HJBC/iStock Editorial via Getty Images

Investment Thesis

Microsoft (NASDAQ: MSFT) has been a dominant leader in the technology sector for several decades at this point. They started as an operating system software company, and the overwhelming success of Microsoft Windows and Office catapulted them to the top of the technology sector. They have since expanded into many different branches (cloud service, productivity and collaboration tools, gaming, and etc.). They are one of the truly dominant companies with many competitive advantages.

Recently, due to pressure from inflation, and increases in labor and supply costs, many companies have seen their margins compress. However, Microsoft somehow keeps finding new ways to expand their margins. Current world turmoil and economic uncertainty wreaked havoc on the stock market, and particularly the technology growth stocks. This volatility created a rare opportunity to grab Microsoft’s shares at a bargain. I believe Microsoft is a great option for a long-term investor because:

- Microsoft announced a blowout 2Q 2022 result with substantial revenue growth and profit margin expansion.

- Microsoft has been consistently expanding their margins since 2019 by focusing on more lucrative segments of the business, while maintaining steady growth in the legacy business.

- Additionally, they continue to expand their dominance through substantial organic growth and key acquisitions.

Blowout 2Q 2022 (4Q 2021) Results From Microsoft

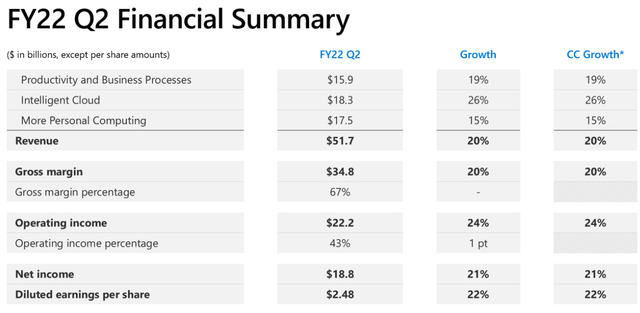

Microsoft reported 2Q 2022 (4Q 2021 for the rest of us) results in late January, and it was a blowout result. They easily beat top and bottom line expectations. Revenue was $51.7 B, which grew 20% YoY, and operating income was $22.2 B, which grew 24%. All segments grew substantially compared to the same quarter last year, and LinkedIn, Dynamics products, and cloud services led the growth. LinkedIn revenue grew 37%, and Dynamics products and cloud services revenue grew 29%.

As an investor focusing on business fundamentals, I was very pleased to see an increase in the operating margin. Operating margin increased from 41.5% in last year to 43.0% this year. This is a remarkable result, especially given that a lot of companies are experiencing compressed margins due to inflation, labor cost increases, and supply chain pressure. Margin expansion of this extent clearly indicates superiority of the products and a savvy business focus by management. I will discuss how they are expanding their margins in the sequent sections.

FY22 Q2 Financial Summary (Microsoft Investor Relations)

Focusing on Right Business

The first secret of their margin expansion – focusing on the right business. Tracking the operating margins of each segment (Productivity and Business Processes, Intelligent Cloud, and More Personal Computing), the Productivity & Business Processes and Intelligent Cloud clearly achieve greater profitability than Personal Computing.

| Operating Margins | 2018 | 2019 | 2020 | 2021 |

| Productivity & Business Processes | 36% | 39% | 40% | 45% |

| Intelligent Cloud | 36% | 36% | 38% | 43% |

| More Personal Computing | 25% | 28% | 33% | 36% |

Operating Margins by Microsoft Segment. Author generated table. Data Source: SEC filings

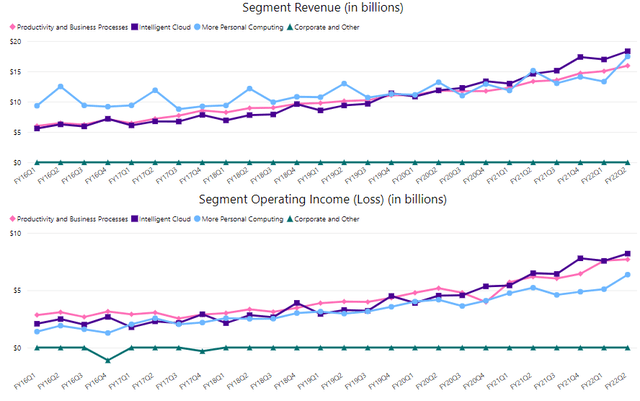

Since 2016, Microsoft has been heavily focused on growing revenue from Productivity & Business Processes (Office, Dynamics, and LinkedIn) and Intelligent Cloud (Azure, related cloud services, and platform). You can clearly see the steeper trend in growth of Productivity & Business Processes and Intelligent Cloud, with both of them passing the More Personal Computing business around 2019.

Revenue and Income Growth Trend of Microsoft (Microsoft Investor Relations)

The growth in Productivity & Business Process was largely achieved by offering superior products and capturing synergies among products. Microsoft has been dominant in the operating system market and office software market for several decades at this point, so the installed base for this software is humongous. On top of the large installed base of operating system and office software, Microsoft offers new products that seamlessly work with other software/platform, and this synergy further fuels cross-sales and, consequently, revenue growth. Dynamics 365 for Talent with LinkedIn is a great example of the synergistic effect between Microsoft software.

The growth in Intelligent Cloud platform is achieved by superior AI technology and economies of scale. Riding the new remote work environment, companies have accelerated digital transformation, and Microsoft is providing key technologies and infrastructure to achieve this transformation. Also, utilizing their large global footprint and resources, Microsoft created a large datacenter network that provides three major benefits for economies of scale; datacenters that are computationally much cheaper; datacenters that provide superb coordination and aggregation of data among diverse customer, geographic, and application demand patterns; and datacenters that provide lower application maintenance costs. Thanks to these advantages, their Intelligent Cloud segment is growing at a truly amazing pace, and I expect that to continue in the foreseeable future.

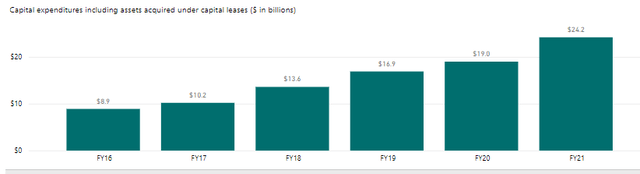

Expanding Their Competitive Edge

The other key component that has driven Microsoft’s increasing margin is their constant effort to expand their competitive edge. Since 2016, they have been consistently increasing their capital expenditure, with that figure increasing from $8.9 B in 2016 to $24.2 B in 2021. Also, they have been consistently spending about 20% of gross profit on R&D ($22 B in trailing twelve months). With this kind of investment towards increasing capacity and improving products, it’s not surprising that their products stay at the top for long time.

Microsoft Capital Expenditure (Microsoft Investor Relations)

Not only that, Microsoft has not been shy about acquiring key business to enhance their competitive edge. Most recently, they made a huge splash with the Blizzard acquisition. I believe this is a great move to acquire top talent in the gaming business along with some great game franchises that will boost future growth. The detailed breakdown of the deal is explained in this article. In 2021 alone, Microsoft closed 14 deals including Two Hat, Clear Software, Peer5, and CloudKnox. These acquisitions will provide key technology and talent to fuel future growth, while providing a revenue boost.

MSFT Stock Intrinsic Value Estimation

I used DCF model to estimate the intrinsic value of Microsoft. For the estimation, I utilized EBITDA ($90.8 B) as a cash flow proxy and current WACC of 7.5% as the discount rate. For the base case, I assumed EBITDA growth of 20% (Seeking Alpha Consensus) for the next 5 years and zero growth afterwards (zero terminal growth). For the bullish and very bullish case, I assumed EBITDA growth of 22% and 24%, respectively, for the next 5 years and zero growth afterwards. Given their rapid growth due to existing tailwinds and additional growth from Blizzard and other acquisitions, I think EBITDA growth of 22-24% is well within reason. Also, their expanding margin will positively contribute to EBITDA growth.

The estimation revealed that the current stock price presents 15-25% upside. This estimation shows that the current market volatility is providing a rare opportunity to grab Microsoft shares at a bargain, and I think investors should take advantage of the opportunity.

|

Price Target |

Upside |

|

|

Base Case |

$311.83 |

11% |

|

Bullish Case |

$335.63 |

20% |

|

Very Bullish Case |

$360.97 |

29% |

The assumptions and data used for the price target estimation are summarized below:

- WACC: 7.5%

- EBITDA Growth Rate: 20% (Base Case), 22% (Bullish Case), 24% (Very Bullish Case)

- Current EBITDA: $90.8 B

- Current Stock Price: $280.07 (03/11/2022)

- Tax rate: 15%

Risk

Acquisition of businesses always carry risks. Especially a company the size of Blizzard can soak up a lot of financial, temporal, and human resources to complete. Even after completion, cost synergies and the revenue increase should be large enough to justify the acquisition cost. Also, Blizzard has been having cultural issues within the company, and are exposed to legal issues. Therefore, the investor should closely monitor news regarding the acquisition process.

There is a lot of turmoil around the world, creating a great deal of uncertainty. The war, inflation, economic growth rates, and supply chain issues are all swinging the stock market wildly on a daily basis. In this market, it’s really hard to maintain a long-term perspective and not to be swayed by short-term market swings caused by news headline. Therefore, the investor needs to stay committed to a long-term investment.

Conclusion

Microsoft has been an amazing investment for several decades at this point. Market dominance, technological superiority, and management’s constant drive for growth have combined for stellar profitability with superb long-term growth. I expect this trend to continue for the foreseeable future. I see 15-25% upside from the current level.

Be the first to comment