Fritz Jorgensen

Meta Platforms Inc (NASDAQ:META) stock has already lost over 50% of its value in the year to date. There has been a massive correction in the stock price as Wall Street tries to price in the recent changes taking place in the company. Meta is undergoing a big transformation on a number of fronts. It is investing heavily in Reality Labs, hardware, Reels, buybacks, and other initiatives. This has caused short-term fluctuations in revenue growth and profits. We have already seen a big dip in revenue growth in the last quarter which was taken negatively by Wall Street.

These swings might continue for another few quarters. A big chunk of user engagement is moving towards short-form video formats and Reels which is not monetized aggressively as the company wants to increase engagement. This has led to a dip in revenue growth. The company is also investing in Reality Labs which has shown losses of over $10 billion on an annualized basis. At the same time, the management has mentioned that it will limit expenses by reducing expensive hires which should improve earnings. Meta stock is trading at only 12.5 times its PE ratio which gives long-term investors an opportunity to invest and ride out the recent swings with the potential of better returns over the long run.

Swing in key metrics

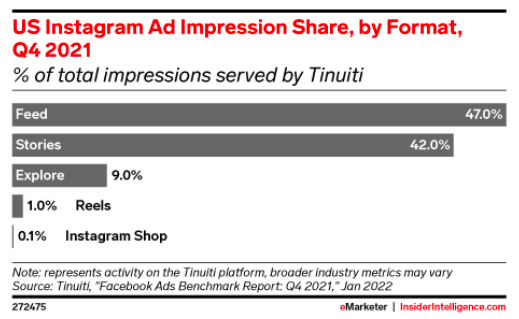

Meta has seen some massive swings in revenue growth and EPS in recent quarters. A part of it had to do with the impact of the pandemic and tougher comps. But the company is also undergoing a transformation that changes the growth trend in the short and long term. There has been higher user engagement in short-form video format which does not monetize at the same rate as Stories or News Feed. Meta has mentioned that 20% of the total usage on Instagram happens on Reels. On Facebook, more than 50% of the time spent by users is on videos. This dramatically changes the monetization ability of the company in the near term.

In the last few years, Meta has managed to deliver good monetization in Stories despite reservations by many analysts. A similar trend could be seen in Reels. Once the user engagement reaches close to saturation, Meta would focus on improving monetization.

eMarketer

Figure 1: Ad impressions on Reels is quite low despite high user engagement.

The above image shows that ad impression on Reels is still quite low compared to the massive user engagement announced by the company.

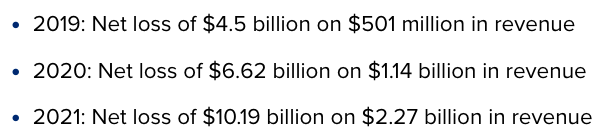

Figure 2: Meta’s revenue growth has shown swings similar to other Big Tech peers.

The pandemic caused a big swing in revenue growth of most tech companies as consumer habits changed. However, as the restrictions are relaxed, most of the companies have faced a decline in revenue growth as consumer usage reverts to pre-pandemic times and also due to tougher comps. Meta has been hit hard due to this trend because it is also undergoing a transformation at the same time.

Future of monetization

Meta’s management has announced flat revenue growth for the next quarter. Wall Street rarely rewards companies that have modest revenue growth potential. However, if we look beyond the next few quarters, the growth trend in Meta seems a lot more promising. The company is showing progress in Reels and we could see a massive monetization effort by the end of the year. This should start showing good results by the second half of 2023. Meta is already testing new features to share revenue with creators on Reels. It has also built a $1 billion bonus program to reward creators who have higher user engagement.

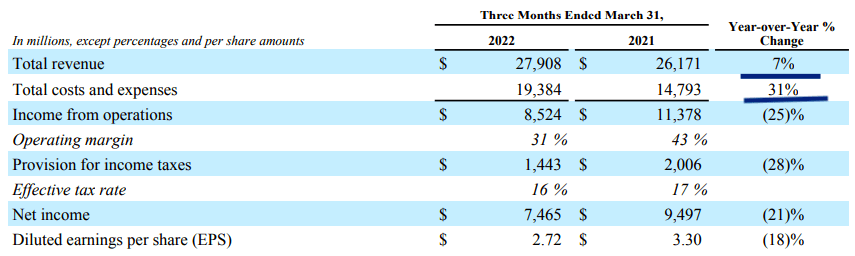

The company has also announced key initiatives to boost monetization in Reality Labs division. We should start seeing more effort diverted towards increasing monetization in this key business which could help in reducing the losses over the next few quarters.

CNBC, Company Filings

Figure 3: Net loss and revenue of Reality Labs in the last few years.

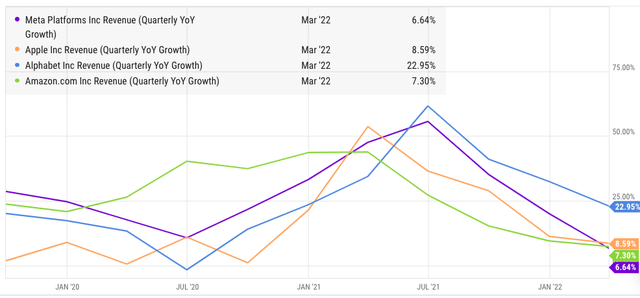

Meta has also mentioned that it will reduce the expenses in the near term. The YoY growth in the recent quarter was 7% while the headcount grew by a staggering 28%. The headcount growth is similar to the growth in expenses which came at 31% on a YoY basis. The company has already mentioned that it will limit hiring and also reduce the forecast for annual expenses in 2022 by $3 billion. This will help in boosting the earnings despite modest revenue growth.

Company Filings

Figure 4: Increase in headcount led to higher expenses compared to revenue growth.

Impact on stock price

The swings in key metrics will continue to have a big impact on the stock price. However, these swings in key metrics are short-term as the company transforms its platform and starts monetizing Reels, Reality Labs and other initiatives. Investors with a long term horizon can take advantage of these corrections.

The fundamentals of the company are still quite strong with very high DAUs and MAUs on various social media platforms. The stock is trading at close to 12.5 times its PE ratio which is quite modest when we look at the growth potential over the next few years.

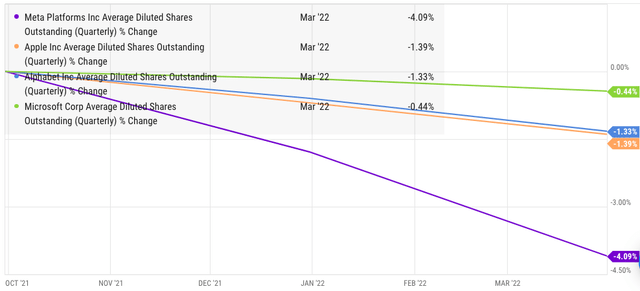

Figure 5: Meta has undertaken one of the most aggressive buyback program.

Meta has bought back over $50 billion worth of stock in the last twelve months. It produces close to $40 billion in free cash flow which should allow the company to maintain the current buyback pace for a long time. In the last year, it was able to expunge close to 5% of its outstanding stock. After the recent correction, the impact of buybacks would be greater due to lower prices. It is possible that we will see close to a 10% annual jump in EPS due to buybacks on a standalone basis for the next few quarters. This is attractive for the long term investor who can take advantage of the recent correction.

While the near term challenges for Meta persist, the long-term fundamentals of the company are quite strong. There are several growth levers available for the management. This makes the stock an attractive option at the current rock bottom price.

Investor Takeaway

Meta is in a good position to deliver long-term revenue and earnings growth. However, the company will see short-term swings due to lower monetization in newer initiatives like Reels and Reality Labs. The management has announced reduction in hiring and limiting expenses which should help in improving earnings over the next few quarters.

As the company starts to monetize new features, we should see improvement in revenue and earnings metrics. This could happen from the second half of 2023. The buybacks are also a good tailwind for the EPS growth of the stock. We might see some swings in the near term which can be used as an ideal entry point for a long-term investment.

Be the first to comment