Thomas Barwick

Thesis

MercadoLibre, Inc. (NASDAQ:MELI) reported a solid Q3 as it outperformed both lines on revenue and EBIT. The momentum in its fintech business continues to shine even though its take rate dipped slightly, offset by robust total payment volumes (TPV).

The growth in MercadoLibre’s critical commerce business has continued to slow, but the company mitigated the deceleration in volume through an improved take rate. Coupled with improved scale efficiencies as MercadoLibre ramps its GMV over time, it significantly lifted its EBIT margin.

Our analysis indicates that MercadoLibre is cautiously perched above its June and October lows. Significant headwinds from record inflation and interest rates are expected to subside into FY23.

However, MercadoLibre has decided to slow the origination growth in its credit business, given macro headwinds from a slowing economy. Furthermore, the newly elected President Luiz Inácio Lula da Silva’s plans to drive economic growth in a time of elevated inflation could throw a curveball to Brazil’s inflation outlook over the next year. Therefore, investors should continue to expect a slowdown in its credit business and monitor for marked deterioration in its loan book, compelling the company to increase its provisions for credit losses.

MELI’s price action suggests it has lost its medium-term bullish bias, with a re-test of its Oct lows increasingly likely. While we remain optimistic about its long-term potential, we recognize that increased macro risks could impinge on MercadoLibre’s steep growth premium, causing further value compression.

Coupled with less convincing price action, we believe it’s appropriate to turn slightly cautious at the current levels.

Revise rating from Buy to Hold.

Record Inflation Could Be Falling Off

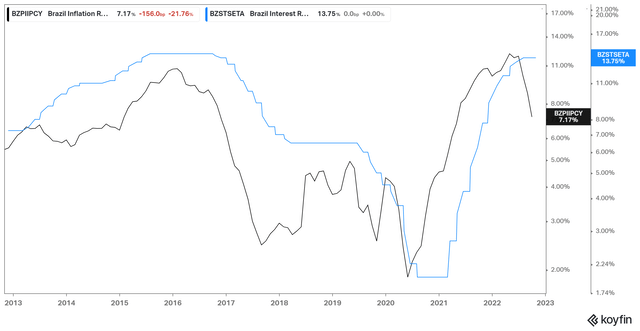

Brazil Inflation and Interest rates (koyfin)

As seen above, Brazil’s hawkish drive to combat its highest inflation rates over the past ten years has proved successful. Therefore, MercadoLibre believes it should help improve its Credit portfolio performance moving ahead, as management highlighted:

We did see some degradation of metrics, particularly in Brazil mostly during the second quarter. Going forward, we don’t provide guidance, but we believe that probably interest rates in Brazil have — are close to — have peaked already or close to peaking. And probably next year, should start coming down. It’s still too early to tell. Brazil elected a new President last week, so it’s still very early to tell. But with that in mind, we expect that macro conditions will start to improve in Brazil, which was the country where we were more concerned about degradation of credit lines. (MercadoLibre FQ3’22 earnings call)

Therefore, the market could remain tentative as it parses the fiscal policy of Lula as Brazil embarks on a new era. Moreover, we believe Brazil’s record inflation has not been constructive for MELI’s valuations and growth performance over the past year. Hence, investors are urged to assess the new government’s spending carefully on whether it could further stoke inflationary pressures.

MercadoLibre’s Commerce Segment Continues To Slow

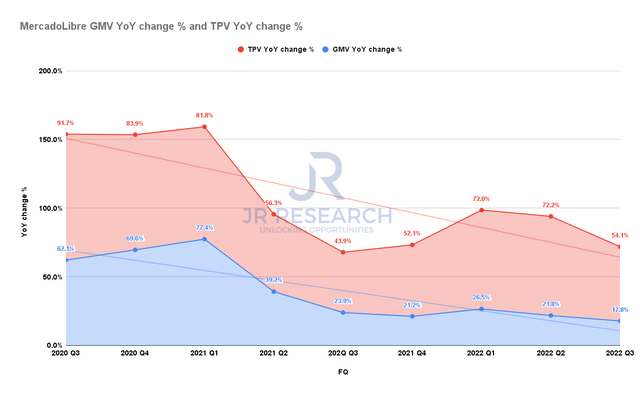

MercadoLibre GMV change % and TPV change % (Company filings)

MercadoLibre delivered a robust quarter, as net revenue increased by 44.8%, ahead of the previous consensus estimates. However, MELI’s GMV growth continues to decelerate from FY20-21’s remarkable growth rates. In addition, its Fintech segment has also experienced slower growth in Q3, as it posted YoY growth of 54%, down from Q2’s 72%.

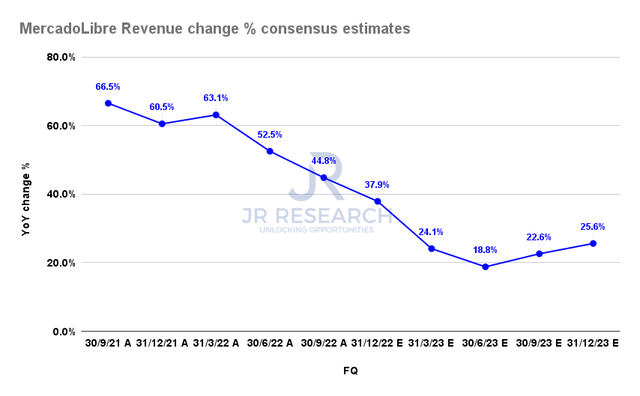

MercadoLibre Revenue change % consensus estimates (S&P Cap IQ)

We believe MELI’s revenue growth should continue decelerating as macro headwinds intensify globally. While Inflation has fallen off its 2022 peak, it remains high. Notwithstanding, the company remains confident that it has yet to see a significant deterioration in consumer spending yet.

However, we believe the revised consensus estimates (bullish) are prudent in reflecting a weaker growth environment. MELI’s revenue growth is expected to bottom out by H2’23 before recovering.

Hence, investors need to assess whether the current challenges have already been priced into its valuation.

Is MELI Stock A Buy, Sell, Or Hold?

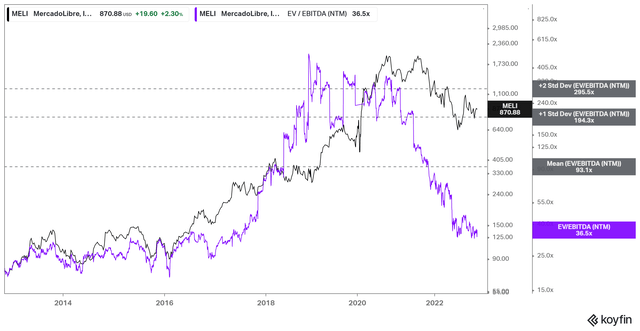

MELI NTM EBITDA multiples valuation trend (koyfin)

We think it’s clear that MELI has been de-rated as the market anticipated that its FY20-21 growth was unsustainable.

It last traded at an NTM EBITDA of 36.5x, well ahead of its e-commerce peers. The company remains in a growth phase; therefore, the market expects the company to continue delivering robust topline growth with incremental operating leverage.

However, we assess that the market has not re-rated MELI, despite its battering from its 2021 highs.

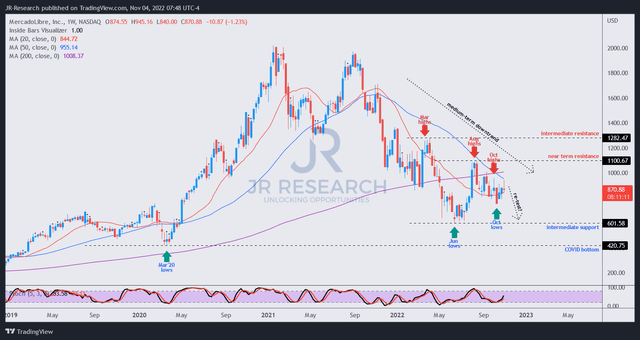

MELI price chart (weekly) (TradingView)

We had previously anticipated that MELI’s June lows should hold robustly. While we have yet to adjust our perspective, we noted that MELI had not regained its medium-term bullish bias.

We gleaned that the sellers remain in decisive control of MELI’s near-term momentum, with Oct highs as another possibility of a near-term top.

Therefore, we assess that a re-test of its October lows cannot be ruled out, with the possibility of another June re-test before it eventually bottoms out.

Hence, we deduce that caution is warranted at the current levels, allowing the market to demonstrate its directional bias before investors should add exposure.

Revising our rating on MELI from Buy to Hold for now.

Be the first to comment