Kelly Sullivan

The broad-based economic slowdown is only one of Meta Platforms, Inc.’s (NASDAQ:META) many headaches. Let’s take a look at its ad-peer Google (GOOG / GOOGL) – the company’s mediocre, though resilient, performance in the face of strong external headwinds was well rewarded by the market. This shows that market expectations have been reasonably lowered. The problem is that META’s delivery came in even lower.

In addition to worsening macro headwinds, META has also been dealing with a ton of idiosyncratic risks, particularly in its core advertising business. And Zuckerberg and Co. is still a long way from restoring credibility that has been tarnished this year.

Apple’s (AAPL) privacy policy changes implemented last year via iOS 14 has upended the effectiveness of META’s delivery of targeted ads, its flagship product. Then, there is accelerated competition from TikTok that is stealing market share from social media platform operators across the board. The company is also dealing with choppy user growth trends that are threatening its ad engagement rates, a key determinant for marketers in making ad placement decisions. META’s transition to metaverse has also raised concerns over potential dilution of investments allocated toward bettering its ad business, which remains the company’s lifeline today.

But META still demonstrates traits that it is playing a long game here. As discussed in our previous coverage, the ongoing transition across META’s underlying business – from pure web- and app-based social media to ads and now the metaverse – is a difficult endeavor that is bound to bring forth some temporary pains. But if it works out, the company will be sitting on massive long-term gains.

It is a big bet, but not so far as to call it a “long shot.” META still benefits from a strong balance sheet today, with a ton of cash on hand and no debt burden to stop it from making the improvements needed to restore credibility, even in the face of economic uncertainties. The company also remains the “strongest player in terms of first-party user data and associated targeting,” while commanding a quarter of the digital advertising market share still. While META continues to find itself tangled in idiosyncratic ad snags, it is also demonstrating gradual, but steady, progress in fighting it.

The stock’s selloff this year has created a favorable risk-reward trade-off, even under today’s dour operating environment. With META currently trading at a significant discount to its internet peers – even those with a mediocre growth profiles like Twitter (TWTR) and Pinterest (PINS) – the stock remains a reasonable long-term investment at current levels.

Idio Ad Snag #1: Apple’s Privacy Policy Changes

Issue: Earlier this year, META guided a potential revenue loss of $10+ billion for the year attributable to Apple-related signal loss for its advertising business. Although management has not provided any specific updates on the quantified impact experienced during the first half of the year, META’s first-ever quarterly revenue decline implies that the Apple privacy policy changes remain the biggest roadblock to its core advertising business. To date, only about a fifth of iOS users have granted permission to app tracking, meaning the bulk of META’s critical data pipeline for its ad business has been severed.

META’s Response: As discussed in our previous coverage, the company has been diligently working on near-, mid-, and longer-term fixes to improve the effectiveness of ad targeting and measurement in the “post-IDFA” world. This includes moving advertisers and merchants to adjacent conversion products, like “click-to-messaging” ads, which has demonstrated strong growth with a 40% take-rate during the second quarter. The company has also rolled out tools like “Conversions API” and “Conversions API Gateway” to provide advertisers and merchants, particularly small and medium businesses (“SMBs”), with easy access to “direct, reliable, and privacy-safe” marketing data required to drive “ad personalization, optimization and measurement.”

But the real long-term solution will depend on META’s ability in leveraging its ongoing build-out of AI / ML capabilities. The company is currently in process of developing “Privacy-Enhancing Technologies” (“PETs”) to enable more relevant ad delivery to users and better performance measurement to advertisers, while using less data over the longer-term. For instance, fields like cryptography and statistics will be leveraged in META’s PETs to “minimize data that is processed while preserving critical functionality like ad measurement and personalization.” PETs will ultimately help META’s ad business bypass the roadblock currently posed by Apple’s App Tracking Transparency feature, while improving user privacy without compromising on the effectiveness of ad measurement and personalization.

But PETs are still years and billions of dollars away from being fully commercialized, and there has yet to be a clear timeline to when it will be effective enough to bring back the data advantage that META’s advertising business had built its previous successes on:

Advances in AI enable us to deliver better-personalized ads while using less data…Now overall, there’s a lot of work to do here and a lot of the investment is in AI compute capex.

Source: META 2Q22 Earnings Call

The Offset: The positive link here is that META remains the “strongest player in terms of first-party data and associated targeting” in digital advertising, meaning there is still leverage to drive a comeback. Seizing this advantage, META has expressed its commitment towards building “first-party understanding of people’s interests by making it easier for people to engage with businesses in [META’s] apps.” Paired with its near- and mid-term mitigation strategies against signal-loss challenges outlined in the earlier section, it just might buy META enough time to rebuild its leading foothold in targeted ads by maintaining sustained advertiser demand.

Idio Ad Snag #2: Increasing Competition

Issue: Despite boasting the biggest, and still growing, user base in social media, META’s Facebook and Instagram are starting to lose their share of screentime to competition like Google’s YouTube and ByteDance’s TikTok. META’s share of user screen time fell 1% y/y (2Q22: Facebook -3% y/y, Instagram +2% y/y; 1Q22: Facebook -5% y/y, Instagram +20% y/y) in the second quarter, while YouTube and TikTok’s grew by 11% y/y and 14% y/y, respectively.

META’s Response: The company has been aggressively marketing its version of short-form videos, Reels, on both Facebook and Instagram in an effort to drive user growth and maintain its leadership in social media. The new feature has also become a new ad distribution channel to further monetization of META’s massive user base.

META has also revamped its Facebook Feed with “Home.” Similar to Instagram’s “Discovery,” the Home feed will rely on algorithms to figure out users’ interests and preferences, and find and display new related content from outside the friends list. Meanwhile, Facebook users can still access friends-only content under the “Feeds” tab. Although sister-app Instagram has long offered a personalized content delivery approach through the Discovery tab, the feature is slowly spilling over to the home tab that was once exclusive to content from the friends list only – the only real difference nowadays between home and Discovery on Instagram is that one scrolls as a feed, while the other scrolls as a grid.

It appears that the combination of Reels, Home, Feed, and Discovery are all pointing to one thing – META’s aspiration to overcome competition in social media by being a copycat of its biggest threat, which is likely TikTok at the moment. Although the new features have been met with pushback from a meaningful portion of META’s user base, and raised questions on whether its social media platforms are losing their original identities to competition, the company has stood by its belief that social interactions are now transitioning from text and photos to video, and personalized content is the way to go.

Instagram Chief Adam Mosseri has recently taken to Twitter to express that the transition to video will be imminent, even if META does nothing about it and stays at status quo. He also reiterated that the vision for Instagram going forward is to make it “about photos [for those] who prefer photos, and about video for those who prefer that format.” However, his followers remained adamant that Instagram has not been adequately soliciting and taking into consideration feedback from its user base.

Meanwhile, CEO Mark Zuckerberg has expressed during the second quarter earnings call that the volume of AI-suggested content seen on Facebook and Instagram feeds today will soon double:

But this overall AI trend is much broader and covers all types of content, including text, images, links, group content and more. And building a recommendation system across all these types of content is something that we’re uniquely focused on. Right now, about 15% of content in a person’s Facebook feed and a little more than that of their Instagram feed is recommended by our AI, from people, groups, or accounts that you don’t follow. And we expect these numbers to more than double by the end of next year.

Source: META 2Q22 Earnings Call

The Offset: In a time where user growth is already showing deceleration and on the brink of a structural decline, forcing content that its most active users (including the tens of thousands who have taken the time to dialogue with Mosseri on Twitter earlier this week) do not favour may not be the smartest thing to do. But META’s hopes of leveraging past experience from its successful replication of Snapchat’s (SNAP) Stories to beat TikTok with Reels might be showing some positive progress here.

Although soon-to-step-down COO Sheryl Sandberg said Reels is a “harder business to monetize,” the feature did already achieve a $1 billion annual run-rate in ad revenues within two short years of its debut. That beats the monetization timeline of Stories, which took almost five years after its launch in 2017.

While the full ramp-up of monetization through Reels is still a few years out, the feature has already garnered rapid user attention. Reels currently accounts for a fifth of time spent on Instagram, with continued growth observed in related engagement – Reels currently make up more than 50% of reshared content on Instagram messages. The results continue to accentuate the increasing navigation of user communication preferences from text and images to short-form videos going forward, which is consistent with what Mosseri had shared on Twitter.

The difficulty now is for META to further simplify the creation of Reels ads for SMBs and advertisers, and improve scalability of the feature so take-rates can expand further. According to RBC’s recent recap on digital advertising, “creating effective campaign content for a vertical-scroll short-form video experience is hard,” and requires specific talent which will serve as a “bottleneck to any of the platform capturing those dollars as the test-and-learn period is months.” This is a big hurdle that even TikTok has not figured out the answer to yet, but it seems META is already on it:

We know we need to create the ad formats. We know we need to give them measurable tools, and we’ve gotten better at selling the next product, and I think we’ll continue to get better at that going forward. But as you do say, there are still some challenges. Video is harder than photos, than static photos.

Small businesses are better at static photos than they are at video. So this is a new format that we have to help them use. I think we have a number of tools that are working. We have a number of tools in development.

But the idea is to help businesses really easily create those Reels ads, really easily test them so they can iterate and keep improving as we do this. So I think it’s very promising but we’ve got some hard work ahead of us.

Source: META 2Q22 Earnings Call

The other challenge is to simultaneously manage the feature’s cannibalization of existing “higher monetizing surfaces” like images, feed and Stories:

One near-term challenge is the growth of short-form video. Reels doesn’t yet monetize at the same rate as Feed or Stories. So in the near term, the faster that Reels grows, the more revenue that actually displaces from higher monetizing surfaces.

Now in theory, we could mitigate the short-term headwind by pushing less hard on growing Reels, but that would be worse for our products and business longer term since we’re confident that Reels will grow engagement overall and quality and will eventually monetize closer to Feed. Our work on ads monetization efficiency for Reels is actually making faster progress than we’d expected. We’ve now crossed a $1 billion annual revenue run rate for Reels ads, and Reels also has a higher revenue run rate than Stories did at identical times post-launch. So the bottom line is I think we’re on track here and we just need to push through this one.

Source: META 2Q22 Earnings Call

While it is too soon to tell if META can overcome this hurdle, the company’s knack for curating industry-leading user experience for advertisers, and past success with monetizing Stories and Feed does provide some confidence that it will be able to safeguard some of its long-term market share within the increasingly competitive digital ads landscape, and ensure sustained demand.

Idio Ad Snag #3: Slowing Engagement

Issue: Increasing competition is not only eroding META’s share of screen time and exacerbating the fragility of its user base growth, but it is also risking a direct adverse impact on its ad engagement levels.

META’s Response: As discussed in earlier sections, META has been diligent in implementing mitigation strategies against Apple’s signal-loss headwinds. And the common thread across the new strategies rolled-out has been ensuring a positive user experience and value creation for advertisers, especially SMBs that make up a meaningful portion of its ad customer base. The company has also reduced the price of its Facebook ads by as much as 14% this year to attract better take-rates, a sweet incentive for advertisers, especially its core SMB client base, in the face of brewing macro uncertainties.

The Offset: The measures are driving a positive impact on META’s financial performance. The company’s ad revenue decline during the second quarter (-1%) has been significantly slower than the price drop for Facebook ads. This suggests take-rates have remained resilient, and corroborates Zuckerberg’s comments that “engagement trends on Facebook have generally been stronger than anticipated, and strong Reel growth is continuing to drive engagement across Facebook and Instagram.”

In addition to META’s speedy progression towards a $1 billion annual revenue run-rate for Reels, the tremendous growth seen in its adjacent conversion tools like click-to-message also supports its success in slowly rebuilding ad engagement on its platform:

Click-to-message is already a multibillion-dollar business for us and we continue to see strong double-digit year-over-year growth. These ads are proving particularly popular with SMBs in emerging markets like Brazil and Mexico, many of whom are new advertisers to Meta who come to us to advertise solely in this format.

Source: META 2Q22 Earnings Call

While META may not be at its prime right now, it does appear to be taking positive strides in the right direction and making gradual progress towards its long-term comeback plan.

Idio Ad Snag #4: Transition of Investments from Ads to Metaverse

Issue: META’s core advertising business remains its lifeline. But in times where this critical link is struggling, investors are becoming increasingly concerned if the company can find a balance between investments needed to sustain its advertising competitive advantage and investments needed to build-out its aspirations in transforming the internet through metaverse.

META’s Response: META has been diligently cutting back on expenses in recent months by shelving projects, slowing talent acquisition, and potentially reducing headcount across the company, including core engineering capacities, in order to optimize capital efficiency amid looming economic uncertainties. This corroborates its plans announced during the first quarter earnings call to reduce current year opex by as much as $3 billion.

The Offset: Yet, the company remains committed to bolstering its build-out of AI/ML capabilities, an area that we view as an effective “two birds with one stone” strategy for META’s overall business. The company has guided $30 billion to $34 billion in planned capex this year, with much of it allocated towards expanding its AI infrastructure.

For one, AI/ML capabilities will be a critical factor in revamping its flagship targeted advertising business. As mentioned in earlier sections, PETs will leverage AI/ML to enable greater effectiveness in targeted ads delivery for advertisers, without compromising user privacy.

And two, AI/ML will drive the “deeper social experiences” that META aims to create through the metaverse. Today, META’s “Horizon” social metaverse platform is already filled with avatars representing its user base. And AI/ML will play an increasingly substantial role in enabling this realistic social experience going forward. In addition to facilitating the avatars’ accurate depiction and imitation of real-life users in the metaverse, AI/ML capabilities will also enable the creation of digital supporting functions within the metaverse, ranging from AI-driven customer service avatars to industrial simulations. This will effectively bolster META’s competition for market share against peers like Nvidia (NVDA) and Microsoft (MSFT), which have already introduced similar offerings through the “Omniverse” and “Microsoft Teams”, respectively.

Final Thoughts

META is down, but not out. Although its core advertising business faces a double-whammy from a macro-driven slowdown and a slew of idiosyncratic risks, the company continues to make positive progress in ensuring a structural turnaround. And that already provides sufficient comfort that the stock makes an attractive risk-reward trade-off at current levels.

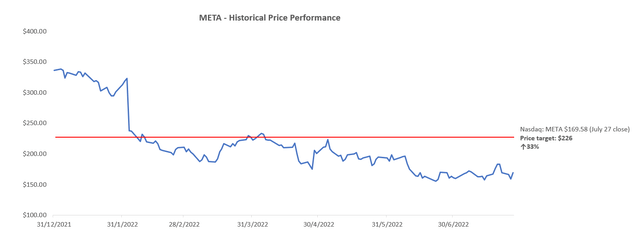

We are maintaining a $226 price target for META’s shares, which would represent upside potential of more than 40% based on the stock’s post-earnings price of $160 in late trading July 27th.

META Valuation Analysis (Author)

Meta_Platforms_-_Forecasted_Financial_Information.pdf

The valuation projection assumes a conservative perpetual growth rate of about 2%, which we believe to be attainable given the gradual, yet positive, progress made by META even under the tremendous headwinds it faces today. The assumption is also consistent with the long-term GDP expansion trajectory to reflect META’s growth-oriented corporate strategy. The company also commands a massive market share of the digital advertising market still, and maintains a strong balance sheet needed to fund the build-out of both new and existing growth drivers, underscoring a favorable outlook for maintaining sustained positive performance over the longer-term.

Be the first to comment