Lisa Maree Williams

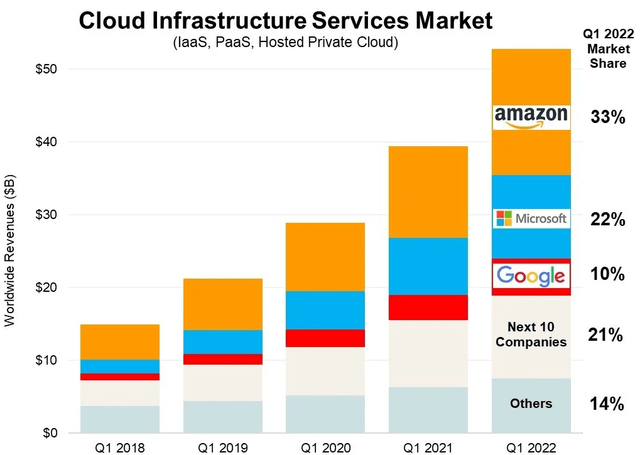

Microsoft (NASDAQ:NASDAQ:MSFT) has made a habit of entering industries relatively late and subsequently dominating them. The company’s rapidly expanding presence as the number two player in cloud computing is a perfect example of this. Despite the fact that Microsoft’s Azure became commercially available ~4 years after Amazon’s (AMZN) AWS, Azure is now hot on the tails of AWS in terms of market share.

Although Microsoft still makes a sizable portion of its revenue on its traditional businesses, from its Windows OS to its software tools, the company has expanded its reach dramatically in recent years. Microsoft’s intelligent cloud business, for instance, generated $20.9 billion in Q4 and shows no signs of slowing down. Microsoft’s ability to continually adapt to a rapidly shifting technological landscape is not to be underestimated.

Leveraging Software Expertise

Microsoft’s ability to rapidly gain market share in highly competitive sectors has much to do with its industry-leading software capabilities. Microsoft’s growth in cloud is a perfect example of how the company is leveraging its software expertise for outsized success. This feat has been especially impressive considering the technology heavyweights involved in the cloud space, most notably Amazon’s AWS.

At the end of the day, success in the cloud business comes down to a company’s ability to manufacture/purchase hardware at a relatively low cost and to offer high-quality cloud services. Given that most large technology firms have the ability and resources to fulfill the former requirement, the real differentiator among such companies is the ability to offer great cloud services. Microsoft stands out on this front due to its software expertise and established software ecosystem.

There are countless cloud services for a wide range of use cases, i.e. compute, storage, database, serverless, etc. The hundreds of popular cloud services like Lambda, Active Directory, EC2, CosmosDB, DynamoDB, Memorystore, and so on, are all competing for business both on the smaller-scale business and large enterprise fronts.

Microsoft’s experience building software and its established Windows ecosystem has allowed the company to leapfrog many well-established cloud providers in many respects. Even cloud heavy-weight AWS is struggling to keep up with Microsoft when it comes to the cloud enterprise segment. While AWS servicers are easier to use and understand, Azure is more geared towards the enterprise market.

Microsoft’s pre-existing Windows ecosystem also gives the company an edge in the industry. Many organizations are already familiar with Microsoft products, from its operating system to its suite of productivity tools, Microsoft 365. This makes the transition to the Azure cloud platform a no-brainer for such organizations. For the organizations that pure Windows shops, of which there are many, choosing Azure as a cloud provider is a no-brainer.

Microsoft continues to take market share in the highly competitive cloud market.

Synergy Research Group

Underappreciated Gaming Ecosystem

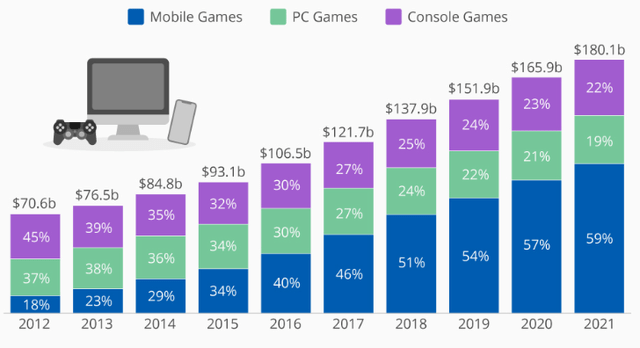

Much of the focus on Microsoft has been centered around its software offerings and cloud business. While these businesses still account for a majority of Microsoft’s revenue, the company’s burgeoning gaming division holds the most long-term growth potential. Microsoft has had a strong presence in gaming for decades now with Xbox. However, the company is starting to put far more attention on its gaming division.

Microsoft recently acquired gaming behemoth Activision Blizzard for $68.7 billion. In what is the industry’s largest acquisition by far, Microsoft now owns some of the most iconic gaming franchises of all time. Titles like Call of Duty, World of Warcraft, and Overwatch now all fall under Microsoft’s umbrella. The addition of Activision Blizzard’s properties to Microsoft’s already expansive gaming library positions the company to be the dominant force in gaming for the foreseeable future.

Microsoft’s vision to be the Netflix (NFLX) of the fast-growing video game industry appears to be coming to fruition. The company’s XBox Game Pass and Cloud Gaming services already made waves in the gaming industry. With the addition of gaming powerhouses like Activision Blizzard, Microsoft appears set to dominate the gaming landscape over the long term. No other company is even close to catching up to Microsoft in terms of building a gaming ecosystem.

According to Statista, the video game industry was worth $180.1 billion dollars in 2021. In fact, gaming has displaced all other major forms of entertainment in terms of global revenue, beating out both music and movies combined. Microsoft’s current strategy of building out an unparalleled gaming ecosystem is a wise move considering where the industry is headed.

The video game industry continues to grow at an incredibly fast pace despite its considerable size.

Statista

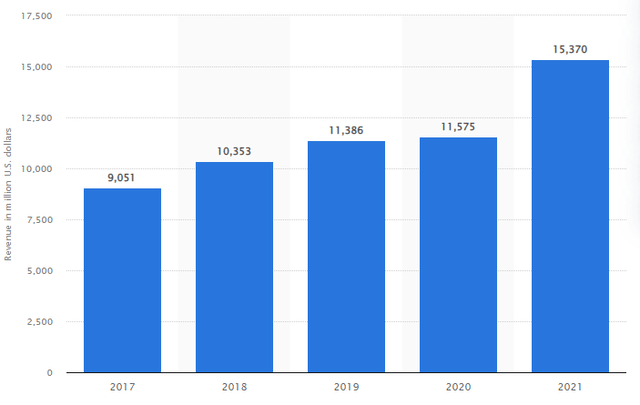

Microsoft reported ~$15.367 billion of gaming revenue in 2021, which represents a sharp increase from the company’s $11.57 billion in 2020. As more consumers are able to get their hands on the latest consoles in the coming years and as highly anticipated titles release, Microsoft should see this figure grow substantially.

Microsoft Gaming Revenue

Statista

Challenges Ahead

Microsoft risks spreading itself too thin with its expanding business ventures and numerous acquisitions. What’s more, competition is ramping up dramatically in the company’s major business segments. While Microsoft still has a solid grip on the personal computing software and productivity markets, the same cannot be said about many of the company’s other businesses.

Given Microsoft’s surprising success in the cloud, it is easy to forget that the cloud industry is still dominated by AWS. On top of this, other technology giants like Alphabet (GOOGL) and IBM (IBM) are starting to invest far more heavily in the cloud space, which is not surprising given how profitable it has been for both Amazon and Microsoft.

The gaming industry presents its own set of unique challenges to Microsoft. For one, the video game service model may not be a long-term winner like the video streaming service has been for Netflix (NFLX). Given that consumers spend far more time on single game titles as opposed to time spent on single movie/tv titles, Microsoft’s Game Pass subscription model may not have the same pull as a Netflix or Disney+.

It may ultimately make more sense to buy games individually, given general consumer habits. Unlike a movie or TV show where most consumers watch once or twice, games have a far greater repeatability factor. As such, Microsoft is taking a large risk by focusing so heavily on a Netflix-like video game service model.

Conclusion

Microsoft reported a Q4 revenue of $16.6 billion, $20.9 billion, and $14.4 billion for its productivity/business processes, intelligent cloud, and personal computing segments, respectively. All three of these segments experienced moderate growth despite relatively tough market conditions. Despite the fact that Microsoft is returning to pre-Covid levels, the company has seen its valuation drop ~30% to $1.8T. Given Microsoft’s growth opportunities and its recent downturn, the company appears relatively cheap at its current market capitalization.

Be the first to comment