Khanchit Khirisutchalual/iStock via Getty Images

Investment Thesis

Meta Platforms’ (NASDAQ:META) near-term prospects leave a lot to be desired. But this is not the time to give up on Meta. As I write this, the stock has erased 7-years’ worth of work. Remember, Meta epitomizes Silicon Valley. The best and brightest.

But when the investors’ sentiment turns bleak, there’s nothing that can stop Mr. Market.

Without any heroics, Meta’s core business, Family of Apps, trades around 5x future operating income. Just needs to stop investing so aggressively in the Metaverse.

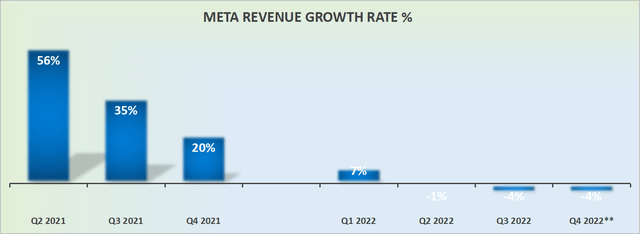

Revenue Growth Rates Slow Down

META revenue growth rates

This time last year, we felt that Meta was able to grow in the high 20s%. It was a high-quality compounder. Today, it’s categorically not a compounder. The company today can’t even deliver any revenue growth.

Q4 was supposed to have an easier comparison against last year. Meta wasn’t supposed to be guiding for yet another quarter of negative y/y growth rates.

This is the same theme that we’ve seen throughout other companies that have already reported in the earnings season, including Snap (SNAP) and Alphabet (GOOG)(GOOGL).

The advertising sector has dried up.

Operating Leverage Cuts Both Ways

When Meta was growing at a steady clip, its cost structure wasn’t a problem. This was one of the world’s best free cash flow printing machines. In good years it was unrivaled by any business, as its free cash flow margins would often reach +40%.

Even amongst the likes of Microsoft (MSFT), Meta would outperform in its ability to see revenue drop to free cash flow.

But today, that’s no longer the case. Investors can’t stand the fact that Meta is investing so much capital into the Metaverse.

Meta is set to increase its 2023 expenses by approximately $12 billion to approximately $98 billion, approximately 15% y/y.

In a time when investors have truly lost their patience with companies that have colorful narratives of investing at any cost, Meta’s after-hours reaction is a reflection of this sentiment.

While we are on the topic of capital allocation, let’s discuss Meta’s share repurchases.

Buybacks Make Minimal Difference Here

So far in 2022, Meta has repurchased $21 billion worth of stock at a fairly steady cadence of $7 to $9 billion per quarter. But keep in mind that this time last year, Meta’s balance sheet had $47 billion and no debt. A rock-solid balance sheet.

This time around, Meta’s balance sheet has $42 billion of cash and $10 billion of debt, or $32 billion of net cash. It’s not a thesis breaker, but it again goes to the heart of the bear thesis, that operating leverage cuts both ways.

When Meta is in growth mode, things can easily sizzle higher. But when revenue growth turns negative, cash flows burn very quickly.

Allow me to provide one further example of cash going out the window. During Q3 2022, Meta sent $1 billion out the window simply to cover the taxes on stock-based compensation.

Put another way, more money was spent in the quarter to pay taxes on management’s stock-based compensation, than Meta’s free cash flow. Needless to repeat that last year things were dramatically better.

META Stock Valuation – 5x its Normalized Family of Apps Operating Income

Realistically, it’s reasonable to say that 2023 will be a write-off for Meta. The operating profits that Meta will report in 2023 will clearly be suppressed. The company could even post a loss in 2023. Does that mean that Meta is doomed? Obviously not.

Meta just needs to cut back its investment in the Metaverse, and its Family of Apps can in a normalized environment report around $55 billion of operating income.

Including the after-hours reaction, Meta’s market cap is around $270 billion. That means that investors are only being asked to pay around 5x the operating income from its Family of Apps.

The Bottom Line

Meta’s share price is now at nearly a 7-year low! Think about that for a moment. What the market is saying is that all the work that Meta has put in the past 7 years, has gone out the window.

You don’t even need to overintellectualize the situation. Everyone talks about buying cheap stocks on sale. Everyone writes stories about the dotcom bust and how Apple (AAPL) was in the bargain basement.

Meta today is nearly as cheap as some of the energy companies that I’m buying. The only thing Meta has to do is set fire to its metaverse ambitions.

Be the first to comment