Justin Sullivan

Description

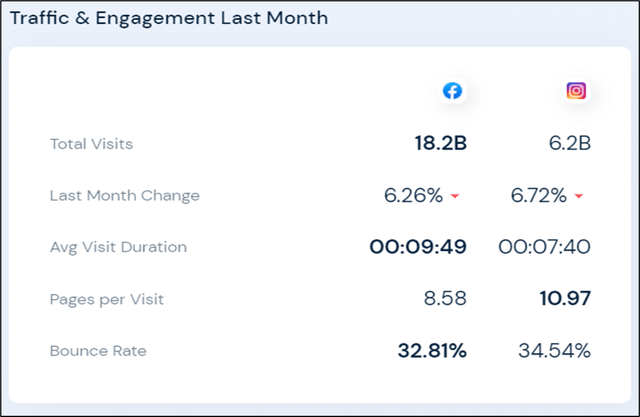

Meta Platforms, Inc. (NASDAQ: NASDAQ:META) (“the company”) is a well-known company, that doesn’t need much introduction, which makes the majority (~ 97.5%) of its revenues from advertising through the monetization of its base of 2.88B users in its family of apps: Facebook, Messenger, Instagram, and WhatsApp. A minority of its revenue (~ 2.5%) comes from the Reality Labs segment, which provides augmented and virtual reality-related products.

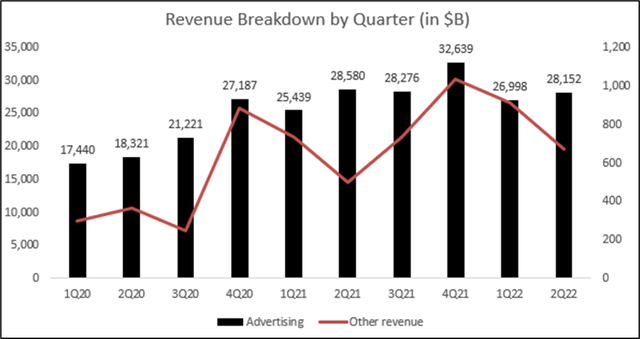

The two segments are represented in the chart below.

Advertising – Market Outlook

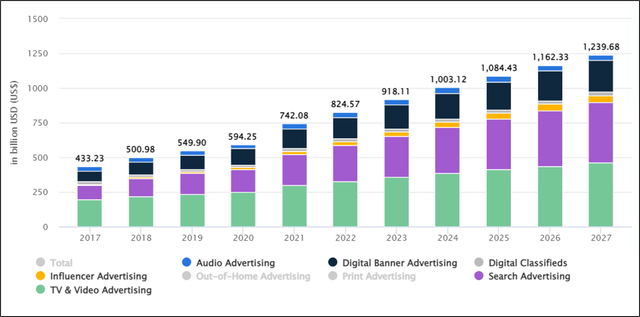

According to Statista’s estimates, ad spending grew at a CAGR of 14.4% over the 2017-2021 period, while in the same time frame the company’s ad revenue grew at a CAGR of 30.2% (2.10x the market’s CAGR).

Going forward, ad spending is expected to grow at a CAGR of 13.5% over the 2022-2024 period, which I believe is quite optimistic, and I expect such CAGR to be within a single digit. The reason for such low expectations is driven purely by the part of the business cycle we are currently navigating (recession), which is likely to put pressure on advertising spending justified by consumers being squeezed, and hence likely to cut their spending on non-essential expenditures.

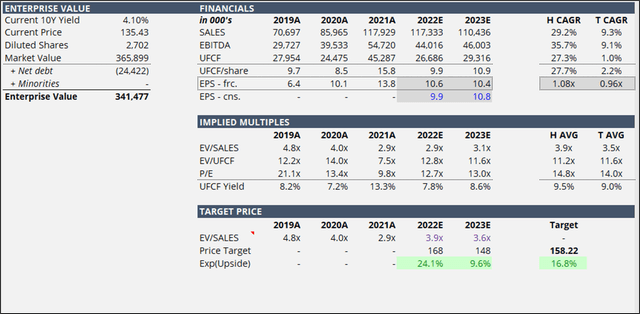

Company Valuation

Competition

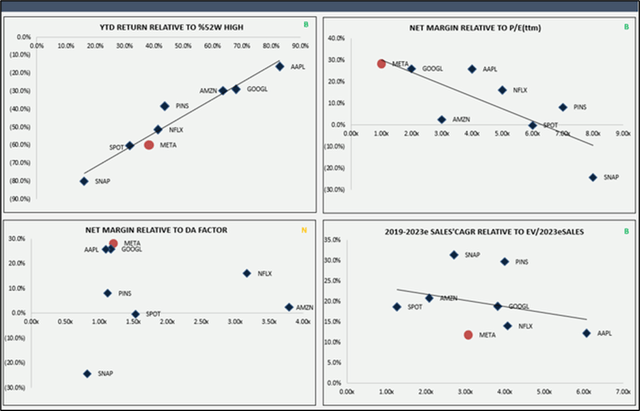

The competition is represented by established and well-known companies. In particular, Alphabet (GOOG, GOOGL), Amazon (AMZN), Apple (AAPL), Pinterest (PINS), Snapchat (SNAP), Spotify (SPOT), and Netflix (NFLX).

The reason I decided to include Netflix is due to the introduction of its new business model, which is expected to be rolled out by the end of the year. This is very important, because Netflix’s new ad-based plan means that a new player joins the market, a market that is more and more shifting to video advertising. In fact, during its 1Q22 Earnings Call, the company said that:

Video overall makes up 50% of the time that people spend on Facebook

Valuation

The company is trading at an EV/SALES of ~ 2.84 TTM, which represents a significant discount relative to the peer’s median EV/SALES of ~ 3.70x TTM.

The reason for such a discount is driven by the deterioration of its business fundamentals with a bit of overreaction on top. Starting with the revenue from advertising, in 1Q22, we saw first a single-digit growth (+6.1% YoY), and, a -1.5% YoY in 2Q22. Since the advertising revenue is nothing more than a volume metric (i.e., DAP or Daily Active People) for a price metric (i.e., ad revenue per DAP), in 2Q22 we observed a volume of 2.88B users (+4.3% YoY) and a price of $9.78 ad-revenue per user (-5.6% YoY).

Both 1Q22 and 2Q22 presented us with a company with deteriorating fundamentals, in fact not only the top line was hit, but also the bottom line with the net margin being down 35.7% (or 23.2% vs 25.7% in 1Q21).

The above outcome was a result of different headwinds that the company is facing (i.e., investments risks), among others:

1. Growing competition (especially from TikTok, but not only, i.e., Reddit)

2. Softness in e-commerce after the pandemic peak

3. Reduction in advertising demand

4. Apple’s iOs changes

5. The war in Ukraine, which led to a loss of users and the subsequent revenue loss in Russia and Ukraine

6. Reels usage increase, whose success is a headwind for the overall business because its monetization is less than feed or Stories. As mentioned during the 2Q22 Earnings Call (emphasis added):

Mark mentioned that we are really excited that the run rate on Reels crossed $1 billion, but it is overall because engagement is shifting to Reels. It is an overall headwind on the business. We haven’t specifically quantified that, but there is a headwind on the business as Reels grows.

In the long run we, of course, believe that this will be a tailwind on revenue but that’s not happening in 2022

Going into the 3Q22 (release expected Wednesday 10/26 after market close), even if we expect volume & price to be slightly down, I also expect a top-line number to be at $28.3B (-2.51% YoY), which is above the market’s consensus of $27.40B. I believe that analysts after 2Q22 become overly pessimistic, a pessimism that can be justified only in part. Hence, I am calling for a back-to-reality with the 3Q22 results and a beat on the top line and bottom line results.

As for the outlook for the 4Q22, I expect it to be in the range of $30.0-$32.5B and I expect, given the current market, to be at $32.3B (-4.01% YoY).

I see more pain ahead starting in 1Q23, as the majority of companies will implement a cut on advertising spending, will seek cheaper forms of advertising, or will look to start to diversify the tools at their disposal.

Having said that, I expect convergence to the median EV/SALES of ~ 3.70x driven by a multiple expansion (i.e., “back to reality”) and earnings better than expected (i.e., above consensus top-line and bottom line).

Final Remarks

I rate shares as a BUY with a fair value of $158.22/share, which implies an expected upside of 16.8% vs. the current price of $135.43.

I believe that the company is undervalued and is well-positioned to do well in a recessionary environment thanks to its strong free cash flow. Moreover, well aware of the current macro-environment, the company started to take all the necessary actions to protect its margins (e.g., headcount cut, budgets slash).

What am I doing personally? Well, I have been short since 2Q22, but now, I have inverted my short into a long position even if it is a small stake as a percentage of the overall portfolio. Finally, I am looking for a small speculative bet through options, in particular a vertical spread with the 10/28 expiration.

Be the first to comment