Sean Gallup

Microsoft Corporation (NASDAQ:MSFT) is bouncing back lately, but there is reason to suspect that it is nearing the peak of that bounce. Shares had been languishing in the mid-$200s for the last several months, but they spiked out of that tight spot after reporting well-received quarterly earnings in late July. Since then, that strength has largely continued, and shares are now approaching a breakout.

MSFT daily candlestick chart (Finviz.com)

I believe Microsoft is unlikely to move much higher on this current bounce, and that a test of the mid-$200s is likely later this quarter. Reasons for this would include the apparent slowdown in PC sales, but the primary basis is likely to be market momentum, as the market is unlikely to sustain its recent short term trajectory.

Microsoft recently reported earnings for the quarter ending June 30. Microsoft earned $2.23 per share on $51.9 billion in revenue, which was a 12% year-over-year increase. That was actually the company’s slowest growth since the Covid-19 pandemic began. Nearly half of is total quarterly, or about $25 billion, was commercial cloud related revenue. Intelligent Cloud, which includes Microsoft’s Azure, brought in $20.9 billion.

Microsoft’s results were also impacted by the strong dollar and related foreign exchange headwinds. In total, Microsoft indicated its results were impacted by about $595 million during the quarter. Beyond that, China’s more recent Covid-19-related shutdown also affected results by around $300 million above and beyond the exchange related headwinds.

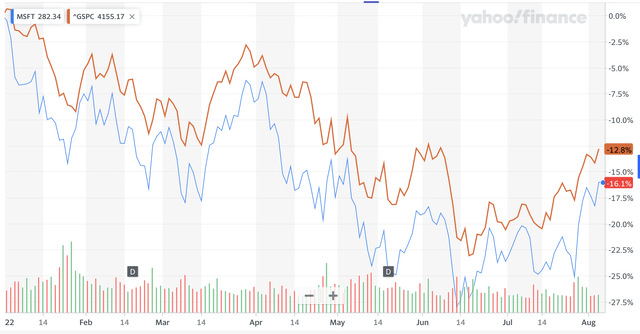

Microsoft has been closely following the broader market this year, including both its decline and this recent move higher. It is reasonably probable that a slowdown will affect the broader market in August and continue through the end of the quarter. Such is likely based upon seasonality and pending mid-term election risk, as well as general reversions towards the mean.

MSFT versus SPY YTD (Yahoo! Finance)

There is also the possibility that Microsoft could become a political target as elections near, including of their pending acquisition of Activision Blizzard Inc. (ATVI). The substantial acquisition is expected to close next year, and the lengthy timetable brings with it the potential for political scrutiny and agency resistance. While it does seem highly probable that Microsoft will end up acquiring Activision, its capacity to engage in further M&A activity is certain to be limited by the pending transaction.

Conclusion

Microsoft’s strong move from the lows it touched last quarter has been a fast and furious move that is unlikely to sustain itself. The same can be said for the broader market, which appears to be in the midst of yet another bear market rally this year.

I believe Microsoft is unlikely to break out into the $300s in the near term due to the headwinds of its own, including slowing revenue growth and the pending acquisition of Activision, as well as a probable market slowdown in the second half of this quarter. I expect that any further near term strength will be a good opportunity to sell short-term covered calls against an existing long term position.

Be the first to comment