Sundry Photography/iStock Editorial via Getty Images

This is an update following my June report on Mereo BioPharma Group (NASDAQ:MREO), a London-based clinical-stage biopharma. More background information on the company and the activist can be found there.

A quick recap of main developments – at the time of the initial pitch MREO was trading 10% below $0.87/share of net cash, with the activist, Rubric Capital (14% stake), urging the board to explore strategic alternatives. The main objective of the activist was to monetize the royalty rights to the Setrusumab, a potential treatment for osteogenesis, cost-sharing partnership agreements, and wind down the rest of the pipeline. The activist identified insurmountable costs associated with the development of an early-stage pipeline and the increasing cost of capital as reasons for the change. Rubric valued MREO at $4 per ADS (vs 0.8/share price of MREO at the time) or 540% upside if monetized. Initially, the setup was attractive due to the downside protection provided by the discount to net cash with the activist campaign’s success providing a chance for an outsized return.

Recent events

The day I uploaded the article, rumors came out that AstraZeneca was eyeing a potential acquisition of MREO for $5/share. On the announcement, the stock shot up by 62%, quickly eliminating whatever was left of the discount to net cash reaching a $1.6/share price at the peak. Despite the initial excitement due to lack of updates the shares gradually declined to $1.3/share, still staying well-above net cash levels, up until the emergence of the latest news.

Last month Rubric Capital, frustrated with the lack of engagement from the management, sent out a letter to the board calling for a special meeting and nominating a slate of 4 nominees to the board aiming to replace 4 out of 10 incumbent directors including the Chairman as well as the deputy Chairman. The management did not take the request lightly, questioning the experience and fit of the activist nominees in their response letter. Plus the board has identified multiple deficiencies (see below) in the filling procedure for the special shareholder meeting, leaving the feeling that it was done just to drag the process along. The response was not well received by the shareholders. Right after the release of the response letter, MREO shares tumbled by 25% to below $1/share.

List of deficiencies identified by the board:

Deficiency 1: Rubric owns ADSs, not Ordinary Shares

Deficiency 2: The requisition doesn’t come from two “members”

Deficiency 3: The requisition is in the short-form format and needs to be in the long-form

Deficiency 4: Our letter within the requisition exceeds the 1,000-word count limit (by 86 words)

Finally, on the 14th of September, the activist released another public letter stating that they have addressed the identified deficiencies and submitted a new request. Unless the management comes up with some other excuse, the special shareholder meeting will likely be convened no later than 21 days after the submission of the request. If the special meeting will be allowed, Rubric has a good chance to win the vote.

Further thoughts and valuation

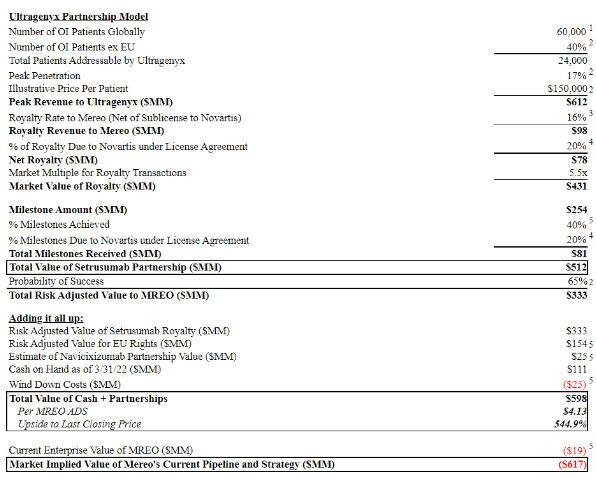

First, let’s present the activist’s model:

Activist Letter

The most notable asset of the company is Setrusumab, a drug used for the treatment of Osteogenesis imperfecta a rare genetic disease. The integral part of the MREO story is its partnership with Ultragenyx since 2020. The partnership significantly boosted MREO’s financial health in the coming years due to a $50 million upfront payment from Ultragenyx. Most importantly, MREO is entitled to significant payments if certain milestones are achieved with further royalty payouts post-FDA approval. These two components make up most of the activist valuation plus the cash on hand (lower by $24m today). Setrusumab will go into Phase 3 trial by the end of the year, which would likely be one of the milestones triggering another payment (the exact details are limited). Moreover, the valuation does not include 5 other earlier-stage drugs that can also yield additional value here. Clearly, despite the contingencies, the potential upside is significant here. Once again, Rubric plans to monetize the potential royalties from Setrusumab, liquidate or license/partner out the rest of the pipeline, reduce the cash burn, and distribute excess cash to shareholders. The success of the campaign will be the catalyst for potentially outsized returns if the assets are monetized at least at a directionally close price to the activist valuation estimates. However, the main questions are whether the activist can succeed in overthrowing the board and if there are any buyers out there for MREO assets.

If the shareholder meeting is convened, I believe, the activist has a good chance of succeeding here, for several reasons. Besides its large 14% stake, a close affiliate of Rubric Capital, Point72 Asset Management, also holds a 9% stake in the company and it is highly likely that their vote is in the pocket of the activist. In fact, Rubric Capital was a part of Point72 before it was carved out in 2016. Point72 capital is a hedge fund run by the infamous Steve Cohen whose former analyst was David Rosen, the current CEO of Rubric Capital. Moreover, to request a special shareholder meeting holders of ADS have to convert their ADS into ordinary shares with a $0.05/share conversion fee. Despite this, the activist was willing to incur, basically, a 10% tax just to request the shareholder meeting which speaks highly of their determination and most importantly confidence that the vote will go in their favor. On top of this, shareholder reaction to the management’s response clearly shows dissatisfaction with the current management further increasing the likelihood of a successful activist campaign.

Recent rumors about the outright sale of MREO to AstraZeneca provide a degree of confidence in the success of the pipeline monetization once the activist takes over the board. Importantly, AstraZeneca already has a relationship with MREO. In fact, since 2017 MREO and AstraZeneca have had an in-licensing agreement for the development of alvelestat, one of MREO’s pipeline drugs. It is not surprising that AstraZeneca could be interested in the company given its understanding of MREO’s pipeline and the business.

Main risks

However, despite the multi-bagger upside potential, there are material risks that need to be taken into account:

- The set-up is still highly speculative and risky.

- No downside protection. If the activist fails, the shares are likely to fall to or even below my estimate of current net cash at $0.51/share (cash minus total liabilities) or about a 50%+ downside.

- Continued cash burn. The current cash burn is about $12m per quarter. At this rate, today’s cash position is approximately $87m, basically, a decrease of $24m from the last reported cash balance of $111m in March of this year. Recently, management reported that they have extended their cash runway into Q2’25.

- Management/shareholder interests are misaligned. Management has negligible ownership (less than 1%) and high compensation making them highly incentivized to continue operations for as long as possible.

- Rumors of AstraZeneca sale could prove to be false and liquidation of the MREO pipeline might be harder/take longer than expected. However, the margin of safety seems quite wide (that is if the liquidation process gets launched in the first place).

- Uncertain timeline for monetization and subsequent cash distribution.

Conclusion

Given the high chance of the activist campaign’s success, and potential significant upside with possible buyout opportunities in the making, the situation is quite interesting at this stage. However, this is a high-risk/high-reward setup with material risks that need to be carefully considered. In the coming weeks, the situation should become more clear with further updates on the special shareholder meeting and the management/activist’s subsequent comments.

Be the first to comment