Jeenah Moon

Investment Thesis

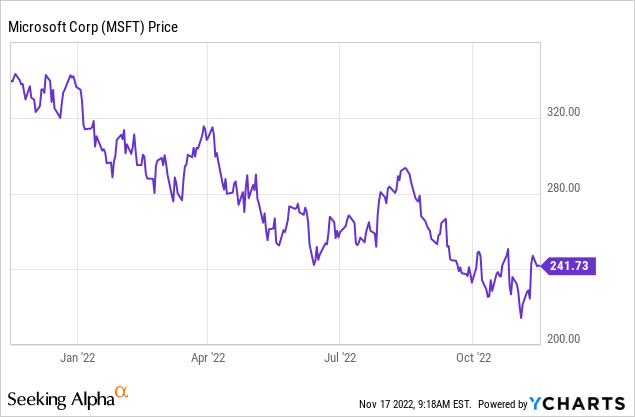

Microsoft Corporation (NASDAQ:MSFT), like most tech stocks, has lost a huge portion of its market cap YTD and, although it recently had a spike in its stock price, it keeps dipping overall.

However, the fundamentals of the company keep becoming better as time goes on, and that makes investors wonder if there is a misconnection between the company’s fair value and its stock price.

Keep reading to find out…

Microsoft’s Cloud Segment

Although the company has had excellent performance in the past, investors keep doubting if Microsoft Corporation can keep growing in double digits, as it is already a mega-cap company. However, some reasons make me believe that the company still has a bright future.

Office 365

cyware.com

Office 365 has more than 61 million paying users and it is still growing at a rapid pace. Although this segment was growing just fine even before lockdowns, in 2020 the demand for it increased drastically as more and more people started to work from home. I believe that this trend is sustainable, as remote work is not fading away. This trend helps Microsoft, as it increases demand for its products even more and also gives the company some pricing power to increase prices as it already did this March.

Azure

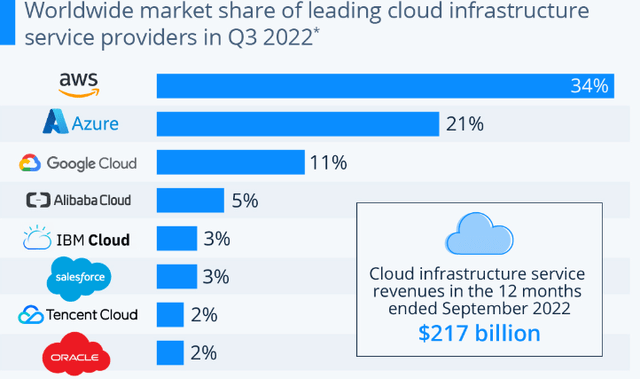

This segment of the business is growing by almost 50% annually, and the management has mentioned that they have a decent backlog there. The growth rate is probably going to accelerate in the future.

Microsoft’s Azure not only already has a decent portion of the cloud market, but is also gaining even more market share quarter over quarter, in contrast to Amazon’s (AMZN) AWS. Although AWS is the biggest player in this market, its share market has been about the same for the last years. And as far as Alphabet’s (GOOG, GOOGL) Google Cloud is concerned, although it is also gaining market share, it is not profitable like Azure, which is not only profitable but is also growing its margins every single quarter.

If Azure and the other cloud services manage to keep growing at 30%-35% per year with decent margins, the entire company will still grow at double digits just thanks to these services.

Gaming Segment

tomsguide.com

When it comes to gaming, and more specifically, when it comes to hardware, there are two main players; Sony’s (SONY) PlayStation and Microsoft’s Xbox. This used to be a cyclical business, as the massive revenue only lasted for about two years after each console was launched. In the case of Xbox, Microsoft Corporation does not even make money by selling it; so how does the company make money from this segment?

Both Microsoft and Sony have realized that offering a cheaper subscription model would be a better way to make money than selling games individually for $50 or $60. In the case of Microsoft, I think that their subscription model is better than Sony’s model because, when Microsoft launches a new game, gamers get it on their subscription offer right away. In the case of PlayStation, on the other hand, gamers don’t get it on every device on the first day, and that gives Microsoft a comparative advantage against Sony.

In addition, if Microsoft eventually manages to acquire Activision Blizzard (ATVI), it will make the company far more competitive, as it will boost its revenue and help it increase its market share in the gaming segment.

Moreover, as Microsoft shifts to the subscription model, the revenue generated from this segment becomes much more predictable and consistent.

Capital Allocation

Throughout the years, Microsoft has built a great track record when it comes to acquisitions.

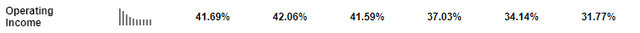

Companies like Alphabet or Meta Platforms (META), just like Microsoft, make so much money in free cash flow that they can decide to reinvest a portion of it to acquire other businesses and buy their growth. The problem is that these companies, in contrast to Microsoft, lose money by acquiring other companies. In the case of Alphabet, for example, the company lost more than $10 billion in other bets. In the case of Meta, the company is investing heavily in Reality Labs, which is at least for now burning cash like crazy. In the case of Microsoft, on the other hand, the company never has had bad investments. As a matter of fact, every year it is investing in more companies, and that helps the company to improve its margins.

The Activision Blizzard Deal

news.microsoft.com

When it comes to acquiring Activision Blizzard, I believe that Microsoft is making a smart move there. Last year, the company reached a market cap of $80 billion. If Microsoft wanted to acquire the business back then, it could easily have done it as it had more than enough cash in its balance sheet. The issue is that if Microsoft wanted to buy ATVI when it was trading at $80 billion, and factoring in a premium of 45%, which is the premium that the company offered to buy ATVI, it would have to pay $116 billion. Besides doing that, Microsoft simply waited for the company to fall in value, and that is when it finally announced that it wanted to acquire this business. By doing so, the company managed to pay $68 billion, or in other words, a bit more than half what it would have to pay if it made this offer a year and a half ago.

This is one of the most important reasons that I believe the company deserves a premium valuation

Concern

SeekingAlpha

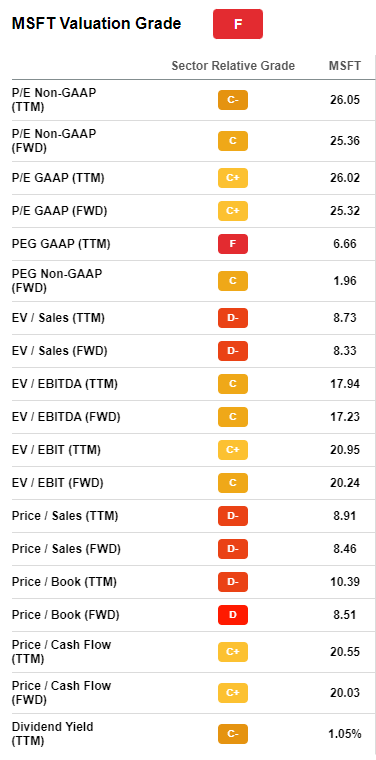

However, the main concern I have about Microsoft is its valuation. For a company that big, which is projected to grow its revenue by 10%-15% for the next 5 years, a P/E ratio of 26 seems a bit expensive. Having said that, the company has proven that it can beat analyst expectations. Factoring in the increasing profit margins, I believe that the company’s shareholders will do just fine.

Conclusion

In my opinion, Microsoft is one of the best of the big tech companies and I think that both its core segment, along with the segments that it will expand into with the acquisitions that it will make, will yield a decent return for its shareholders.

However, even though I believe that Microsoft Corporation deserves a premium, I would like to see its share price fall a bit further in order to be a bargain and start a position.

For now, at the price that it is trading at, and bearing in mind everything mentioned above, I think it is safe to say that the company is at least going to match the market. Therefore, I rate Microsoft Corporation as a HOLD.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment