benkrut

Earnings of Midland States Bancorp, Inc. (NASDAQ:MSBI) will likely remain flattish next year as loan growth will counter the effect of higher non-interest expenses. Slight margin expansion will offer some support to the bottom line. Overall, I’m expecting Midland States Bancorp to report earnings of $3.91 per share for 2022 and $3.85 per share for 2023. Compared to my last report on the company, I’ve slightly increased my 2022 estimate because I’ve reduced my non-interest expense estimate. Next year’s target price suggests a high upside from the current market price. Further, the company is offering a moderately high dividend yield. Based on the total expected return, I’m maintaining a buy rating on Midland States Bancorp.

Loan Growth, Slight Margin Expansion to Lift the Top Line

Midland State Bancorp’s loan growth has continued to remain incredibly high for four consecutive quarters that ended September 30, 2022. The portfolio grew by 7.0% in the quarter, or 27.8% annualized, taking the first nine-month growth to 18.7%, or 25% annualized. The management expects loan growth to moderate due to higher interest rates and uncertain economic conditions, as mentioned in the earnings presentation. Further, the management mentioned in the conference call that it’s planning to reduce new originations in the GreenSky portfolio, which is comprised of consumer loans. The management expects to run off $50 million of GreenSky loans in the fourth quarter. To put this number in perspective, $50 million is just 0.8% of total loans outstanding as of September 30, 2022.

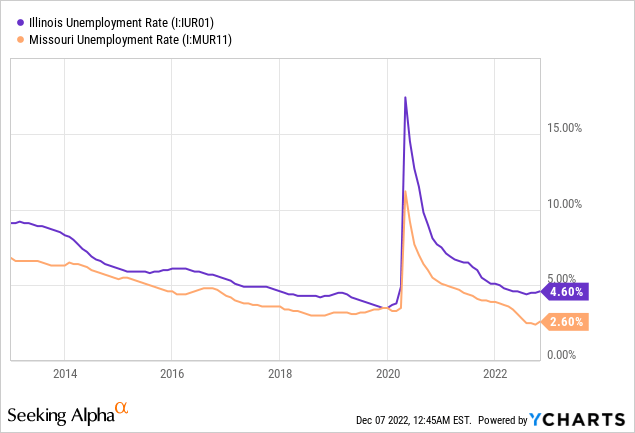

In my opinion, loan growth will most probably not dip below high-single-digit rates because of robust pipelines. The management mentioned in the presentation that its loan pipelines remain strong, especially the equipment finance pipeline. Further, strong job markets bode well for loan growth. Midland States Bancorp mostly operates in Illinois and Missouri. The state of Missouri currently has an exceptionally low unemployment rate. However, Illinois isn’t faring as well, as shown below.

Nevertheless, the employment situation for both states is very healthy in a historical context. Due to the existing job markets, I believe the appetite for commercial loans will remain robust through at least the mid of 2023.

Considering these factors, I’m expecting the loan portfolio to grow by 2% in the last quarter of 2022, taking full-year loan growth to 21%. For 2023, I’m expecting the portfolio to grow by 8%. The company has historically relied on acquisitions for growth. As there are no upcoming transactions announced so far, I have excluded this factor from my estimates. Meanwhile, I’m expecting deposits to grow in line with loans. The following table shows my balance sheet estimates.

| Financial Position | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Net Loans | 4,117 | 4,373 | 5,043 | 5,174 | 6,263 | 6,779 |

| Growth of Net Loans | 28.2% | 6.2% | 15.3% | 2.6% | 21.0% | 8.2% |

| Other Earning Assets | 694 | 673 | 824 | 955 | 705 | 734 |

| Deposits | 4,074 | 4,544 | 5,101 | 6,111 | 6,523 | 7,061 |

| Borrowings and Sub-Debt | 907 | 800 | 1,067 | 575 | 614 | 639 |

| Common equity | 609 | 662 | 621 | 664 | 705 | 740 |

| Book Value Per Share ($) | 25.8 | 27.0 | 26.6 | 29.4 | 31.5 | 33.1 |

| Tangible BVPS ($) | 17.3 | 18.6 | 18.5 | 21.2 | 23.3 | 24.8 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) | ||||||

Apart from loan growth, the top line will also receive support from some margin expansion. Around 55% of the loan portfolio is based on fixed rates, with the remaining being variable, as mentioned in the second quarter’s conference call (MSBI did not update this information for the third quarter). Therefore, the average earning asset yield is only moderately rate-sensitive. In comparison, the average deposit cost is also only moderately rate sensitive as interest-bearing demand, savings, and money market accounts made up 58% of total deposits at the end of September 2022.

The results of the management’s interest-rate sensitivity model given in the 10-Q filing show that an immediate upward rate shock of 200 basis points can increase the net interest income by 8.4% over twelve months. As the Federal Reserve has gradually ramped up the Fed Funds rate, in reality, the impact will most probably be less than that projected by the model.

Overall, I’m expecting the margin to grow by five basis points in the last quarter of 2022 and 10 basis points in 2023. Based on the margin and loan outlook, I’m expecting the net interest income to increase by 14% year-over-year in 2023.

Inflation-Driven Surge in Operating Expenses to Drag Earnings

Midland States Bancorp pleasantly surprised me by reporting low non-interest expenses for the third quarter of 2022. The management expects these expenses to remain almost flat at around $42.5 million to $43.5 million for the fourth quarter, as mentioned in the conference call. I believe this target is too ambitious given the high-inflation environment. Further, the tight labor market will continue to keep salary expenses under pressure. Therefore, I’m expecting the non-interest expenses to be higher than the management’s target.

Overall, I’m expecting non-interest expenses of $61 million for 2022, down 2%, and $55 million for 2020, up 15%. Compared to my last report on Midland States Bancorp, I’ve reduced my non-interest expense estimate for 2022 because the company’s cost discipline has surprised me so far this year. I’ve barely changed my estimate for 2023.

Expecting Flattish Earnings for Next Year

Earnings will likely be flattish in 2023 as the growth in non-interest expenses will likely cancel out the anticipated increase in net interest income. Meanwhile, provisioning for expected loan losses will likely be slightly above the historical average, just like the first nine months of 2022. Non-performing loans were 0.76% of total loans while allowances were 0.95% of total loans at the end of September 2022. This allowance coverage seems a bit tight, especially in light of threats of a recession and a high inflation environment which will give financial stress to borrowers. As a result, I’m expecting the net provision expense to make up 0.37% of total loans in 2023, slightly higher than the average of 0.31% from 2017 to 2019.

Overall, I’m expecting Midland States Bancorp to report earnings of $3.91 per share for 2022, up 9.5% year-over-year. For 2023, I’m expecting earnings to decline by just 1.5% to $3.85 per share. The following table shows my income statement estimates.

| Income Statement | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Net interest income | 180 | 190 | 199 | 208 | 249 | 283 |

| Provision for loan losses | 9 | 17 | 43 | 3 | 24 | 25 |

| Non-interest income | 72 | 75 | 61 | 70 | 61 | 55 |

| Non-interest expense | 192 | 176 | 185 | 175 | 171 | 198 |

| Net income – Common Sh. | 39 | 55 | 22 | 80 | 88 | 86 |

| EPS – Diluted ($) | 1.66 | 2.26 | 0.96 | 3.57 | 3.91 | 3.85 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) | ||||||

My earnings estimate for 2023 is almost unchanged from the estimate I gave in my last report on Midland States Bancorp. However, I have significantly increased my earnings estimate for 2022 because I’ve reduced my non-interest estimate following the third quarter’s results.

My estimates are based on certain macroeconomic assumptions that may not come to pass. Therefore, actual earnings can differ materially from my estimates.

High Total Expected Return Warrants a Buy Rating

Midland States Bancorp is offering a high dividend yield of 4.3% at the current quarterly dividend rate of $0.29 per share. The earnings and dividend estimates suggest a payout ratio of 30% for 2023, which is below the 2018-2021 (excluding 2020) average of 42%. Although the payout ratio suggests there is room for a dividend hike, I have assumed no change in the dividend level in order to remain on the safe side.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Midland States Bancorp. The stock has traded at an average P/TB ratio of 1.17 in the past, as shown below.

| FY19 | FY20 | FY21 | Average | |||

| T. Book Value per Share ($) | 18.6 | 19.0 | 21.2 | |||

| Average Market Price ($) | 26.0 | 17.5 | 25.3 | |||

| Historical P/TB | 1.40x | 0.92x | 1.19x | 1.17x | ||

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $24.8 gives a target price of $29.1 for the end of 2023. This price target implies an 8.6% upside from the December 6 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.07x | 1.12x | 1.17x | 1.22x | 1.27x |

| TBVPS – Dec 2023 ($) | 24.8 | 24.8 | 24.8 | 24.8 | 24.8 |

| Target Price ($) | 26.6 | 27.8 | 29.1 | 30.3 | 31.5 |

| Market Price ($) | 26.8 | 26.8 | 26.8 | 26.8 | 26.8 |

| Upside/(Downside) | (0.6)% | 4.0% | 8.6% | 13.3% | 17.9% |

| Source: Author’s Estimates |

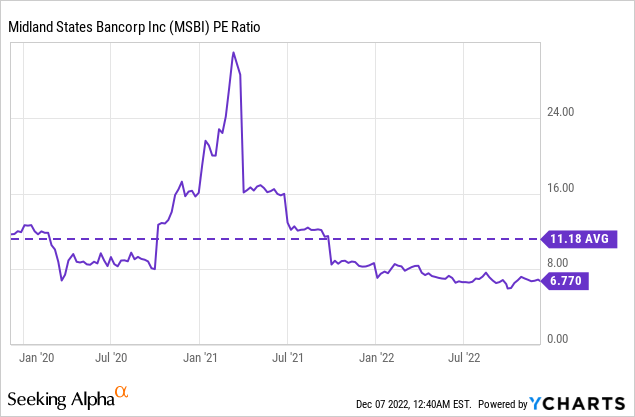

The stock has traded at an average P/E ratio of around 11.18x in the past, as shown below. Excluding the outlier in the early part of 2021, the P/E multiple has tended towards 10.0x in the past.

Multiplying the P/E multiple of 10.0x with the forecast earnings per share of $3.85 gives a target price of $38.5 for the end of 2023. This price target implies a 44% upside from the December 6 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 8.0x | 9.0x | 10.0x | 11.0x | 12.0x |

| EPS 2023 ($) | 3.85 | 3.85 | 3.85 | 3.85 | 3.85 |

| Target Price ($) | 30.8 | 34.7 | 38.5 | 42.4 | 46.2 |

| Market Price ($) | 26.8 | 26.8 | 26.8 | 26.8 | 26.8 |

| Upside/(Downside) | 15.2% | 29.6% | 44.0% | 58.4% | 72.8% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $33.8, which implies a 26.3% upside from the current market price. Adding the forward dividend yield gives a total expected return of 30.7%. Hence, I’m maintaining a buy rating on Midland States Bancorp.

Be the first to comment