Justin Sullivan/Getty Images News

Elevator Pitch

I have a Buy rating for Meta Platforms, Inc.’s (NASDAQ:META) shares. In my prior March 25, 2022, update for META, I discussed the company’s 2022 financial forecasts.

Based on the analysis done in the current article, I reach the conclusion that META is an attractive investment candidate, following a correction in its share price in tandem with the sell-off in technology stocks as a group. Meta Platforms is undervalued as seen with its current valuation multiples. In addition, the company’s shares have a decent chance of re-rating in the short term assuming that a number of catalysts such as a Q2 revenue beat and stronger-than-expected profitability driven by lower investments materialize.

META Stock Key Metrics

I will focus on analyzing Meta Platforms’ key metrics first, before touching on the company’s recovery prospects, valuations, and outlook in subsequent sections of this article. In my view, META’s stock price performance and brand valuation metrics are what investors should watch closely.

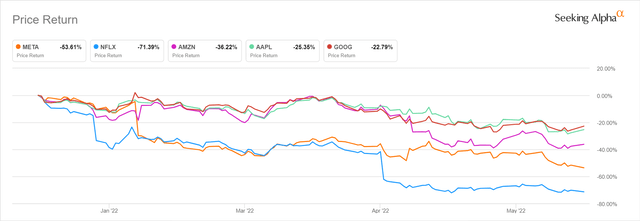

Year-to-date in 2022, the technology sector has fallen out of favor with investors, and this is seen with the performance of the largest and most prominent technology companies, the FAANG stocks, as highlighted in the chart below.

2022 Year-to-date Stock Price Chart For META And The Other FAANG Stocks

Among the FAANG stocks, the second worst performing stock thus far this year is Meta Platforms whose share price has fallen by -53.6%; only Netflix (NFLX) has done worse with a -71.4% price drop year-to-date. The shares of the other major technology stocks, Amazon (AMZN), Apple (AAPL) and Alphabet (GOOG) (GOOGL), also pulled back by -36.2%, -25.4%, and -22.8%, respectively in 2022 year-to-date.

A rising rate environment and the reopening of the economy have been negative for listed technology companies. Expectations of higher interest rates have led investors to favor value stocks over growth stocks, with fast-growing technology stocks in general suffering from a significant valuation de-rating. I will elaborate on META’s valuations in a subsequent section of this article. Also, Work-From-Home tailwinds for the technology sector have eased considerably with an increasing number of workers returning back to offices. Specifically, there are concerns that a larger-than-expected decline in spending on digital advertising in a post-pandemic environment will be a drag on Meta Platforms’ future growth.

Interestingly, META’s shares have underperformed most of the other FAANG stocks (with the exception of Netflix) in 2022 year-to-date, and this is aligned with the results of a recently released worldwide brand value ranking.

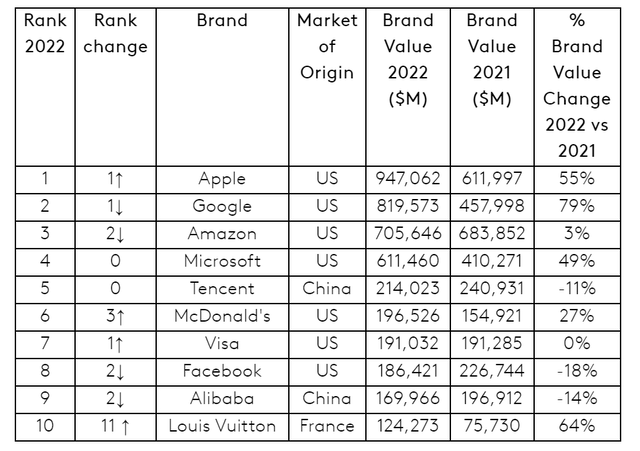

On June 15, 2022, Kantar disclosed its “BrandZ Top 10 Most Valuable Global Brands” for this year. Notably, the Facebook brand’s ranking fell from sixth last year to eighth in 2022.

Kantar’s BrandZ Top 10 Most Valuable Global Brands For 2022

More importantly, Kantar’s analysis found that Facebook’s brand value decreased by -18% from $227 billion in 2021 to $186 billion this year. In contrast, the brand valuations for Google, Apple, and Amazon rose by +79%, +55% and +3%, respectively in 2022. This might help to explain why Meta Platforms’ shares have dropped to a larger extent year-to-date, as compared to the stock prices of Alphabet, Apple, and Amazon.

There have been a couple of negative news items for META in just June alone, and this might have affected the company’s brand value and stock price performance. A June 17, 2022, Seeking Alpha News article noted that the company is involved in a “suit claiming a medical data leak to Facebook.” CNET reported on June 8, 2022, that META is “facing 8 lawsuits that allege its addictive algorithms harm young users.” Also, it was announced at the beginning of this month that Sheryl Sandberg will no longer be Meta Platforms’ Chief Operating Officer in a few months.

In a nutshell, the stock price performances of technology stocks have been disappointing this year, and META is no exception. Meta Platforms’ shares have underperformed most of its FAANG peers, and this is consistent with a decline in Facebook’s brand valuation which could possibly be driven by negative news flow.

Can Meta Stock Recover?

I hold the view that META’s stock price can recover in the near future, due to three key factors.

Firstly, there are various indicators that point to Meta Platforms investing at a more moderate pace going forward, which will be supportive of the company’s future profitability.

On June 22, 2022, Ming-Chi Kuo from TF International Securities, a highly-regarded sell-side analyst covering the technology sector which Bloomberg also refers to as “one of Apple’s top analysts”, published a tweet on Meta Platforms. In the tweet, he noted that META won’t proceed with “all new headset/AR (Augmented Reality)/MR (Mixed Reality) hardware projects after 2024” for now. This appears to be consistent with other recent news and the company management’s comments at its most recent quarterly earnings call.

Seeking Alpha News highlighted on June 9, 2022, that META “has paused the development of its dual camera smartwatch” which was “part of its greater metaverse vision.” Separately, Meta Platforms had earlier stressed at the company’s Q1 2022 results briefing on April 27, 2022, that “we’re now planning to slow the pace of some of our investments” considering “our current business growth levels.” The company also emphasized at its recent quarterly investor call that it will make sure that “our investment plans are appropriately calibrated to the operating environment.”

In other words, Meta Platforms could deliver better-than-expected profitability and earnings in the short to mid term, with the company’s future investments possibly turning out to be lower than what the market anticipates.

Secondly, concerns with regards to Apple introducing new privacy initiatives have been partially allayed.

AdExchanger, which describes itself as a media publication covering “programmatic advertising and the data-driven marketing technology ecosystem” on its website, mentioned in a June 6, 2022, article that there was a “lack of privacy-related bombshells” at AAPL’s 2022 Worldwide Developers Conference.

Assuming that Apple doesn’t take a more aggressive stance on privacy or speeds up the introduction of other privacy-related measures in the short term, this should offer some breathing space for digital advertising companies, including Meta Platforms.

More significantly, META seems confident in tackling the privacy-related headwinds, which have affected its digital advertising business in a negative way, in the intermediate to long term. At its Q1 2022 investor briefing, Meta Platforms highlighted that it can “grow other onsite conversion products” in the “medium term”, while it is in the process of “developing privacy-enhancing technologies” for “the longer run.”

In summary, the absence of new privacy initiatives from Apple at its recent event is a positive for the digital advertising industry and META, and Meta Platforms should be able to adapt to the changes to AAPL’s privacy settings in time to come, notwithstanding headwinds in the short term.

Thirdly, META is expected to announce the company’s Q2 2022 financial results in late-July, and there is a good chance that Meta Platforms might achieve a meaningful revenue beat.

Meta Platforms’ Historical Quarterly Revenue Surprises

As per the chart above, META’s revenue in the past three quarters was either below consensus estimates or met market expectations by a whisker. If Meta Platforms can deliver a substantial top line beat in Q2 2022, the market is likely to react positively to the company’s above-expectations revenue.

According to a June 15, 2022, research report (not publicly available) titled “Deep Dive Refresh: Pricing Data Suggests Headwinds May be Moderating” published by Piper Sandler, the firm’s sell-side analysts forecasted that “impressions (for Facebook and Instagram) would only have to grow ~8% to hit Street 2Q numbers” according to their internal pricing data analysis. The Piper Sandler analysts also noted that impressions for Facebook and Instagram “have grown (at a much higher) 11% y/y on average” in the preceding five quarters.

On an absolute basis, a top line beat in the second quarter doesn’t seem a huge hurdle to cross for META. Wall Street analysts expect Meta Platforms to grow its revenue by a mere +0.6% YoY in the second quarter of 2022, as per consensus financial projections sourced from S&P Capital IQ.

To round things up, I think a recovery in META’s share price is very probable, taking into account the three catalysts I mentioned in this section. It also helps that Meta Platforms’ current valuations are inexpensive, a topic which I cover in the next section.

Is Meta Stock A Fair Value Now?

META stock is now undervalued in my opinion.

The market currently values Meta Platforms at consensus forward next twelve months’ EV/EBITDA and EV/EBIT valuation multiples of 6.7 times and 10.2 times, respectively. In comparison, META’s 10-year mean EV/EBITDA and EV/EBIT valuation multiples are 15.9 times and 20.6 times, respectively according to S&P Capital IQ data.

In other words, META’s current valuations are substantially below their historical averages, and Meta Platforms’ undervaluation is further validated by a comparison of its P/E multiple with its intermediate term financial outlook as discussed in the subsequent section.

What Is META Stock’s Outlook?

As per Wall Street’s consensus forecasts obtained from S&P Capital IQ, Meta Platforms’ normalized earnings per share are projected to expand by a CAGR of +14.3% from $11.76 in fiscal 2022 to $20.05 in FY 2026. Over this same period, the market consensus expects META to continue generating ROEs in excess of 20% for every single year.

These financial estimates make sense. META’s revenue growth should accelerate again starting in 2023, when the company manages to deal with the Apple privacy changes successfully. Separately, the company’s current strong profitability (and high ROEs) should be sustained in the future, as it moderates its pace of investments going forward.

META trades at a 13.2 times consensus forward next twelve months’ normalized P/E now. A low-teens forward P/E multiple for Meta Platforms appears to be inconsistent with the company’s financial outlook i.e. forward ROEs in the low 20% range and annualized EPS growth rates at the mid-teens percentage level.

Is META Stock A Buy, Sell, Or Hold?

META stock is a Buy. Its shares aren’t expensive based on various valuation metrics, and there are a number of events (as highlighted above) which could drive the company’s share price upwards in the near term.

Be the first to comment