zorazhuang

Thesis In A Nutshell

Baidu stock (BIDU) is down approximately 55.5% from All-Time-Highs. Is now the time to buy? Reflecting on decade-low valuations, more policy support from the CCP and the exposure to a potential reboot of the Chinese economy, I strongly believe so.

In my opinion, Baidu is the company with the highest business potential in Asia. Baidu is a leading tech/internet company in China with a diversified portfolio of competitive businesses. The company’s search engine and mobile ecosystem generates solid free cash-flow, while cloud (1), smart devices (2) and intelligent driving (3) continue to deliver impressive growth and moon-shot potential.

I value Baidu stock based on a residual earnings framework, anchored on analyst EPS consensus estimates, and see more than 60% upside. My target price is $237.80/share.

Company Overview

Baidu is a leading internet and technology company based in Peking, China. The company was founded in 2000 by Robin Li, who still leads the company as CEO. Notably, Baidu operates China’s largest and the world’s second largest search engine. Therefore, Baidu is frequently introduced as ‘the Google of China’. Similar to Google, Baidu has leveraged the technological expertise of its search engine into multiple businesses related to Artificial Intelligence such as autonomous driving, natural language processing, computer vision, augmented reality and smart devices. Baidu was listed on the NASDAQ stock exchange on August 2005 (ticker: BIDU) and has been dual-listed on the Hong Kong Stock Exchange since March 2021 (ticker: 9888).

Baidu’s Business Segments

Baidu is structured into two primary business segments: (1) Baidu Core and (2) iQiyi, which is a leading entertainment platform in China. Baidu acquired a 56.2% stake in iQiyi in 2013 for $350 million. As of Q1 2022, Baidu Core accounts for approximately 70% of Baidu’s revenue and comprises three main business clusters: Mobile Ecosystem (1), AI Cloud (2), and Intelligent Driving & Other Growth Initiatives (3).

Mobile Ecosystem: is a portfolio of various IT-applications with 622 million monthly active users as of Q1 2022. The ecosystem builds around the value proposition to connect people, share information and discover knowledge. The collection of apps includes, amongst others, the flagship app Baidu Core, Baidu Wiki, Baidu Scholar, Baidu Post, Baidu Maps, Haokan Video. The company monetizes the mobile ecosystem business segment primary through online marketing services.

AI Cloud: incorporates the full value chain of cloud infrastructure, services and solutions—including PaaS, SaaS and IaaS.

Intelligent Driving: Intelligent driving includes the development and commercialization of self-driving services such as intelligent vehicles and robo-taxi fleets. Notably, Baidu’s vehicle arm Jidu was the first AI company to achieve level 4 autonomous driving capabilities, which means that cars could potentially handle all aspects of driving without human intervention.

Other Growth Initiatives are:

- Xiaodu: smart devices, for example speakers displays, powered by DuerOS smart assistant.

- Kunlun: AI smart-chips that can be used in cloud and transportation sectors. The chips are optimized for AI areas such as intelligent driving, voice, natural language processing, and images.

- Other early-stage AI initiatives.

Notable Business Developments

Mobile Ecosystem: Baidu’s advertising business remained relatively resilient in 2021 amidst macroeconomic headwinds growing 12% yoy. In addition, Baidu app MAU grew +14%, reaching 622 million users. Although Baidu’s advertising business is the company’s largest revenue and profit driver as of Q1 2022, both management and analysts from leading investment banks expect that non-advertising revenue will overtake revenue from advertising by 2024.

Autonomous driving: Apollo Go, which is Baidu’s robo-taxi service, has begun to charge fees and expanded into Chongqing, Shenzhen and Yangquan. The ride-hailing services are currently available in eight cities, including Beijing, Shanghai, Guangzhou, Shenzhen, Chongqing, Changsha, Cangzhou and Yangquan. In the Q4 2021, rides provided by Apollo Go almost doubled compared to Q3 2021, reaching approximately 213.000. In addition, Baidu received a nomination letter from China’s leading car manufacturer BYD, who intends to use Apollo’s autonomous driving technology for its cars. Baidu management estimates that the partnership will bring approximately $1.5 billion – $2 billion of revenue, recognized over a five-year period. Baidu also holds a nomination letter from Dongfeng Motors.

Jidu, which is an electric vehicle brand established in partnership with Zhejiang Geely Holding Group, completed Serie A financing, raising $400 million in equity funding. The joint venture’s first concept car has been announced on June 8th. Here is the link. Jidu plans to accept pre-orders in summer 2022 and commence mass production in early 2023.

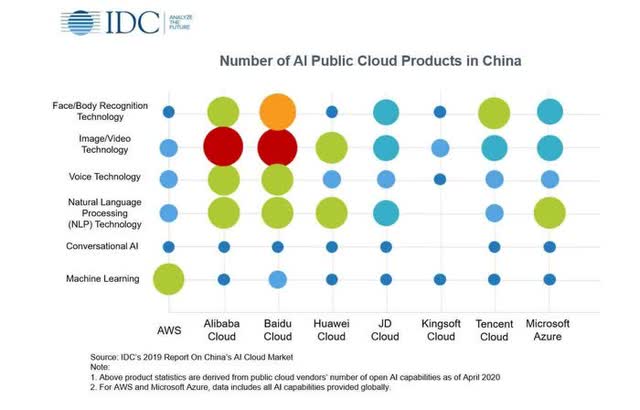

Cloud: Baidu’s cloud initiatives deliver impressive growth: In 2021, revenue from cloud grew 60% yoy. Notably, Q1 2021 was the 5th consecutive quarter with cloud revenues growing above 50%. According to the IDC report on China’s public cloud market, Baidu was ranked as the No.1 AI cloud provider in terms of service quality and technological capability.

Other:

- Xiaodu ranked No.1 in smart display shipments globally, according to Strategy Analytics, IDC and Canalys.

- Baidu has begun mass-producing its second generation of Kunlun II artificial intelligence chips, which are expected to further accelerate the company’s ambitions for cloud and intelligent driving.

- In early 2022, Baidu unveiled its metaverse project, XiRang. Described as a virtual world, users can explore a VR environment and engage with other users. For now, the application may support up to 100,000 users interacting in real-time.

- PaddlePaddle, Baidu’s open-source deep learning framework, has grown to become the second largest developer community worldwide (Google is first).

Baidu’s Enormous Opportunity

China’s internet sector is at the forefront of technological innovation, highly dynamic and fast-growing. According to Statista.com, China has over one billion active internet users, implying a penetration rate of 73 percent. After years of super-charged growth, the sector is slowly reaching maturity. Thus, China’s internet giants, notably the BATJN companies (Baidu, Alibaba, Tencent, JD and NetEase), will increasingly need to compete against each other in order to find business growth. Moreover, while the internet sector in China has enjoyed an environment of almost no regulatory discipline in the past, the Chinese Communist Party is now beginning to structure strict regulation in three main categories: antitrust, data-security and gaming/live-streaming. Going forward, profitable and rapidly expanding internet companies must align their business with broader national strategic objectives and public interest. However, in China’s 14th Five Year Plan, a development blueprint that runs from 2021 to 2025, Beijing has clearly highlighted that digitalization and AI remain one of China’s core priorities, which should imply a considerable tailwind for Baidu’s new business initiatives. McKinsey estimates that China’s internet sector will grow approximately 8% annually until 2025 – significantly higher than global GDP growth which is estimated at ≈3.28%. Competitive drivers

Mobile Ecosystem: Baidu’s core business—the search engine and mobile ecosystem—has arguably reached full penetration in China. And with 97% market share, Baidu has claimed the cake. The company’s platform is well established as China’s leading address for search queries and information discovery. Thus, Baidu’s search business features a highly competitive moat, as economies of scale and network effect make it almost impossible for competitors to take market share (Reference: Google vs Bing). I argue that Baidu’s legacy business is a source of supreme competitive strength for the company based on three core arguments: firstly, the AI-capabilities required to build search algorithms can be leveraged into multiple related AI businesses; secondly, the search business fosters brand recognition and trust; thirdly, the search business generates stable cash flows that can be directed to compete in new business ventures.

However, while Baidu may not see direct competition in ‘search’, the company will likely see increasing competition from social media solution, e-commerce and short-video platforms. Baidu has invested efforts to build its own content ecosystem to help fortify its competitive moat and retain users.

Cloud Baidu’s cloud business is a true bright spot for the company. The market grows rapidly and Baidu enjoys a leading edge in terms of technological capabilities. According to Bloomberg’s Intelligence Primer, Baidu currently has the leading position in four of six cloud sub-segments: Machine Learning (1), Face-Body recognition (2), Voice Technology (3) and Video/Image Technology (4).

Although Baidu has only approximately 9% market share as of 2022 [Alibaba (37% market share), Huawei (18% market share) and Tencent (16% market share)], the company has a strong track record of gaining market share thanks to the technological edge of Baidu’s cloud applications. Moreover, Baidu has established an early leadership in China’s public cloud market through the expansion of its leading application programming interfaces for artificial intelligence (AI). China’s cloud market is forecast to grow at a CAGR of >30% until 2025, reaching a market size of 87 billion yuan. While China’s tech/internet giants have experienced multiple headwinds from the regulatory crackdown in 2021, the could market is an industry enjoying governmental support. Going forward, strong tailwinds of digital transformation demand from enterprises and government will continue to benefit Baidu’s cloud initiatives.

Autonomous Driving This is another business segment where Baidu can leverage its competitive strength relating to Artificial Intelligence. Baidu has started investing in autonomous driving as early as 2012 and has been one of the first companies to achieve Lvl 4 autopilot capability. As of early 2022, Apollo’s Lvl 4 autonomous vehicles have driven over 25 million kms.

Moreover, Baidu’s commercialization of its autonomous vehicle platform Apollo may enjoy easier adoption as compared to competitors, since self-driving systems are powered by high-definition maps—a discipline where Baidu has established an early advantage with Baidu Maps. Finally, trust plays a significant role for the adoption of autonomous driving. Baidu’s strength of brand will contribute significantly to drive user acceptance, in my opinion.

Financials

Given Baidu’s enormous potential, investors might expect that the company is valued at start-up multiples of > x50. But no, Baidu is currently trading at an EV/EBITDA of below x10!

Baidu’s financials imply deep value. The growth initiatives are thus given to investors for free. In 2021, Baidu generated about $12.7 billion of revenues and about $1.68 billion of operating income. The net-income becomes truly if investors consider that in 2021 Baidu has expensed more than $3.8 billion of R&D investments.

Even more astonishing, as of Q1 2022, Baidu holds more than 28 billion of cash on the balance sheet, which is about 50% of the company’s market capitalization. Cash provided from operations for the past 12 month was about $2.8 billion.

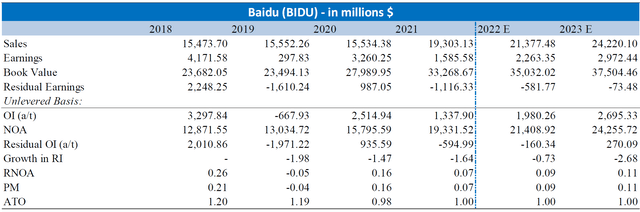

Analyst Consensus Estimates and Baidu Financial Statements

Residual Earnings Valuation

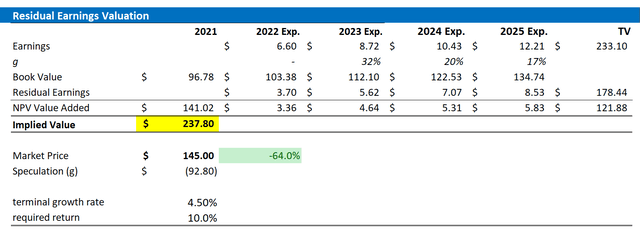

Let us now look at the valuation. What could be a fair per-share value for the company’s stock? To answer the question, I have constructed a Residual Earnings framework and anchor on the following assumptions:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise.

- To estimate the cost of capital, I use the WACC framework. I model a three-year regression against the S&P 500 to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of July 22nd, 2022. My calculation indicates a fair WACC of about 10%.

- To derive Baidu’s tax rate, I extrapolate the 3-year average effective tax-rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply expected nominal GDP growth plus one percentage point to reflect a favorable growth outlook for Baidu’s high-potential initiatives

- I do not model any share buyback further supporting a conservative valuation.

Based on the above assumptions, my calculation returns a base-case target price for Baidu of $237.80/share, implying material upside of more than 60%.

Analyst Consensus; Author’s Calculation

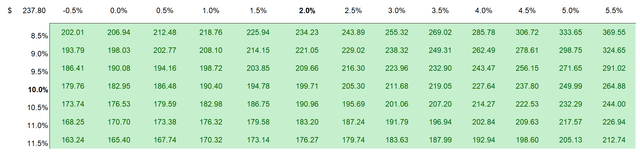

I understand that investors might have different assumptions with regards to Baidu’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation. Notably, all tested combinations imply an undervaluation!

Analyst Consensus; Author’s Calculation

Investment Risks

Investors should be aware of the following downside risks that might cause Baidu stock to materially deviate from my base-case target price of $237.80/share: First, the economy in China is currently pressured by multiple headwinds including inflation, real-estate crisis and COVID-19 lockdowns. If the Chinese economy would slow more than what is expected and priced in, investors should adjust expectations for Baidu’s short/mid-term business monetization accordingly. Secondly, China’s internet/tech companies are strongly exposed to regulatory risk. While the worst seems to be behind us, the elevated risk exposure persists. Third, much of Baidu’s share price volatility is currently driven by investor sentiment towards Chinese ADRs and risk assets. Thus, Baidu stock price might show strong price volatility even though the company’s business fundamentals remain unchanged.

Conclusion

Although BIDU delivered a strong, above consensus Q1 2022, I advise to keep focused on the long-term potential. This is a company with truly secular growth potential with leading exposure to artificial intelligence, cloud, and intelligent transportation. That said, Baidu is currently ranked as the 34th highest valued company in China. I believe Baidu will grow to claim the #1 spot by 2030. Strong Buy.

Be the first to comment