lcva2

Microsoft Corporation (NASDAQ:MSFT) just announced its annual dividend increase, as Seeking Alpha has covered here. The new quarterly dividend of 68 cents per share represents nearly 10% dividend growth and marks the 13th consecutive year that Microsoft has announced a dividend increase in the month of September.

Why is the month important, you may ask, as long as the annual dividends increase year-on-year. We offer two reasons: (1) reliability on the company’s part; and (2) the ability to plan based on the reliability for income-seeking investors. Even those who throw shade at dividend growth stocks due to inflation may not have much to say about a double-digit increase.

Microsoft and even the world at large, one might argue, have changed quite a bit since this article we wrote in 2014. But the fundamentals of dividend growth investing have not. Hence, this article uses the same template and compares how things appear now vs eight years ago. Let’s begin.

New Yield: The new annual dividend of $2.72/share gives Microsoft a yield of 1.12%. This is much lower than the 2.66% after 2014’s dividend increase. No prize for figuring out the reason, though: the share price has since gone up nearly 6-fold, from $47 to $242. Even dividend lovers would not complain about that price change, as Microsoft was stuck in a narrow trading range for close to a decade before breaking out thanks to its Azure dominance.

Payout Ratio: Here is the kicker. Despite 8 more years of dividend increases since the 2014 article, Microsoft’s current forward payout stands at 26% compared to its 46% in 2014. Put this together with the share price increase mentioned above, and you can clearly see the health of Microsoft’s earnings and dividend growth potential.

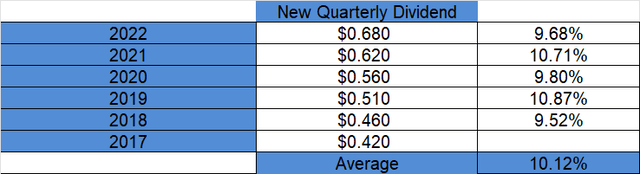

Dividend Growth Rate (DGR): At the time of our 2014 article, Microsoft’s 5-year dividend growth rate ranged between 10% and 25%. In stark contrast, the recent five-year range is much tighter between 9.52% and 10.87%. Why are we optimistic about it? It shows a company that is more mature and reliable when it comes to its dividends. To use a parallel from the running world, runners appreciate what are called “tight splits” for each mile, where the range of outcome is more predictable and leads to long-term success.

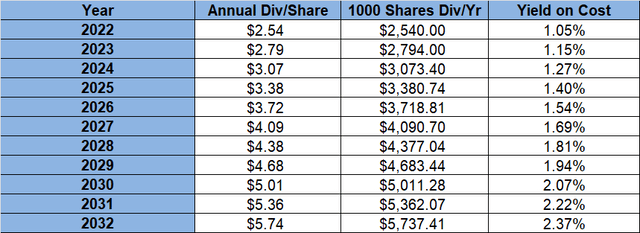

Extrapolation: To keep things consistent from the 2014 article, the table below assumes a dividend growth is 10%/yr for the next 5 years and 7%/yr for years 6 to 10. This seems very conservative given the room in payout ratio, plus the expected double-digit earnings growth rate. It is easy to scoff at that number, but keep in mind that if the company realizes it cannot use its earnings and capital more productively, it is very likely to increase the payout ratio. Meaning, total return for investors is still likely to be satisfactory given the combination of earnings growth and dividend growth.

Forward-Looking Thoughts

- A stock trading at the low end of its 52-week trading range alone does not make it a buy. However, it does offer a compelling story if the company’s fundamentals are not deteriorating. No one can say it with a straight face that Microsoft, the company, is not going to be around in the next few years. Microsoft, the stock, was inflated like almost every other stock in the market, but after falling from $350 to $240, Microsoft is trading at a forward multiple of 24. If you think that is excessive, Procter & Gamble (PG) trades at 23 and our beloved Coca-Cola (KO) trades at 24. When inflation, the unfortunate war, COVID, and other macro conditions stabilize (they do not even need to get better), stocks like Microsoft will catch the first bids.

- You are not to be blamed if you are sick of the Cloud growth stories. It has to stop at some point, you think. You may be right. But that point is not anytime soon, as Microsoft’s Azure is still showing sequential strength whether you look at it by quarter or year. The company recently announced it is expecting double-digit growth in the next few quarters as well. It is a bit funny and rewarding to read what we wrote in the 2014 article about Microsoft’s Cloud potential: “The company is doubling its focus on Cloud and Enterprise Mobility Suite. Although Microsoft’s phone hasn’t changed the world, even Apple (AAPL) fans must admit that the Cortana vs. Siri commercial is hilarious and to the point. If consumers get your message straight, chances are that your products will recover too. Windows tablets could have a nice run according to this piece on Seeking Alpha. Long story short, there are some encouraging signs that Microsoft could be more than just a dividend stock.”

- If earnings grow at 15%/yr as expected, the earnings per share will be at $20 in 5 years. Even if the payout ratio stays at the current lowly 26%, that would give investors an annual dividend of $5.29 per share. That would represent almost a double from the current $2.72/share. Not too shabby.

Conclusion

All of us have been envious at some point in our lives. We think others have it all somehow: money, fame, health, and good looks. In the world of investing, the 4 cornerstones in our opinion are stability, capital appreciation, dividends, and balance sheet strength. Not many companies have it all like Microsoft. We are sticking with Mr. Softie through this sell-off and appreciate the “SWAN” (sleep well at night) attribute it brings to our portfolio.

Be the first to comment