Introducing The Term Premium

Through the use of economic models, academic research has decomposed the observable long-term bond yields (i.e. US 10Y Treasury bond yield) into the expected path of the real interest rate (r*) and the additional term premium, which is thought as the extra return that investors demand to compensate them for the risk associated with a long-term bond. Using the dominant measure developed by the NY Fed (Adrian et al., 2013), we overlay it with a set of macro and financial variables and look at the pros and cons of a rise in the term premium in the coming months.

Figure 1 shows that the evolution of the US 10Y yield along with the expected r* and the term premium. While we can notice that part of the fall in the 10Y was driven by the decrease in the expected r* from 3.15% to 1.80%, the elevated volatility in the short run was mainly coming from the moves on the Term Premium (TP). The TP hit a historical low of -1.47% on March 9th and is still standing at the extreme low level of -1.1%. Many investors had expected the term premium to start rising the US in 2018 and in the first half of 2019, but it surprised most of them by constantly reaching new lows.

Figure 1

Term Premium: A counter-cyclical variable

One important characteristic of the term premium is that it is a counter-cyclical variable that tends to rise when the uncertainty around unemployment (or the business cycle) and inflation expectations start to increase.

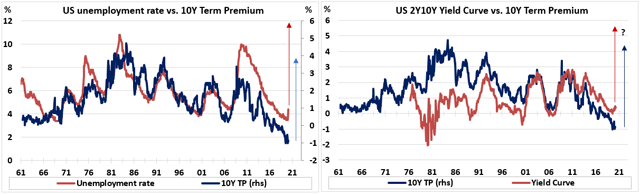

Figure 2 (left frame) shows the striking relationship between the unemployment rate and the term premium since 1961. Periods of rising unemployment have been generally associated with a sharp increase in the term premium. Now that we expect the jobless rate to skyrocket following the dismal prints of NFPs and initial claims in recent weeks, could we see a response in the term premium as well?

Figure 2 (right frame) shows another interesting relationship between the US 2Y10Y yield curve and the term premium. We know that the inversion of the yield curve is usually marked by a sharp steepening effect within the next 12 to 24 months as the economy enters a recession. This is referred to as a ‘bear steepener’ as the long end of the curve starts rising due to a surge in the term premium. Will the Fed’s emergency measures and QE purchases be enough to deprive the yield curve and term premium from rising significantly in the coming months?

Figure 2

Term Premium vs. inflation expectations

The 2-trillion USD increase in the Fed’s balance sheet as a response of COVID-19 has brought its holding of securities to a new all-time high of $5.85tr. The Fed has recently been buying $625bn of securities each week, which corresponds to an annual pace of $32.5tr and is $25bn more than the entire QE2 run between November 2010 and June 2011. The balance sheet of the Fed is now expected to hit 8 to 9 trillion USD by the end of the year in hopes that it will bring back confidence in the market. Hence, it is fair to raise the following question: will we experience rising inflation in the medium term?

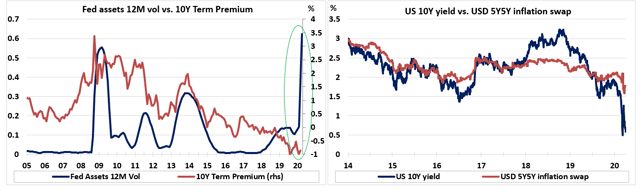

As the term premium is very sensitive to the uncertainty around inflation expectations, it shows an interesting co-movement with the 12-month volatility of the Fed’s balance sheet assets. When interest rates reach the zero bound, central banks run aggressive asset purchase programs in order to decrease the shadow rate below the neutral rate of interest rate (r*) and stimulate demand and inflation. Figure 3 (left frame) shows that previous periods of rising 12M vol in Fed assets were associated with a short-term increase in the term premium.

Investors could argue that inflation expectations have been falling if we look at the market-based measures – the USD 5Y5Y inflation swap. Figure 3 (right frame) shows that the 5Y5Y inflation swap is currently trading at a historical low of 1.75%, down from nearly 3% in January 2014. However, we previously saw that inflation swaps have been very sensitive to equity and oil prices in the past cycle; in theory, an oil shock should not impact inflation expectations as better monetary policy readjustments from central banks will offset that shock. Hence, these products represent more the demand for inflation hedges (which decreases when energy prices fall), but do not tell us anything about long-term inflation expectations.

Figure 3

Term premium and free-floating bonds

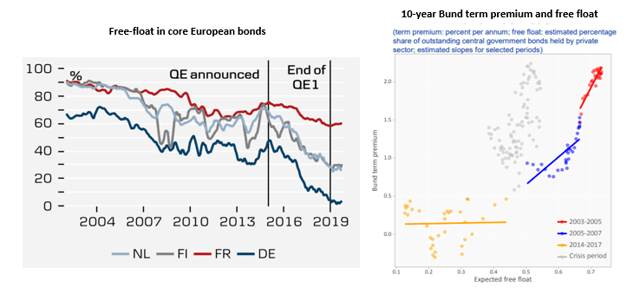

Certainly, moves on the term premium also depends strongly on the amount of free-floating securities in the market. As central banks keep increasing their balance sheet through the purchase of securities such as government bonds, the amount of free-floating bonds have dramatically been reduced in the past cycle. For instance, it was estimated that large asset-purchase programs in the Euro area have decreased the free float of German government bonds from approximately 40% in 2015 to 3% in early 2020 (figure 4, left frame). Figure 4 (right frame) shows how the relationship between the 10Y Bund term premium and the free float flattened in the past few years; low free float is associated with a flat term premium.

In the US, the amount of free float is much higher due to the large quantity of marketable debt securities (USD 16tr) held by the non-residents; non-resident holders (NRH) hold nearly 40% of the US debt. Hence, even though the Fed’s aggressive purchases will reduce the free float in the medium term, there is still the risk of a sudden rise in the term premium in the short run as the economy enters a recession.

Figure 4

To conclude, the risk of higher long-term interest rates in the US is still there in the coming months; even though we do expect long-term rates to eventually go to zero, there is still a high probability to see a little short-term surge in the 10Y yield (i.e. plunge in US Treasury prices (NASDAQ:TLT)), which would significantly steepen the yield curve coinciding with the drastic rise in unemployment.

Did you like this?

Click the “Follow” button at the top of the article to receive notifications.

Disclosure: I am/we are long USDJPY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment