onurdongel

We started coverage with a hold rating of Methode Electronics, Inc. (NYSE:MEI) in our September 2020 article on Seeking Alpha. The share price was $28. It slipped to $24, then climbed over the next eight months to nearly $50.

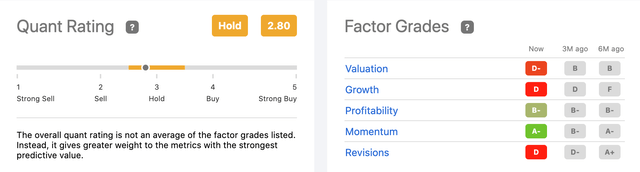

The stock stumbled around for another 15 months. The price fell to $34 before closing November 2022 at $50.23 on a good Q2 ’23 earnings report. While we think highly of the company’s management, we concur with Seeking Alpha’s long-held hold Quant Rating. Recently, the rating began sliding to the sell side. Any significant pullback into the mid-$30s, like on October 6 ’22, might make this a bullish opportunity.

MEI Stock Price (seekingalpha.com/symbol/MEI)

The Business

Chicago-based Methode Electronics, Inc. is in business for 76 years. The company produces mechatronic products selling worldwide through four segments:

· The Automotive segment supplies electronic and electro-mechanical devices including integrated center consoles, hidden switches, ergonomic switches, transmission lead-frames, and LED-based lighting and sensors.

· The Industrial segment manufactures lighting solutions, industrial safety radio remote controls, braided flexible cables, current-carrying laminated busbars and devices, custom power-product assemblies, high-current low-voltage flexible power cabling systems, and powder-coated busbars for aerospace, cloud computing, commercial vehicles, industrial, military, power conversion, and transportation.

· The Interface segment provides various copper-based transceivers and related accessories for the cloud computing hardware equipment and telecommunications, for appliances, fluid-level sensors for marine/recreational vehicles, sump pumps, and point-of-sale equipment markets.

· The Medical segment sells a surface support technology aimed at patients at risk for pressure injuries, including patients undergoing long-duration surgical procedures.

Concerns

We think the MEI share price is currently overvalued. It rose a whopping 468% over 10 years, as the company made 14 acquisitions. The stock bucked this year’s downward trend in the technology (-19.7%), services (-18.6%), and transportation (-9%) sectors of the economy. But Methode’s shares are up only 10% over the last five years, 13.8% in the last 52 weeks, and a mere +3% YTD. A recent upswing in positive new coverage coupled with a better-than-expected Q2 ’23 report amped the jump to +$50.

A second concern is the overall quality of the stock. Seeking Alpha consistently has a hold rating that extends over 12 months; the Factor Grades remain weak over the past six months. Sell territory is where the hold rating is now. Only a few analysts cover the stock.

Quant Rating/Factor Grades (Chart)

The actions of hedge funds and corporate insiders highlight our third concern for retail value investors. Hedge funds decreased their holdings in the last quarter. 15 funds owned Methode Electronics shares in Q1 ‘21, as the price neared $40; seven of them then sold out. 10 funds are invested at the present time. This suggests smart money is cautious about the stock’s current high price. Corporate insider stock sales far outpace the buys for two years; corporate insiders sold $462K worth of shares in the last three months.

The fourth concern is the high price of the shares. We think a fair average price target is about $45. We base that figure on historic multiples of the P/E ratio, PB ratio, and price-to-cash flow ratio. Past returns, growth, and future estimates, if the economy improves, can potentially move the price closer to $55. There are several positive factors to consider.

Opportunities

Methode Electronics, Inc.’s share price boost might have come from some shift in the economic outlook. Some gurus are bullish in their outlook. They are discounting talk about a market crash. Others believe stashing cash, and buying high-yield money markets, bonds, and companies with the promise of better returns is wiser. The response to the Q2 report suggests to us that investors responded more to the sizzle than the steak.

Seeking Alpha reported on December 1, ’22, that Methode’s Q2 ’23 net sales were +6.9% Y/Y to $316M. Earnings per share were $0.75, topping the consensus of $0.63. Net sales growth was driven by the Industrial segment (+28.6%). There were record electric and hybrid vehicle application sales. Management raised expectations for higher net sales and EPS next quarter from previous announcements, but they are cautious because of lingering problems in the economy. The next report date is March 1, 2023.

On the downside, the Automotive segment sales showed a soft increase of half-of-one percent. The Interface segment revenue in the quarter fell -21.7%. The operating margin for the quarter dropped to 10.4% for all the same reasons challenging the company for the last several years: the war in Europe, higher material costs, supply chain disruptions, semiconductor shortages, foreign currency headwinds, lockdowns in China, labor shortages, etc. Keep in mind that robust sales in Q2 include “approximately $15M of sales recovered from Q1 through the COVID lockdowns in China,” according to the CFO, as Seeking Alpha reports.

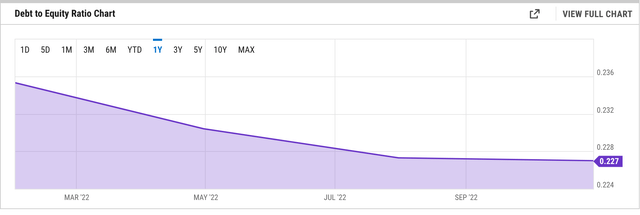

Other positive considerations for the price increase might include the short interest standing at 1.83%. The dividend yield is low at 1.1% but we consider it safe and it has been consistent. The company cut debt by $6.5M and $150M since 2018. Its debt-to-equity ratio is better than half of the nearly 2100 similar companies. Methode made 14 acquisitions, 3 in the last 5 years, primarily in the electrical equipment and automotive segments. A decade ago, Methode stock sold for about $10. Grakon is a custom lighting solutions company that was bought in 2018 for $420M.

Debt to Equity Ratio (ycharts.com/companies/MEI/debt_equity_ratio)

Q2 ended with Methode Electronics, Inc. holding almost $130M in cash. The company bought back almost $20M in shares. It spent $31.6M in the first two quarters on buybacks. There remains another $97M to purchase under the Board’s plan. Accounts receivable are up, thus reducing cash from operations in the quarter; that will probably even out. Meantime, non-GAAP free cash flow is down to $7M compared to $21.6M in FY ’22.

Takeaway

Methode Electronics, Inc. appears financially healthy and able to cover its debt and interest payments. The Industrial segment is strong, and there is potential for the Automotive segment to blossom in 2023. Global EV revenue is expected to jump by 20%. The global LED market is speeding up at an annual 14.68% CAGR. The World Health Organization estimates there are 2M different medical devices on the world market, categorized into over 7000 generic device groups. More spending on medical devices is on the way. Conditions bode well for future sales across Methode Electronics segments.

We missed the October-November price pop, but we do not believe the Q2 ‘23 results warrant the stock making a 52-weeks high. We expect the shares to slip before the end of Q3, especially if the economy softens, as predicted.

We take some solace in having written in 2020 that Methode Electronics has the potential for “good financials (that) comes with good management” at the company’s helm. “Management knows it’s business; management is focused on the industries it serves and products they need.” We forecast that “MEI shares might spike from time to time…” and retail value investors ought to keep an eye out for opportunities.

Be the first to comment