Justin Sullivan

It’s been just over a year since Meta Platforms Inc (NASDAQ:META) officially changed its name from ‘Facebook’, signaling an ambitious strategy to focus on opportunities in the virtual economy beyond social media. Thus far, the decision has been widely seen as a disaster coinciding with what was likely peak exuberance in the segments of new technologies like ‘Web3’. The surge of spending toward R&D has hit earnings with little progress in driving new growth while shares of META are down more than -65% in 2022.

The other dynamic at play considers the emergence of rival “TikTok” which has captured a climbing share of video content representing intense competition to Facebook and Instagram. The Chinese app has been a sensation with key demographics translating into impressive user growth worldwide. That said, investors need to be closely following the headlines on what are growing calls to outright ban TikTok in the U.S. and other countries on the grounds of security and data privacy issues.

Recognizing the still remote possibility the app actually gets pulled from the U.S., in what would be a historically unprecedented step facing backlash, Meta Platforms likely stands to be a major winner from such a scenario. In this regard, we would expect a boom in Meta user metrics and sales as content creators and advertisers migrate their time and spending. In our view, any outlook for Meta needs to incorporate this very bullish case which would be a game-changer in terms of both near and long-term earnings potential. We believe META is undervalued and has an upside from current levels.

The movement to ban TikTok

TikTok has been in the crosshairs of regulators considering its Chinese control and the evolving impact of social media. While it may be controversial for some to believe that “TikTok is dangerous”, that’s exactly what lawmakers are explaining. The fear is that the Chinese government is data-mining the app to spy on Americans and using content algorithms to influence opinion.

Heads of the Central Intelligence Agency and the FBI are both on record stating TikTok is a genuine concern for national security. Some of the quotes are alarming including the description by U.S. representative Mike Gallagher:

TikTok is digital fentanyl that’s addicting Americans, collecting troves of their data, and censoring their news. It’s also an increasingly powerful media company that’s owned by ByteDance, which ultimately reports to the Chinese Communist Party

The latest development is a bipartisan bill named the “Anti-Social CPP Act” moving through congress calling for a national ban that appears to have some bipartisan support. Seven states have already expelled the platform from being used on government-owned devices and computer networks with a sense that the movement now has traction in a delicate geopolitical climate.

TikTok rivaling Meta

As it relates to Meta, while the company hasn’t officially taken a position on TikTok’s future, it’s fair to say insiders have their fingers crossed the ban goes through. It’s not an exaggeration to claim TikTok has been eating Meta’s lunch, in part related to its early success in short-form video, with Meta still attempting to play catchup.

Depending on your definition, TikTok has become the most popular social media platform in the U.S. in terms of new app downloads this year, at 53 million compared to 38 million for Instagram, and 25 million for Facebook. The trend is also similar worldwide.

source: apptopia

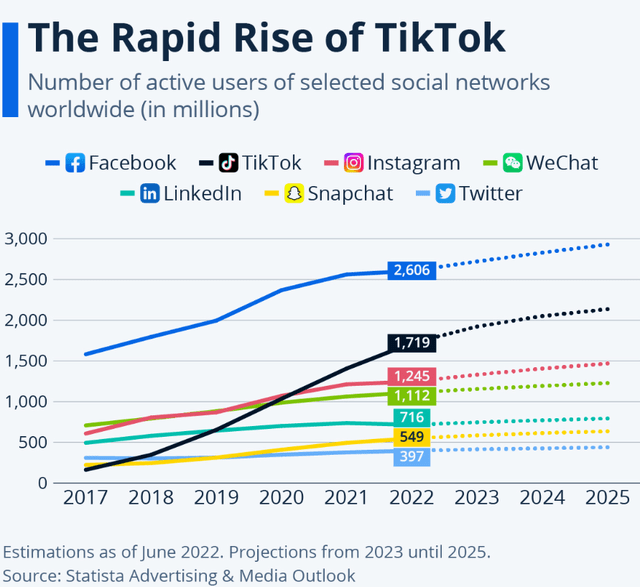

Technically, Facebook is still the largest social media site in the world with over 2.6 billion active users, but the data suggests TikTok is growing faster with 1.7 billion users, already surpassing Instagram in 2020. More importantly, TikTok has a grip on younger users including children which has particularly come at the expense of other social media players like “Snapchat” from Snap Inc (SNAP) where its growth has stagnated recently.

source: Statista

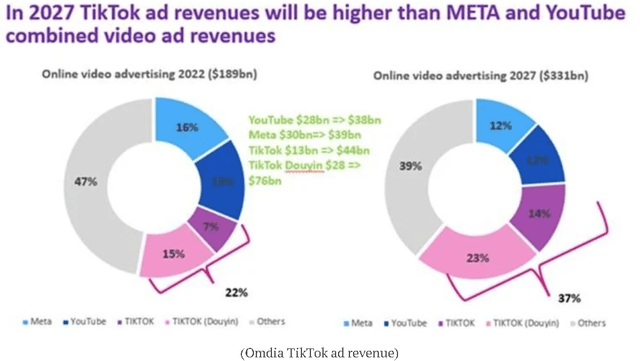

The chart that really stands out to us is the market share of video advertising where TikTok is forecast to overtake META and “YouTube” from Alphabet Inc (GOOGL)(GOOG) combined over the next five years. The context here is the current market is valued at approximately $189 billion, expected to expand by an average of 15% annually to $331 billion through 2027.

According to research from Omdia Media Group, the outside-of-China arm of TikTok currently holds a 7% market share of online video advertising compared to 16% from META. This is expected to reverse by 2027 with TikTok at 14% while META narrows to 12%. Together with TikTok’s “Douyin” operation in China, the entire group is estimated to control 37% of the market worldwide from 22% currently.

source: Omdia Media

The trajectory of TikTok’s growth or the potential for a ban has significant implications to Meta as both companies are essentially sharing the video content market now. Keep in mind that video is just one segment of Meta’s business which also counts on non-video advertising and other monetizable products.

The way it could play out is that if advertisers are forced to abandon TikTok, that ad spending would likely be spread across all other social media platforms over time. We estimate Meta could conservatively capture one-third of that shift in the immediate aftermath.

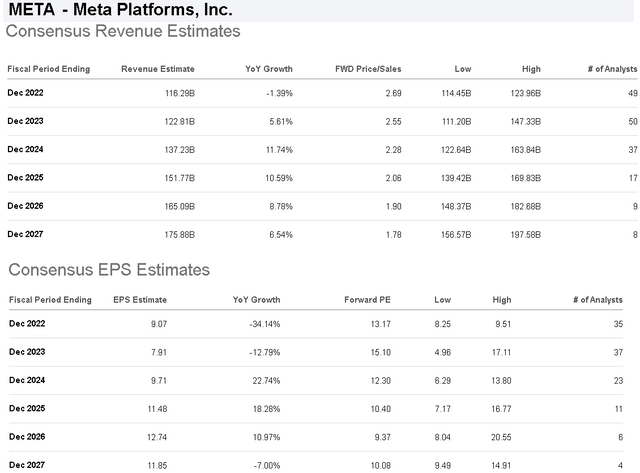

From a forecasted $116 billion total revenue for Meta Platforms this year, the market consensus sees the top line climbing toward $176 billion by 2027. Playing around with the numbers, if we assume that TikTok is completely banned in the U.S., the setup could add upwards of $5.0 billion in annual revenue or 4% to the top-line growth on the 2023 forecast. There is also a sense that other countries across Europe and Latin America would also follow suit, allowing Meta to consolidate dominance in the short-form video category.

Over the next five years based on the implied market growth, Meta Platforms stands to capture between $35 billion to $45 billion in incremental sales from the video ad market assuming a TikTok exit. Playing around with the numbers, assuming a flat operating leverage and constant net income margin from recent trends, Meta Platforms could see a $15.0 billion windfall or approximately $6.00 to incremental EPS through 2027 by our calculation.

Again, there are many uncertainties here, but the takeaway is that the effective collapse in a company’s largest competitor will almost always be positive for business. We can connect the dots and find other externalities where the boost to user engagement on Instagram and Facebook would add to the momentum in other monetizable products beyond video. Whether or not banning TikTok is right or wrong, it’s hard to see Meta Platforms investors objecting.

Seeking Alpha

What’s next for Meta?

We’ve already seen the trading action in META respond favorably to the ban-TikTok headlines, and we expect any further progress in moving the legislation forward to be reflected with a more sustained rally. At the same time, investors counting on the ban as the only major bullish catalyst for the stock are essentially waiting for a hail mary. A lot can happen, ByteDance will likely take all possible steps to keep its app on the market or find a solution to completely satisfy regulator concerns.

The reality is that Meta Platforms is dealing with more pressing issues including signs of a slowing advertising and soft global economic environment that have created a challenging condition into 2023. Meta faces its own headaches dealing with regulators including a new inquiry in the European Union which itself can add volatility to shares.

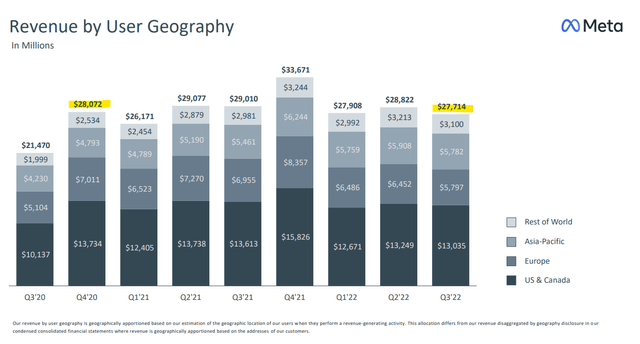

Revenues are nearly flat from a level in Q4 2020 while earnings are under pressure and expected to decline further next year. A theme during the last earnings conference call was the effort to find efficiencies in support of cash flows and margins. Beyond the macro headwinds, the metaverse investments through the Reality Labs segment continue to support a positive long-term outlook.

source: company IR

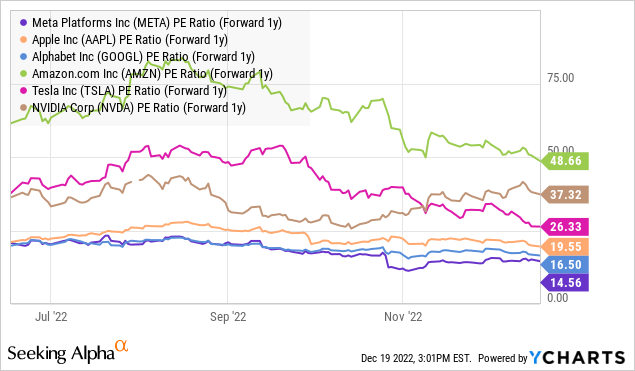

All that said, bulls have in their corner what is a deeply discounted valuation with shares of META now trading under 15x on the 2023 consensus EPS. Placing the TikTok question aside, there is a good case to be made that shares are a bargain among mega-cap tech firms considering the outlook for a return to growth next year and the potential for sharply higher earnings through the next decade.

Some near-term rationalization in spending towards AI and the metaverse future opens the door for the company to sustain profitability from its core businesses allowing it to outperform expectations. We are more optimistic about its sales outlook and the ad market in general noting strong trends in Instagram engagement and the rollout of new features.

META Stock Forecast

A bullish call on META today sort of needs the macro picture to cooperate. We want to see stronger economic indicators that help brush aside concerns over a deepening recession. Declining inflation has been encouraging and could allow the Fed to slow the pace of its rate hikes and support stronger sentiment going forward.

What makes META interesting today is that the potential for a TikTok ban, whether the legislation is certain or only has a small chance of going forward, adds to the potential positive catalysts. Updates including comments from government officials are a key monitoring point going forward.

With shares extremely volatile, a string of positive headlines on this issue sent the shares back to levels from Q3 this year when it traded near $160 representing nearly 40% upside from the current level, as our initial price target for the year ahead. As long as the stock remains above its cycle low of $88, the bulls are in control with positive momentum.

In terms of risks, a deterioration of the macro outlook beyond what is already a low baseline would force a reassessment of current near-term earnings estimates. It will be important for Meta to keep its user metrics stable and cash flow trends positive as a gauge of fundamental health.

Seeking Alpha

Be the first to comment