petekarici/iStock Unreleased via Getty Images

Investment thesis

Just Eat Takeaway’s (OTCPK:JTKWY) (OTCPK:TKAYF) Q1-3 FY12/2022 results highlighted a slowdown in customer activity with falling orders and cost inflation pressure. With cash burn and an indebted balance sheet, management is seeking liquidity with asset sales, demonstrating that the business model cannot sustainably generate shareholder value. We have a sell rating on the shares.

Quick primer

Just Eat Takeaway is an online food order and delivery service headquartered in Amsterdam, operating in 22 countries and serving 94 million customers. The company stems from a merger between Takeaway and Just Eat in January 2020, and the USD7.3 billion acquisition of GrubHub in June 2021. Its core geographic markets are North America, Northern Europe, and UK and Ireland.

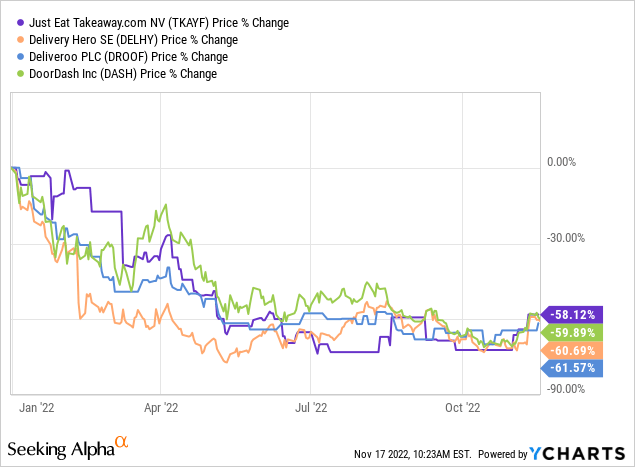

Key peers include Delivery Hero (OTCPK:DLVHF), Deliveroo (OTCPK:DROOF), DoorDash (DASH), and Uber Eats (UBER).

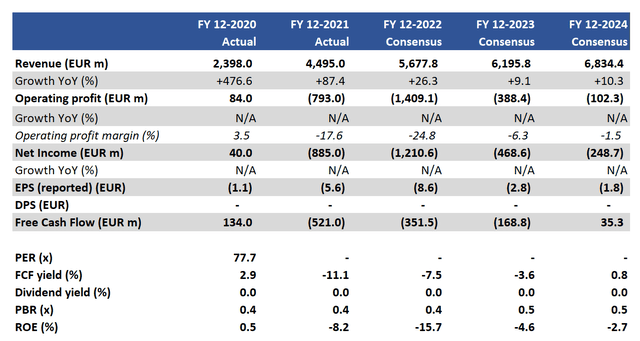

Key financials with consensus forecasts

Key financials with consensus forecasts (Company, Refinitiv)

Our objectives

Just Eat Takeaway’s shares have corrected 58% YTD, in line with its peer group as it experienced accelerating losses YoY and overspending on the Grubhub acquisition. After a cash burn profile in FY12/2021 and consensus expecting this situation to continue into FY12/2023, we want to assess whether there are any fundamental reasons to invest in the shares.

A return on investment?

The company’s Q3 FY12/2022 trading update highlights the company’s adjusted EBITDA becoming profitable ahead of schedule, after a period of significant investment in the business. This has resulted in the company updating its guidance for H2 FY12/2022 for a positive adjusted EBITDA, compared to the previous guidance range of minus 0.5% to minus 0.7% of the gross transaction value. A positive margin is better than a negative one, but in the overall scheme of things relays very little good news considering its non-GAAP adjusted status. Underlying trends are negative, with Q3 orders down 11% YoY, and gross transaction value down 5% YoY under constant currencies – geographically only Northern Europe saw growth, with the key North American market experiencing an 8% decline YoY, and UK and Ireland falling by 5%.

H1 FY12/2022 demonstrated pressures over cost inflation, with operating costs visibly increasing YoY in courier costs (+32%), staff costs (+86%), and other operating expenses (+53% YoY). Although YoY comparisons are distorted by the GrubHub acquisition, it nevertheless highlights that increased sales volume is not resulting in generating positive returns. We expect trading conditions to deteriorate into H2 FY12/2022 with the cost-of-living crisis having a major impact on the UK economy, as well as Southern Europe.

Management is now guiding a slowdown in gross transaction value to low-single-digit growth YoY. This deterioration in fundamentals is a concern for the company’s creditworthiness, and asset sale activities highlight this issue. The balance sheet looks fairly solid with a debt-to-equity ratio of 0.2x in FY12/2021. However, a closer look shows that over 50% of equity is comprised of intangible assets from Grubhub which have questionable value – this was already written down from EUR8.3 billion to EUR5.5 billion in H1 FY12/2022 – clearly the acquisition was overvalued. The sale of iFood to raise EUR1.8 billion cash shows the company’s underlying weakness, and continued exploration over a partial or full sale of Grubhub will be a double-edged sword as further intangible writedowns will be crystallized, reducing equity further.

It would appear that positive free cash flow generation in FY12/2020 was a one-off. Accounting profit is fiction, but cash is cash, and no amount of restating the numbers will hide the fact that the company remains in a very poor state.

A decelerating growth profile

Management talks about being well-capitalized and positioned to capture profitable future growth. Consensus does not appear to share this view, estimating a decelerating sales growth profile (which will be exacerbated by any asset sale to maintain liquidity), and continued operating losses for the next two financial years. Positive free cash flow is estimated in FY12/2024, but hardly making a notable difference to the debt pile.

The EUR2.1 billion bonds currently outstanding will have their first maturity in 2024 of EUR250 million, followed by EUR600 million in 2025. These could be covered by the iFood disposal which is preferable to refinancing as borrowing costs have increased. However, debt servicing will have to be balanced by the company’s cash burn status – and with the company’s poor track record we do expect to see minimal cash generation for the medium term.

To focus on survival, we believe the company will start to pull out of markets – this has already commenced with discontinued operations in Norway, Portugal, and Romania. We expect to see more exits in Southern European markets, and continued loss of market share in key markets such as the UK where ‘super-apps’ such as Uber continue to make headway.

If a cash burn profile persists, the company will face questions over going concern, as many of its partner restaurants face difficulties – a recent survey found that more than a third of UK hospitality businesses, including pubs, restaurants, and hotels, could go bust by early next year.

Valuation

With no earnings, no free cash flow, and no dividends, the shares are not undervalued. PBR of 0.4x appears to show deep value, but we have noted that equity is at risk due to the future write-down of Grubhub’s intangible assets.

Risks

Upside risk comes from the disposal of Grubhub raising ample cash to provide a sufficient runway to rebuild the business. The company could potentially put itself up for sale if business conditions worsen.

Downside risk comes from a significant deterioration in trading conditions in the UK, Southern Europe, and parts of North America, resulting in falling gross transaction value and commissions. An inflationary increase in operating expenses will push down profitability or result in sustained losses and cash burn.

Conclusion

Just Eat Takeaway operates a low-return business, with scale as the only way to gain a competitive advantage. Acquiring scale with Grubhub has been too costly, the business environment is set to worsen from both a demand and cost perspective and the company is in retreat to access liquidity. We rate the shares as a sell.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment