rez-art/iStock via Getty Images

Casino stocks have plummeted in 2022 amid record inflation and mounting fears of a recession. These macroeconomic headwinds, which tend to be associated with lower consumer discretionary spending, have fueled sustained sell-offs in all major casino and gaming stocks.

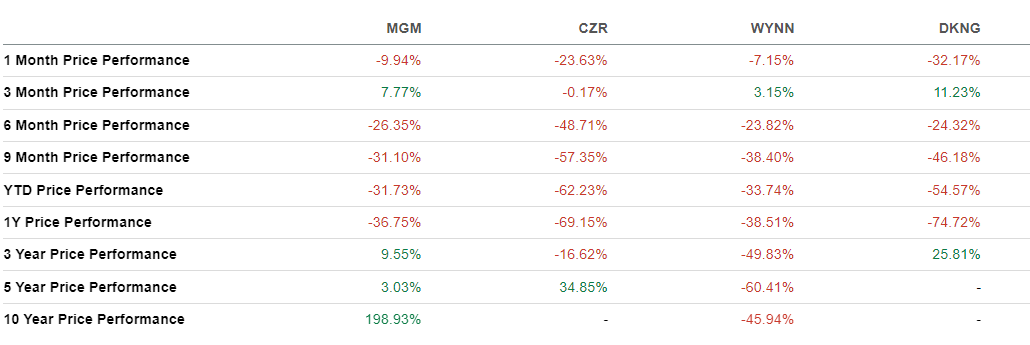

The screenshot below, which shows the performance of key stocks in the sector, illustrates how badly the sector has fared. MGM Resorts International (NYSE:MGM) and Wynn Resorts Ltd (WYNN) are each down more than 30% YTD, Caesars Entertainment Inc (CZR) is down more than 60%, while DraftKings (DKNG), which operates a digital sports betting platform, is down more than 50%.

Casino stocks are in a downtrend (Seeking Alpha)

Exposure to China has been another major headwind for MGM, WYNN and CZR. All of them have a presence in the gambling hotspot of Macau in China. Lockdowns and travel restrictions are still being actively implemented in China under the government’s zero-covid policy. This has led to a decline in visitor numbers and a consequent slump in revenue for resort and casino operators in Macau, including MGM, WYNN and CZR.

Amid these challenges, it may be tempting for investors considering casino stocks to stand on the sidelines and wait for a positive shift in sentiment. In some situations, this is the safest and smartest move to make. However, this is not one of those scenarios. There is an exciting opportunity to profit by initiating a long position in MGM, which stands out as the best bet compared with its peers, WYNN and CZR, as well as other newer digital-first entrants like DKNG.

Strong revenue and profitability

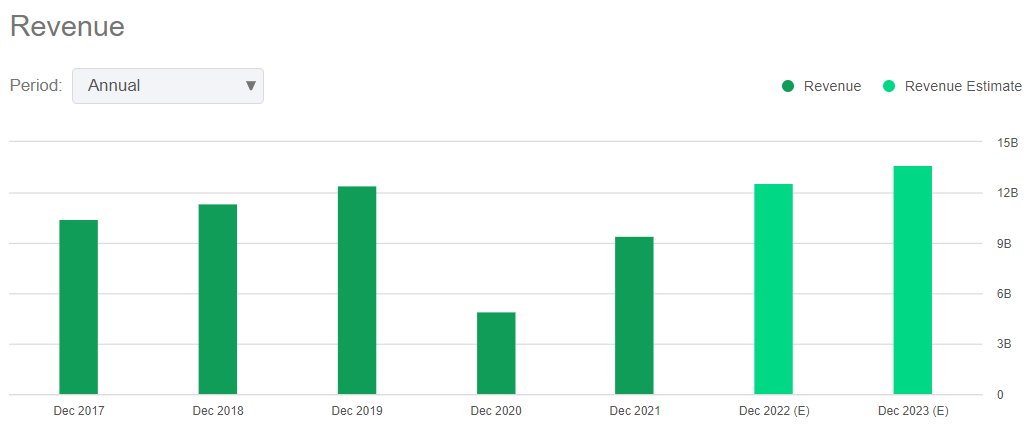

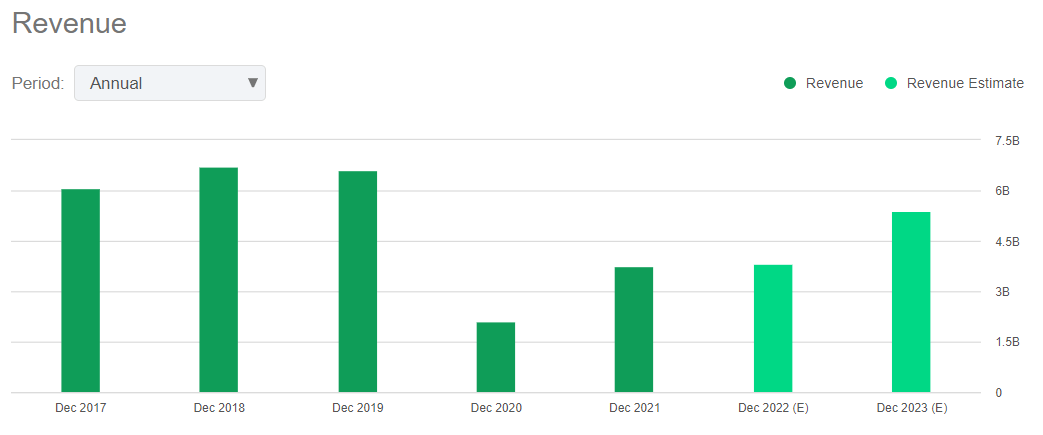

MGM’s revenue for FY2022 is on track to surpass 2019 levels. This means that the company has successfully worked its way through the pandemic-induced downturn – something that peers like WYNN are yet to do. WYNN is a smaller business today (from a top line perspective) than it was before the pandemic.

MGM’s revenue is on track to getting back to pre-pandemic levels (Seeking Alpha) WYNN’s revenue is yet to recover to pre-pandemic levels (Seeking Alpha)

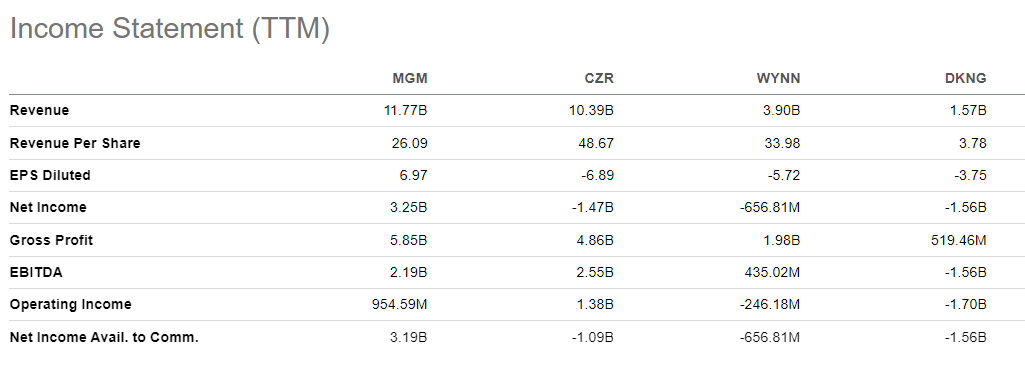

Another point to consider is MGM’s superior profitability relative to its peer set. To begin with, it is the only profitable player, which is a crucially important consideration for investors amid rising interest rates.

MGM income statement vs peers (Seeking Alpha)

It’s noteworthy that MGM is not only profitable, but has grown its margins in the past few years despite the headwinds the broader sector has faced with Covid and the difficult macroeconomic environment.

MGM’s gross profit margin (TTM) stands at 48.68%, compared with a five-year average of 42.94%. Its EBITDA margin (TTM) stands at 18.57% compared with a five-year average of 14.35%. CZR has not had a material improvement in its profitability while WYNN has seen a deterioration in its profitability.

MGM looks set to maintain its strong margin performance if you zoom into Q2 earnings. “Our second quarter results represented our highest adjusted property EBITDAR quarter in the history of Las Vegas, both on an absolute and same-store basis,” said CEO Bill Hornbuckle on the earnings call.

If you pore over its Q2 earnings presentation, there is one interesting insight you’ll uncover that speaks to MGM’s potential to continue delivering strong financial performance. This is its performance in China.

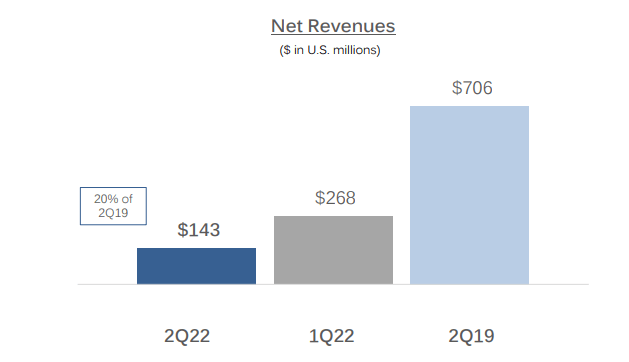

As at Q2, net revenues for MGM’s Chinese unit were just 20% of 2Q2019 revenues. The business in China has contracted substantially due to the zero covid policy. This is a huge opportunity in terms of future earnings potential and stock price movement.

MGM Chinese revenues in Q2 (MGM)

Why is this an opportunity and not a risk? Although the zero covid policy is set to continue, it won’t stay in place indefinitely as the government will at some point have to declare “victory” over the pandemic. Macau will come back. MGM, with a 14% market share in China as per its Q2 earning presentation, is well positioned to benefit when this happens. Reopening in China will supercharge its already impressive and profitable financial performance.

Shareholder-friendly management

MGM also has a shareholder friendly management team. There are several indicators of this. The most obvious one is its share repurchase program. “Since the beginning of 2021, through last night, we repurchased 104 million shares for $4 billion, or 31% of our market cap. This activity brings our share countdown to approximately 393 million shares,” said CEO Bill on the Q2 earnings call.

The other less obvious but equally important indicator of MGM’s shareholder friendly management is the smart investments it is making to grow the business. MGM has been selective about the partnerships it’s making to grow its sports betting and iGaming propositions. The same cannot be said about majority of companies venturing into the space.

Many gaming companies are eroding shareholder value in pursuit of the growth opportunity in mobile sports betting and iGaming. They are spending too much marketing dollars on promotions and discounts to acquire disloyal customers who are spoilt for choice. DKNG best exemplifies this. DKNG has an EBITDA margin of negative 99.56%, highlighting the unsustainable cash burn at the Cathie Woods backed sports betting company. This atrocious margin essentially means its operations are losing a dollar for every dollar it generates from customers – hardly sustainable.

MGM’s iGaming and sports betting endeavors are held within BetMGM, which is a 50-50 joint venture with Entain. This model spreads the risk and the cost associated with venturing into sports betting and iGaming. It also brings in an experienced and formidable partner in the form Entain, which is a FTSE 100 company. BetMGM has unsurprisingly been able to grow market share in the U.S., where the sports betting opportunity has exploded thanks to ongoing legalization. It had about 22% of the combined U.S. sports betting and iGaming market, according to February data from Eilers & Krejcik, second only to FanDuel and ahead of DKNG. The fact that it has built this strong presence in online gambling without eroding shareholder value is impressive.

MGM has been able to bring in quality shareholders, underlining the confidence the management has built in the investment world. IAC Inc (IAC) has been lapping up shares since early 2020. The Barry Diller-led firm in August had a 16.5 percent stake.

Conclusion

MGM’s EV/EBITDA (FWD) stands at 12.10x. WYNN’s, in contrast, is 20.09x and CZR’s is 10x. MGM is cheap when you take into account that its peers are profitless at the moment and the fact that its 5 year average EV/EBITDA is 26.28x.

The main risk to watch out for is a recession. Although casino CEOs have in recent months downplayed fears of a recession, investors need to be prepared nonetheless as company executives have an incentive to project confidence and strength. In the event of a recession, the risk of sector -wide sell off pulling down MGM cannot be ruled out. We are, however, confident that the stock is a buy based on fundamentals and view any pullbacks in the near-to-midterm as a discount from Mr. Market.

Be the first to comment