Justin Sullivan

Meta Platforms’ (NASDAQ:META) Family of Apps (‘FOA’) Facebook, Instagram, and WhatsApp still boast solid engagement and improving monetization prospects, strong network effects, and robust free cash flow generation. Add increasingly compelling valuation and the stock’s appeal seems irresistible.

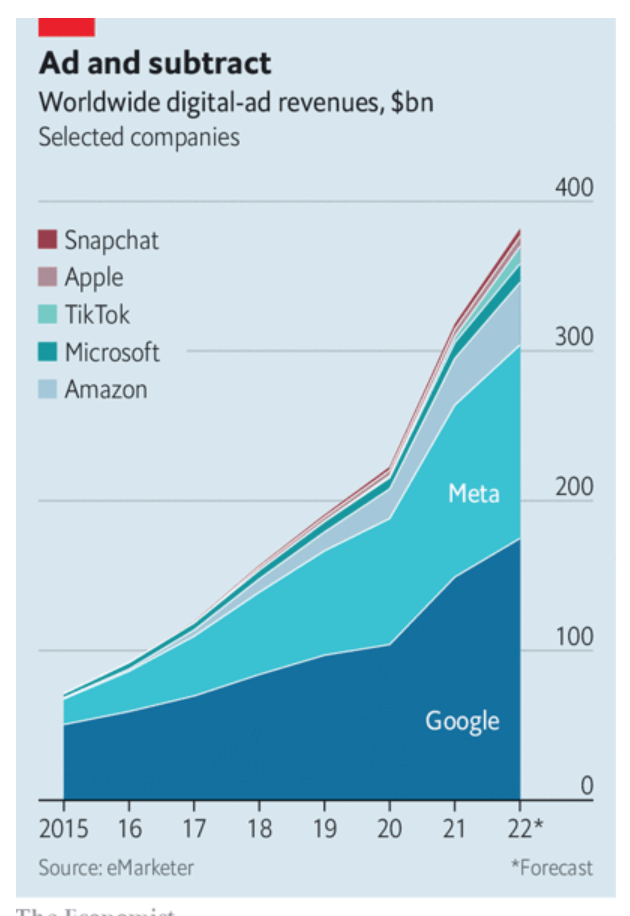

Still, a recent decline in revenue and net income, the emergence of powerful rivals (TikTok, not to mention Amazon (AMZN), Apple (AAPL), and Microsoft (MSFT)), signal an erosion of market moat and change in fortune, prompting CEO Mark Zuckerberg to seek renewal.

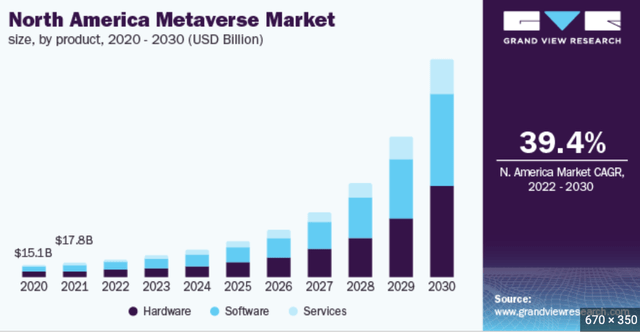

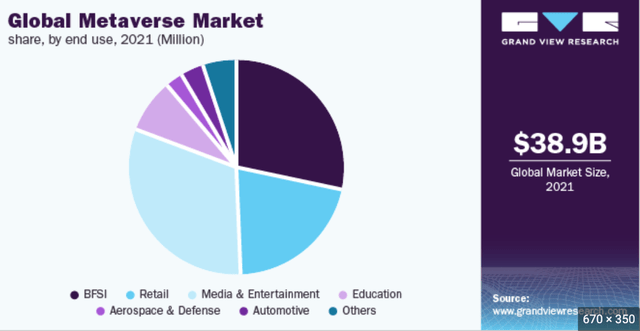

The global metaverse market size is expected to grow at a compound annual growth rate (‘CAGR’) of 39.8% during 2022-2030. Reality Labs is a bet on the creation of an ecosystem that encapsulates AI, AR, Virtual Reality alongside 3D, blockchain, virtual worlds/games, online shopping, why not search and iPhone-rival functionality.

Nothing short of industry 4-type tech, and possibly right back at Apple. Willingly or not, Apple started a war with its App Tracking Transparency (ATT) implementation; now it’s about to see the fighter – and get a run for the money. Even Microsoft scents the blood.

Recent Quarterly Results Don’t Spell the End, Just a New Beginning

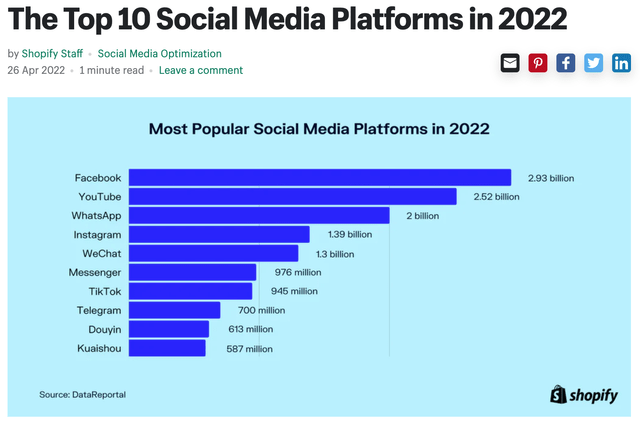

The stock fell hard following publication of the firm’s Third Quarter 2022 Operational and Other Financial Highlights. But Family daily/monthly active people were 2.93 billion and 3.71 billion respectively for September 2022, an increase of 4% year-over-year. Facebook daily and monthly active users were 1.98 billion and 2.96 billion, also good for a slight increase year-over-year. Engagement thus remains strong. So much for the assertion that Meta’s FOA’s user base is evaporating and the firm loses traction in the marketplace. It’s just tough to grow double digits off such a large base. The company does still dominate the world of social media. For all the chat about TikTok, the rival is still only one third the size of Facebook and half the size of WhatsApp, as is made clear below.

In the third quarter of 2022, ad impressions delivered across Family of Apps increased by 17% year-over-year. Not bad at all.

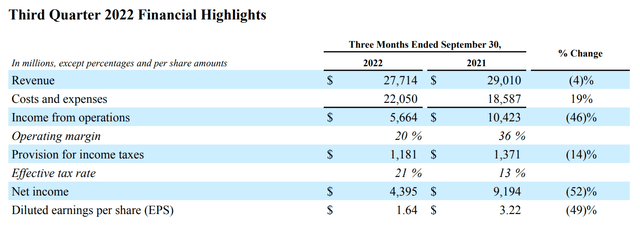

Now for where it hurts the most. Q3 ’22 Revenue was $27.71 billion, a decrease of 4% year-over-year, but it’s still an increase of 2% on a constant currency basis. As Management was quick to point out, “had foreign exchange rates remained constant with the third quarter of 2021, revenue would have been $1.79 billion higher”. Total costs and expenses were $22.05 billion, an increase of 19% year-over-year – not good, but this includes an impairment loss of $413 million for operating leases. No wonder Meta’s laying off some of its staff and the stock rallied two days ago in an otherwise grim market on the prospect of significant resulting operating expenses reductions, signaling Management’s commitment to its shareholder base – and profitability. (Meta also repurchased $6.55 billion of its Class A common stock in the third quarter of 2022. As of September 30, 2022, the firm had $17.78 billion available and authorized for repurchases; at Meta, shareholders do matter, Zuckerberg is one after all.)

Capital expenditures, including principal payments on finance leases, were $9.52 billion for the third quarter of 2022, a significant increase from $7.75 billion for the second quarter of 2022. But Cash, cash equivalents, and marketable securities managed to be $41.78 billion as of September 30, 2022, actually higher than $40.49 billion as of June 30, 2022. Long-term debt was $9.92 billion.

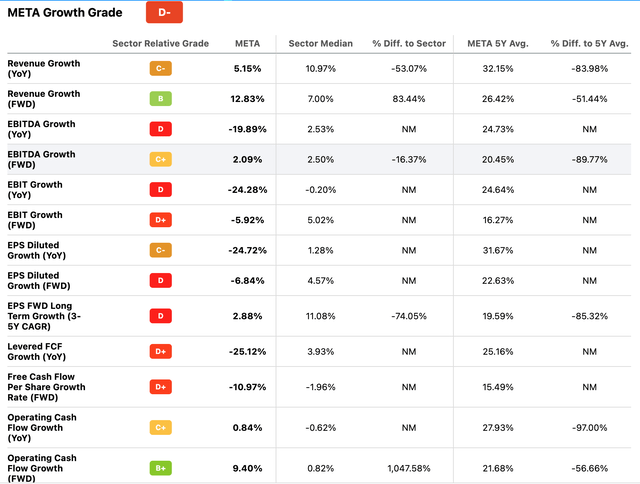

The aforementioned revenue decline guides Meta’s poor growth grade, as follows:

Driving the erosion of Meta’s top line are a slowing economy (with the bond market now considering a recession in 2023 a 100% certainty), which results in a slowdown in digital-ad revenues, Apple’s App Tracking Transparency implementation, and intensifying competition, particularly from Amazon and, of course, Alphabet’s Google (GOOG) (GOOGL). The emergence of other key players including ByteDance’s TikTok, Microsoft’s LinkedIn, Apple, Netflix’s (NFLX) ad-subsidized streaming service (just getting started), is further complicating the outlook (see below for detail).

eMarketer

Still, Meta expects fourth quarter 2022 total revenue to be in the range of $30-32.5 billion, thus around 10% higher. This guidance assumes foreign currency will be an approximately 7% headwind to year-over-year total revenue growth, based on current exchange rates. Not exactly the end of the world.

What likely hurt the stock the most following quarterly results is losses incurred launching Reality Labs.

Per Meta’s Third Quarter 2022 Results report (i.e., CFO Outlook Commentary):

We expect the slight majority of our 2023 expense dollar growth to be driven by operating expenses, with the remaining growth coming from cost of revenue. We expect the percentage growth rate of 2023 operating expenses to decelerate meaningfully as we curtail non-headcount related expense growth (…). Conversely, our growth in cost of revenue is expected to accelerate, driven by infrastructure-related expenses and, to a lesser extent, Reality Labs hardware costs driven by the launch of our next generation of our consumer Quest headset later next year. Reality Labs expenses are included in our total expense guidance. We do anticipate that Reality Labs operating losses in 2023 will grow significantly year-over-year. Beyond 2023, we expect to pace Reality Labs investments such that we can achieve our goal of growing overall company operating income in the long run.

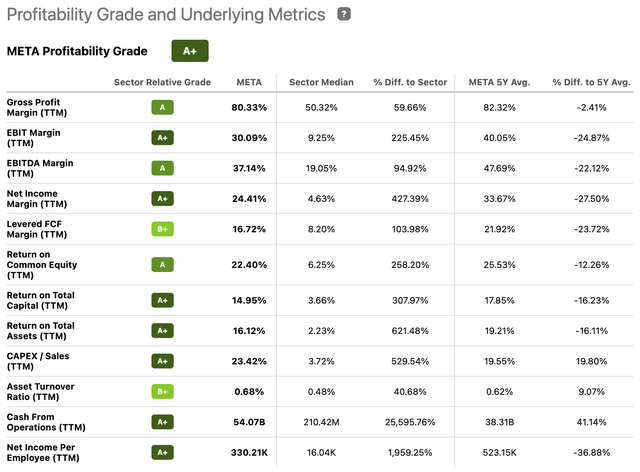

Over the past few years, Meta has delivered a solid record of profitability, as recently illustrated by the table below:

All major gauges from gross profit margin to net income margin, returns on equity, capital, and assets, and cash from operations, have exceeded many a shareholder’s expectations.

Per the same CFO Outlook Commentary:

We expect 2022 capital expenditures, including principal payments on finance leases, to be in the range of $32-33 billion, updated from our prior range of $30-34 billion. For 2023, we expect capital expenditures to be in the range of $34-39 billion, driven by our investments in data centers, servers, and network infrastructure. An increase in AI capacity is driving substantially all of our capital expenditure growth in 2023.

Third Quarter 2022 Financial Highlights, Meta Platforms

Essentially, a concomitant revenue decline and increase in capital expenditures driven by investments in AI, Reality Labs, and other tech/infrastructure, has contributed to an erosion of profitability. Meta’s EPS has been hammered by spending at Reality Labs, and is now expected to decline 34% in 2022 (49% in Q3 year-over-year, as shown above) and another 15% in 2023. But this deterioration is clearly meant to be temporary. Meta’s very own track record of profitability, the recent layoffs, and management’s guidance, all constitute powerful market signals, and tell us as much.

The recent stock’s meltdown thus creates a unique window of opportunity. Valuation has become quite compelling.

Valuation Has Become Attractive

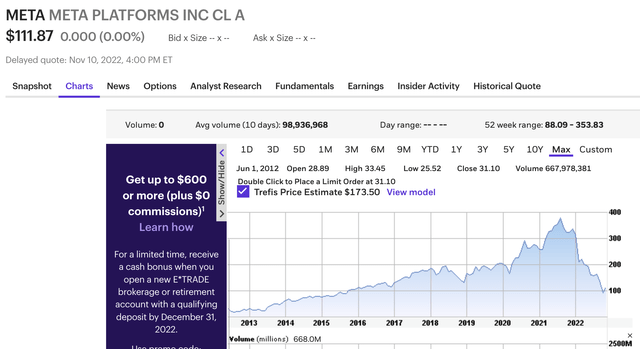

The stock chart for Meta Platforms shows the extent of the damage. The stock is still down nearly 70% from an all-time high of $384.33 reached on September 1, 2021.

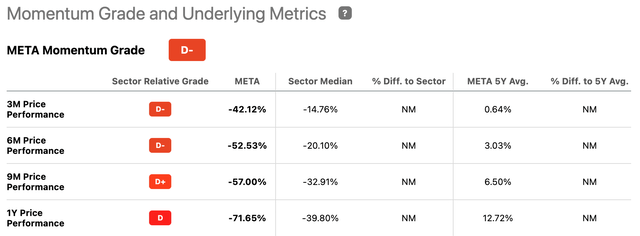

The following Momentum Grade table also captures the magnitude of the meltdown:

All recent time capsules reflect heavy distribution. The stock has shown continued deterioration and underperformed its sector median by a wide margin during all four time periods referenced. Whoever has been holding META over the past few months has, alas, incurred steep losses.

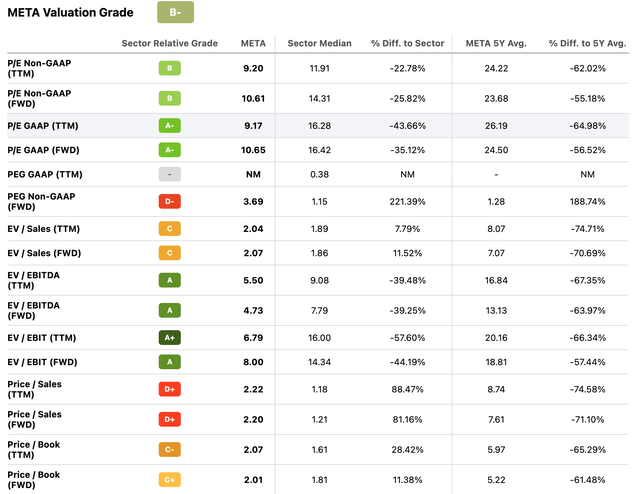

The result is most valuation gauges show the stock seems heavily discounted, as follows:

P/E (GAAP and non-GAAP, TTM and FWD, just around 10), Enterprise Value over EBITDA (TTM and FWD, both well under 10), and Price / Cash Flow, all concur. The stock is cheap. Only price per sales seems to disagree, courtesy of the recent revenue decline, but the top line is expected to resume growth next year, as indicated above. Meta’s Reels (short form videos) has already reached a $1 billion annual revenue run rate in Q2, ’22 and likely hit well north of $3 billion in annual revenue run rate, one of many initiatives planned to revitalize the top line.

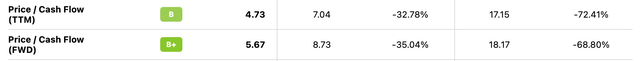

The 45 analysts offering 12-month price forecasts for Meta Platforms have a (rather conservative, watch for upgrades over the next few weeks) median target of 140.00, with a high estimate of 250.00 and a low estimate of 80.00. The median estimate represents a +25.21% increase from the last price of 111.81.

The business thus remains fundamentally healthy, but trades at a discount. Still, the deceleration of the top line prompted by the slowdown in digital ad markets, Apple’s App Tracking Transparency implementation, and intensifying competition, has prompted the CEO to seek renewal and boost investments in Reality Labs and AI, contributing to the depression of the bottom line. The capital being deployed is massive for a reason.

Meta’s Metamorphosis To Metabolize The Metaverse Into Meteoric Win Will Likely Catalyze the Stock

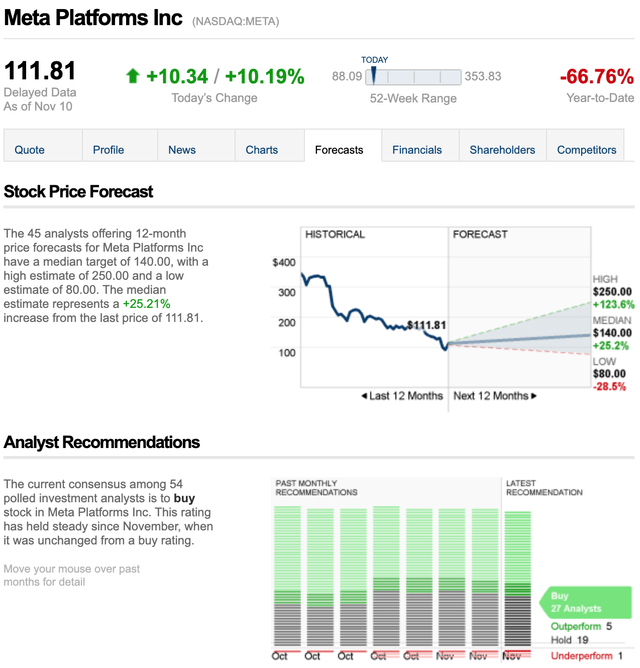

Apple’s change in privacy policy, which now automatically blocks data tracking unless iPhone users specifically opt-in, may this year inflict Meta a potential loss in revenue of as much as $10 billion.

META has been hit hard. Just 25% of iOS users have opted in and that number appears to be rather stable (or only improving very slightly) over the past couple of months.

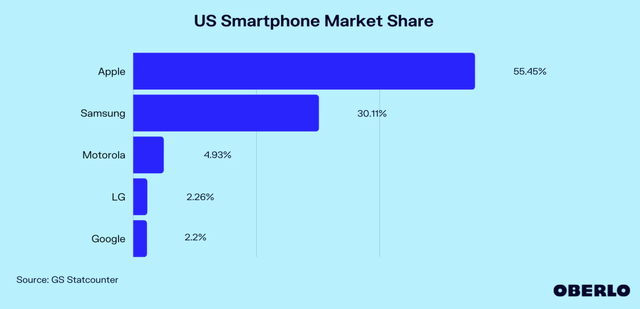

According to the latest data on smartphone usage in the US, as of September 2022, Apple commands a 55.45% market share. Apple’s privacy policy change thus impacts the digital ad market – and social media companies in particular – dramatically.

Meta is likely more exposed than some of its rivals, namely Amazon, whose ad algorithms run on its own proprietary data, and Alphabet, who can leverage multiple alternate ecosystems from nine different services that have over a billion users each – Android, Chrome, Gmail, Google Drive, Google Maps, Google Search, Google Play Store, YouTube, and Google Photos. (Google answers over 3 trillion searches per year and counts more than half the global population as consumers of its services directly.) However powerful a social media network, Meta has no such moat, and the CEO likely feels the pain. Willingly or not, Apple has thus started a war with its App Tracking Transparency implementation; now it’s about to see the fighter – and get a run for the money.

According to GlobalData estimates (Grand View Research), “the global metaverse industry will grow from USD 22.79 billion in 2021 to USD 996.42 billion in 2030” at a CAGR of 39.8% from 2022 to 2030. (“Metaverse Market Size, Share, Trends, Analysis and Forecasts By Vertical, Component Stack, Region and Segment 2022-2030”). This sort of growth is exponential, not linear, which likely is the reason why many don’t realize yet the full magnitude of changes to come.

Grand View Research, GlobalData

The metaverse, a virtual world where users share experiences and interact in real-time within simulated agents, avatars, and scenarios, is still in its infancy, and its full reach has yet to be delineated. But it has the potential to transform lives – both professional and personal. The likelihood that it will develop powerful competitive alternates even to Apple’s iPhone (and why not Amazon’s ecosystems and Alphabet’s Google search?), may increase significantly over time.

Reality Labs is thus a bet on the creation of a universe that encapsulates AI, AR, Virtual Reality, 3D, blockchain, games, online shopping, nothing short of industry 4-type tech, and possibly right back at Apple and other rivals. VR & AR are critical technologies spearheading the development of the metaverse, but they’re only the beginning.

Per the GlobalData/Grand View Research report referenced above:

Metaverse encompasses nine critical technologies: Networking equipment and cloud infrastructure, data governance and security, Blockchain and cryptocurrencies/NFTs, AI/ML, AR and VR, AdTech (Internet advertising), Gaming, Enterprise applications, and Payments Platforms.

The global service addressable market is categorized into hardware, software & services. The hardware segment encapsulates market size for cloud infrastructure, 5G infrastructure, headsets, wearables, IoT and other mobile devices. VR headsets are expected to witness rapid proliferation with prototypes emerging. For instance, Meta’s Reality Labs division showcased a plethora of prototypes guiding a roadmap towards VR graphics. Although not commercial yet, the hardware segment with prototype development poses a lucrative revenue opportunity for the overall metaverse industry (…). The speed and commitment of headset hardware vendors is an indicator of metaverse acceleration, creating opportunity for metaverse hardware market segment.

The software service addressable market is also expected to witness rapid growth during 2022 to 2030. The segment primarily encapsulates, platforms/software including Artificial Intelligence (‘AI’), Augmented Reality (‘AR’), Virtual Reality (‘VR’) alongside 3D & spatial tech, blockchain, virtual worlds and games. Alongside VR, AR is central to the metaverse (…).

The hype around the metaverse is largely focused on consumer use cases. Gaming and social media companies are at the vanguard, but enterprises will lead the charge in the next five years. This shift will be driven by the future of work and digital transformation initiatives ongoing across sectors ranging from retail to healthcare and financial services. Big Tech is championing the metaverse, with Microsoft and Meta promoting it as the ideal environment to support hybrid working.

The number of applications (game, social, communications, online shopping, etc.), technologies involved (Augmented Virtual Reality, Internet Of Things, Artificial Intelligence, Robotics) and industry verticals targeted (Automotive, Electrical And Electronics Equipment, Healthcare, etc.), speaks volume about the opportunity.

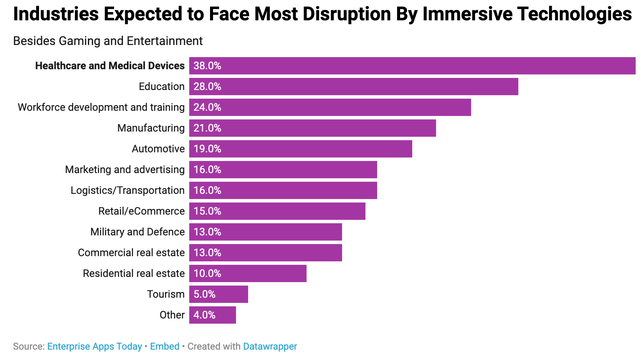

Interestingly, apart from the gaming and entertainment sector, the healthcare vertical is expected to experience one of the highest levels of VR disruption. Education, workforce development, manufacturing, automotive and marketing, logistics, military, and retail industries are also expected to see significant disruption by immersive technologies.

Given the stakes and opportunity, no wonder there’s increased interest in finding strong metaverse ecosystem partners. In June 2020, Meta itself acquired Ready at Dawn, a VR-based video game developer.

Per the same GlobalData/Grand View Research report referenced above:

M&A activity is picking up, with access to technology being the key rationale for most deals. Providers of AR, VR, AI, and blockchain solutions are becoming prime targets as acquirers aim to develop novel experience.

In its Q2 earnings report, Coinbase management noted:

We believe blockchain and crypto are ushering in a major wave of disruption to the internet’s current business model. Today’s internet is largely run by a handful of centralized companies that have access to — and monetize — their users’ personal data. We believe Web3 will be owned by builders and users and will be orchestrated by crypto tokens — creating a more decentralized and community-governed version of the internet.

The latest key M&A transaction associated with the metaverse industry is likely Microsoft Corp.’s acquisition of Activision Blizzard, a game publisher, in January 2022. The next five years will likely see more metaverse-related mergers and acquisitions.

To gain momentum, Meta is striking a number of ground-breaking partnerships, as well. One of the latest is that with Microsoft. The companies will seek to integrate key Microsoft apps with Meta’s VR and metaverse technology, allowing for potential 3D renditions of Microsoft Office 365 apps and immersive Teams meetings. In a similar vein, Verizon (VZ) and Meta struck a deal to explore 5G metaverse opportunities. May telcos see the emergence of an alternative to iPhone-like functionality?

The sheer scope and range of component stack insights sure make it clear that the metaverse is not just about headphones, glasses, and oddities. Zuckerberg would probably not mind building a coherent, compelling alternative to major rival technologies and sources of pain, including the iPhone itself. Google, with its 2% market share (see above), has tried and failed so far. That Meta is capturing a majority share of the VR/AR market in the US holds promise for the firm. The fact that Apple is contemplating market entry, hints at what’s at stake, as well. Other data sources point to the same conclusion: Meta dominates the segment.

Per the same GlobalData/Grand View Research report referenced above:

There will be a lot of new hardware over the next few years, but there does not seem to be a hardware contender that would instantly make the metaverse relevant, à la iPhone. The importance of headsets cannot be understated (…).

Clearly, though, meta is working on it, and maybe the importance of headsets is best construed as a starting point for redefining a whole ecosystem -and the metaverse itself.

Risks to the bullish case abound, of course. From Meta’s Family of Apps Facebook, Instagram, and WhatsApp not delivering enough top and bottom line growth, as a result of intensifying competition from the likes of Alphabet’s Google, Amazon, Microsoft’s LinkedIn, ByteDance’s TikTok, Netflix, not to mention Elon Musk’s Twitter (that’s quite a crowd for sure), to the emergence of other metaverse alternatives including the very pertinent NVIDIA’s Omniverse. The ability of the metaverse itself to create compelling alternatives to Apple’s iPhone or Amazon’s ecosystems also surely remains to be established at this juncture. Add economic and market risks (recession, inflation, stock meltdown, etc.) if you must. But Meta’s CEO, who enjoys roughly 54% voting control of the firm (thanks to his 10-1 voting shares, as granted well before the IPO), likely believes that Meta needs to define the next computing (mobile) ecosystem in lieu, or at least ahead, of Apple to reiterate or re-ascertain its economic moat. He is thus willing and able to spearhead the deployment of massive Reality Labs, AI-related, and other potentially game-changing investments to reenergize growth and (re)claim tech leadership, which may ultimately be redefining the industry in my opinion.

Conclusion

At the current price and even after the jump of the past couple of days, Meta Platforms may constitute a significant wealth creation opportunity for long-term investors. The firm qualifies as:

- The social media network leader, with Meta’s Family of Apps Facebook, Instagram, and WhatsApp still boasting solid engagement and improving monetization prospects, strong network effects, and robust free cash flow generation,

- Endowed with solid financials and fundamentals. The recent revenue and profit decline likely is temporary.

- Negative market sentiment has punished the stock, presenting bargain hunters with an opportunity.

- Reality Labs is a bet on the creation of an ecosystem that can subvert the current competitive landscape and challenge tech hierarchy, i.e., dislodge Apple and others. Even Microsoft smells the blood. It has the potential to be a game changer.

I think solid appreciation potential exists for the stock within the next five years. Bullish investors should start accumulating decisively. The more cautious ones – i.e., those waiting for greater visibility into Meta Platforms’ future sales, cash flow, earnings, and Reality Labs bet – might prefer to dollar cost average.

Be the first to comment