Justin Sullivan

Introduction

When the price of a stock is cheap, there are usually two possible explanations for the phenomenon. One, the market may be misunderstanding the company in question, causing the stock to plummet and be undervalued. Two, the company’s fundamentals are inherently changing.

For Meta Platforms, Inc. (NASDAQ:META), I believe the reasoning behind the stock’s plummet comes from the latter explanation. Meta is fundamentally changing. It is not the Facebook investors used to know. Thus, analyzing and creating financial modeling as such may create a false perception that Meta is undervalued today due to the market’s misunderstanding.

Instead, I believe investors should focus on the new trajectory of the company, the metaverse, and ask if the risk that follows this investment is worth it. Meta is investing and plans to continue investing tens of billions of dollars into its Reality Lab business to create a virtual world where Meta controls both the hardware and the software. While this plan may work in the long term, to date, the business is seeing no traction with further risks and uncertainty in the future; therefore, I believe Meta is a sell despite its low valuation.

Meta Is Not A Facebook

Numerous investors continue to see Meta as an extension of Facebook, saying that the change of tone in the macroeconomic environment will bring Meta back into its growth trajectory as a result of a strong social media business. However, I believe looking at Meta from Facebook’s lens can be misleading.

Before Facebook became Meta, the company’s primary focus was on its social media platform and its advertisement business. With a dominant market position, the company had strong growth and margins. Today, this relatively traditional business is permanently under pressure from Apple (AAPL) and TikTok. The company’s advertising business is in an inherently different environment than it was a few years ago.

After Apple’s implementation of privacy controls, it became harder for Meta to provide targeted ads, hurting both the top and bottom lines totaling by about $10 billion dollars a year. Unfortunately, Apple’s new privacy policy is not a one-year event. Apple will continue this policy and likely strengthen it going forward, providing a continued challenging environment for Meta.

Further, TikTok is surging in popularity in the younger populations around the world, eating away screen time from Meta’s family of apps. TikTok has already surpassed Twitter (TWTR) and Snapchat (SNAP) and is on track to tackling Meta with its surging popularity. Unless some significant event such as the total banning of TikTok occurs, a social trend will likely persist, especially as TikTok’s primary customers are young. Thus, even after the advertisement market comes back, Meta’s social media portfolio will likely not be able to perform the same way as it has before.

Meta’s lack of control over the hardware that its software performs upon has created an environment where Meta could not do anything about Apple’s new policies. Thus, to mitigate these risks in the future, Meta is going all-in on controlling both the hardware and the software in the metaverse. Meta has long changed its primary focus on the metaverse, and, given the current risks involving Apple and TikTok, I do not see Meta returning to its past glory even when the advertising market comes back.

The Reality of Reality Labs Business

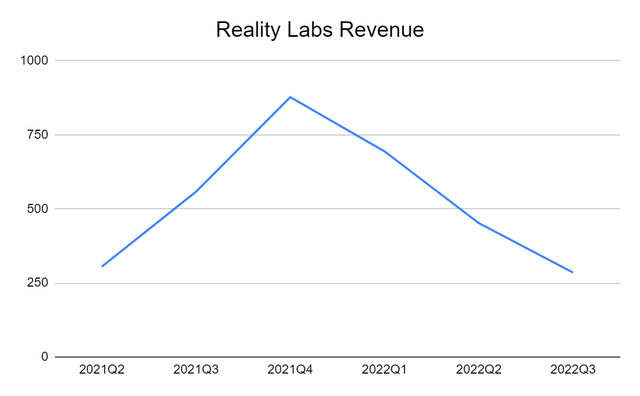

Meta’s Reality Labs business has seen no traction despite massive investments and losses, to date. The chart below is a revenue graph of Meta’s Reality Labs business since 2021Q2. In 2021, it seemed like the company’s vision was gaining traction; however, after consumers’ initial interest in the product, it quickly cooled, causing continued sequential revenue decline throughout 2022. In fact, in 2022Q3, the Reality Lab revenue was lower than in 2021Q3.

[Sources: 2021Q4, 2022Q2, 2022Q3.]

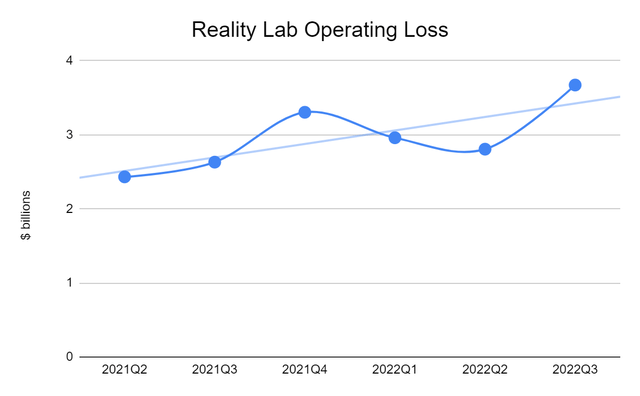

Further, the chart below shows the Reality Lab’s operating loss in billions of dollars since 2021Q2. It shows that the company’s losses have continued to increase even in times of revenue growth in 2021. Also, during the 2022Q3 earnings call, the management team signaled that the Reality Labs investment will further increase by saying that the company “expect[s] Reality Labs expenses [to] increase meaningfully again in 2023.”

[Source: 2021Q4, 2022Q2, 2022Q3.]

Meta is doubling down on its dream of making the metaverse a reality for everybody. The company is set on continuing its multi-billion dollar investment in the Reality Labs project despite the business seeing no real traction. Further, in times of a slowing advertisement market with inherent risk to Meta’s social media platforms, I believe investors should not sit and take the risks associated with Reality Labs.

Can Reality Labs Succeed…In time?

On top of the staggering and growing losses, I believe investors should also determine if Meta’s investment in the metaverse will eventually pay off in the future. While it may, I believe this future is full of uncertainties. Because, even if the future is the metaverse, I believe Meta might be too early in the game, similar to the dot.com bubble. The Internet was the future, but everyone was too early. We did not see search engines, online shopping, video streaming, and more until nearly 2010.

Similarly, with today’s technology, it is impossible to make the metaverse experience good enough for current consumers to switch to a new way of life. Socialization in the metaverse is nowhere close to being on par with the real world. Meta has just managed to put a facial expression feature on its newest Meta Quest Pro, but consumers still cannot smell, feel, or even interact with a real person by looking at each others’ faces in the video conferencing. Thus, for the technology to be ready for the mass public to live two lives, one in the metaverse and one in the real world, it will likely take years for the technology to develop, and even longer for the consumers to accept this new reality even if the vision Meta dreams is true. Meta may be too early into the game.

Risk to Thesis

Valuation

One of the biggest risks to the thesis is Meta’s low valuation. Meta is currently trading at about 10.5x forward price-to-earnings compared to its historical average of about 20-30. However, if the market comes back from the economic slowdown, Meta’s family of apps’ performance will likely rebound despite the permanent changes to the social media advertising market. Further, Meta’s Reality Labs investment is expected to slow down starting in 2024, reigning in on costs. Thus, given a more favorable macroeconomic setting, Meta’s valuation multiples may expand again.

Summary

Meta can seem as if the company is undervalued when comparing the company’s historical and current valuations; however, I believe the company is cheap for a reason. First, Meta’s social media business is operating in an inherently different environment with Apple’s new privacy rules and TikTok’s presence in the market. Second, Meta is investing tens of billions of dollars into the Reality Labs business in hopes of adapting the metaverse to the mass public.

To date, after accelerating losses, the company has not seen any sustainable traction in the market. The future of this business is uncertain, and even if the public is to eventually adapt to this new future, the process will likely take years if not a decade. Therefore, I believe Meta Platforms is a sell.

Be the first to comment