT, NEAR, and the Vanguard Prime Money Market Fund (VMMXX) side by side, we see the MINT’s recent pivot to a more conservative allocation has cost it in yield.

Looking at trailing 12-month yields can be misleading since much of that yield was earned in a higher rate environment. As far as current yields, MINT is at 1.77%, NEAR is at 2.00%, and VMMXX is at 1.60%.

Again, this is a case of MINT maintaining a more conservative credit profile. While NEAR maintains a fully investment-grade profile as well, it has about 42% of assets in BBB-rated bonds compared to just 25% for MINT.

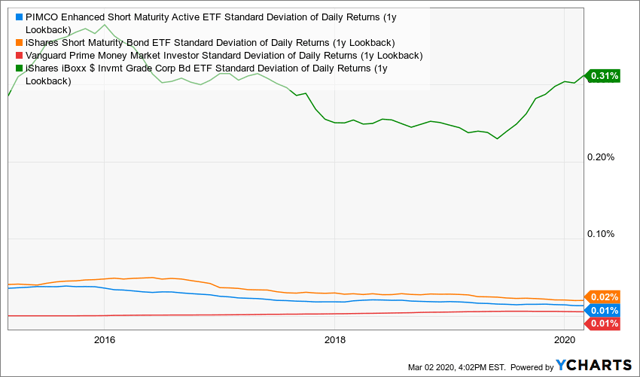

MINT may carry a relatively modest 0.17% yield premium over the money market fund right now, but that yield boost also comes with a negligible amount of added risk.

MINT has always been in the ultra-low risk category, but its recent shift towards higher quality puts it within a rounding error of the average risk level of a money market fund. LQD’s standard deviation of returns is also on the chart for comparison’s sake.

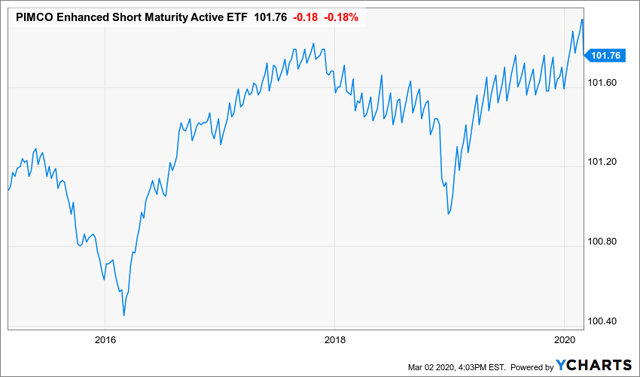

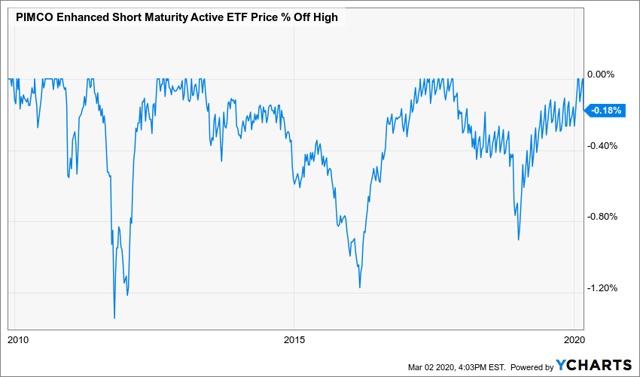

Since the industrial recession of 2016, MINT’s share price has held steady in the $101 range. Of course, since this is a corporate bond portfolio with exposure to credit risk, it will tend to fall in value during tougher market conditions as it did in both 2015/2016 and again in late 2018.

Historically, however, MINT’s share price downside has been relatively limited. On just three occasions over the past decade has the maximum drawdown reached more than 0.8%.

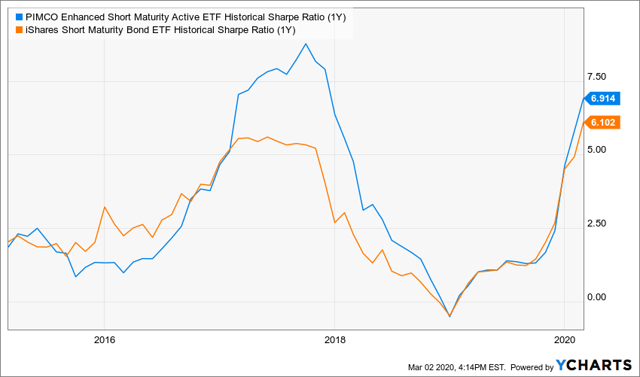

Looking to make the case why you might want to choose MINT over a peer, such as NEAR? While both tend to be similar in portfolio composition and riskiness, the risk-adjusted returns over the past few years have been superior for MINT.

Granted, this could be the case of one or the other depending upon what your objective is. Investors looking for better risk-adjusted returns might prefer MINT, while more pure yield seekers might opt for NEAR. I think you can make the argument for NEAR as long as the yield premium remains above that 0.2% level. Less than that and there might not be a huge advantage.

Conclusion

With volatility spiking and the VIX routinely residing above the 30 level, now is a good time to think about asset protection instead of asset growth. For most people, that means diving into Treasuries and gold, but that doesn’t have to be the case.

Ultra-low duration, investment-grade corporate bonds are still OK in this environment as long as the focus is on quality and risk is minimized. MINT’s recent focus on moving higher up the quality ladder into A-rated bonds and better makes it a better choice in a volatile market while not sacrificing too much in the way of yield.

With 10-year Treasury yields now dipping below the 1% level, don’t worry about adding low-risk, high quality, low duration corporate bonds to your portfolio as a yield enhancer.

Disclosure: I am/we are long VMMXX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment