peshkov

Thesis Summary

Meta Platforms, Inc (NASDAQ:META) has been severely punished by the market in recent months, and the main reason behind this is the company’s new focus on the metaverse. Most investors see the metaverse as a bottomless money pit, but I strongly disagree.

The recent stock movements and general perception of the metaverse are eerily similar to the 1999 dotcom crash. But despite this minor setback, the internet has become the motor of the 21st century. Big losers of 2000 became champions in 2020, and I expect a similar thing to occur now.

META is a pioneering company in the world of AR/VR and an undisputed market leader. And, unlike many billion-dollar companies, it is still being actively managed by the same man who revolutionized social communication almost 20 years ago.

It’s the 1990s Again

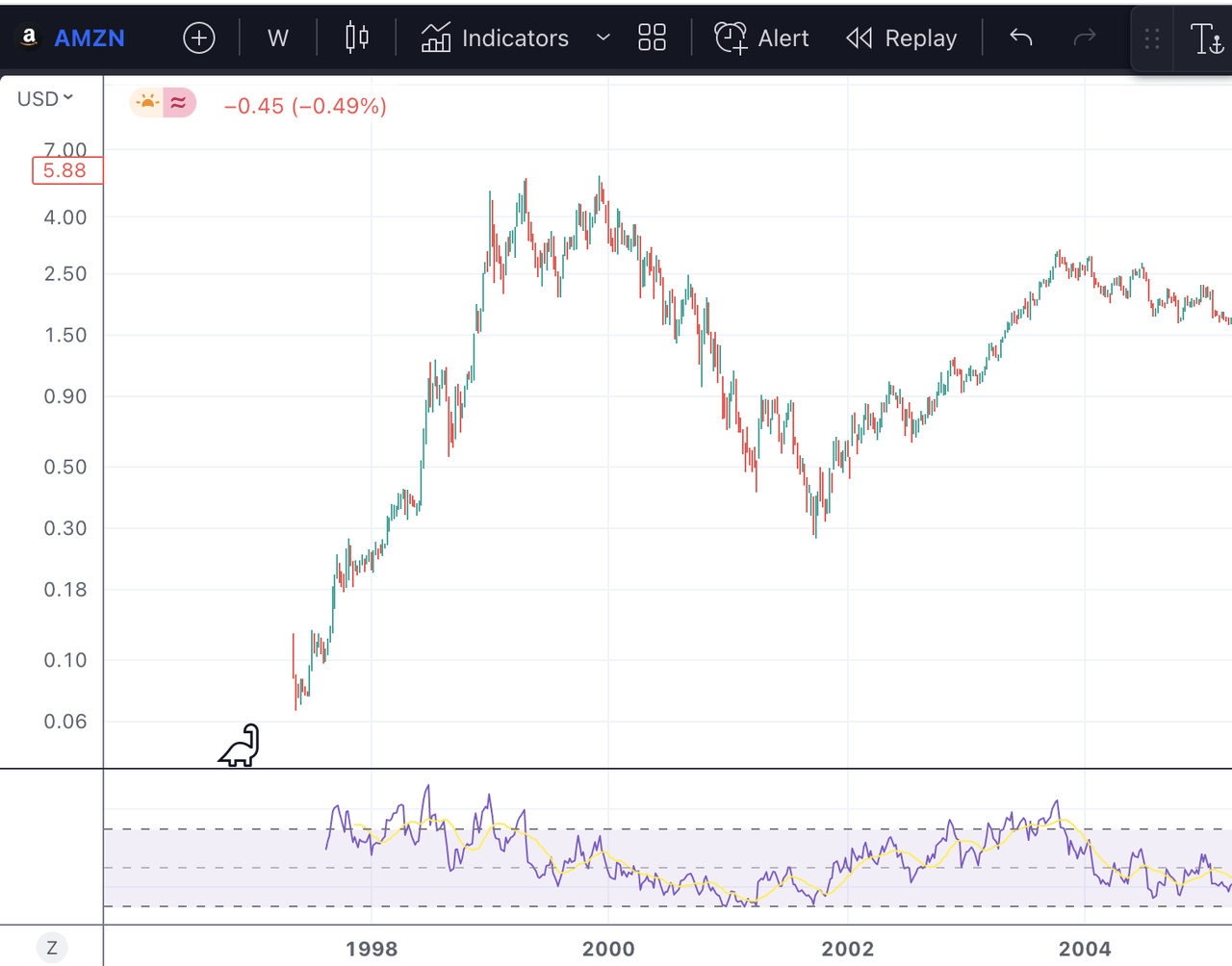

The dot-com crash saw hundreds of tech companies go bankrupt, but some persevered in the face of adversity, and there is no better example of this than Amazon.com (AMZN).

22 years later, Amazon is now one of the largest companies in the world. Though the company did expand its operations beyond selling books, its core principles and ideas did not change, they were just proven right over time.

AMZN price 1999 (TradingView) |

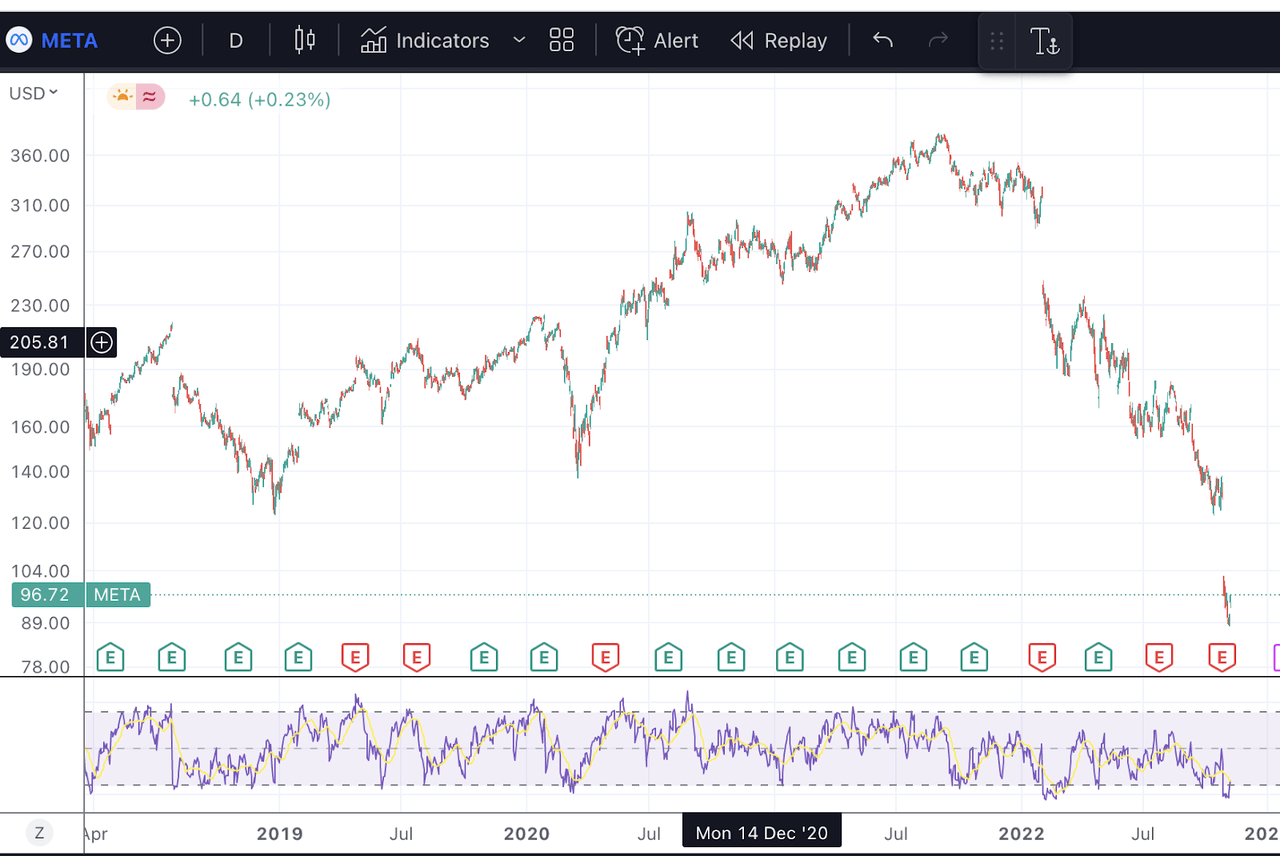

META price (TradingView) |

Now, META is in a very similar situation. Following the 2020 sell-off, META rallied over 160%. The pandemic brought into focus the importance of the internet and online communication, which benefited many of the big tech names. But now, with the economy contracting and financial conditions tightening up, investors are showing little tolerance for what they perceive as profligate spending. In fact, we have seen META rally on the back of news that the company would be carrying out significant layoffs.

While this may be the right course of action right now, I believe META is on the right track with its AR/VR investments. META is laying the foundation of the next iteration of the internet, and just like in 1999, only a few will see it coming and profit handsomely from it.

The True Metaverse Potential

The metaverse gets a bad rep, but I think this is because it is misunderstood. The metaverse shouldn’t be thought of as an all-encompassing universe that seeks to replace the physical world. Rather, it should be seen as an extension to what can be done in the “real” world. A way to break the limits of the physical and merge it with the digital. This is better captured by the term Augmented Reality.

The utility of the metaverse is not just limited to a niche set of people and markets, it will ultimately be how we interact with the digital world. The internet lacked popularity initially because computers were expensive and not common. This was a big obstacle to mass adoption but was slowly overcome. It slowly became common for families to have a desktop computer. Still, only a couple of decades later, the norm is for each family member to have at least one personal computing device.

We are not there yet, but we are slowly getting there. The Oculus 2 has sold nearly 15 million units, and the Oculus app was one of the most downloaded over Christmas last year. At $400-$500, and with an ecosystem of applications that is still in its early days, the Oculus is still just a cute toy, but this will soon change.

The metaverse will not replace the real world, but VR/AR headsets may very well replace computers/phones or at least redefine how we interact with this technology. An Oculus headset does increase the quality of a digital experience, and that opens the door to many potential uses. From learning, to fitness to entertainment and everyday use at work. This will happen eventually. Technavio’s most recent market report claims that the AR/VR market could grow at a CAGR of 46% until 2025, making it worth $162 billion.

So far, in 2022, META has sunk close to $10 billion on the metaverse, and this should increase in 2023, and I say bring it on. I’d much rather invest in a company that is becoming a dominant player in a growing market than one that is simply living off its increasingly irrelevant social media platforms.

Technical Analysis

With that said, let’s look at some TA for META.

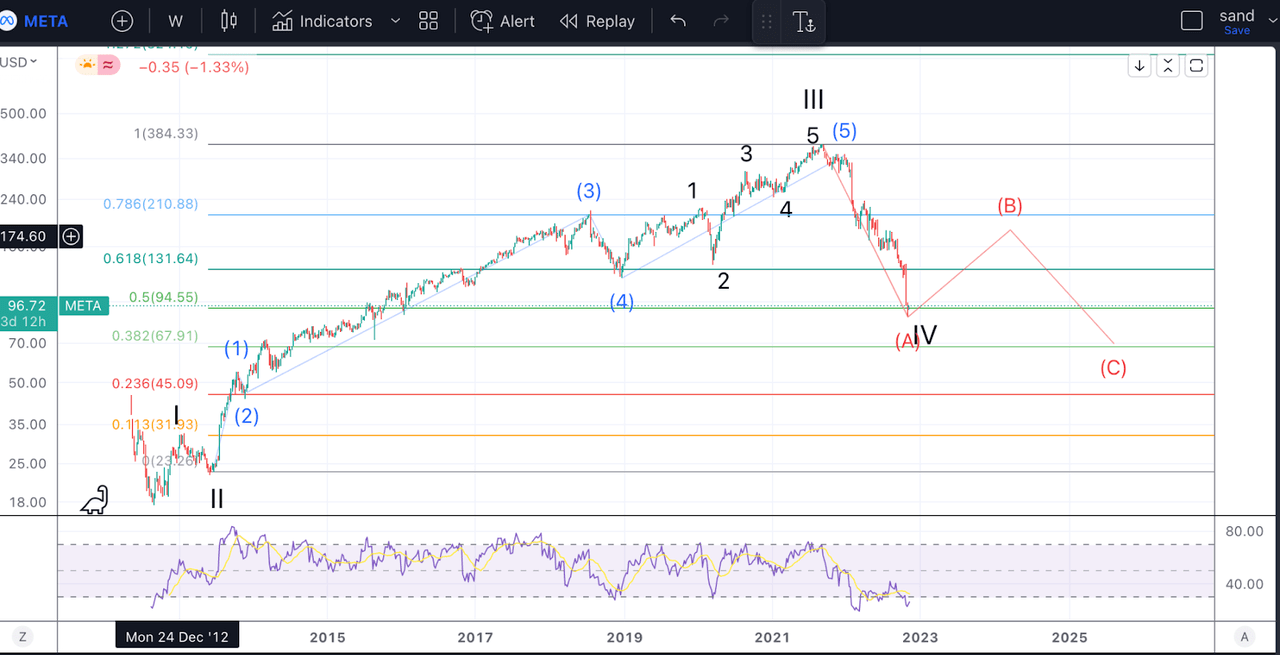

META analysis (Author’s work)

I believe that since its IPO, META has been completing a five-wave structure that started at around $18. The high at $384 was the top of a large wave III that has been taking place for almost a decade. This means that the wave IV could retrace significantly. So far, we have broken below the 50% retracement, and the next key level of support would be the $67 level at the 61.8% retracement.

Before that, however, I’d expect somewhat of a bounce. You might call this a relief rally. The $170-$200 area has been a prior level of trade and support/resistance, so this could be where we turn.

Ultimately, there are two important takeaways from this analysis:

-

I expect META to continue to sell off, but I think most of the pain (the 70% drop in the last year) is behind us.

-

After META bottoms, I’d expect the stock to rally towards the $900 in the final wave V. This is based on Fibonacci extensions but can’t be measured precisely at this point.

Takeaway

In 2020-21, the metaverse, crypto, and the broader market of tech stocks got incredibly hyped. New technologies opened the door to new possibilities, such as the metaverse and NFTs, and money started pouring into them. Now, with the Fed tightening and slower economic growth on the horizon, the euphoria has turned into panic. We are, however, entering the other extreme, and companies with solid fundamentals and good business ideas, like META, are getting caught up in the negative sentiment.

Be the first to comment