RUNSTUDIO

Overview:

Micron Technology, Inc. (NASDAQ:MU) and Rambus Inc. (NASDAQ:RMBS) are both involved in the manufacture of memory chips. Micron actually makes and sells the complete chip modules (as shown in the above picture) while Rambus manufactures components and licenses IP (Intellectual Property) that are used in the modules themselves. In fact, Micron is one of RMBS’s biggest customers.

Here is what RMBS specializes in:

Join Rambus at IntelON and view a demo of our DDR5 Registering Clock Driver (RCD), Serial Presence Detect (SPD) Hub and Temperature Sensor (TS) that enable new levels of performance in DDR5 memory modules for servers, storage systems and PCs. Source: Yahoo Finance

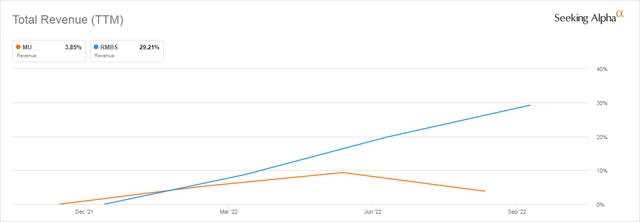

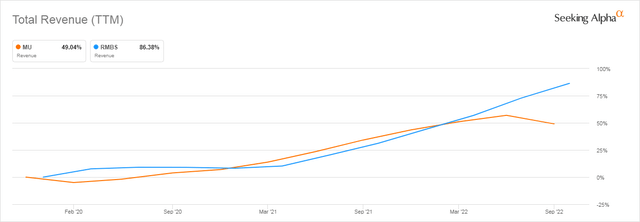

Looking at their 1-year revenue trends RMBS has far outdone MU with revenue increasing by 29% vs a much lower 4% for Micron.

Seeking Alpha

On a longer 3-year basis, RMBS has increased its revenue by 86% compared to Micron’s 49%.

Seeking Alpha

I have written 39 articles on MU over the last 7-plus years, many times comparing their prospects with other chip companies such as my most recent article: AMD Vs. Micron: Which Stock Is The Winner By The End Of 2023?

In this article, I will compare the current status of both companies and come up with an investment recommendation for both.

Financial metrics

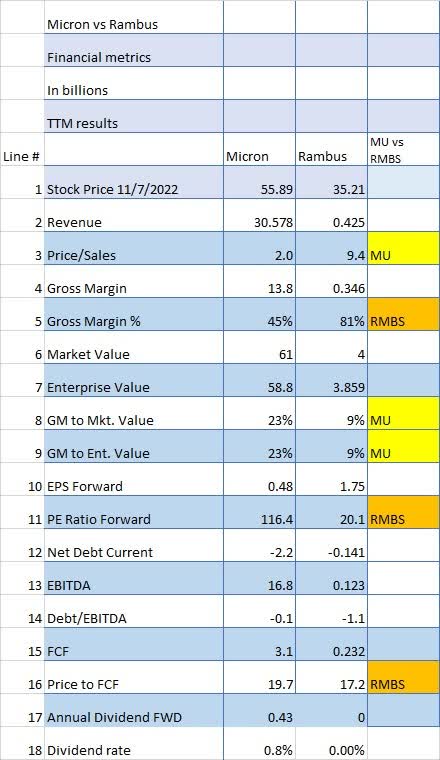

Although technically in the same sub-market memory chips, Micron and Rambus have a huge size differential.

The most noteworthy is the Revenue (Line 2) which shows Micron has a whopping 75x times more revenue than Rambus.

But Rambus does have some advantages such as a huge Gross Margin (Line 4) advantage of 81% to 45% due mainly to Rambus’s high IP sales as a percentage of their total revenue.

Seeking Alpha and author

But the margin metrics look different when you compare them to the relative prices of the two stocks in terms of the GM (Gross Margin) percentage of MV (Market Value) and EV (Enterprise Value). In that case, MU looks much better with a Gross Margin to MV and EV of 23% (Lines 6 & 7) compared to RMBS’s rather paltry 9%.

That would indicate Rambus’s stock may be overvalued on a relative basis.

But if you compare the P/E Ratio (Line 11) and Price to FCF (Line 16), both make Rambus look underpriced relative to MU’s current valuation.

However, over the last 5 years, RMBS has consistently had a much higher Price/Sales ratio most likely due to its IP product lines giving it such a Gross Margin advantage. Therefore, RMBS’s price advantage has a historical basis and may be justified by its large margins.

Seeking Alpha

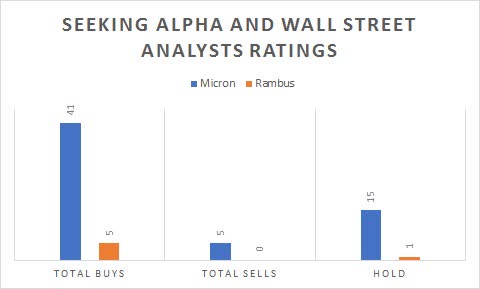

Analysts’ ratings are high for both MU and RMBS but Quants not so much

If we look at Seeking Alpha plus Wall Street analysts combined, we can see that both stocks come highly recommended with a combined score of 46 buys and only 5 sells.

Seeking Alpha and author

But the Quants have both rated as mediocre Hold.

Seeking Alpha and author

Rambus sells products and IP to all the big DRAM manufacturers

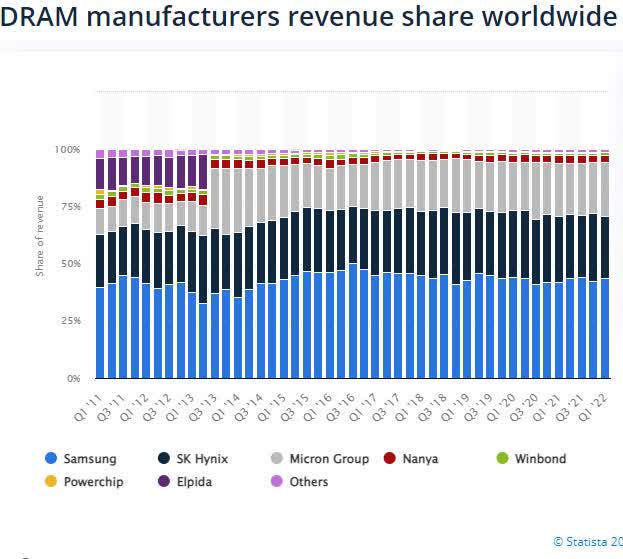

When it comes to memory products, Micron is 2nd only to Samsung (OTCPK:SSNLF) which, of course, uses tons of memory in its own products. SK Hynix is also right in the race for volume.

Statista

And guess who is Rambus’s biggest customers?

We have a high degree of revenue concentration. Our top five customers for each reporting period represented approximately 56%, 46% and 45% of our revenue for the years ended December 31, 2021, 2020 and 2019, respectively. For 2021, revenue from Micron, Samsung and SK hynix each accounted for 10% or more of our total revenue. Source: Rambus 10-K

But Micron is also dependent on a small number of customers:

In each of the last three years, approximately one-half of our total revenue was from our top ten customers. A disruption in our relationship with any of these customers could adversely affect our business. Source: Micron 10-K

Neither company did well in the last recession

If you are concerned, as I am, of a looming recession in the next year or 18 months, knowing how a company did in the last recession can provide some investment insight.

December 2007 through June 2009 is the last recognized recession period and both Micron (down 39%) and Rambus (down 36%) did poorly which makes complete sense since Rambus sales are dependent on Micron and other DRAM manufacturers.

So neither company would be a pick if a recession is coming.

Seeking Alpha

Conclusion:

As seen above in the Overview section, over the last 1 and 3-year period, Micron’s revenue has gone down and Rambus’s has gone up.

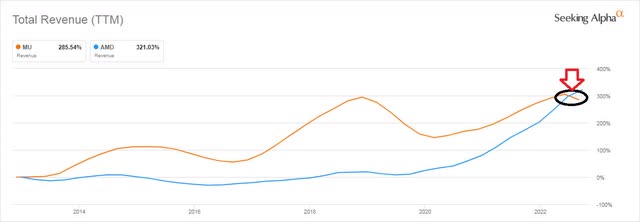

The other issue is how cyclical Micron’s business and revenue have been over long periods of time.

For a high-tech comparison here’s the 10-year revenue chart for Micron compared to AMD and it is easy to see the lumpiness of MU’s revenue. This is because the memory business is very commodity-like compared to for example the CPU business. You might also wonder if that last little dip shown by the red arrow in the 10-year chart is the beginning of a new downward cycle.

Seeking Alpha

The obvious investment question is whether now is the time to buy either of these two memory chip companies considering the state of the world with chip and logistic issues, very high inflation, and war in Europe for the first time in decades. Personally, I am very wary of high-tech stocks like Micron and Rambus.

Micron is a sell and Rambus is a Hold.

Be the first to comment