lcva2

Summary

Shares of Microsoft (NASDAQ:MSFT) are down as much as 28% YTD as markets are beginning to reassess the investment narrative on slowing Azure growth while other businesses like Windows face headwinds in a deteriorating PC market. Though shares are likely to experience selling pressure following the recent rally, I see Microsoft as a Buy given its market position and relatively stable margins. At the key support level of $200, I will be an aggressive buyer on a near 5-year low valuation coupled with a conservative FY23 EPS estimate, which should provide investors with limited downside risks and a compelling risk/reward profile.

F1Q23 Review

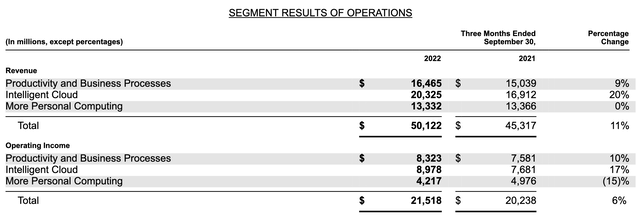

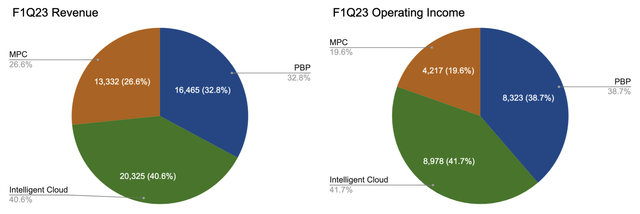

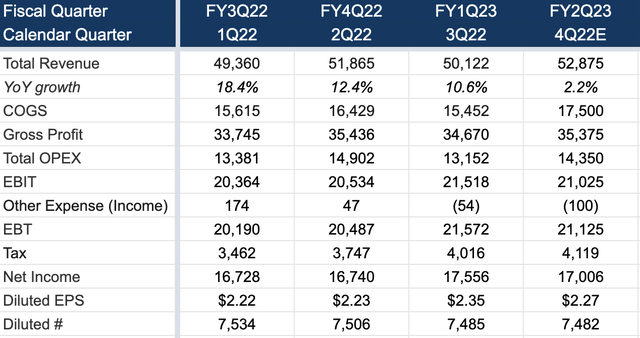

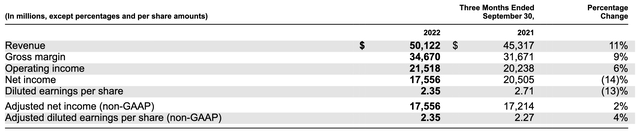

In F1Q23 (Sept), Microsoft reported revenue of $50.1 billion (+11% YoY/+16% ex-FX) and EPS of $2.35 which both beat Street estimates of $49.7 billion and $2.31. Revenue growth was primarily driven by strong Cloud revenue growth of 24% YoY to $25.7 billion in Q3 (51% of revenue). Gross margin of 69% was down slightly from 70% a year ago due to higher COGS related to Microsoft Cloud and Gaming. Operating margin was down roughly 2 points to 43% on a 15% YoY growth in OPEX driven by a 22% YoY increase in headcount and investments in cloud engineering, LinkedIn, commercial sales and Nuance. Net margin of 35% was down 10 points YoY on a higher tax rate of 19% vs. 0% in 3Q21 that had a $3.3 billion net income tax benefit. EPS of $2.35 was up 4% and 11% in constant currency. Overall, Microsoft delivered another strong quarter and continued to be a highly profitable business that generated almost $17 billion in free cash flow for a FCF margin of 34%.

Company data Company data, Albert Lin

Productivity & Business Processes

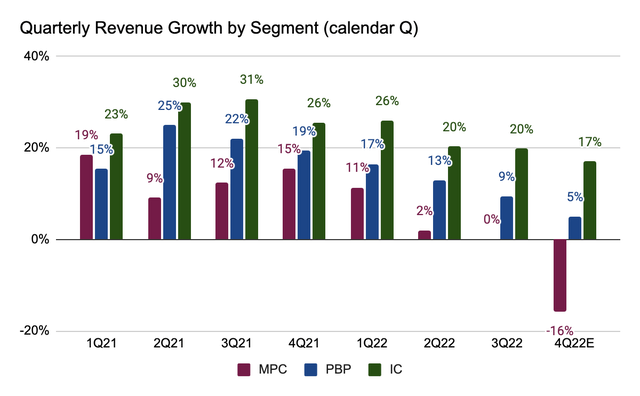

Revenue of $16.5 billion grew 9% YoY (15% ex-FX) was 2% above consensus. Results were driven primarily by Office commercial products & cloud services (+7%/+13% ex-FX) and LinkedIn (+17%/+21% ex-FX). Office 365 commercial sales was up 11% (17% ex-FX), coupled with a 14% YoY seat growth driven by SMB & frontline offerings as well as higher installed base and ARPU from E5. Dynamics revenue grew 15% YoY (22% ex-FX) driven by Dynamics 365 which was up 24% (32% ex-FX). Operating margin of 50.5% was up slightly vs. 50.4% in C3Q21.

Intelligence Cloud

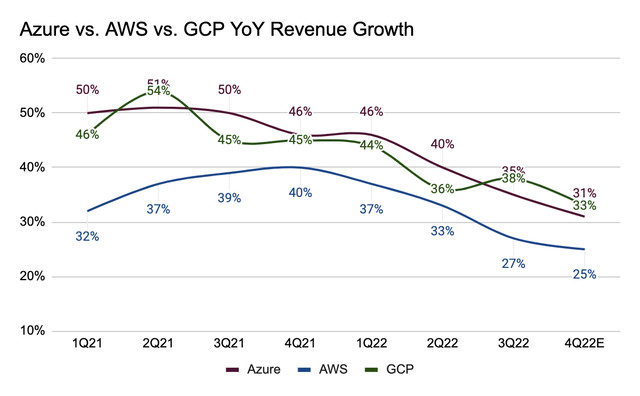

Revenue of $20.3 billion was up 20% (26% ex-FX) in F1Q23, inline with consensus. Azure growth of 35% (42% ex-FX) was a 5 point deceleration from +40% YoY in F4Q22 (Jun) as management highlighted continued moderation in consumption growth. For reference, slower consumption was also noted in Amazon’s C3Q22 earnings (analysis here) where AWS saw growth decelerating from 27% YoY (28% ex-FX) to mid 20%’s exiting Q3 while customers have become more cost sensitive. Operating margin for Intelligence Cloud was down slightly to 44.2% vs. 44.6% a year ago.

Company data, consensus estimates

More Personal Computing

Revenue of $13.3 billion was flat YoY (+3% ex-FX), almost 2% below consensus. Given a deteriorating PC market, Windows OEM revenue declined 15% YoY. Devices revenue was up 2% YoY (8% ex-FX), with growth from a large Hollands deal offset by a low-double-digit decline in Surface. Search and news advertising grew 10% due to an increase in search volumes offset by a 5 point headwind from Xandr on increasing macro pressure in the ad market. Gaming revenue was flat YoY (+4% ex-FX), driven by better Xbox hardware sales (+13%/+19% ex-FX), offset by soft content and services sales (-3% YoY/+1% ex-FX) on declines in 1P and 3P content and lower engagement hours. Operating margin was down 220bps YoY to 31.7% vs. 33.9% last year.

Outlook

On a consolidated basis, Microsoft expects F2Q23 (Dec) revenue of $52.9 billion (+2% YoY/+7% ex-FX) and operating income of roughly $21 billion (-5% YoY). These figures are below consensus revenue of $55.9 billion and operating income of $23.4 billion.

Company data, management guidance

On a segment basis, management guided the following:

Productivity & Business Processes

- Revenue growth of 5% at the midpoint (12% ex-FX) = $16.7 billion.

- Office 365 revenue growth similar to F1Q23 (ex-FX).

- Office Consumer to decline low to mid-single digits due to negative FX impact.

- Dynamics revenue to grow low double digits (low 20%’s ex-FX).

- LinkedIn revenue growth to moderate to mid to high single-digit (low to mid-teens ex-FX) due to a soft advertising market and slower hiring.

Intelligence Cloud

- Revenue growth of 17% YoY at the midpoint (23% ex-FX) = $21.4 billion.

- Azure growth to decelerate by 5 points sequentially to 37% YoY ex-FX (31% in USD assuming a 6 point negative impact from FX).

More Personal Computing

- Revenue of $14.7 billion at the midpoint (-16% YoY/-13% ex-FX).

- Windows OEM revenue to decline in the high 30%’s due to weakness in the PC market.

- Devices revenue to decline ~30%, inline with the PC market.

- Windows commercial products and cloud services revenue to grow in the mid-single digits (low double digits ex-FX).

- Search and news advertising (ex-TAC) to grow in the low to mid-teens.

- Gaming revenue to decline in the low to mid-teens, where Xbox content and services revenue will decline at a similar rate.

Company data, management guidance, Albert Lin

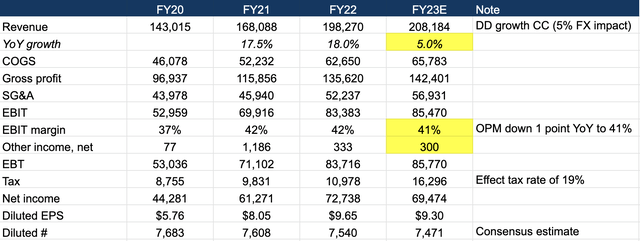

For fiscal 2023, Microsoft expects a strong dollar to impact top-line growth by 5 points (vs. 4 points previously), while FX will decrease COGS and OPEX growth by 3 points. Compared to the previous guidance of double-digit full year revenue growth (incl. a 4% FX impact), management now expects double-digit top-line growth on a constant currency basis. This translates into a reduced FY23 growth outlook from at least 14%/10% (ex-FX) to 10%/5% in USD, reflecting weak PC demand and decelerating Azure growth. With lower expected Windows OEM revenue and a higher energy bill of $800 million for FY23, operating margin is guided down 1 point YoY to 41% vs. roughly flat previously. Assuming a 5% top-line growth (vs. 7% consensus), an EBIT margin inline with management’s guidance, $300 million in other income and a 19% tax rate, I model FY23 EPS of $9.30 vs. $9.55 consensus.

Company data, mgmt guidance, consensus estimates, Albert Lin

Valuation

Microsoft currently trades at a forward P/E of 26x based on FY23 EPS of $9.30, which compares to the 25x average amongst software peers including Adobe (ADBE) (24x), Salesforce (CRM) (31x), Oracle (ORCL) (16x), Intuit (INTU) (28x), a well deserved premium given Microsoft’s market position and earnings quality. Against other big tech peers, Microsoft trades at a premium to Apple (AAPL) (24x) and Google (GOOG) (21x), likely due to the more enterprise-focused and sticky nature of its business vs. Apple’s hardware-driven model and Google’s higher exposure to advertising. Compared to Amazon (AMZN) (56x), Microsoft is relatively cheap but this is because markets tend to value Amazon based on SOTP vs. P/E.

Where will I double down on the stock?

Over the past 5 years, Microsoft’s stock has traded within a P/E range between 20x to 35x. With ongoing macro concerns driven by inflation, rate hikes and slower economic growth, shares are likely to experience another round of selloff following the recent rally, which in my view was fueled by short covering on a better-than-expected October inflation report.

While Windows OEM, devices, gaming and advertising (incl. LinkedIn) are all likely to remain challenged throughout 2023 due to nonexistent PC demand, lower gaming activities post-Covid, and a challenging macro, these issues are well understood. What’s frankly concerning, in my view, is decelerating Azure growth where markets may start to question the Microsoft story as a safe haven in a volatile market.

As a result, the most ideal scenario where I’d double down on the stock is when valuation revisits its 5-year low at 20x or $186 a share (23% below the current price). That said, I must also recognize the fact that markets don’t always have to behave according to my expectations. Considering a strong level of technical support at $200, this is likely the price I’d start buying aggressively. While Microsoft is certainly a less exciting growth story under the current macro narrative, the company remains a top performer with strong execution and enviable margins. All told, investors with a multi-year horizon should eventually benefit from progressively higher earnings and buybacks.

Be the first to comment