Justin Sullivan/Getty Images News

(Source: Euphoric Investment)

Metaverse: A New Reality

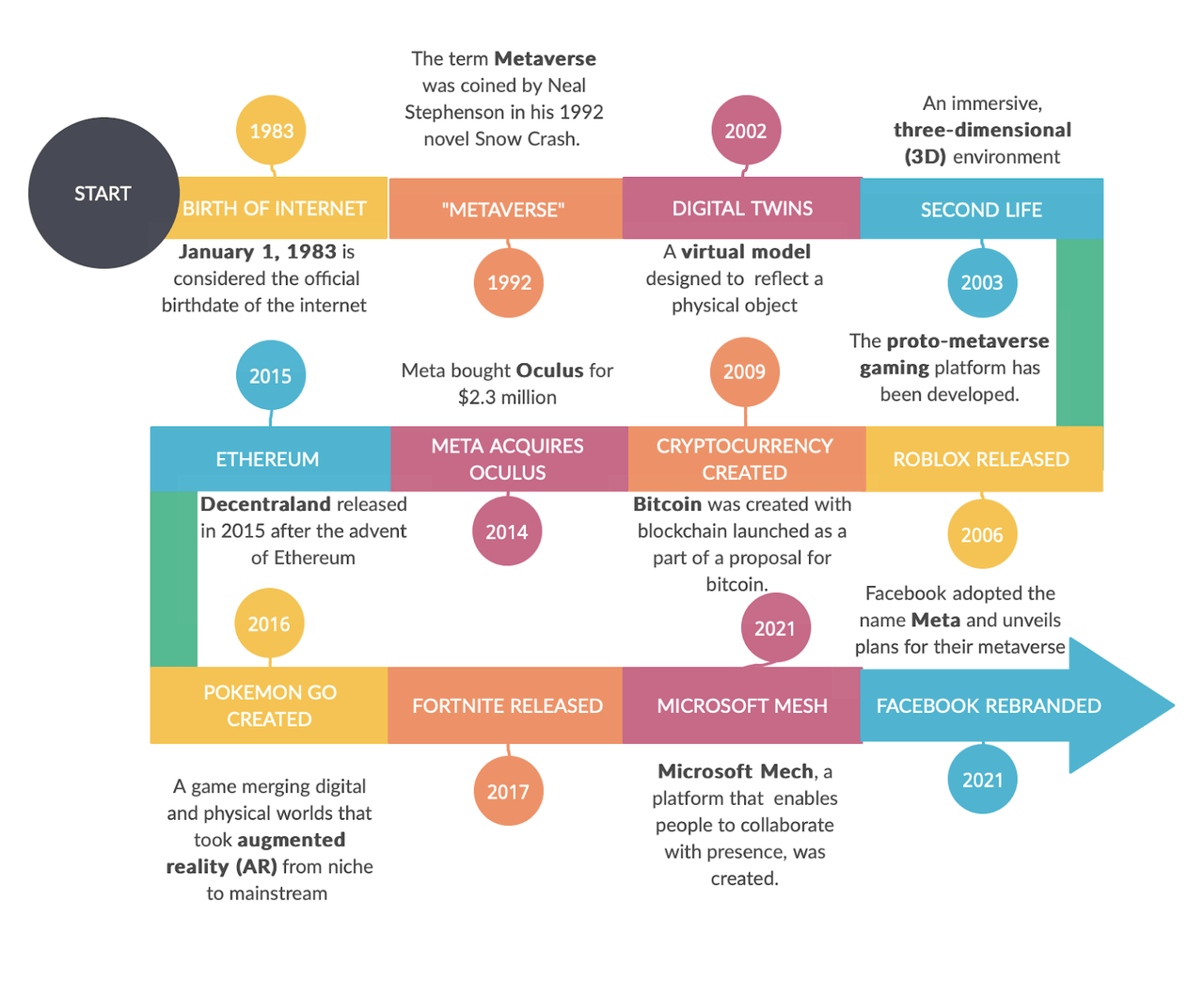

Meta Platforms (NASDAQ:META) believes the metaverse to be the next evolution of social connection. Imagine being transported into a virtual reality where you can seamlessly talk and interact with your family and friends. You can play games, go to a concert, and even go shopping- all within the metaverse. That reality is here today, with Mark Zuckerberg envisioning a billion people in this new reality by the end of the decade. The metaverse simply refers to a 3-D virtual world that is accessed largely through augmented reality (AR) and virtual reality (VR) technology like headsets or through gaming apps such as Roblox and Fortnite. The metaverse has seen explosive growth fueled by the rise of a new generation of internet users.

(Source: Euphoric Investment)

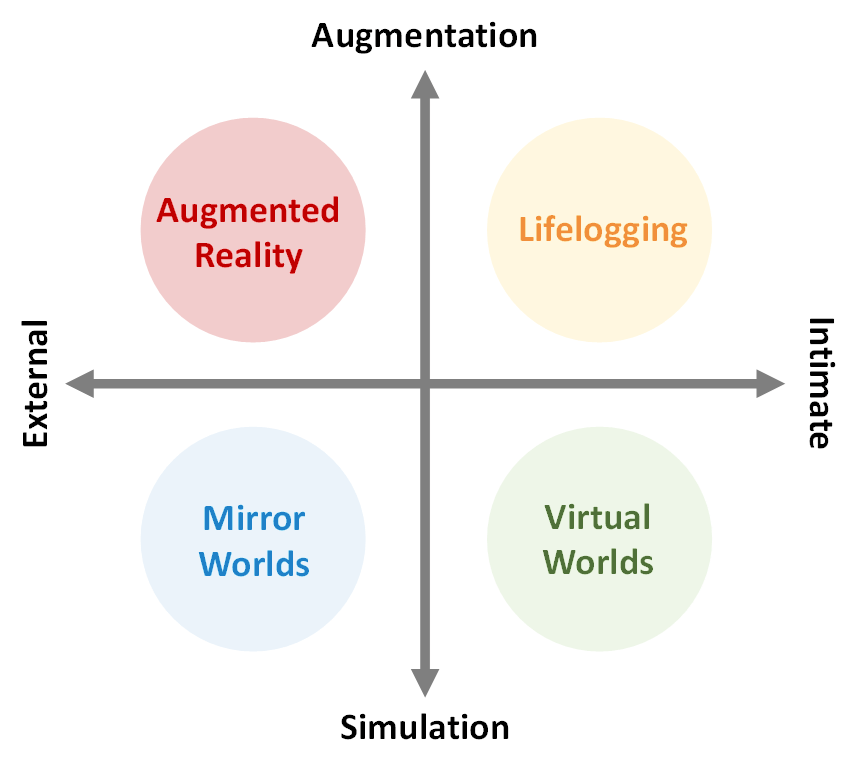

While the metaverse is often thought of as just VR headsets, it encompasses multiple dimensions including AR, Lifelogging, and Mirror Worlds. Lifelogging, represented by Apple (AAPL) watch, allows users to record/monitor their daily activities and augment their lives to the digital world. Mirror Worlds such as Google Maps (GOOG) (GOOGL) capture the real world and create a virtual simulation of external reality.

(Source: Euphoric Investment)

Potential Size of the Metaverse

Alvin Graylin, China President of HTC, predicts that “within 10 years, we will spend more of our waking time in the 3D world, in the virtual world than we will in the physical world.” The metaverse has the potential of being highly disruptive, particularly within the gaming, retail, education, healthcare, manufacturing, real estate, and entertainment sectors. According to XR Today, there could be virtual work, learning spaces, businesses, and markets.

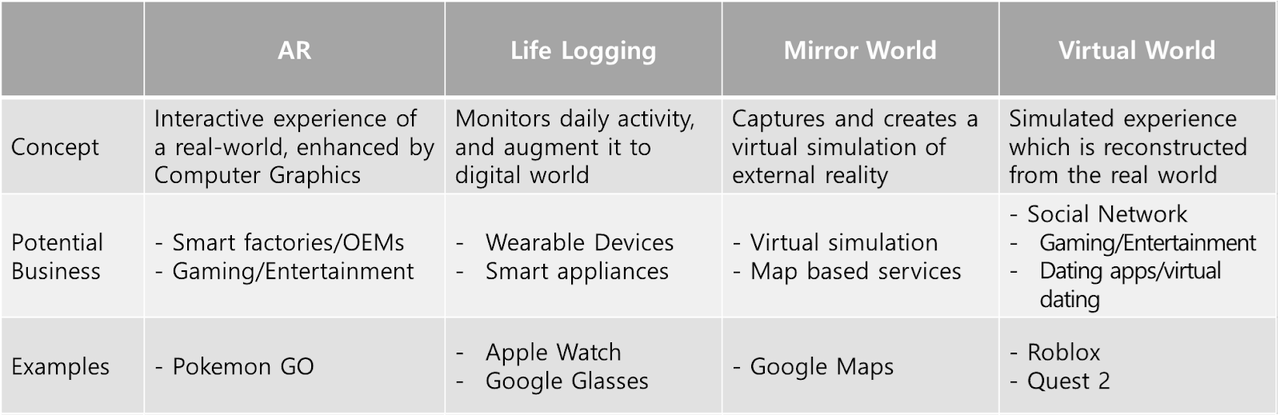

(Source: Goldman Sachs Global Investment Research)

The above chart shows the estimated market size of the metaverse in 20 years based on a growth rate and the percent of the digital economy shifting to the metaverse. Assuming 21%~27% of digital economy shift rate and 25%~35% of market growth rate, the projected potential market opportunity ranges from $6.91T to $9.31T.

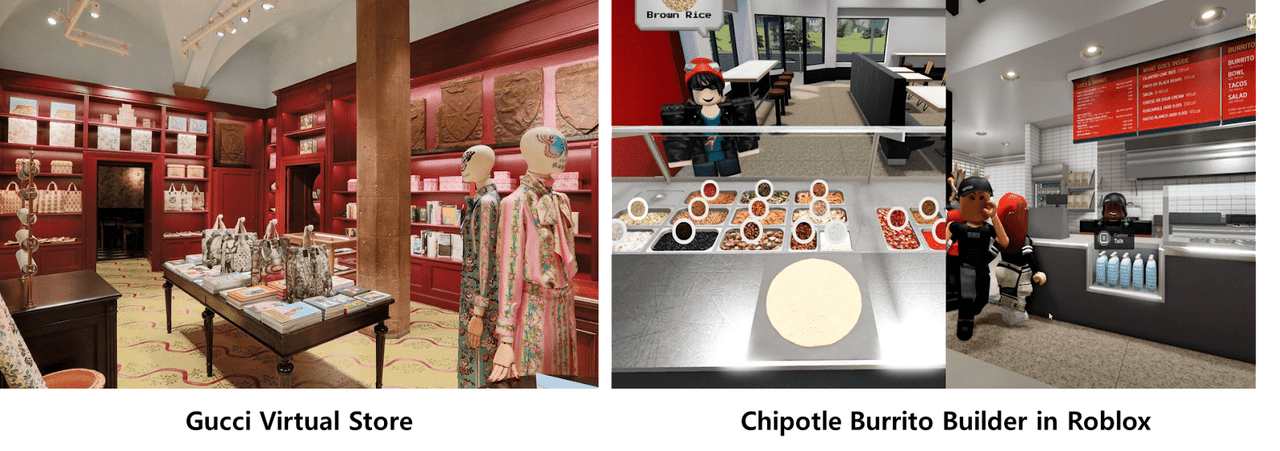

Digital Advertising and Commerce

The metaverse is opening up new avenues for marketing campaigns, offering immersive ads where users can interact with products and complete purchases without leaving the metaverse. Chipotle (CMG) recently launched Burrito Builder, a simulation experience inside the platform Roblox (RBLX). Players can earn in-game currency and then exchange that virtual currency for a real-life Chipotle entrée. Gucci opened virtual popup stores in the metaverse platform ZEPETO and Roblox, selling digital-only items such as handbags, sunglasses or hats as a part of the limited Gucci collection.

(Source: Gucci, Chipotle, Roblox)

Current Applications

The metaverse is already being utilized in industries such as healthcare and real estate while adding another dimension to the already popular work-from-home concept.

AR and VR are used in real estate to virtually map properties and locations through the use of digital twin software that can offer more immersive virtual tours. Further, it has practical applications in city infrastructure planning with “Las Vegas unveiled a virtual version of its 4.3 square mile downtown created by digital twin firm Cityzenith, which utilizes a network of sensors to pull in real-time data on traffic density, air quality, noise pollution, and carbon emissions from local buildings.”

In hospitals, more and more training modules are being conducted with the use of VR headsets. This approach lowers costs associated with training and allows for low stakes trial and error simulations. A study through the NIH (National Institute for Health) explains that “using virtual reality has improved learning in 74% of studies, and a higher accuracy in medical practice by people trained through VR has been reported in 87% cases.”

Corporate work life will be shifting from Zoom meetings to virtual offices and meetings that can facilitate greater communication and collaboration. With more and more workers opting for remote work, this technology can help bridge the gap between the office and remote. This is largely being done through Meta’s Horizon Workrooms that helps remote work feel real.

Most focus on gaming as the primary use case, but these examples highlight more of the practical applications that metaverse related technologies are fueling.

Gaming

PWC sees VR and AR adding 1.5 trillion to the global economy by 2030. “Gaming” currently represents the largest sector of the metaverse. People socialize and interact in popular gaming apps such as Roblox and Decentraland while using Facebook’s “Quest 2” headset (also called Oculus). Users often purchase costumes, items, weapons, new episodes, and music are all (add-on) features to personalize their avatars and enhance the experience.

Pokémon GO opened a new era of the AR gaming industry. The wildly successful game generated $14 million of revenue in the first 4 days after its release. In July of 2016, iOS smartphone users spent more of their time on Pokémon GO than Facebook or Twitter (TWTR).

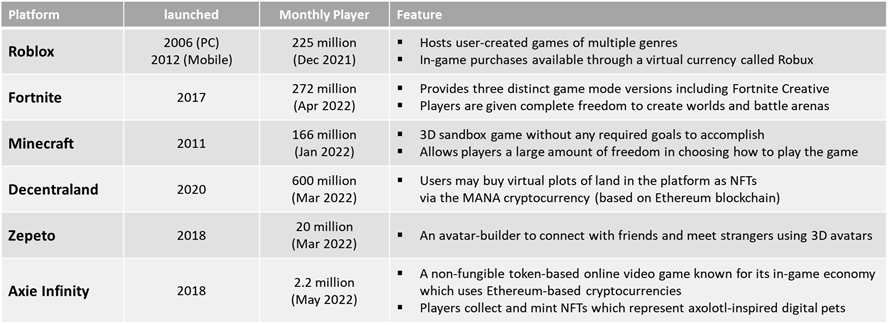

Most popular gaming platforms within the metaverse ((Source: Euphoric Investments))

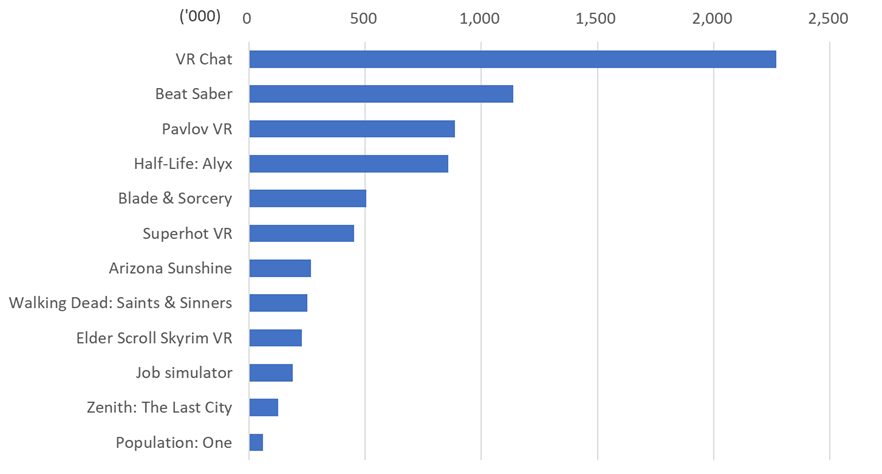

Active Users of VR Games on 3rd party platform Steam (May 2022) (Source: Steam VR)

According to PwC, the global VR gaming market will grow to $2.4 billion in 2024, up from $1.4 billion in 2021.

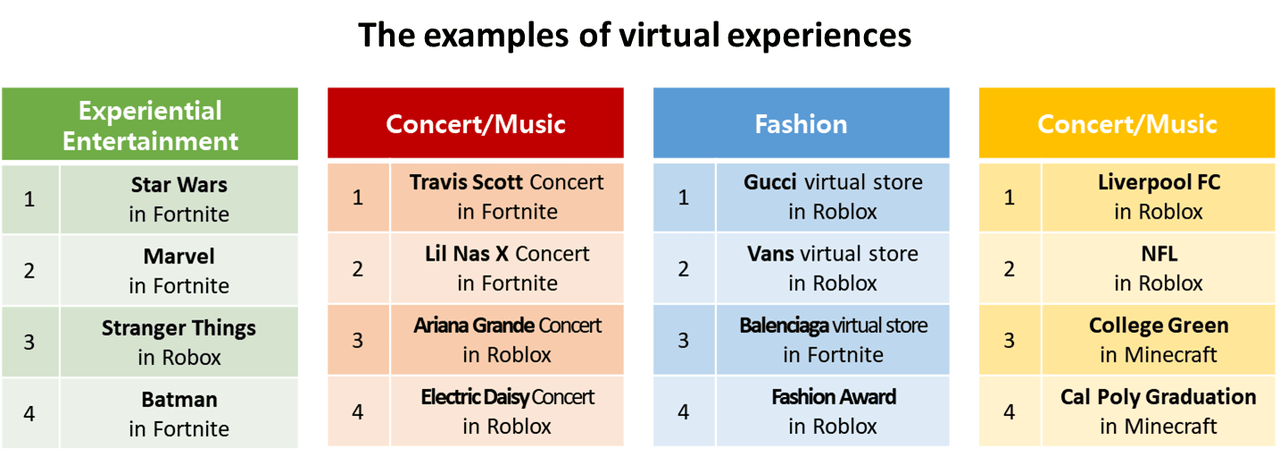

Entertainment

As consumers search for more immersive experiences, the use of VR and AR open up new opportunities allowing users to be immersed in a story and interact with digital worlds more realistically. This gives advertisers and marketers new ways to create more immersive campaigns. Everything from seeing your favorite performer in concert, to feeling like you are actually on the sidelines of a soccer match, all from the comfort of home, are slowly becoming a reality.

(Source: Euphoric Investment)

Digital Ownership

Digital ownership in the metaverse is represented through non-fungible tokens (NFTs) that indisputably prove ownership through blockchain ledgers. Decentralization and interoperability are two major components of digital assets. Decentralization means there is no single entity or individual that is controlling the transfer of ownership. Interoperability refers to the ability to unify economies, avatars, and systems across different metaverse platforms. For interoperability to exist, there needs to be a standardized system for protocol, location, identity, and currency exchange.

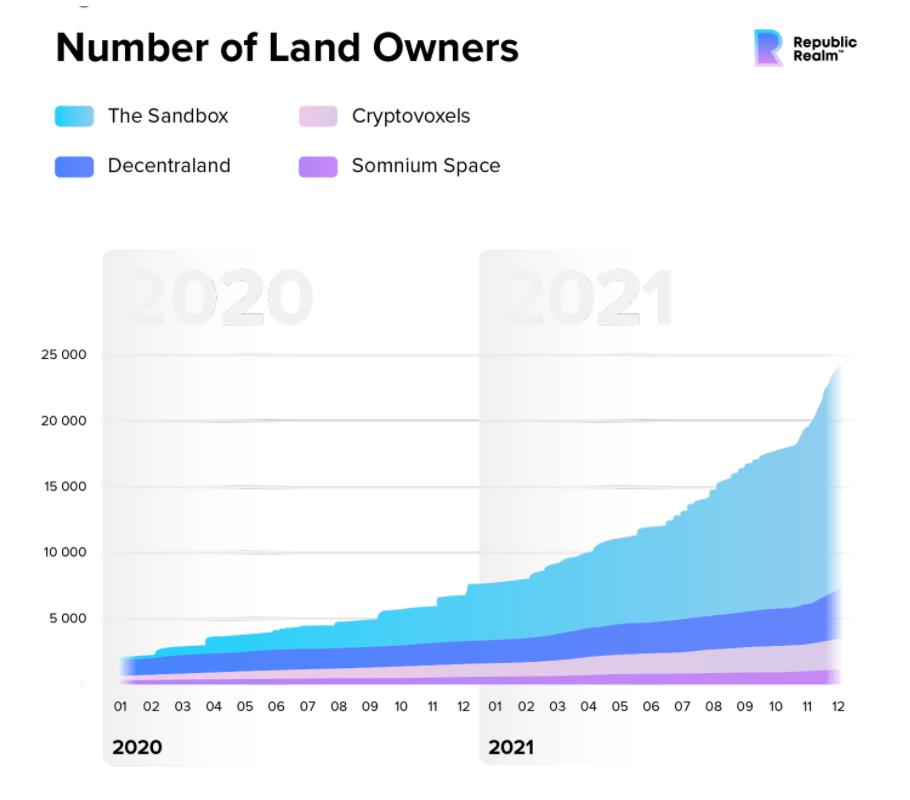

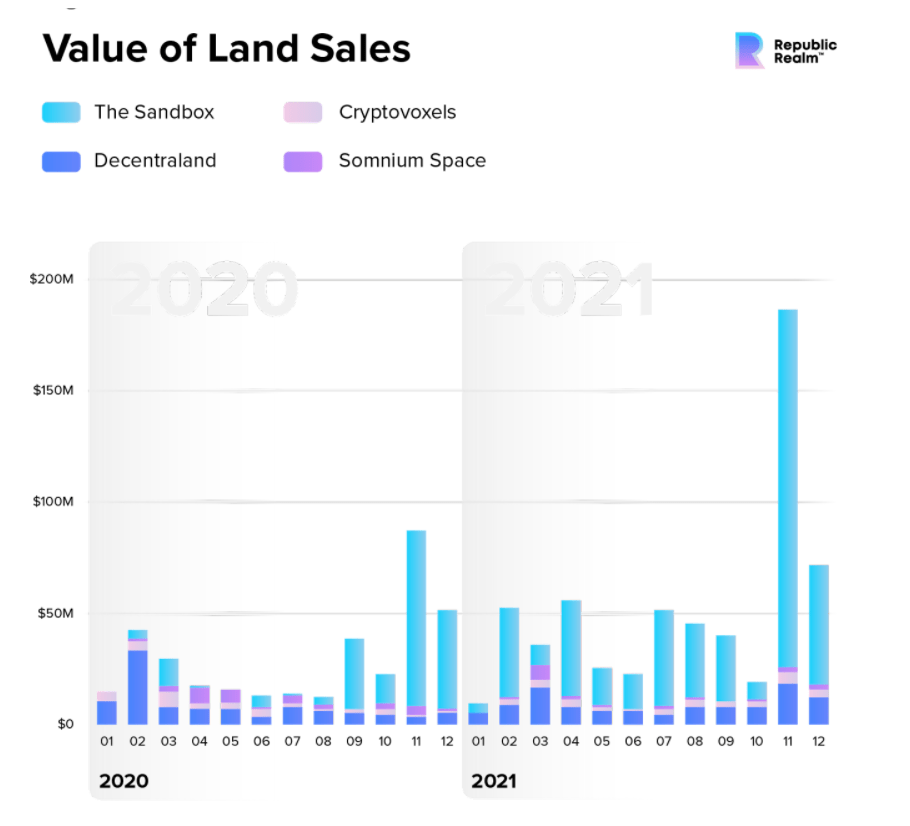

Through popular platforms like Decentraland, Sandbox, and Somnium Space, investors are spending millions to acquire virtual real estate inside the metaverse. The combination of fixed supply and surging demand has led to a runup in price. Plots in Decentraland began selling for just $20 in 2017- now the average parcel of land sold for about $15,000. According to CNBC, virtual real estate sales totaled $500 million in 2021, and are projected to be over $1 billion in 2022.

(Source: Republic Realm) (Source: Republic Realm)

Big Tech in the metaverse

Morgan Stanley projects the metaverse to grow to an $8.3 trillion total addressable market, and big tech is attempting to capitalize on it. The infrastructure needed to make the metaverse a reality is highly capital intensive, with these firms well positioned to leverage their advantages of scale into this market.

-

Apple has acquired 12 AR/VR companies since 2013, and have quietly been developing their own competing technology. They recently gave a demo test of its own mixed reality headset, and have over 14,000 AR developer kits in the app store. This suggests Apple’s attempts to gain a foothold in the fast growing VR market.

-

Microsoft (MSFT) has called the metaverse “the ability to bridge the digital and the physical worlds.” Their cloud computing software Azure is well positioned for infrastructure needs, and Meta even uses a Azure cluster for artificial intelligence (AI) research. HoloLens, their own VR headset, is described as a mixed reality technology with military application and for businesses in healthcare and manufacturing. In addition, millions of users in Microsoft’s Xbox platform could translate to the metaverse ecosystem.

-

Google’s first attempt in this space came back in 2013 with their Google Glass smart eyewear that failed to gain broad consumer interest. Now this project has been revived, called Project Iris, expected to be released in 2024 which will run on Android with new supporting technology.

The Economics of Reality Labs

Vision

Facebook’s conviction of the potential prospects of the metaverse is so strong that back in October 2021, the company officially rebranded to Meta Platforms to signify their pivot and new focus on the metaverse. With our daily lives increasingly spent staring at a screen, Vox predicts “Facebook’s efforts could end up normalizing spending time in the metaverse the way it normalized sharing our private lives on the internet.” Mark Zuckerberg has deemed the metaverse “the successor to the mobile internet, a set of interconnected digital spaces that lets you do things you can’t do in the physical world.” He envisions that by “end of the decade 1 billion people will use the metaverse, and (Meta will) support hundreds of billions in digital commerce.” Meta Platforms is working to build the framework that can support their vision for metaverse by developing cutting edge hardware, and software content that entices consumers to engage with their products. To achieve this, an analyst from Evercore ISI forecasts that the “key to its realization will be interoperability among device types: the metaverse will not be exclusive to VR headsets but accessible on mobile and desktop devices as well. We believe the metaverse will exist in Mixed Reality (MR) form that spans the real world, to AR, VR and fully digital.” Meta Platforms has been setting the pace by pouring billions into its new segment Reality Labs costing the firm an estimated $20 billion, which has largely been fueled by aggressive M&A deals to purchase metaverse specific developer firms, and a surge in internal hiring aimed at building out this vision. Reality Labs employs an estimated 19,000 workers with no plans of slowing expansion.

Hardware

Reality Labs develops and produces hardware, namely the Quest 2 VR headset that has dominated the market with an estimated 80% market share (previously 62% in prior year). These headsets act as an onboarding system to access the broader metaverse that gives Meta control of the entry point. Part of Meta’s onboarding strategy has been to offer hardware products and accessories at or below cost to spur user growth. According to investors.com, “IDC forecasts virtual reality [headset] shipments to reach 38.3 million units annually in 2026.” If Meta Platforms accounted for 70% of the 38.3 million forecasted sales by 2026 it would represent a 208.161% increase in shipments from current levels. This huge market share held by Meta Platforms will only further outpace competitors with new hardware offerings slated for near term future release. Reality Labs is currently expected to offer a higher end VR headset code-named Project Cambria that could eventually replace the need for laptops and workspaces all together. (per Q1 earnings call) While Project Cambria comes with an expected retail price tag of $799 (compared to $299 for Quest 2), Meta suggests it will produce better VR and MR (Mixed Reality) experiences than anything achieved before.

Meta is also expanding their augmented reality products, primarily through a brand deal with Ray-Ban, that offers first generation smart glasses targeted for creatives. Ray-Ban Stories are designed to “take photos and videos hands-free to stay immersed in the moment, captured from a first-person perspective and enjoy consistently high-quality content” These glasses are far off from the future vision of augmented reality, but mark an important step in achieving it. Project Nazare is what Zuckerberg refers to as “our first fully augmented reality glasses.” Slated to release in 2024, Project Nazare aims to be able to fully replace your smartphone.

Software

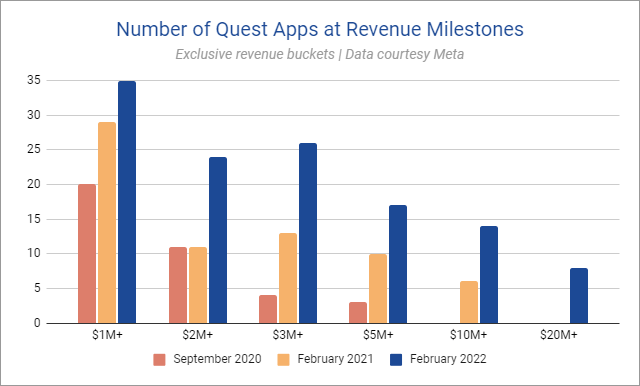

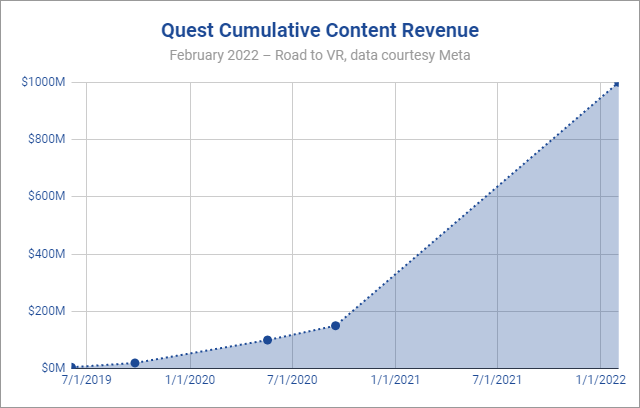

During the earnings call in February 2022, Meta announced that the Oculus app store has generated more than $1 billion in software revenue since its launch in 2019. The Oculus Quest 2 is fast becoming the most popular VR headset, accounting for over 48% of VR headset usage on Steam.

(Source: RoadtoVR and Statista) (Source: RoadtoVR and Statista)

Zuckerberg said that while advertising will be “an important part” of Meta’s strategy, he was more optimistic about commerce in the digital world. Games like Minecraft, Roblox, and Fortnite demonstrate the strong consumer demand for virtual goods. In the earnings call, Zuckerberg hinted that Meta would replicate this model by taking a percentage fee of every transaction.

Meta sees Horizon being the centerpiece of their strategy, which is their virtual reality social platform. A web browser and mobile version of its Horizon social platform are slated for a later year release. IDC analyst Jitesh Ubrani stressed that “the biggest mistake that any of these companies could make would be to make a VR headset a requirement to experience the metaverse.” Horizon Worlds reached 300,000 monthly users shortly after release, and announced 10,000 worlds have been created. Horizon now competes more directly with 3D gaming-meets-social apps like Fortnite, Roblox, and Rec Room.

Headwinds for Reality Labs

Meta faces several roadblocks to achieve widespread adoption of the metaverse and for Reality Labs to become profitable. Latency is the biggest hurdle that Meta has to address, which is the ability for data to transfer efficiently. Another way of explaining latency in the metaverse is the amount of time it takes to initiate something in the real world and then have an avatar mirror it in the metaverse. Having a low latency rate in the metaverse is vital for users to feel like they are in the real world. Earlier this year, Meta said that there needs to be better cellular networks and computing power to achieve its metaverse ambitions.

Designing user friendly and easy metaverse-related technologies is key to reaching widespread adoption. Key to this will be the development of haptic technologies that allow users to feel more immersed in the virtual world. Meta is working on a Power Glove that lets users feel digital objects in the metaverse. Meta has been working on this for eight years, and executives predict it may take a decade from now to fully develop the technology.

Meta faces broad criticism and potential regulatory scrutiny over how it will handle privacy and security concerns in the metaverse. In October 2021, Meta announced that they would no longer require Quest 2 users to sign in using a Facebook account. Authentication in the metaverse could be more akin to fingerprint or face recognition, which is more secure than traditional password authentication.

Analyst Perspective on Reality Labs:

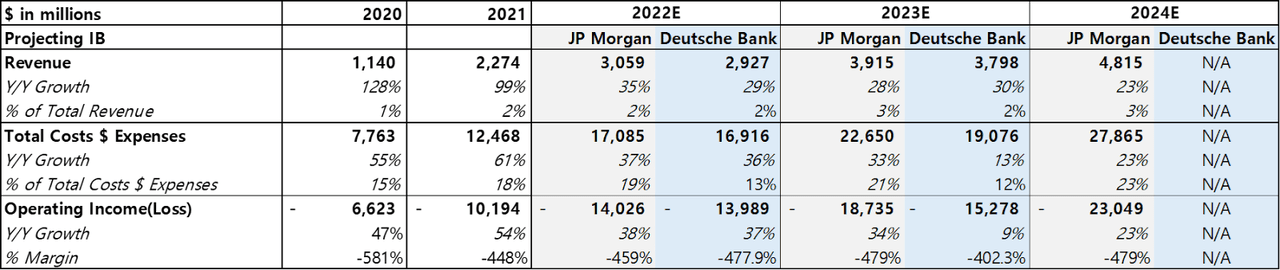

(Source: JP Morgan, Deutsche Bank, Euphoric Investment))

Analysts emphasize that the future of Meta Platforms is dependent on whether the metaverse really is the next computing platform and how well Meta can execute. Although Meta’s metaverse business would not be profitable for the very foreseeable future, analysts believe there are tons of viable business models in the future. Annual revenue of Meta Reality Labs has been doubling every year since 2019, and is expected to continue high growth for the next several years. VR hardware and content sales have been driving its rapid revenue growth, with ad supported models expected down the road. According to JP Morgan and Deutsche Bank, Reality Labs revenue will grow almost 30% every year from 2022 to 2024.

Despite the rapid growth of its revenue, Reality Labs is still stuck in the red. Total cost and expenses of Reality Labs is also growing really fast, expanding the deficit. Meta Platforms is developing the monetization model of Reality Labs to make it profitable. Embedded advertisements, consistent release of VR games, expansion of productivity platforms such as Horizon are all the parts of Meta’s ongoing efforts for growth and profitability.

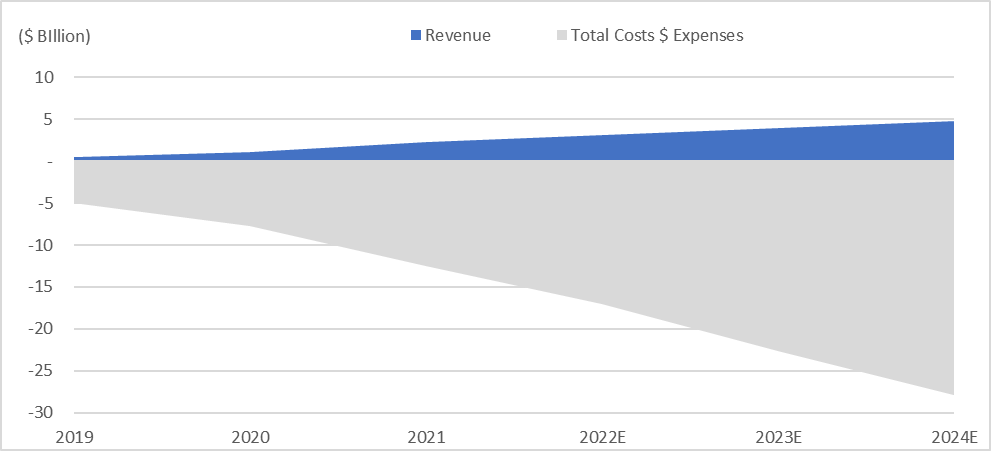

Reality Labs revenue and operating loss projection ((Source: Meta, JP Morgan, Euphoric Investment))

Meta Platforms M&A Deals

Meta Platforms may have driven the recent frenzy surrounding the metaverse, but have been investing in AR/VR since 2014, for a total of 19 acquisitions. Meta’s first move was to acquire Oculus VR for $2 billion in 2014, which is now their flagship brand. In 2021, Meta acquired ImagineOptix, which is an AR/VR optics company. According to SiliconAngle, the company raised $20 million in venture funding before being acquired by Meta. Meta later acquired CTRL-Labs, a neural interface startup, paying over $500 million for it, marking one of the biggest deals that Meta made into this space since acquiring Oculus. CTRL-Labs is developing technology where neuromuscular signals will translate into commands. Thomas Rearden, CEO of CTRL-Labs said that they will have a neural interface device in under five years. This acquisition is vital to reducing latency in AR and VR. Beat Saber, a virtual reality video game, was acquired by Meta back in 2019. In 2021, Meta acquired the developer firm Within, which produced SuperNatural, a virtual workout game. Within creates and distributes 360-degree video for console, mobile, web, and headsets. Each of these strategic investments work like puzzle pieces to complete Meta’s larger strategy for this market.

Bull Case

Meta Platforms is the first to dedicate extensive resources towards the metaverse. With a first mover advantage, Meta can set the stage and build the metaverse on their terms. They are a market leader in VR hardware accounting for ~80% of shipments. With an estimated $20B invested in Reality Labs, largely in strategic acquisitions, and a 19,000 headcount, they are primed to succeed. We believe previous monetization strategies (FOA) will translate well to this venture. While real progress is not expected to develop until the closer end of the decade, Meta has already shown its ability to offer potential business models within this space. Focusing on a new venture supports long term growth and offers a potential better shareholder return than conventional share buybacks or dividend offering.

Bear Case

JP Morgan analyst Doug Anmuth calls this “an expensive, uncertain, multi- year transition.” Consumer willingness and broad adoption has not been reached and could never materialize. Meta faces fierce competition from other firms, namely from Apple, Google, and Microsoft. Meta will have to be significantly better at developing the cutting edge hardware and content that draws in users. Lack of an established legal framework and vague guidance poses cybersecurity, privacy, and copyright issues. Failure to handle these issues would lead to resistance from users and hinder market growth. Facebook has a long history of drawing regulatory scrutiny over privacy and speech concerns. Many critics are skeptical on how Meta will safeguard user data, and prevent harmful user conduct.

Outro

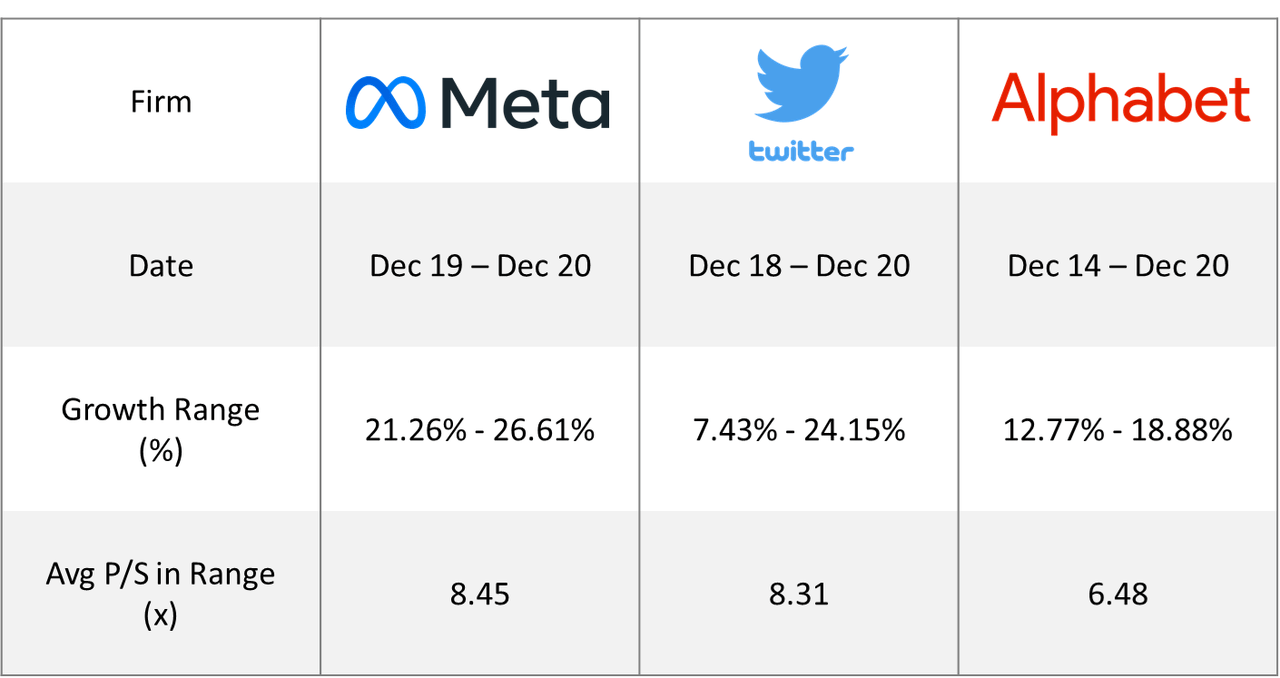

It is our belief that Reality Labs will not be a primary driver of Meta Platforms stock in the near term since it is projected to account for only 3% of future revenues. We do however view Meta as deeply undervalued after tumbling 50.32% YTD. The TTM P/E is 12.23 while the current P/E ratio for the S&P 500 is 21.54 (14 June 2022). Despite trading at a lower P/E multiple than the S&P 500, Meta has higher growth prospects than the S&P 500 as a whole. This sell off can be explained by recent headwinds to the core advertising business due to Apple iOS privacy changes. The impact of this seems to be overblown as Meta has moved to “rebuild our ads stack to employ more machine learning and AI to be more effective at ads with less data” (1Q22 Earnings Call). We expect the stock to move higher as Meta demonstrates the ability to successfully navigate these challenges. Given a future growth rate of 16% for Meta Platforms, and comparing that similar historical growth rates from firms like Alphabet and Twitter, we see a Price/Sales multiple between 6.48 and 8.45. Taking a conservative P/S multiple of 6, gives a price target of $257 for Meta implying a 55% upside.

(Source: Macrotrends, Bloomberg, Euphoric Investment)

Be the first to comment