Justin Sullivan/Getty Images News

A few days after the humbling Q4’21 earnings report, Meta Platforms (FB) shareholders need to re-evaluate the stock. The company has a much different view no longer being the dominant social media platform while investing in the metaverse at potentially reckless rates. My investment thesis remains Neutral on the stock following the massive dip after digging more into the forecasts for 2022.

Reckless Spending

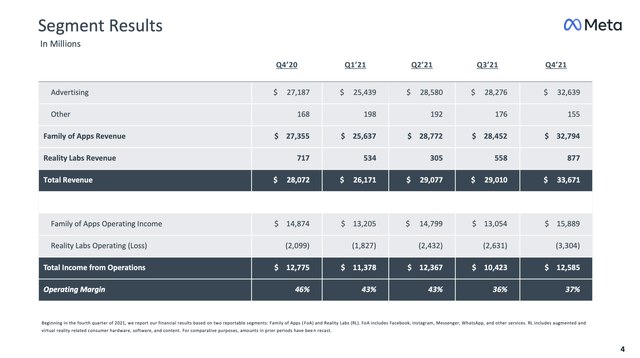

A big reason the stock collapsed following Q4’21 earnings is that the market was shocked by the size of the investments in Reality Labs and the direction of the losses. CEO Mark Zuckerberg had projected the company would lose $10 billion on the AR/VR division in 2021, but most investors weren’t prepared for the annualized loss rate to reach $13.2 billion. The Reality Labs loss surged nearly $700 million sequentially.

Source: Meta Platforms Q4’21 presentation

Meta Platforms only grew metaverse-related revenues by 22% in the quarter, but the company grew expenses by 48%. The market wasn’t prepared for this level of investing feeding into another big year of total expenses jumping up to $92.5 billion from $71.2 billion in 2021.

Again, the key to the weak revenue guidance is that it exposed this reckless spending on the metaverse. If Meta wasn’t seeing a $10 billion impact to advertising revenues in 2022 per CFO David Wehner on the Q4’21 earnings call, investors might not even notice the big losses on Reality Labs:

And we believe the impact of iOS overall as a headwind on our business in 2022 is on the order of $10 billion, so it’s a pretty significant headwind for our business.

Sometimes more detail actually harms a stock. Investors now have to consider that that $10 billion Reality Labs loss in 2021 and elevated loss in Q4’21 are expected to lead to another $10+ billion loss for Reality Labs in 2022. If the loss reaches $15 billion, Meta Platforms will have lost $25 billion investing in the metaverse over the two-year period. The company started 2021 losing $2.1 billion in Q1, so the total losses were already large heading into 2021 are probably set to top $30 billion by year-end.

On the Q4’21 earnings call, CFO David Wehner was clear the spending was only ramping up from here:

Though we do expect Reality Labs operating loss to increase meaningfully in ’22, and that’s incorporated into our outlook.

If the Reality Labs division can eventually generate nearly 50% operating margins like the Family of Apps segment, the company will need to produce over $60 billion in future revenue to just cover the losses to the end of 2022. At 25% operating margins normal for a startup, Meta will need $120 billion in future revenues to just break even on the division.

Incredibly, these estimates only factor in estimated losses through the end of 2022. Some estimates have Reality Labs generating losses for the rest of the decade. With the relative small size of the revenue base and the sizable losses combined with further increases in spending, one has to assume Meta Platforms is looking at sizable losses for years ahead.

Updated Forecasts

A few days after a quarterly report, investors always need to take a second look at any stock for updated analyst numbers. In the case of Meta Platforms, they cut revenues for Q1’22 along with the elevated spending vastly alters the EPS view going forward.

The social media giant came out with the following guidance:

Q1’22

- Revenues of $27 to $29 billion.

2022

- Total expenses of $90 – $95 billion, down from $91 to $97 billion.

- CapEx at $29 to $34 billion.

- Tax rate to match 2021 rate of 17%.

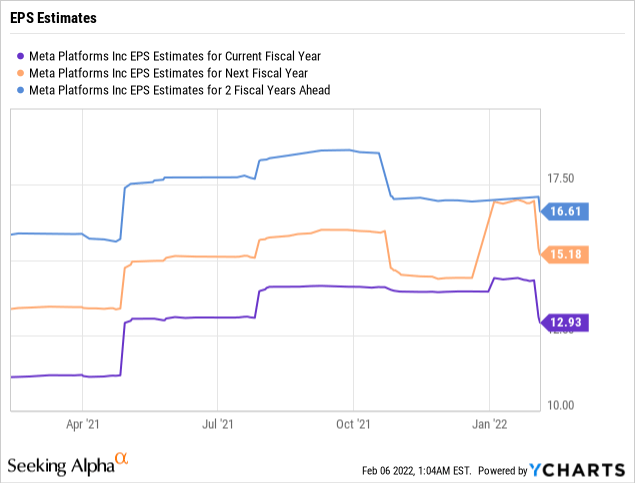

The Q1’22 guidance shocked the market with analysts expecting Meta to produce revenues of $30.3 billion. The big cut in revenue expectations combined with the hefty spending has analysts cutting 2022 EPS estimates to $12.93.

The numbers still appear extremely high with one analyst forecasting the company only earns $10.80 per share in 2022. Based on the management guidance on the earnings call, a reasonable 2022 EPS forecast is as follows:

- Revenue – $132.5B (12% growth)

- Costs – $92.5B

- Operating Income – $40.0B (30% margin)

- Taxes @ 17% – $6.8B

- Net Income – $33.2B

- EPS – $12.30

The EPS number assumes 2.7 billion shares outstanding, though this number is hard to predict with the company executing large share buybacks. The company has a net cash balance of $48 billion at the end of 2021 and will still generate large cash flows going forward, though a $10+ billion boost to capex spending in 2022 will cut into the free cash flows of $38.4 billion last year.

The revenue growth rate used was 12% which assumes Meta Platforms reaccelerates growth in the 2H of the year. The company continues to face strong headwinds with the iOS privacy changes not impacting the comparable 1H’21 numbers, making such a high growth rate a tough target.

Meta Platforms faces an increasingly challenged 1H’22. Analysts currently have the average EPS falling around 20% in both Q1 and Q2, making the annual numbers still far too high. The suggestion here is that EPS estimates will continue to fall over the next few months and quarters.

Takeaway

The key investor takeaway is that Meta Platforms still trades around 20x 2022 EPS targets. The stock isn’t nearly as cheap as thought by some due to the massive EPS cuts from prior expectations. As long as the company recklessly spends on the metaverse, the stock could struggle with margins pressured.

Investors should expect more pain ahead for Meta Platforms.

Be the first to comment