INFLATION KEY POINTS:

- Mexico’s headline CPI cools down to 5.88% y/y in June from 5.89% y/y in May

- Meanwhile, core inflation soars to 4.58% y/y from 4.37% y/y in the previous month, a sign that inflationary pressures are becoming more widespread

- Inflation results fail to trigger a strong reaction in USD/MXN as risk-off mood appears to dominate markets

Most read: Equities Resume Pullback, DAX 30 and FTSE 100 Face Critical Levels

Mexico’s headline inflation cooled moderately last month relative to May’s results, as lower livestock prices helped offset increases in multiple other sources, such as goods and services. According to INEGI, the June consumer price index rose 0.53% on a monthly basis, bringing the 12-month reading to 5.88% from 5.89% in May, slightly above expectations. Meanwhile, core inflation, which excludes volatile items, climbed 0.57% m/m. This result pushed the annual print to 4.58%, its highest level since December 2017, a sign that upward pressure on prices is becoming broad-based and pervasive.

The table below summarizes the data released this morning

Source: DailyFX Economic Calendar

According to its mandate, Banxico targets an inflation rate of 3%, with a tolerance of one percentage point above or below that level. Given that both headline and core CPI currently sit well above the upper limit of the variability range, the central bank will be under more pressure to raise interest rates again in the coming months to maintain credibility, contain inflation and ensure expectations do not become unanchored.

In Mexico, economic activity has started to improve and risks around the growth outlook have become more balanced in the midst of rising vaccinations rates, higher oil prices, record high remittances and strong external demand, primarily from the United States. The somewhat favorable backdrop affords Banxico more flexibility to continue tightening monetary policy in order to prevent second-round effects on the economy’s price formation process.

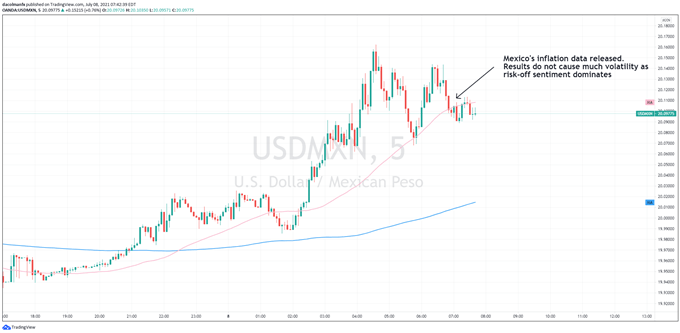

In any case, Mexico’s CPI results are not triggering any major reaction in the USD/MXN exchange rate this morning as risk-off mood dominates the markets. At the time of writing, the pair is up 0.76% to 20.10 amid strong safe-haven demand and reduced appetite for EM FX. It is worth noting that the dollar could accelerate its gains against the Mexican peso if the equity sell-off intensifies throughout the day. Over the medium term, however, the Mexican peso outlook remains constructive, supported primarily by its higher carry advantage in the forex market.

USD/MXN 5-MINUTE CHART

EDUCATION TOOLS FOR TRADERS

—Written by Diego Colman, DailyFX Market Strategist

Follow me on Twitter: @DColmanFX

Be the first to comment