Leon Neal

Thesis

After a (perceived) disastrous Q3 report, all eyes are now on Meta Platforms, Inc.’s (NASDAQ:META) Q4 results. They are set to be released on February 1st after the market closes. Due to a decline in digital ad spending, market expectations are low, and analysts believe the company may see a 6% decrease in revenue for 2022 compared to 2021 – despite inflationary pressures. But are expectations reasonable? In this article, I will highlight what I think is most relevant to know.

For reference, Meta stock continues to be a strong relative underperformer: shares are down approximately 55% for the past twelve months, as compared to a loss of about 10% for the S&P 500 (SP500).

Earnings Preview

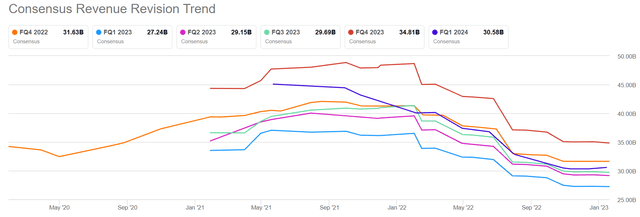

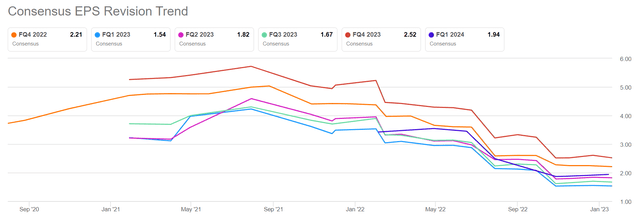

According to data from Seeking Alpha, as of January 24th, 40 analysts have provided their predictions for Meta’s Q4 results. They expect total sales to be between $30.01 billion and $33.45 billion, with an average estimate of $31.63 billion, compared to Meta’s own guidance of $30-32.5 billion. Assuming the average analyst consensus estimate as a benchmark, it is suggested that Meta’s Q4 sales may decrease by around 6.1% compared to the same quarter in 2021. Additionally, analysts have provided EPS estimates ranging from $1.41 to $2.66, with an average of $2.21, which would indicate a year-over-year decline of almost 40%!

Referencing consensus analyst expectations, I would like to point out that revenue estimates have steadily deteriorated during the past 12 – 14 months, with sales expectations now being approximately 30% below September 2021 estimates.

Similarly, EPS expectations for Q4 2022 have slumped. As compared to EPS of close to $5 predicted in early 2021, analysts now expect only half this number.

But Are Estimates Reasonable?

I acknowledge that the competition in the social space, notably competition against TikTok, as well as the slowing digital advertising market have affected Meta’s outlook. But, personally, I do not believe that the situation has deteriorated as significantly as analysts are predicting. Given the negative sentiment, it would not take much positive news for Meta to deliver better-than-expected results.

One potential source for upside could be anchored on a recovery in digital advertising. Investors should consider that macro conditions, or at least sentiment and expectations, have materially improved in Q4 2022 as compared to Q3 2022 – with leading banks such as JPMorgan Chase (JPM) now expecting a softish landing. Notably, going into Q2 and Q3 reporting, some advertising players, notably Snap Inc. (SNAP) warned investors about the deteriorating advertising environment. But we have not heard any such warning from any player going into Q4. Investors should also not fail to disregard implications from the China reopening on advertising – as a bullish macro driver for the global economy.

In that context, Sir Martin Sorrell, the Executive Chairman of S4 Capital commented:

I think that is the big thing here [the reopening of China]. And remember… Alphabet/ Google, Amazon, Meta, there second biggest profit centers have historically been outbound Chinese — Chinese companies targeting business abroad.

Additionally, investors should also consider that the FX headwind won’t be as strong in Q4 as in Q3. According to Meta’s projections, the negative impact of foreign currency on year-over-year total revenue growth in the fourth quarter was estimated to be around 7%, based on current exchange rates at the time of guidance. Since then, however, the U.S. Dollar Index has depreciated materially – by almost 8%!

A third consideration of why Meta might perform better than expected is anchored on the possibility that Meta might overdeliver on cost discipline. Most notably, the company has already announced significant cost-cutting programs during Q4, including a 13% headcount reduction which I estimated could likely add as much as $30 billion to Meta’s equity value. With such aggressive actions, it is doubtful that Meta’s Q3 prediction of full-year 2023 total expenses being in the range of $96-101 billion is still up-to-date.

Personally, I model Meta’s Q4 sales to come in between $31-33.5 billion, squeezing out the FX headwind from Meta’s prediction and also modelling a 75 basis point tailwind from the sharper-than-expected reopening in China. Accordingly, accounting for the higher topline, my EPS expectation is between $2.20 to $2.80.

Risks To Q3 Earnings

Investing in a company based on their earnings can be risky, even for well-established companies like the FAANGS. For example, within the past 12 months, Netflix (NFLX) and Meta Platforms have both experienced a 30% decline in their stock prices. Despite conducting thorough research on a company’s quarterly performance, there is still a level of uncertainty that presents a risk for investors. This uncertainty is evident in the wide range of estimates provided by analysts, for example, for sales between $30.01 billion and $33.45 billion. Moreover, investors should also keep in mind that the risk to Q4 earnings may not be limited to what happened in the December quarter, but may also extend to what Meta expects going into 2023. Or, in other words, guidance may fail to meet expectations.

Conclusion

I am bullish on Meta stock heading into Q4 earnings, as I think the market underestimates the company’s potential to top expectations. And at a TTM EV/EBIT of less than x10, the stock is undervalued.

Personally, I believe Meta Platforms, Inc. will exceed analyst Q4 expectations, which could lead to a significant increase in the company’s share price – especially considering the still depressed sentiment. That said, I am increasing my investment in META stock and buying time-sensitive call options as a short-term strategy. I suggest investors consider 105/115 %-moneyness call spreads with a February 10th expiration date, as they have the potential for a 4:1 payoff if Meta Platforms, Inc. stock closes at $162/share.

Be the first to comment