COM & O/iStock Editorial via Getty Images

Meta Platforms (NASDAQ:META) stock has been beaten down to levels that few expected to see at the start of the year. Currently trading $138, it is below even fairly modest estimates of fair value. The current stock price implies that Meta’s earnings will decline for a long time. If you simply take Meta’s 12 month free cash flow per share and discount it at 8% (with no growth), you get a terminal value estimate of $162.10. That’s already higher than Meta’s current stock price (it’s about the level META was at when people started calling it a value stock), so there is real potential here. Unless interest rates reach double digit territory, Meta only has to grow at 0% to be worth more than its shares cost today.

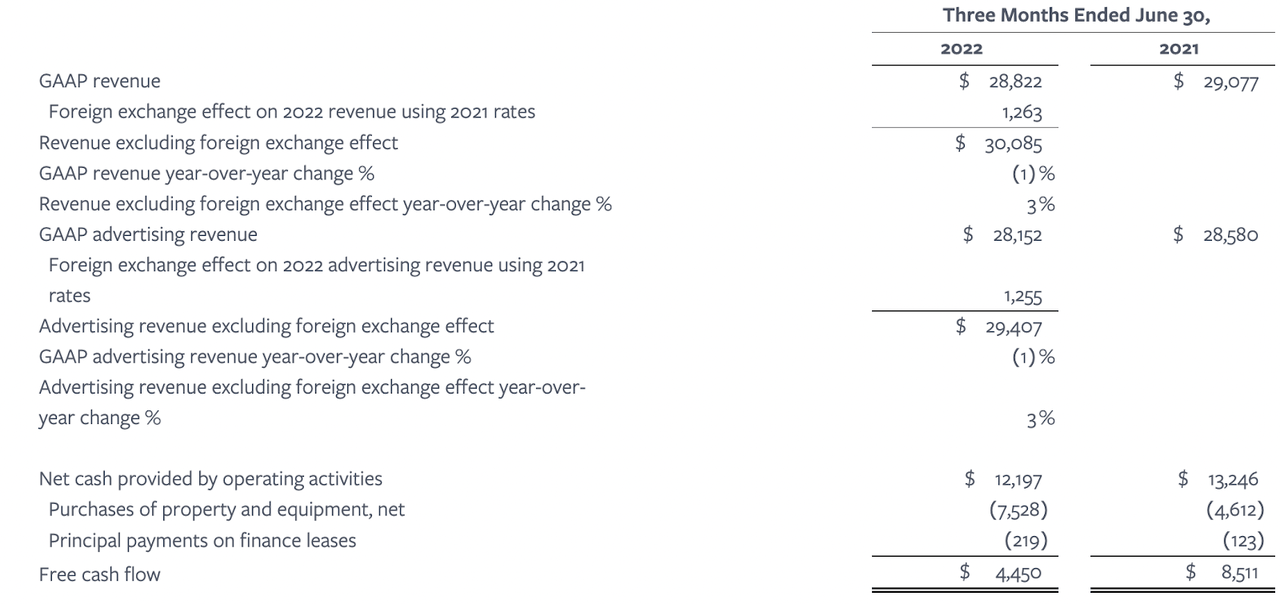

However, the matter is complicated by the fact that Meta’s earnings have been declining. In its most recent quarter, Meta’s net income declined 36%. That wasn’t because of “on paper” factors either: revenue declined 1% and free cash flow (“FCF”) took a nearly 50% haircut.

Meta earnings (Meta Platforms)

So, we have some signals that Meta’s growth in coming quarters will be lower than 0%. If upcoming quarters look like the previous one, then we’ll eventually see -36% earnings growth for an entire 12-month period. Should that occur, the terminal value calculations I did above will not apply.

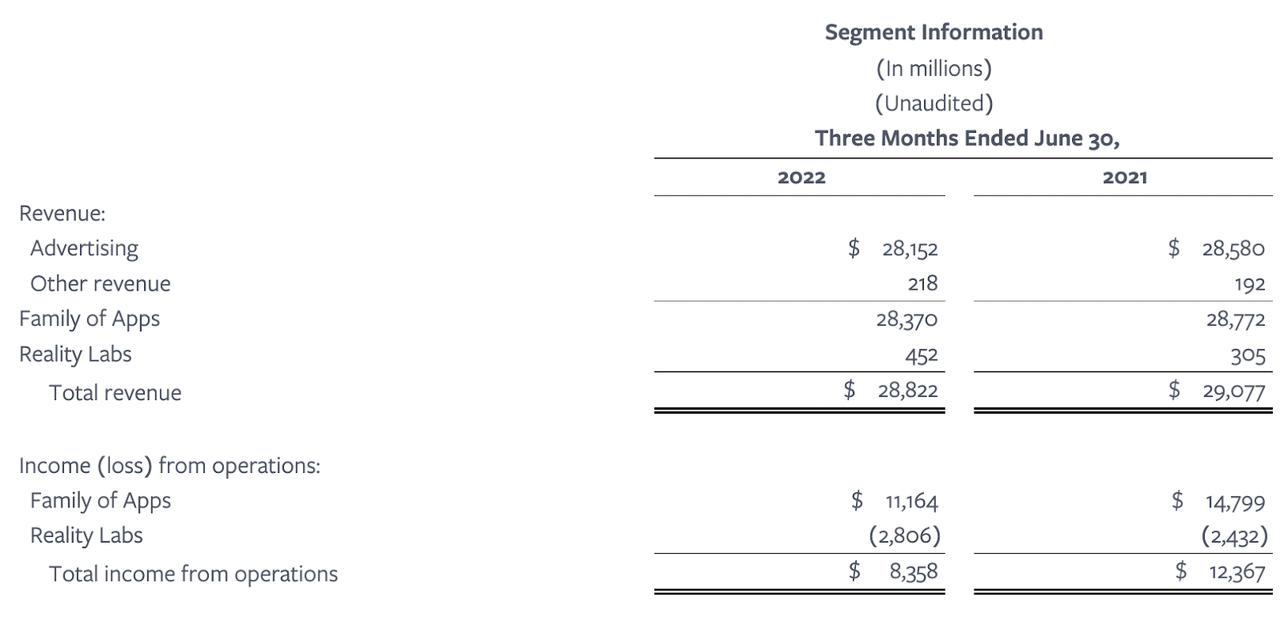

The question is whether Mark Zuckerberg can turn this ship around. He has one obvious tool at his disposal to pare the decline in earnings: cut spending on the Metaverse. Reality Labs, Meta’s Metaverse segment, costs $10 billion a year and is not profitable. In the most recent quarter, Reality Labs brought in $450 million in revenue and lost $2.8 billion in operating income (“EBIT”). So we’re talking about a -622% EBIT margin here. Cutting spending in this segment would produce an instantaneous jump in earnings with revenue just staying flat. Please refer my previous analysis Meta Platforms: Zuck’s Big Gamble.

Meta segment results (Meta Platforms)

The problem is that the Metaverse is very strategically important to Meta Platforms. META, like many other social media companies, lacks full control of its platforms. A company like Apple (AAPL) controls the software and operating systems on which its apps run. Meta controls neither–except the Quest, its VR headset. If Meta can get the Quest, Ray-Ban glasses and other such hardware devices to take off, it will join the club of companies that control entire tech ecosystems and can do with them what they wish.

In today’s tech industry, that is a big strategic advantage, and nobody knows it better than Mark Zuckerberg. In 2021, Apple single-handedly took a bite out of Meta’s advertising revenue by forcing it (and all other third-party developers) to ask permission before tracking users. If users declined, then Meta lost the ability to show them targeted ads. The end result was a $10 billion bite taken off of 2022 revenue.

If the Quest and other products like it take off, then Meta will no longer have to worry about other companies eating its lunch. The Quest is a hardware platform that runs on Meta software: Meta sets developer fees, data policies, and everything else relevant to monetizing the platform. If VR really does become the future of content consumption like Zuck thinks it will be, then Meta stands to gain enormously. So, there is some tentative cause for optimism toward Meta stock, but there are real risks as well, as I’ll reveal shortly.

Meta – Competitive Position in the Metaverse

When looking at Meta’s chances of succeeding in the metaverse, we need to consider its competitive position. Other companies are trying to get into this space, so Meta’s competitive position has to be assessed.

First, we can look at Meta’s competitive position in gaming, the most obvious use case for the metaverse. Here, Meta is at a disadvantage compared to Apple, Alphabet (GOOGL) and Microsoft (MSFT). These three companies already have large numbers of games on their platforms. If they wanted to break into VR gaming, all they would have to do is incentivize some of their current game developers to build VR versions of the games they’re already developing for mobile and PC. They’d first have to build a VR headset, but once that was done, they would have a relatively straightforward path to getting a big library of VR games. Indeed, Microsoft is already working on building its gaming IP: it spent $2.5 billion to buy Minecraft and is in the process of buying out Activision Blizzard (ATVI). If the ATVI deal closes, Microsoft will own dozens of profitable franchises, and hundreds of individual titles.

Meta does not have this advantage. If you look at the Quest’s game list, it does have some popular franchises like Resident Evil, but Meta doesn’t actually own the IP. It’s at risk of the developers pulling their games off the platform if they strike an exclusive deal with another publisher. And yes, exclusive deals are common in gaming: just ask any console manufacturer that missed The Last of Us when it released as a PlayStation exclusive.

When it comes to other applications of VR, Meta has an advantage. In past Facebook Connects, Mark Zuckerberg talked about using VR for business meetings, surgery, and employee training. None of the other three companies I mentioned are working on these use cases yet, so Meta has the edge here. Some smaller companies are working on them, but they don’t have anywhere near Meta’s funds, so Meta could very well go on to dominate these more “practical” metaverse niches.

The Metaverse: Impact on Meta’s Bottom Line

As we’ve seen so far, the metaverse is a promising concept with applications in gaming, medicine, and business. It could eventually become a big deal. However, Meta is currently losing money on its Metaverse projects and says it will continue losing money on them for 3-5 years, so investors need to think about the financial impact of all this spending.

To get a sense of how the Metaverse is impacting Meta’s financials, we can look at its most recent quarterly results.

In the second quarter, Meta delivered:

-

$28.8 billion in revenue, down 1%.

-

$6.6 billion in net income, down 36%.

-

$2.46 in diluted EPS, down 2%.

-

$4.45 billion in free cash flow, down 47%.

Pretty big declines, right? Indeed, they were. But the interesting part is that the bottom line would have been decent had the metaverse spending not been a thing. In the second quarter, Reality Labs (Meta’s metaverse segment) lost $2.8 billion. If you add that figure into net income you get to $9.4 billion. The prior year’s net income was $10.4 billion, so earnings would have only declined 9.6% in Q2 had the metaverse not been part of the mix. Most likely, this year’s weak revenue growth would have impacted financials regardless, but the decline in earnings probably would have been less severe were the spending on Reality Labs not enormous.

This has bearing on Meta’s valuation. By most conventional metrics, Meta is a cheap stock, trading at:

-

11.6 times earnings.

-

3.2 times sales.

-

3 times book value.

-

6.4 times operating cash flow.

The earnings and cash flow multiples are low by the standards of all stocks: the S&P 500’s P/E ratio is currently 19. The sales and book value multiples can also be considered “low” if we narrow the benchmark down to just tech stocks.

However, these are all historical multiples. What matters is where the multiple will be using next year’s earnings and today’s stock price, and with earnings going down 36%, it’s likely that Meta’s multiples will go up if the stock price stays flat. Right now, you can take Meta’s TTM earnings per share ($12), discount them at the treasury yield, and end up with a $300 price target. That’s a fair value estimate more than DOUBLE the current stock price with ZERO growth assumed! That’s all very exciting, but if earnings keep going down the way they have been, then this math will cease to work at some point in the future.

Which is why I have rated Meta a ‘buy’ rather than a ‘strong buy.’ Basically this stock is suitable for an investor with the exact same time horizon and risk tolerance as me, which is why I personally own it, but it’s not really ideal for a lot of other investors. If future earnings disappoint, then META stock will be extremely volatile. If you’re looking for a smooth ride, this stock isn’t for you.

The Bottom Line

The bottom line on Meta Platforms is that it’s a riskier-average stock that could produce better-than-average results. It only needs 0% growth to be theoretically worth more than it costs now. Above, I showed that terminal value for the stock comes out to $300 if you use the current 2 year treasury yield (4%) as the discount rate. In fact, if you up the discount rate to 8%, you still get a fair value estimate higher than today’s price. So there is a real chance for capital appreciation here. However, the fact remains that in the most recent quarter, bottom line growth was -36%, not 0%. As long as Meta continues spending $10 billion a year on the metaverse, risks remain very high. For now, I’m comfortable holding a small amount of META, but it’s not the kind of stock I’d overweight or “go all in” on.

Be the first to comment