Bjarte Rettedal/DigitalVision via Getty Images

Thesis

We run a marketplace service on Seeking Alpha. You can guess from the name of our service (Envision Early Retirement) that our mission is to build a community to help each other reach earlier retirement (a journey we are going through ourselves). And a key piece in our plan involves a UTMA (Uniform Transfers To Minors) portfolio that we manage for our young son. If you are in a similar stage in your financial life, there are a few good reasons to consider such an account too (as detailed in the second section).

Under this context, the main thesis for today is that we don’t mind buying deeply cyclical stocks like Micron (NASDAQ:MU) for our UTMA account. Actually, we like buying deeply cyclical stocks in this account, as you can see from our holdings below. Specific to MU, you will see that our key considerations are:

- Now is a good entry point for MU. Its valuation is near a cyclical low. And if you can wait out the near-term volatilities and hold it through one cycle, the return potential is truly outsized.

- The key for cyclical businesses to do well is to A) maintain solid finances to survive the contraction phase, and B) be disciplined and consistent with CAPEX investment. And in our view, MU has been doing a great job on both fronts.

- MU’s planned chipmaking plants, combined with the support from the CHIPS act, will put it in an excellent position for expansion when the contraction phase is over. And my estimated timeframe for the end of the contraction phase is sometime in 2023 as detailed in our earlier article.

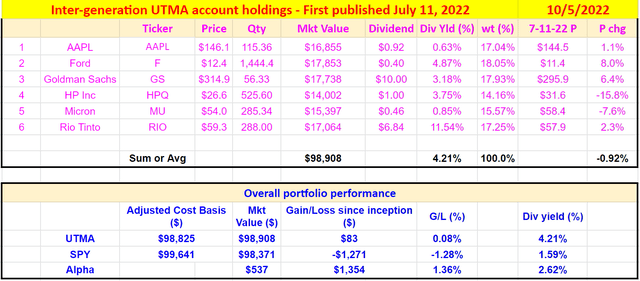

Source: Author based on Seeking Alpha data

Our UTMA account holdings

Before diving into the details, a few quick words about our UTMA account in case it is of interest to you. More details can be found in our recent article or on this page from Fidelity (where our account is). To be brief, the key considerations for us to have such an account boil down to 3 buckets:

First and foremost, provide a nest egg for our son. Second, use it as an educational tool for him to learn investing and financial responsibility (it is a wish and we will see how it goes when he is old enough). And finally, it offers some tax advantages and the time horizon to accommodate more aggressive investment ideas.

Our current holdings are listed in the chart above. A few notes:

- Our style is to hold a really concentrated portfolio given the timeframe of this account. You should tailor your diversification and exposure accordingly.

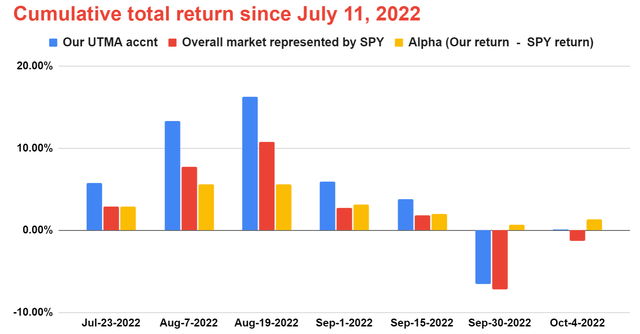

- For performance tracing purposes, I used the prices on July 11, 2022 (the date I first published this portfolio) on SA as the entry price to make it easier for readers to track its performance. As you can see, the whole account is leading SPY by a small margin of 1.36% (based on the prices after the market close on Oct 4) since then adjusted for dividends.

- Also note that despite the fact that we hold only 6 stocks and quite a few of them are highly cyclical (commodity stock like ROI and auto stock like F), the portfolio actually suffered lower downside volatility and consistently performed the SPY so far even amid some of the most extreme market turbulence. Again, there is nothing wrong to own cyclical stocks, but everything can go wrong when you buy them near cyclical peaks.

Source: Author based on Seeking Alpha data

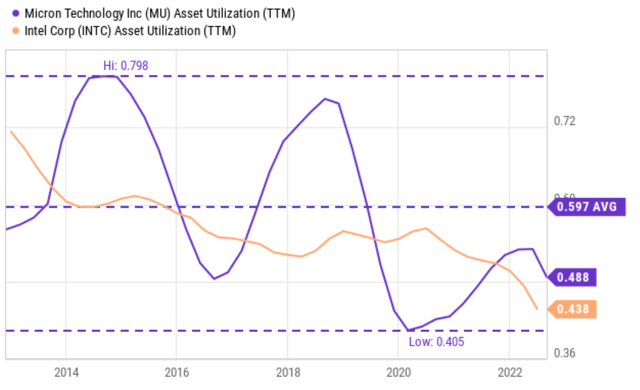

MU is deeply cyclical

There is no doubt that MU is deeply cyclical. As a matter of fact, it is the most cyclical chip stock among the major ones, as we’ve analyzed in our previous article. In the next chart, you can see this clearly from its asset turnover rate when compared to Intel (INTC), a less cyclical one. To wit, the ATR for MU has fluctuated in almost a perfect sinewave fashion over the years, as you can see. It oscillated widely between about 0.798x and 0.405x, with an average of 0.597x in the past 10 years. Its current ATR of 0.488x is below its long-term average and also close to its bottom level in a decade. In contrast, INTC’s ATR is lower than MU on average, but also a lot less cyclical as seen.

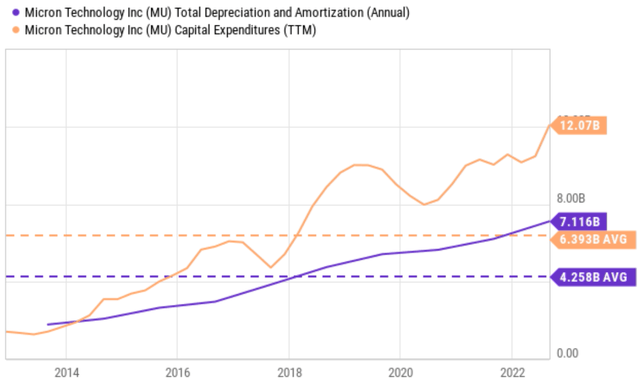

Discipline is the key

As aforementioned, the key to surviving (and thriving) through cycles is to be disciplined both with finances and with CAPEX investment. And in my view, MU has demonstrated discipline on both fronts. The chart below shows a small example of its disciplined way of managing the business through cycles.

The chart shows MU consistently reinvests in itself over the years despite the business cycles. Its CAPEX expenditures have always exceeded its depreciation and amortization (“DA”). Its CAPEX expenditures have been averaging $6.39B per year over the past decade, exceeding its average DA of $4.25B by more than 50%. In particular, in the most recent quarter, MU spent more than $12.0 billion on CAPEX expenses, and its total DA is only about $7.1B. If we use the total DA as an approximation for its maintenance CAPEX expenses, then MU has spent about $4.9B on growth CAPEX as of the latest reporting period. In other words, about 40% (38.6% to be exact) of its CAPEX is still aimed at fueling future growth.

Total shareholder yield

A key advantage brought about by the long-term horizon of our UTMA account is that we do not have to worry about current dividend income. We can completely focus on total shareholder yield (or total shareholder returns as detailed in the next section).

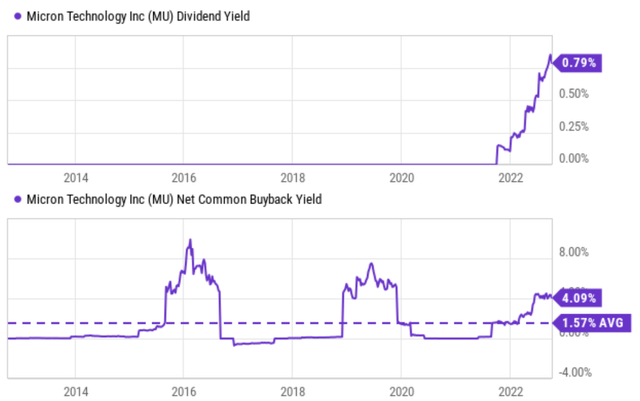

MU currently provides a somewhat negligible dividend yield of about 0.79% as seen in the top panel of the chart below. However, when the total shareholder yield is considered, the picture changes drastically as seen in the bottom portion of the chart.

It has been consistently buying back its own shares over the years. Again, you can see the cyclicality again – the magnitude of the buybacks is also cyclical because of the cycles in its cash flow. But on average, its buyback yield is about 1.57% over the long term and it currently stands at 4.09%. As result, MU actually provides a quite healthy total shareholder yield of around 4.9% under its current conditions (4.09% buyback yield plus 0.79% dividend yield).

And I also much prefer it spend more cash on buybacks than dividends given its currently depressed valuation, as detailed immediately next.

Earning yield

Taking a further step, even the above buyback yield underestimates its return potential. As argued in my earlier article:

For other long-term investors, earning yield is what’s really matters. The reason is that it doesn’t really matter how the business uses the earnings (paid out cash dividends, retained in the bank account, reinvested to further grow the business, or used to repurchase stocks), as long as used sensibly (as MU has done in the past), it will be reflected as a return to the business owner.

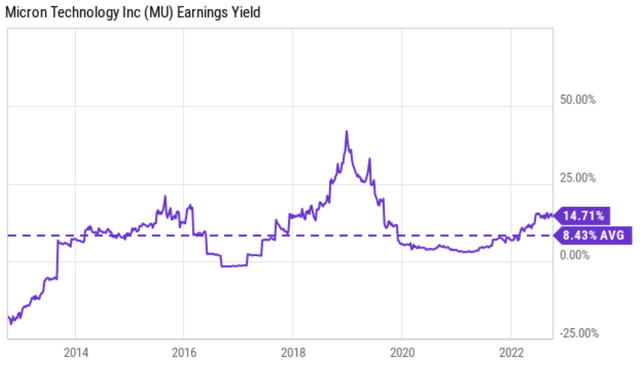

That is why earning yields are more fundamental for a long-term account such as our UTMA account. As can be seen from the next chart, currently the earning yield of MU is about 14.7%. It is so attractive in both absolute terms and also in relative terms (say compared to a 10-year treasury yield of about 3.9% or the earning yield of the overall equity market around 5%). Compared to its own history, the stock is currently yielding more than 600 basis points (or 74% in relative terms) above its long-term average of 8.43%.

Risks and final thoughts

Besides being cyclical, there are a few other risks worth mentioning. Its auto unit production remains below demand because of supply chain disruptions and silicon shortages. The Russian/Ukraine war, and more generally, the geopolitical unrest in Eastern Europe in general, further exacerbates the problem. Many semiconductor manufacturers there began to search for alternative product inputs. Its planned new plant will involve intensive capital investments, even with the subsidies from the CHIPS act. And the construction of these plants will stretch out to the end of the decade or even beyond.

To conclude, we have little doubt that MU will survive this cycle with its disciplined finances and capital investment. We further believe its new plants, helped by the CHIPS act, actually will make it stronger in the next cycle. Buying a cyclical stock like MU at a secularly low valuation like now creates the potential for 20%+ annualized total return if you have an investment horizon that is long enough (say 5 to 10 years). The current earnings yield already provides nearly 15%. Moderate growth of 5% per year can already deliver a 20% total return, even if valuation remained compressed at the current bottom level.

Be the first to comment