Jeenah Moon

Shares of Microsoft (NASDAQ:MSFT) dropped to a new 1-year low after Microsoft presented earnings for its first fiscal quarter of FY 2023 in the last week of October. Although Microsoft beat expectations on the top and bottom line, the company’s Cloud business didn’t grow as strongly as expected and the PC market continues to pose a challenge for the software company. However, I believe that Microsoft Intelligent Cloud business will continue to grow rapidly and that the software company is undervalued based off of its free cash flow. Shares of Microsoft have an attractive risk/reward trade-off and Microsoft, as opposed to other large-cap technology companies, provides more protection against a broader down-turn in the PC market!

Microsoft: Q3’22 results overview

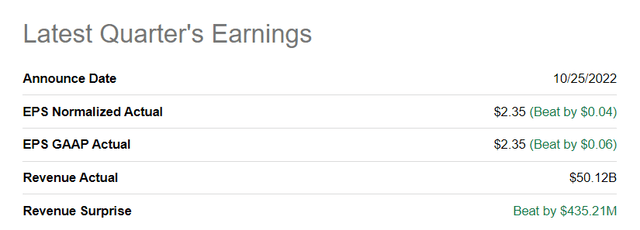

Microsoft beat top line and bottom line expectations easily in the first fiscal quarter of FY 2023: the software company reported revenues of $50.1B compared to a consensus prediction of $49.6B. On the earnings side, Microsoft generated EPS of $2.35 per share which compares against a $2.31 prediction.

Seeking Alpha: Microsoft Q3’22 Results

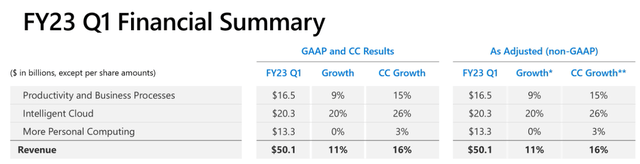

Microsoft’s revenue growth in FQ1’23 was 11% which showed a deceleration from the 12% top line growth rate in the previous quarter. Microsoft’s FQ1’23 was the fourth straight quarter of revenue deceleration which is caused by declines in consumer electronics shipments, high inflation and a moderation of growth after the 2-year long COVID-19 pandemic.

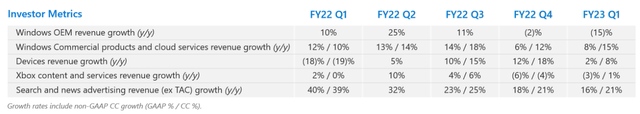

Microsoft’s strongest growth, once again, occurred in the Intelligent Cloud business which has become the biggest growth engine for the software company. Intelligent Cloud revenues soared 20% year over year to $20.33B, but still fell slightly short of expectations which were $20.36B. Growth in Personal Computing, which includes revenues from Windows OEM, slowed to 0%, unfortunately, due to the slowdown in the PC market that has led to a sharp decline in PC and laptop shipments in the third-quarter.

According to consulting company Gartner, PC shipments declined almost 20% in the third-quarter with most vendors seeing double-digit declines in volume shipments year over year. As a result, Microsoft OEM revenues in FQ1’23 declined 15% which was the poorest performance of all of Microsoft’s businesses.

While the PC down-turn may last for a few more quarters, Microsoft’s diversified business generates recession-resistant cash flows that could be used for stock buybacks or a higher dividend.

Recession-resistant free cash flows

Microsoft generates an unreal amount of free cash flow (“FCF”) from its super-profitable software business. The software company generated $16.9B in free cash flow on revenues of $50.1B in FQ1’23 which calculates to a free cash flow margin of 33.7%. Microsoft is even more profitable than Google regarding free cash flow which in the last quarter had a FCF margin of 23.3%. In the last four quarters, Microsoft generated a massive total free cash flow of $63.3B.

|

$billions |

FQ1’23 |

FQ4’22 |

FQ3’22 |

FQ2’22 |

FQ1’22 |

Y/Y Growth |

|

Revenues |

$50,122 |

$51,865 |

$49,360 |

$51,728 |

$45,317 |

11% |

|

Cash Flow From Operating Activities |

$23,198 |

$24,629 |

$25,386 |

$14,480 |

$24,540 |

-5% |

|

Capital Expenditures |

($6,283) |

($6,871) |

($5,340) |

($5,865) |

($5,810) |

8% |

|

Free Cash Flow |

$17,758 |

$17,758 |

$20,046 |

$8,615 |

$18,730 |

-5% |

|

Free Cash Flow Margin |

34.2% |

34.2% |

40.6% |

16.7% |

41.3% |

– |

(Source: Author)

Microsoft is cheap based on what the company offers investors

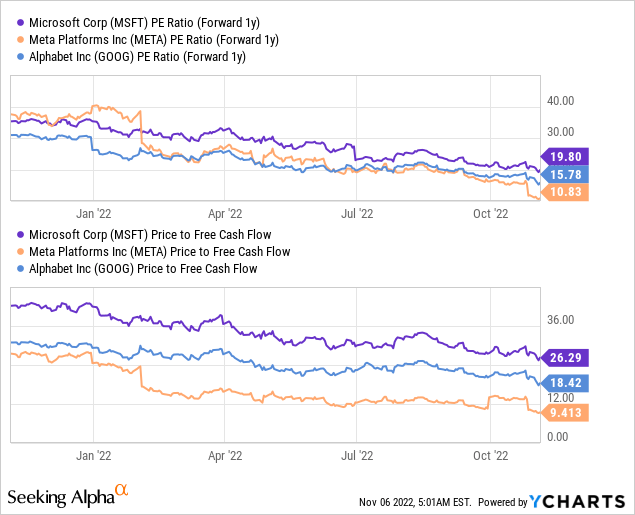

Many investors may take issue with the statement that I consider Microsoft as cheap. The software company is currently trading at a P-E ratio of 19.8 X and a P-FCF ratio of 26.3 X. There are certainly other technology companies, FAANG companies included, that have lower valuation ratios. However, investors need to take into account that Microsoft, as opposed to Meta Platforms (META) or Alphabet (GOOG), has very limited exposure to the digital advertising market. For those reasons, I consider Microsoft’s free cash flows to have much less risk than the cash flows of Meta Platforms, as an example.

Risks with Microsoft

Growth in the PC market is moderating and it has resulted in a major drop-off in device shipments — in both PCs and notebooks — which is affecting Microsoft’s Windows OEM revenues. The down-turn in the PC market poses a risk for Microsoft, but the Cloud segment provides a strong counterweight to the Personal Computing business. Given how much free cash flow the software company generates, I believe the down-side risk is very limited for Microsoft’s stock.

Final thoughts

I believe Microsoft’s shares are a bargain near 1-year lows considering how much free cash flow the company’s core businesses generate each quarter. Microsoft’s free cash flow margins in excess of 30% are also impressive and, on top of that, the software company is unlikely to be very much affected by a recession as companies will continue to need Cloud services. For those reasons, I believe Microsoft represents deep recession value for investors and the company’s free cash flow is set to stabilize both the business as well as the stock price!

Be the first to comment