Kelly Sullivan/Getty Images Entertainment

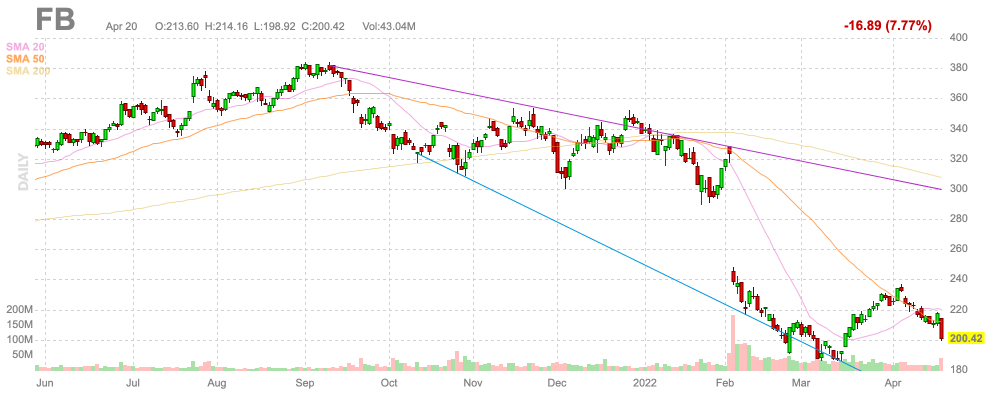

After a disastrous start to 2022, Meta Platforms (NASDAQ:FB) appears to have set a bottom with the steep plunge in early February leading to a low of $185 in March. The social media company remains in growth mode despite the obvious concerns about the advertising business model and COVID pull forwards in 2021. My investment thesis is vastly more Bullish on the stock trading near $200 with a lot of the expected near-term weakness built into the price.

Source: FinViz

User Blip

The Netflix (NFLX) user problem has cast a concern that other companies benefitting from COVID pull forwards will face a tough 2022 due to tough user comps. The streaming video service lost 200K users in Q1’22 and forecast another 2.0 million paid subscriber loss for the June quarter when the market was expecting the company to add over 5 million subs in the 1H of the year.

These weak numbers are impacting Meta by causing fears the company will face the same outcome after Q4’21 results showed weak user growth. In addition, the social media company is facing a far different challenge in the advertising market due to Apple (AAPL) privacy changes.

The big difference is that Netflix highlighted a 6.4% higher share of the US TV time during February 2022 in comparison to 6.0% in May 2021. The issue faced by Netflix is the lack of monetization of the extra screen time due to a lack of ads and password sharing leading to multiple users in multiple households sharing the same subscription.

Meta doesn’t face this same issue with Facebook and Instagram living off an advertising model where time spent on the platform is monetized whether users share an account or not.

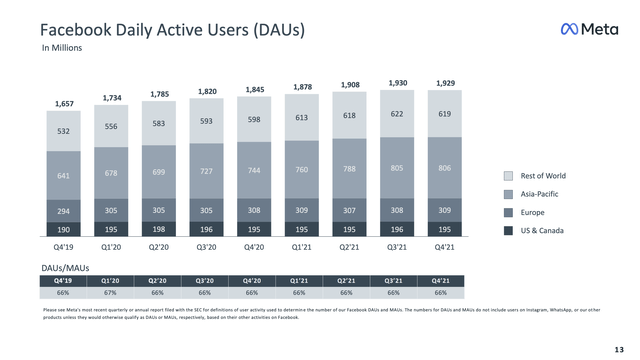

Facebook had already seen a slight sequential dip in DAUs (daily active users) to end 2021. The company still saw a surge in users since the start of COVID in 2020 with the user base growing 272 million in the 2-year period.

Source: Meta Platforms Q4’21 presentation

Though, the market is focused on the user dip in both the key US & Canada region where Facebook generates the vast majority of ad revenues and Rest of World where the majority of growth opportunities exist in places like India. In total, DAUs were 1,929 million in Q4’21, up a still solid 5% for the year.

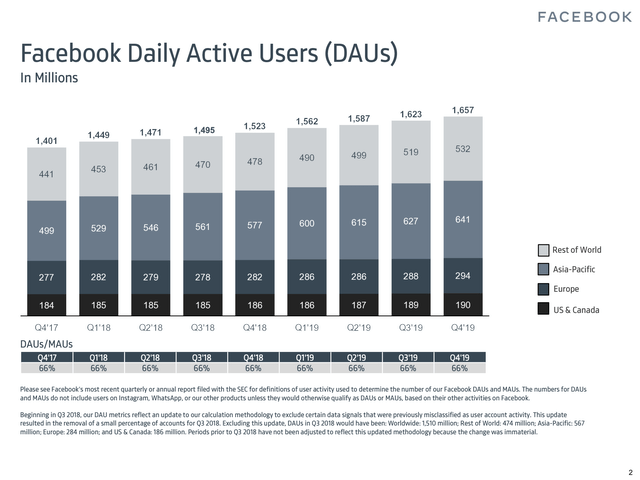

Going back to pre-COVID, Facebook grew DAUs by 134 million in 2019 and 122 million during 2018. Users grew by 188 million during 2020 and another 85 million in 2021 through Q3.

Source: Meta Platforms Q4’19 presentation

In total, the 273 million DAUs growth in the 2020-21 period exceeded the 256 million in the 2018-19 period even with the recent slowdown in Q4’21. One can easily see a COVID pull forward scenario, not a saturation problem. Users stuck at home during COVID lockdowns were just more active on social media causing a temporary blip in user growth.

Weak Expectations Built In

In the midst of the market concerns brought on by the Netflix results, Cleveland Research is throwing gasoline on the fire. The research firm suggest Meta has started off Q2’22 with weak advertising returns for ad agencies.

The company already guided to weak Q1’22 revenue growth targets of 3% to 11%. Analysts have slowly cut revenue growth targets for the quarter to only 8% with Q2’22 slowing further down to below 6%. The Cleveland Research data points sound shocking, but the general analyst consensus is for similar weakness in the current quarter.

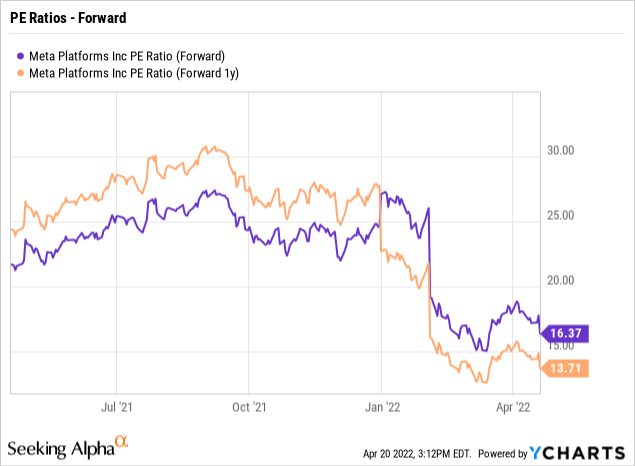

How the stock reacts to any further weakness will tell the story on whether Facebook will retest the March lows or plunge to new lows similar to Netflix. The stock trades at a minimal 2023 PE multiple below 14x current EPS targets of $14.64.

Meta previously traded at 25x to 30x forward multiples and the expectations have been cut in half. Remember, the social media company is investing substantially in the Metaverse leading to annualized loss rates reaching the $13 billion range, or the equivalent of a nearly $5 EPS cut on 2.8 billion shares outstanding.

If Meta cut the losses on the Metaverse to only $3 billion per year, the company would quickly add nearly $4 to current 2022 EPS targets of $12. Note, Alphabet (GOOG, GOOGL) famously loses ~$6.0 billion per year on Other Bets in a sign of how aggressively Meta is spending on the Metaverse. Alphabet is even aggressively investing in autonomous vehicles with a potential market size far exceeding any estimates for Metaverse in the next decade, yet Meta Platforms is already doubling the losses in the category.

The work on Horizon World is starting to take shape with monthly users reaching 300K by February. Meta isn’t even monetizing the platform to a great extent with a goal of building an advertising stream from usage along with charging for digital goods purchased on the platform.

Takeaway

The key investor takeaway is that Meta Platforms faces a tough quarterly report and guidance for the June quarter when the company reports Q1 results on April 27. How the stock reacts to possibly weak numbers is key on whether the stock is safe to purchase now. Meta Platforms is already set to retest the recent lows around $185 and the stock is cheap, but nothing prevents the stock from getting even cheaper.

Be the first to comment