Editor’s note: Seeking Alpha is proud to welcome The Rare Opportunities as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

P. Kijsanayothin

Meta’s (NASDAQ:META) shares have fallen 60% from their all-time high. Thanks to this plunge, the price multiples of Meta are at an all-time low. Even though several problems caused this drop, I think there is still light at the end of the tunnel for Meta and that’s why I plan to keep buying shares. But now let’s look at the reasons behind this slump.

The first is the unfavorable macroeconomic situation in the U.S. The country is currently in recession, inflation is rampant, and interest rates are expected to rise no less aggressively than they have so far in the coming months. All this had the effect of reducing the profits of companies. Companies are generally worried about the upcoming economic situation, so they try to save where possible. And what is the first thing that companies try to save on when they find themselves in such a situation? Advertisements. And how does Meta mostly make money? Via ads, of course.

This situation reduced Meta’s sales and profits, which was one of the reasons why the stock fell. Another reason is increasingly strong competition, mainly from TikTok (BDNCE). Apple’s (AAPL) new iOS changes are no less worrying. The change deprived Meta of $10 billion in annual revenue. And finally, there is the investment in Metaverse. Mark Zuckerberg wants to spend about $10 billion a year on Metaverse research, which is something investors are not happy about at all.

The Solutions to Investor Fears

Now, let’s focus on the investor concerns that sent Meta stock down so much. The first problem is, as we already discussed, Apple’s iOS changes. And that’s a problem I think is troubling. $10 billion is quite a large amount for Meta, and in 2021 it was about 8.5% of the total revenue. But management responded to this problem and Meta began to invest in the development of AI technology, which should replace at least part of this future loss. Furthermore, there is the macroeconomic situation, which I don’t want to deal with much since it is almost non-influenceable by Meta. However, if you are a long-term investor and have a time horizon of at least five years, then this situation should not worry you significantly.

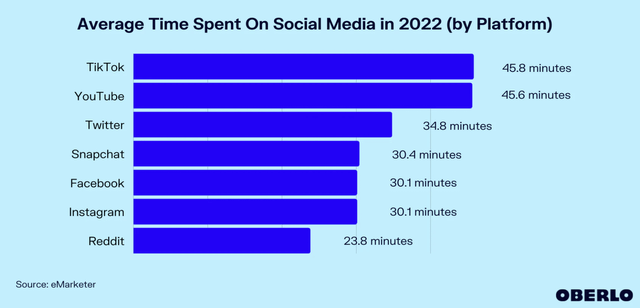

Next, we have competition from TikTok. Users now have more options in terms of where they can spend their time than ever before, and like everyone else on this planet, they have limited time. This has caused a great battle for user attention among social networks. And TikTok has been the most successful so far in this fight in recent years.

Meta management responded to this situation in August 2020 by releasing a new video format, very similar to TikTok called Reels. Reels have seen quite a large adoption since then, and in the last quarter, they already made up 20% of the total time that users spend on Instagram. Reels already have a higher engagement than stories and feeds. Instagram Reels already pull in $1 billion in annual revenue. But I think that revenue from Reels will grow even faster in the coming years. Meta’s management is already slowly pushing Reels on Facebook as well, where mostly the older generation is active. Most of them don’t have TikTok at all, which is something that, in my opinion, represents an interesting opportunity for Meta.

I would also like to comment on the concerns regarding Metaverse investments. Metaverse has been very unprofitable for Meta so far and will probably continue to be for years to come. However, Meta can afford this with their balance sheet. And the opportunity is huge. But the reality is that no one knows yet whether Zuckerberg’s Metaverse will be successful. What we do know is that Mark Zuckerberg still owns 13.6% of the company and all of his wealth is in the company. He knows that there is a lot at stake and, in my opinion, he is capable of doing anything to make Metaverse a success. And that’s exactly what you want to see as an investor. In my opinion, the risk of Metaverse failing is already factored into the price.

What About Future Growth?

The question about Meta’s sales continuing to grow is the reason why many investors are reluctant to invest in the company. I would like to take a look at that now because I think Meta has a lot of opportunities to grow its business. The first is, as I mentioned, an improvement in the macroeconomic situation, which will likely result in businesses spending on advertising again that, in turn, could once again boost Meta’s sales and profits.

The second opportunity for growth are Reels. In my opinion, management is doing a very good job with Reels, and it’s already clear that the short video format is probably the future of social networks. In addition, Reels have better results than Stories when they first started in terms of sales and engagement. Management claims that Reels and Stories are very similar in terms of their beginnings. Stories didn’t monetize very well in their early days either. However, they persevered and finally found a way to monetize Stories well. According to Meta management, a similar trend is also being seen with Reels. Although Reels have brought in $1 billion in annual sales, management still thinks that real growth is a long way off.

An opportunity that has not yet been mentioned is WhatsApp. WhatsApp is an application that is actively used by 1 billion people every day. On average, users use it for 28 minutes a day. Meta hasn’t managed to monetize WhatsApp yet – that in itself is interesting. Management has been actively trying to monetize WhatsApp for some time, but so far it has not been successful. Monetizing WhatsApp is not as simple as it seems at first. In the past few years, WhatsApp has primarily focused on user growth. That was successful, in my opinion. According to Zuckerberg, ads are not a way to monetize WhatsApp.

Personally, I think there are three main options to monetize WhatsApp. The first is simply an annual subscription for using WhatsApp. This could be, for example, $5. That would bring a fair amount of money to Meta. But the problem here is that users would probably stop using WhatsApp and move to another messaging platform, because there are so many of them now. And this is something that, in my opinion, management does not want to risk at all. The second option is a premium version of WhatsApp. This is something that could work if the premium version brought in some really good features. Even so, there is no guarantee that users will use the premium version of WhatsApp.

Lastly, there is WhatsApp Business, which is probably the most likely option in terms of how WhatsApp will be monetized. WhatsApp Business is actually WhatsApp, which is created precisely for communication between the specific business and the customer. Management will probably monetize WhatsApp Business in some way in the next few years. But overall, WhatsApp poses a big question.

As the last opportunity for Meta, there’s the Metaverse as mentioned earlier. Zuckerberg thinks the Metaverse is the future and that it represents hundreds of billions of dollars of opportunity. That’s why he decided to invest $10 billion a year over the next few years into the Metaverse. Whether the company will be successful with Metaverse will tell us in the next few years, but what is clear is that Metaverse really represents a big opportunity.

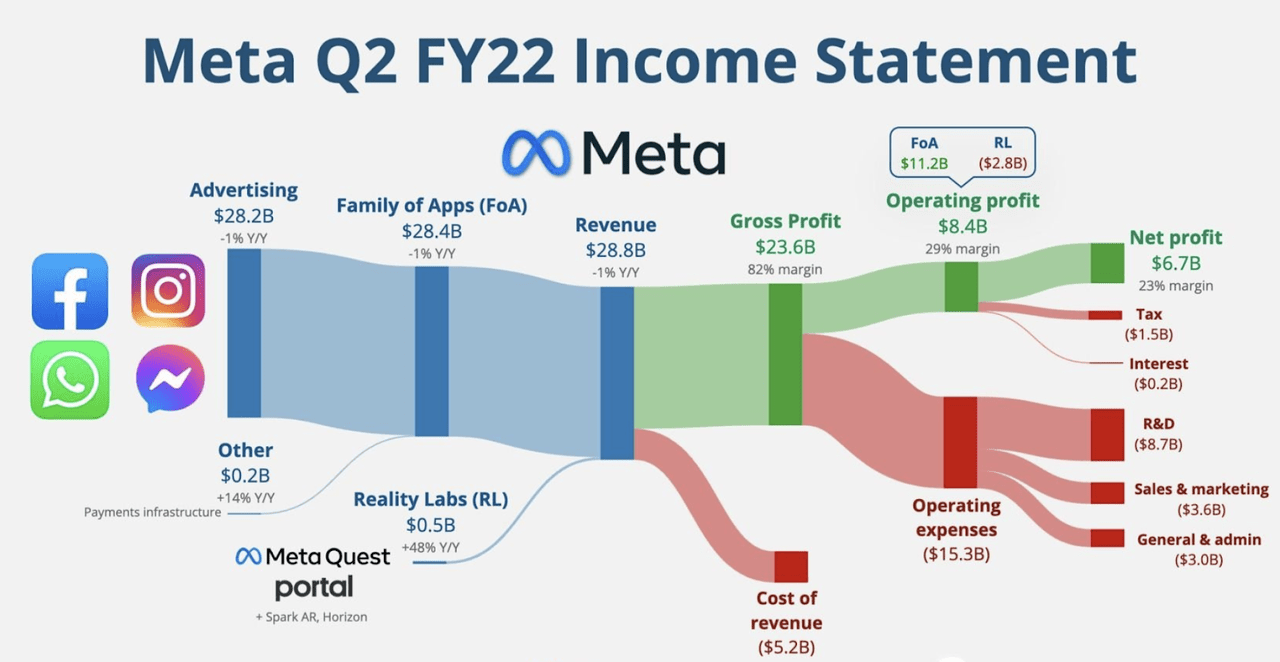

Financials

Now, let’s take a look at Meta’s financials. In the last quarter, Meta had a gross margin of 82%, which is still a very high gross margin. The company earned $8.358 billion in operating income, which was a decrease of 32.4% YoY. This was due to increased costs, mainly on research and development. Meta’s balance sheet is still very strong. Meta has over $169 billion in total assets. Right now, Meta has over $40 billion in cash and just $44 billion in total liabilities, with $0 in long-term debt. If Meta’s management wanted to, it could pay off almost all liabilities tomorrow and still generate tens of billions of dollars in free cash flow.

Meta has $125 billion in total equity. This means it is trading at a ridiculous price to book of only 3. Keep in mind that Meta has traded at an average price to book of around 6 over the past 10 years. With a current ratio of 2.52x, Meta is secure financially for the next 12 months. Meta is currently trading at a P/E of 11, which is the lowest P/E the company has ever traded at. Overall, Meta has one of the best balance sheets in the world. And that’s exactly what I want to see.

App Economy Insights

Meta’s Moat

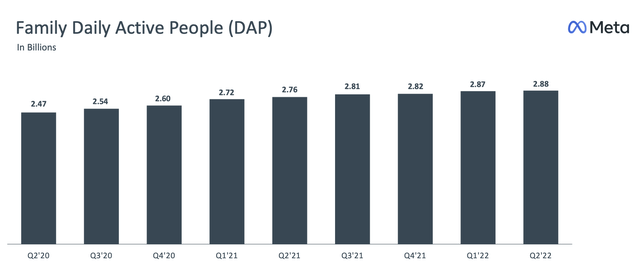

As for Meta’s moat, it is still strong in my opinion. The current number of daily Meta product users is 2.88 billion, an incredible number that is still growing. Meta’s moat mainly consists of the fact that users have almost all their friends on one platform. The fact that users have most of their friends on one social network is in itself a big competitive advantage. It is really difficult for other companies to create another successful social network. TikTok has succeeded, but the problem is that TikTok is not about the users themselves and their friends. TikTok is mostly about creators and various trends that users then follow.

The reason I like Instagram so much is that it’s just about everything. Users can comfortably write with their friends there; it actually replaces WhatsApp. There, users can follow what their friends and favorite creators are doing via feed and stories. It partially replaces Facebook. And there, through Reels, users can watch short videos that replace TikTok. So Instagram is basically everything in one app. Overall, in my opinion, Meta’s moat is still getting stronger every day.

Valuation

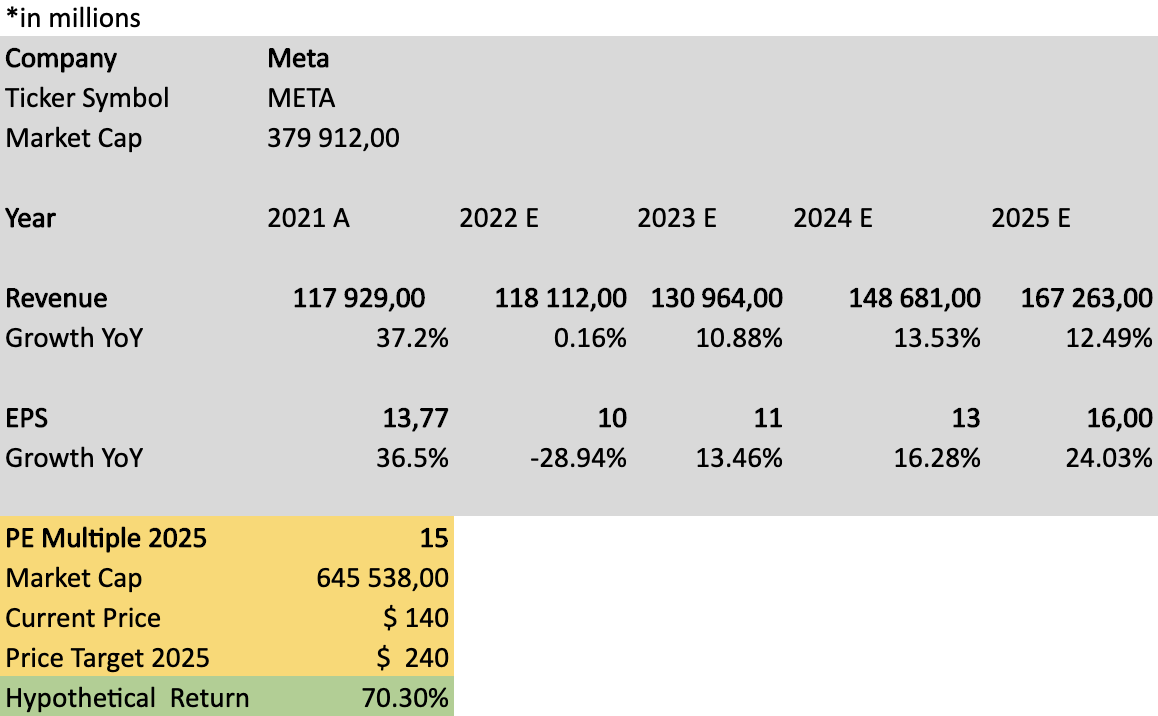

Meta shares are trading at the same price they were trading at in 2017. Profits have doubled since that year and revenue even managed to nearly triple, yet we see Meta at the same price it was at five years ago. But, for now, let’s focus on my expected return for Meta.

Here I created a very simple model, which, if it happens, Meta could see a 23% return per annum in the next three years. It all depends on how Meta can grow the top and bottom lines. If management is able to grow sales and profits as expected, then Meta will probably see a very attractive return. However, if these expectations are not fulfilled, then in my opinion the return will still be OK. That’s why I have Meta in my portfolio.

Autor

Risks

Meta stock has risks like any investment. The first risk is if the current macroeconomic situation lasts many more years than expected. That wouldn’t be good for Meta at all. This would mainly be the cause of much slower growth than is currently expected. Another risk for Meta is competition, mainly from TikTok. If management fails to compete well with TikTok with Meta’s Reels, this could pose significant problems for Meta as users would spend less time on Meta’s social networks, which would of course reduce profits. Next is the Metaverse – if management spends billions of dollars a year on Metaverse research and the sales and profits are not significant, that would be a problem. These are the main risks associated with investing in Meta shares right now.

Catalyst

A catalyst that is not talked about much, but has more than a small chance of happening, is TikTok being banned in the U.S. After all, American social networks are also not allowed in China, so the U.S. could ban TikTok. This would probably mean significantly higher prices for Meta shares. The chance of this happening isn’t huge, but it’s something to keep in mind.

Conclusion

The price multiples of Meta are at an all-time low. The moat is getting stronger every day. Meta has one of the best balance sheets in the world. Zuckerberg and the rest of management are still hungry for success, and there are plenty of opportunities for growth. It should be noted that the near future for Meta shares doesn’t look very positive. That said, despite a number of risks, if you are a long-term investor Meta could represent an interesting opportunity.

Be the first to comment