DarrelCamden-Smith

It’s been a rough year thus far for the Gold Juniors Index (GDXJ). While the softness in the producers makes sense given the negative revisions to cost guidance, the royalty/streamers have also been pummeled, down over 20% year-to-date on balance. The fact that names that are inflation-resistant are also taking a beating suggests that this bear market in the sector is now at the point where companies are trading devoid of fundamentals and simply being sold to halt the proverbial bleeding.

One name that’s been sold off sharply in this bear market is Metalla Royalty & Streaming (NYSE:MTA), a junior royalty/streaming company with six producing assets and a solid pipeline of development assets. While the stock came into the year expensive at $7.00 per share, MTA is becoming much more interesting near $4.00 per share especially given the recent positive developments. So, with strong organic growth, I believe we can overlook its lacking liquidity to capitalize on the current environment, and I would expect pullbacks below US$3.70 to present buying opportunities.

Metalla Royalty & Streaming (Company Presentation)

Q2 Results

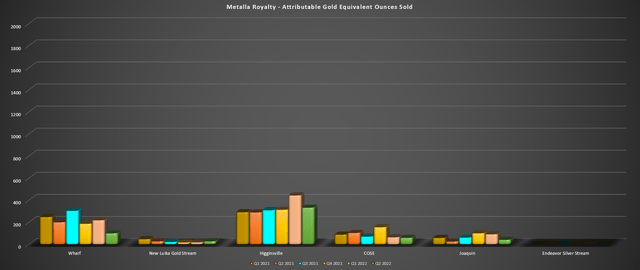

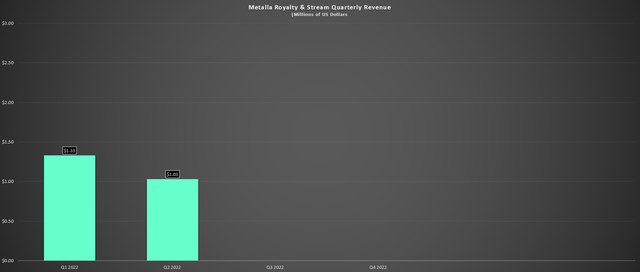

Metalla released its Q2 results last month, reporting an attributable volume of 560 gold-equivalent ounces [GEOs], a 22% decline on a sequential basis. This was related to lower attributable GEOs at nearly all of its assets (below chart), except for the New Luika Gold Stream, its smallest contributor. On a year-over-year basis, volume was also lower, with lower volume at nearly every asset except Higginsville and Joaquin. Given this decline in attributable GEO volume and a relatively flat gold price, Metalla’s revenue fell sequentially to $1.03 million (Q1 2022: $1.33 million).

Metalla – Quarterly GEO Volume by Mine (Company Filings, Author’s Chart)

While these headline numbers might be disappointing when some companies like Franco-Nevada (FNV) and Osisko Gold Royalties (OR) just came off record quarters, it’s important to note that Metalla’s portfolio is nearing an inflection point, and things can change very quickly for junior companies. Hence, rather than looking solely at quarterly sales, a superficial endeavor that provides little to no value, I think it makes sense to look at the portfolio as a whole and where it’s going in the future. In this sense, Metalla’s future has never looked brighter, which we’ll dig into below:

Metalla – Quarterly Revenue/Payments (Company Filings, Author’s Chart)

Recent Developments

Before getting into the positive developments, it is worth pointing out the one negative development, which was the news that Monarch (OTCQX:GBARF) has seen a slower-than-expected ramp-up at its Beacon Mill. This was expected to be a key contributor for Metalla (1.0% NSR royalty), even if small, but for now, milling is continuing at a lower rate of 500 tonnes per day with the processing of stockpiles, with the goal being to optimize its mining method and get production up to the goal of 750 tonnes per day. Given the slower ramp-up, I would be surprised to see more than 20,000 gold ounces produced next year, suggesting less than $0.50 million in revenue attributable to Metalla.

On the positive front, there are too many developments to count, so I will list them in bullet form, except Wasamac, where Metalla holds a 1.5% NSR, subject to a 0.50% buyback for ~$6.0 million.

- G Mining Ventures (OTC:GMINF) Financing: This has placed the project on a path to the first gold pour by H2 2024, with the asset expected to be a ~175,000-ounce producer, generating significant revenue based on Metalla’s 0.75% GVR.

- Akasaba West to Feed Goldex Mill: Agnico (AEM) has announced the project will contribute 1,500 tonnes per day to the mill, with construction to start in 2024, potentially contributing up to $1.0 million in attributable revenue for Metalla.

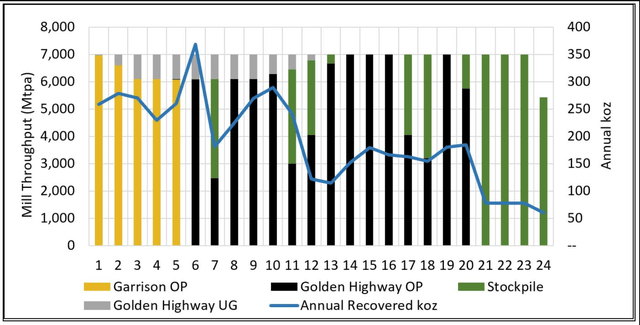

- Tower Gold Project PEA Completion: While Moneta’s (OTCQX:MEAUD) market cap to capex ratio is relatively high at 0.50 to 1.0, and it may be tough to fund the project in the current environment, the PEA has outlined a robust project capable of producing ~197,000 ounces in its first five years from Garrison, where Metalla holds a 2.0% NSR. See the chart below, with Garrison contribution in gold.

Tower Gold PEA + Garrison Contribution (Moneta Gold Website)

4. Agnico advancing Amalgamated Kirkland: Agnico Eagle continues to advance Amalgamated Kirkland, an orphaned deposit that lies east of the South Mine Complex, but closer to the surface, but was too small to develop. Following the KL/AEM merger, the asset could be in production by late 2024, benefiting Metalla, which holds a 0.45% NSR.

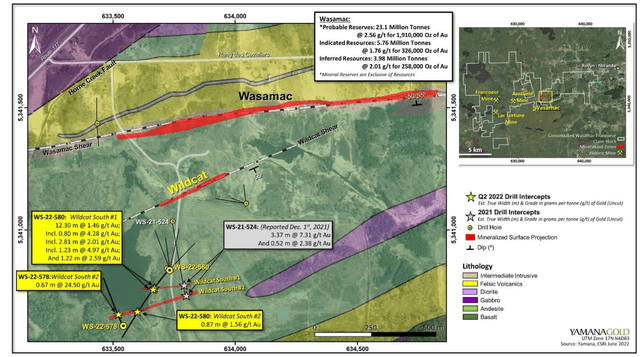

Wasamac Drilling (Yamana Presentation)

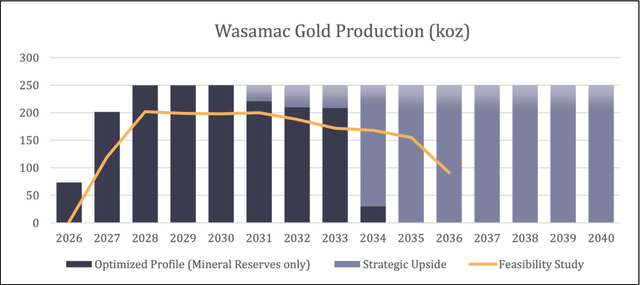

While these are all positive developments, the major one was Wasamac, where the operator continues to release phenomenal exploration results, with infill results confirming and or exceeding expected grades and widths. However, the big news is that parallel structures such as Wildcat and South Wildcat seem to be pointing to this being a much larger deposit, leading Yamana (AUY) to believe this could be a 200,000 to 250,000 ounce per annum operation with a mine life of 15 years. For those unfamiliar, this is a major step up from ten years at 169,000 ounces previously.

Wasamac Production Profile Upside (Yamana Presentation)

Assuming this is the case, with Yamana confident it could incrementally increase throughput (7,000 to 9,000 tonnes per day) and boost recoveries, this would be very positive for Metalla. The reason is that even if Yamana chooses to buy back its 0.5% NSR for ~$6 million (representing a nice cash payment), the 1.0% NSR would still represent ~2,200 GEOs per annum from 2027-2030 attributable to Metalla, or ~$4.0 million in revenue at a $1,800/oz gold price. This would be a similar revenue figure from this asset alone vs. all its paying assets combined currently, and the higher production would offset any reduction in the royalty.

To summarize, I believe the positives for Metalla within its portfolio easily outweigh any negatives, and the positives have come in droves year-to-date.

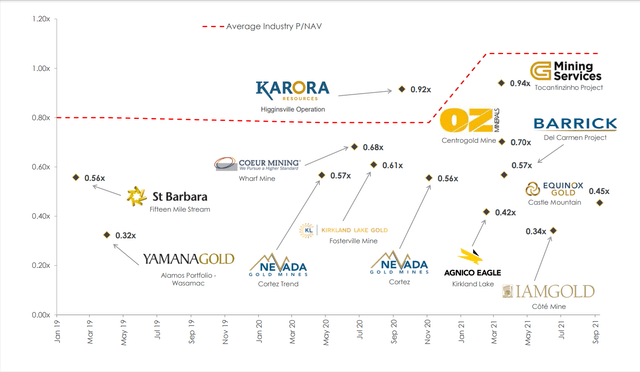

Valuation

Based on ~48 million fully diluted shares and a share price of US$4.20, Metalla has a market cap of $202 million. This translates to the stock trading at 0.73x P/NAV based on my estimates of ~$275 million in net asset value. Given that Metalla has a diverse portfolio of assets held by some of the best operators globally, this is becoming a much more reasonable valuation. That said, the one negative worth pointing out is that it’s transitioned to a harsh winter for the junior/developer space, and even some producers are in rough shape. While the mid-tier royalty/streaming companies are cashed up to take advantage, Metalla is not. As of quarter-end, the company had less than $20 million in available liquidity.

One reason that the company has less flexibility is that it’s been very busy doing deals over the past few years, completing 28 deals since Q3 2016 vs. the peer average of less than 20. Normally, I would be critical of the significant deal flow in a seller’s market, but the company has done a solid job picking up assets at the right price. That said, this looks to be the time to really strike, and while names like Osisko Gold Royalties with ~$650 million in liquidity could benefit considerably if they bulk up the portfolio with equity markets less favorable, Metalla won’t be able to benefit. The exception is if it sold shares on its ATM, which would not be accretive at current prices.

Obviously, the lack of liquidity is a negative development because Metalla is not generating consistent cash flow to funnel into future deals. Still, the company did far better than its junior peers, given Metalla’s size and deal flow over the past two years. The reason is that it didn’t use up its capacity doing average deals with mediocre operators and overpaying. To summarize, even if we discount Metalla slightly for its inability to complete meaningful transactions in a market ripe for deal flow, I still see the stock as undervalued, and while there are royalty/streaming companies that can be criticized for their acquisitions and rush to burn through their available capacity to grow, Metalla is not one of them.

Metalla – Recent Deals (Company Presentation)

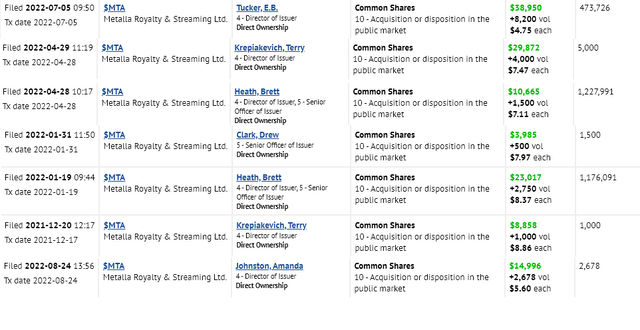

Metalla – Insider Buying (SEDI Insider Filings)

Looking at the chart above, the Wasamac transaction at less than 0.40x P/NAV stands out as a phenomenal deal, and one that would likely cost twice as much or more in the current market environment, especially if Yamana merges and the asset is held by a top-5 gold company. Also of note is that insiders seem to agree with the value proposition, with some smaller insider buys recently filed.

Technical Picture & Risks

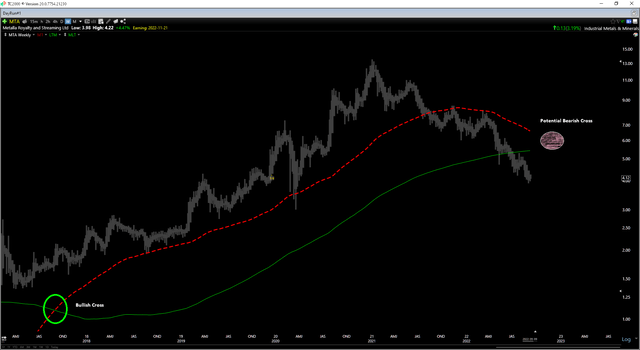

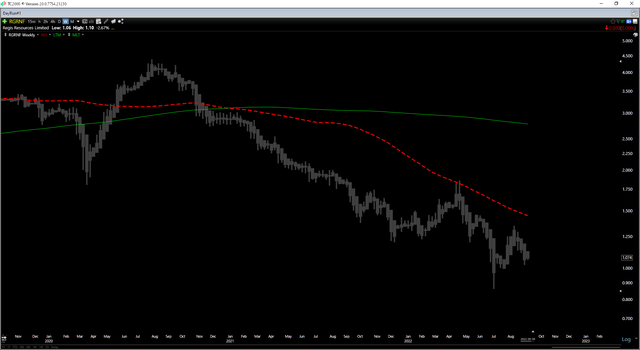

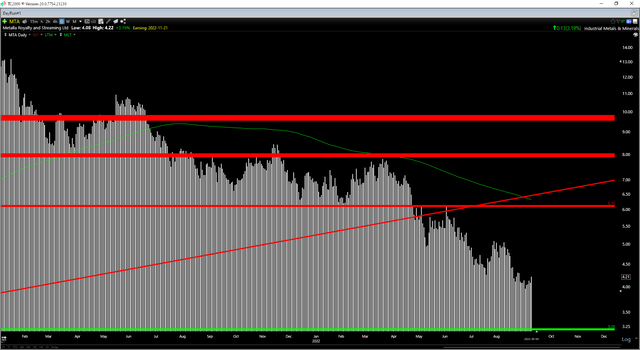

While Metalla’s valuation has improved considerably, we have seen a negative development from a technical perspective, and the turbulent market environment has led to additional risk. Beginning with the technical picture, the stock broke a key support level at US$5.200, and it’s now looking like we could see a bearish cross later this year if the stock can’t rebound sharply. This often leads to underperformance for miners after extended uptrends, and we saw this in Regis Resources (OTCPK:RGRNF), which saw a bearish cross in Q1 2021 (down 70% since), and Equinox Gold (EQX) which saw a bearish cross in Q2 2022 (down 40% since). Obviously, history doesn’t have to repeat itself for MTA, but a negative cross-over would be an unfavorable development.

MTA Weekly Chart (TC2000.com)

RGRNF Weekly Chart (TC2000.com)

Meanwhile, with the US$5.20 support being removed, the next strong support level for the stock doesn’t come in until US$3.20, which is more than 20% below current levels. So, while there’s considerable upside to the next strong resistance level at US$6.10, the reward/risk ratio has deteriorated slightly with $1.00 in potential downside to support and $1.90 in potential upside to resistance. This translates to a reward/risk ratio of 1.90 to 1.0, below the 6.0 to 1.0 reward/risk ratio that I prefer for micro-cap stocks. For Metalla to enter a low-risk buy zone with a ~6.0 to 1.0 reward/risk ratio, it would need to decline to US$3.70.

MTA Daily Chart (TC2000.com)

Finally, although Metalla has become much more attractive from a valuation standpoint at just over 0.70x P/NAV, the market environment for micro-cap stocks has become riskier. This is because the S&P 500 (SPY) is currently in a cyclical bear market, below its 30-week and 40-week moving averages. Typically, this environment favors holding more liquid stocks with higher market caps that are generating consistent cash flow given that they tend to have institutional support and ideally defensive stocks in general that are recession-resistant.

While Metalla may be recession-resistant (no demand destruction for gold) and inflation-resistant, I generally prefer holding larger-cap precious metals names when markets get ugly, given that they are less susceptible to violent sell-offs in a liquidity crunch than their micro-cap peers. So, while Metalla offers a very attractive growth profile, my preference in the sector in the royalty/streaming space currently is Osisko Gold Royalties, which trades at a similar P/NAV ratio (~0.88x) but is in a position to put considerable money to work in this downturn, has ~10x the market cap, and is generating consistent cash flow with a net cash position.

Summary

Metalla has declined more than 65% from its highs since I noted to take profits above US$12.75, and the severity of this decline combined with positive developments at some royalty assets has put the odds back in the bulls’ favor from a valuation standpoint. This makes for a riskier environment for holding micro-cap stocks, and while Metalla is medium-term oversold, the low-risk buy zone comes in 15% lower below US$3.65. This doesn’t mean that MTA must decline here, but in a turbulent market environment, I prefer to only invest at the best possible price when buying micro-caps. Hence, while Metalla remains high on my watchlist as a potential Buy, I remain on the sidelines for now.

Be the first to comment