Kwarkot

Investment Thesis

MFA Financial (NYSE:MFA) is a specialty finance business and a mortgage real estate investment trust (REIT) dealing in Residential Whole Loans, Residential Mortgage Securities, and MSR-related assets. The company has recently reported its third-quarter financial results, which are negatively affected by market volatility. Despite the adverse conditions, I believe the company has a lot of growth opportunities as its SFR portfolio is rapidly growing, which can help it to expand its profit margins. MFA Financial has a high dividend payout, making it an attractive investment opportunity for risk-averse investors.

About MFA

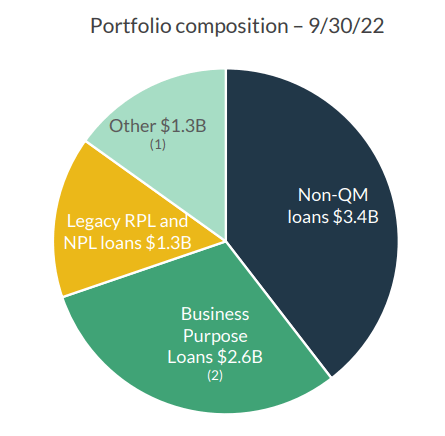

MFA is a real estate investment trust and a leading specialty finance business that deals in financing & investing in mortgage assets. Targeted investments of the company include Residential whole loans, Residential Mortgage Securities, and MSR-related assets. The Residential whole loans mainly include purchased non-performing loans, purchased credit deteriorated, and purchased performing loans. It also consists of originating and servicing business-related loans for investors dealing in real estate. Residential Mortgage Securities include CRT securities which are debt obligations financed by Fannie Mae and Freddie. MSR-related assets comprise term notes directly or indirectly backed by Mortgage Servicing Rights. In the previous year, MFA Financial acquired the remaining ownership in Lima One Capital and now owns 100% of the company. It deals in originating & servicing business purpose loans and has managed business purpose loans of over $6.0 billion since inception. MFA has reported over $2.9 billion in originations since acquisitions in Q3 2021 and a trailing 12-month origination volume of $2.5 billion in Q3 2022.

Portfolio Composition of MFA (Investor Presentation: Slide No. 9)

Q3 FY2022 Result

The mortgage REIT sector was negatively affected by the global Covid-19 Pandemic and experienced a downturn for a long period. Despite all the economic pressures, the industry rebounded rapidly and outperformed market expectations. It is further expected to grow with improving economic conditions favoring the markets for residential mortgage assets. The company has recently reported its third-quarter results. It reported a net interest income of $52.3 million, down 15.37% compared to $61.8 million in the previous year, mainly due to market volatility and increasing interest rates. However, net interest income from Residential Whole Loans surged 12% to $114.4 million on a sequential basis. The company generated a GAAP loss of $63.2 million, a 150% decrease compared to Q3 2021. A decline in earnings resulted in a loss per share of $0.62. It reported a GAAP book value of $15.31 per common share compared to $4.82 per common share in the same quarter of the previous year. The company reported loan acquisition activities of $710.4 million, which included $519.6 million of funded originations. The company ended its third quarter with $434.1 million in cash and cash equivalents.

Though the financials experienced a downturn in the third quarter due to market volatility, some of the company’s investment portfolios delivered attractive yields. Lima maintained its strong growth in this quarter by acquiring $152 million of SFR (single-family rental) loans. I believe that the company can benefit from the SFR portfolio in the future as the demand for it is increasing rapidly, mainly due to insufficient housing supply to meet the demand of the U.S. population. I expect that the market conditions can normalize in the coming times, which can further help the company to perform well and expand its profit margins which are currently affected by the volatility despite significant growth in the portfolios.

Dividend Yield

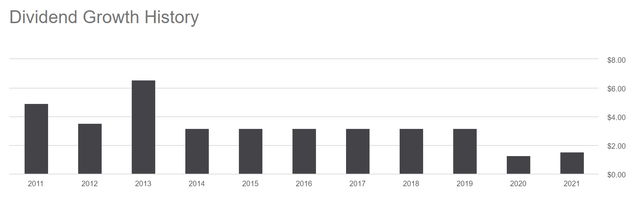

Dividend Payment History of MFA (Seeking Alpha)

The company’s impressive dividend payout history signals its well-positioning in the market. In the current year, it distributed a cash dividend of $0.11 in the first quarter. In the second quarter, the company completed a 1-for-4 reverse stock split of its common stock, making the dividend payment per share $0.44. Looking at the company’s current cash balance, I think MFA can maintain this dividend payout for the coming quarters. I believe this dividend can remain constant for the fourth quarter making the annual dividend $1.76. This dividend payment represents a dividend yield of 16.43%. I think this is an attractive investment opportunity for risk-averse investors as it can generate stable income in the long term.

What is the Main Risk Faced by MFA?

MFA Financial’s performance highly depends on changes in interest rates. Interest rates can fluctuate due to many factors, such as monetary and fiscal policies, and also highly depends on the international, economic and political environment. The company depends on borrowings under repurchase agreements to raise funds for the purpose of acquiring residential mortgage assets, which exposes it to the risk of fluctuating interest rates. If the interest rate rises, it can increase the company’s borrowing cost rapidly as compared to interest earnings. In such cases, its net interest spread and net interest margins can be affected negatively, further contracting its profit margins.

Valuation

MFA Financial has recently reported weak third-quarter results due to market volatility despite well-performing portfolios. I expect that the market conditions can be favorable in the coming times, and REITs can benefit from the increasing demand for SFR loan portfolio as the demand for it is increasing rapidly, mainly due to insufficient housing supply. After considering all the above factors, I am estimating an FFO per share of $1.75 for FY2023, giving the forward P/FFO ratio of 6.11x. After comparing the forward P/FFO ratio of 6.11x with the sector median of 9.87x, I think the company is undervalued. Fluctuating interest rates due to various political, economic, and international factors can affect the financial performance and contract the company’s profit margins. Hence, I think the company might trade below the sector median in the coming years. After considering all these factors, I estimate the company might trade at a P/FFO ratio of 8.60x, giving the target price of $15.05, which is a 40.6% upside compared to the current share price of $10.70.

Conclusion

MFA Financial is a mortgage real estate investment trust. It is exposed to the risk of fluctuation in interest rates which can contract its profit margins. The company has recently reported its weak third-quarter financial results affected due to market volatility despite some of its well-performing portfolios. I believe that the market conditions might normalize in the coming year, and it can accelerate the company’s growth as the SFR loan portfolio has a lot of growth opportunities due to increasing demand for housing.

MFA pays a high dividend yield which might be sustainable as it is well-positioned in the market. This dividend yield makes the company an attractive investment opportunity for yield-hungry investors. After considering all the above factors, I assign a buy rating to MFA Financial, Inc.

Be the first to comment