gremlin

Microvast (NASDAQ:MVST) is many ways has become a micronism for the total collapse of hope that has transpired across many thousands of growth stocks year-to-date. The Stafford, Texas-based company is probably one of the more global EV battery firms that went public on the back of the SPAC phenomenon in early 2021 with operations in the US, China, and Germany. Further, it’s also generating revenue albeit unprofitably with revenue growth for its last reported quarter coming in at over 90%. The hyper-growth rate reflects the continued momentum of the climate economy as policymakers continue to take radical measures to boost EV adoption and meet targets to bring down climate emissions by 2030. This has most recently seen New York join California in a planned phase-out of the sales of new gas and diesel-powered vehicles by 2035. This has added two of the USA’s largest economies to a growing list that includes the European Union, the United Kingdom, South Korea, and China.

The future of transport is now undoubtedly going to be shaped by EVs and Microvast continues to execute its long-term plans to capitalize on this growth set to be realized in the decade ahead. Indeed, the company was recently just awarded a $200 million grant from the Department of Energy to build a new separator facility in Tennessee. A separator is an insulating film between a cathode and an anode that enables ions to be transferred whilst preventing thermal runaway. Microvast will aim to produce its polyaramid separator at the new facility which management stated is capable of resisting temperatures in excess of 300°C versus a ceiling of 135°C and 165°C respectively for polyethylene and polypropylene-based separators in lithium-ion battery cells.

The grant award was part of a total of $2.8 billion being made available by the DoE, to which there were over 200 applications. It will support the construction of a domestic battery supply chain in the United States as the Inflation Reduction Act is set to catalyse an EV boom like never before. $7,500 in EV tax credits is being made available for all EV automakers over the next decade. The Tennessee facility is well placed to capitalize on this because the IRA comes with a prohibitive requirement that qualifying cars must be assembled in North America with critical minerals in the battery coming from the US or a country with whom the US has a free trade agreement.

The Future Of Transport Is Set To Be Defined By EVs

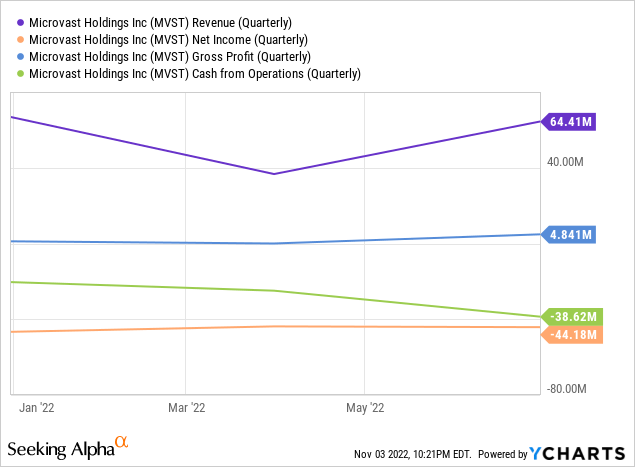

Microvast is set to release its earnings results next week with continued hyper revenue growth momentum expected on the back of earnings results for its fiscal 2022 second quarter that saw revenue come in at $64.41 million.

This was as the company’s backlog grew by 52% year-over-year to reach $105.3 million. Gross profit was $4.8 million versus a gross loss of $6.8 million in the year-ago quarter. This was as gross margin improved to 7.5% from negative 20.3%. Net loss on the back of this was a material $44.2 million, up from a net loss of $27.1 million in the year-ago quarter as adjusted EBITDA hit negative $9.2 million.

Whilst this was an improvement from negative adjusted EBITDA of $17.3 million in the year-ago quarter, the company’s underlying cash flow position deteriorated as cash loss from operations came in at $38.6 million, up from a loss of $12.9 million in the year-ago quarter. This contributed to a sequential decline in cash and equivalents from $416.2 million to $334 million.

Potential Salvo For Long-Suffering Shareholders

The strong long-term growth of Microvast’s core markets presents a potential salvo for its embattled shareholders against current headwinds which are much more of a result of the broader stock market malaise than its core fundamentals and execution. Whilst profitability is currently terrible, the company is very much still in growth mode. Revenue growth and operational momentum should be the primary metrics for assessing Microvast’s investment potential. This is set for continued growth with sales of passenger EVs forecasted to grow to at least 26.8 million by 2030, up from 6.6 million in 2021.

Microvast currently trades at a market cap of $717 million against expected revenue for fiscal 2022 of $220.4 million. This would be at the high end of guidance and would mean year-over-year growth of at least 45%. Fundamentally, that Microvast operates in a space set to see material growth in the decade ahead potentially paints a brighter future for its common shares. Concerns over the human impact on our planet have now morphed into concrete fiscal momentum with the Inflation Reduction Act. Hence, decarbonization through the electrification of transportation is now set to form a tranche of a decade-long attempt to wean the US from fossil fuels. Whilst I am no longer a shareholder due to broader economic concerns and the likelihood of more short-term downside, I continue to monitor the company’s progress.

Be the first to comment