anon-tae/iStock via Getty Images

Argentina-based MercadoLibre (NASDAQ:MELI) just reported its Q2 FY22 performance.

There is a ton to love about this leader at the crossroads of e-commerce and Fintech. The company is present in more than 18 countries. Brazil remains the company’s main focus, representing 56% of revenue.

MercadoLibre Markets (Company website)

Founder Marcos Galperin is still the CEO and owns about 8% of the shares. The company has received many awards and accolades across several platforms (such as Great Place to Work and Top Of Mind) and is one of the best rated on Glassdoor.

MercadoLibre Reviews (Glassdoor)

The story is familiar here:

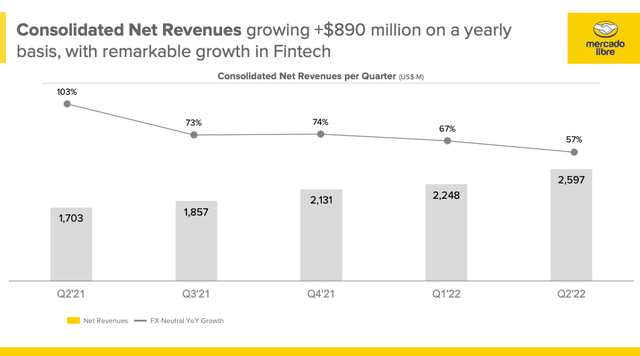

- The company has seen a three-digit revenue in the four quarters following the start of the global pandemic in Q2 FY20.

- Since Q3 FY21, revenue growth has normalized in a more challenging environment with tough comps and multiple macro headwinds.

Yet, despite challenging comps, the company is still growing at a brisk pace.

Revenue grew +56% (fx neutral) to $2.6B in Q2 FY22, compared to Q2 FY21, which already saw revenue grow +103% Y/Y.

The exceptional growth of the fintech segment was behind this success.

MercadoLibre Revenue (Q2 FY22 Earnings Slides)

MercadoLibre is a big winner in the accelerated transition to digital payment and e-commerce. As a result, MELI has been a long-time favorite in the App Economy Portfolio (my real-money portfolio) and is one of the Starter Stocks in my marketplace.

What I like about the company is its optionality. In many ways, you could call MELI the Amazon (AMZN) (retail side) and PayPal (PYPL) of South America.

Morgan Stanley (MS) pointed out that the company was “on the path to be a one-stop fintech provider.”

The company has the reach (84 million active users) and the potential to expand into other fintech solutions (digital wallet, insurance, asset management solutions, and so on).

Other contenders are vying for a share of the market as well. Among them are Sea Limited (SE), Amazon (AMZN), and Alibaba (BABA). But given the market size (more than 400 million people), multiple winners can emerge.

The company breaks down its performance in four main businesses:

- Marketplace – Mercado Libre.

- Logistics – Mercado Envios.

- Payments – Mercado Pago.

- Credits – Mercado Credito.

In Q2 FY22, the revenue breakdown was:

- Commerce: $1.4B or 54% of revenue (+23% Y/Y).

- Fintech: $1.2B or 46% of revenue (+107% Y/Y).

Fintech represents a growing part of the business and is on track to be the leading segment in the coming quarters.

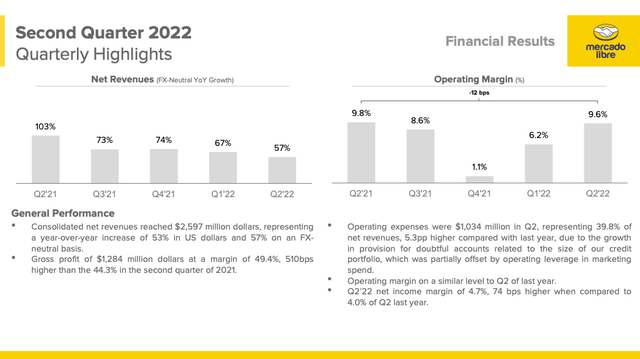

MercadoLibre Q2 FY22 Financial Results:

MercadoLibre Highlights (Q2 FY22 Earnings Slides)

Note: GMV = Gross Merchandise Volume. TPV = Total Payment Volume.

Key metrics:

- GMV grew +26% Y/Y to $9B (+32% Y/Y in Q1) fx neutral.

- TPV grew +84% to $30B (vs. +72% Y/Y in Q1) fx neutral.

- Unique active users grew +11% Y/Y to 84 million (vs. +16% Y/Y in Q1).

Income statement:

- Net Revenues grew +57% Y/Y to $2.6B, (vs. +67% in Q1) fx neutral.

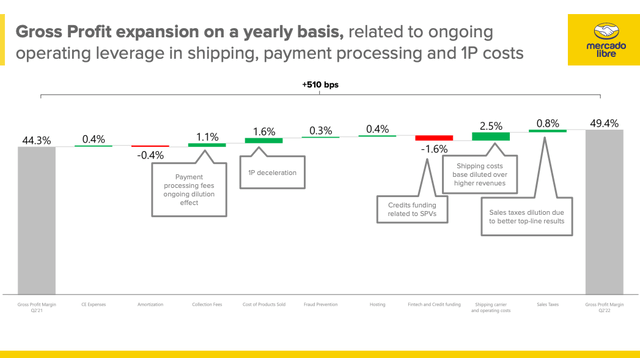

- Gross Margin was 49% (+5pp Y/Y).

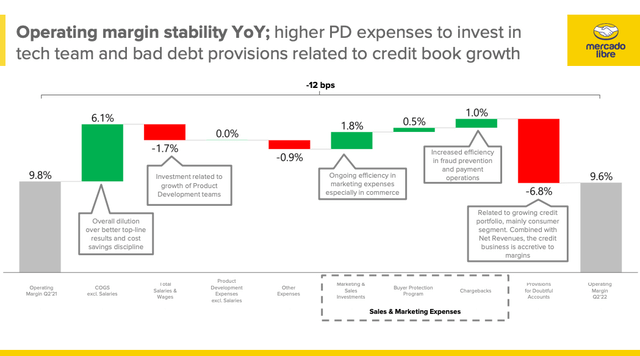

- Operating margin was 10% (flat Y/Y).

Cash flow:

- Operating cash flow margin was 14% in H1 FY22.

- Cash provided by operations was $1.2B in the past 12 months.

Balance sheet:

- Cash and short-term investments were $3B.

- Long-term debt was $3B.

The company’s balance sheet is not as robust as other App Economy Portfolio companies. However, since MELI generated more than $1.2B in cash from operations in the past 12 months, it’s not an area of concern for me.

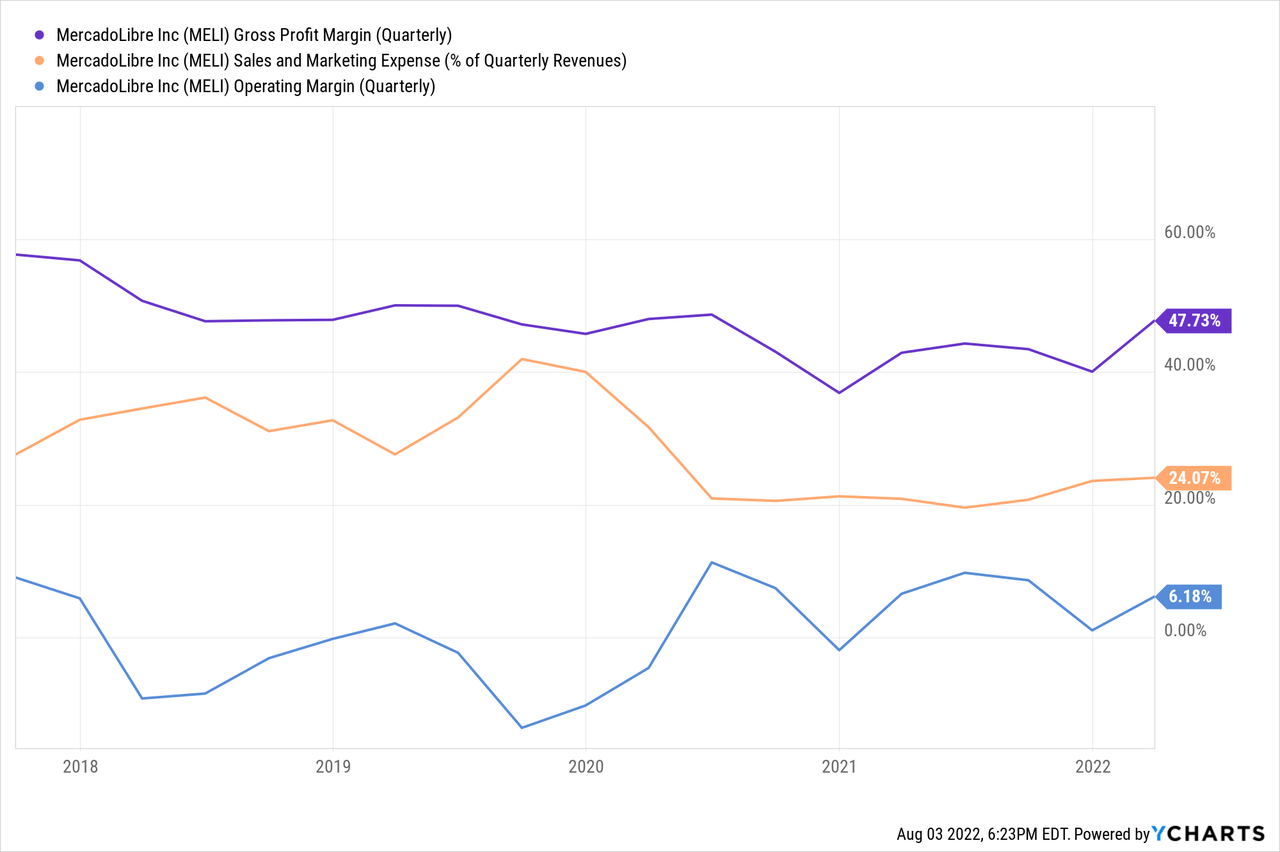

If we look at margin trends on a GAAP basis:

- Gross margin has rebounded to 49% in Q2 after compressing since 2017.

- Sales & Marketing costs dropped over time and were 11% in Q2.

- Operating margin is firmly in the black, at 10% in Q2.

Note: the chart below shows the margin trends up to Q1 FY22.

The company’s most recent financial results for Q2 FY22 can be summarized as follows:

- Strong top-line growth (+57%) – showing strength.

- High gross margin at 49% – showing long-term potential.

- Dropping sales & marketing costs at 11% – showing scalability.

- Operating margin staying positive during this fast-growth phase.

- Cash from operations reaching $1.2B TTM – showing sustainability.

MELI was able to more than quadruple its revenue while stabilizing its margins in the past three years.

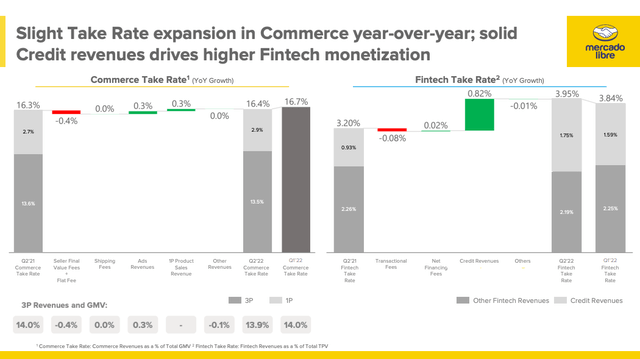

Take Rate And Margins

MELI’s steadily improving take rate has been an encouraging sign of its moat and pricing power.

The take rate showed improvements for both segments:

- 16.4% for Commerce (+0.1pp Y/Y), driven by first-party product sales.

- 3.95% for Fintech (+0.65pp Y/Y), driven by Credit Revenues.

MercadoLibre Take Rate (Q2 FY22 Earnings Slides)

The gross margin improved to 49.4% (+5.1pp Y/Y) primarily thanks to scalability with higher revenue.

MercadoLibre Gross Margin (Q2 FY22 Earnings Slides)

The company has maintained its profitability while growing at a breakneck pace. The operating margin was stable at 9.6% (-0.2pp Y/Y), with cost efficiencies offset by bad debt provisions from the growing credit portfolio.

MercadoLibre Operating Margin (Q2 FY22 Earnings Slides)

Risk & Opportunities

The risk/reward profile of the company is becoming more attractive.

- Opportunities:

- Over time, the company’s take rate improvement illustrates its pricing power and indicates a durable economic advantage.

- There is untapped potential for advertising across Mercado Libre and Mercado Pago, and it’s a very high-margin business (~80% margin profile, according to CFO Pedro Arnt).

- Management sees tremendous potential in Mexico after years of heavy investment, and it was the first profitable quarter in the country in the last five years.

- MELI’s reach allows for new revenue streams over time. The company keeps expanding its TAM by entering new categories, in a way reminiscent of Block (SQ) or Amazon (AMZN). For example, scaling the credit business is on track to make Fintech the leading segment.

- Aristotle taught us that “the whole is greater than the sum of the parts,” and MELI could be a perfect example. The success of each segment can fuel the others, with potential for user acquisition, retention, and monetization across platforms.

- Risks:

- The macro-environment could continue to be a headwind for e-commerce and Fintech in the quarters ahead. In addition, Brazil exited a recession in the fourth quarter of 2021.

- Weak economic growth and high inflation in South America could challenge MELI in the near term.

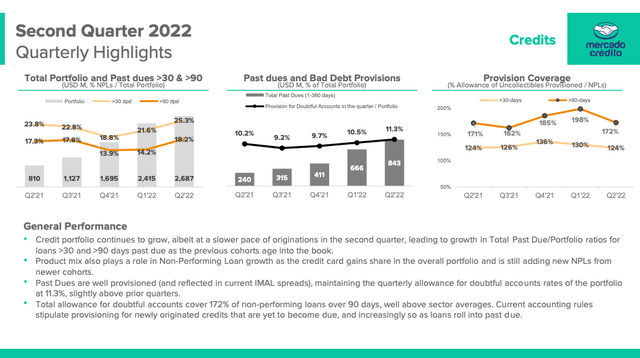

- The credit portfolio grew +231% Y/Y to $2.7B, primarily on the consumer side. In Q2 FY22, total loans past due by 30 days or more were 25% of the portfolio (+1.5pp Y/Y). It will be necessary to watch if management can keep it under control in worsening market conditions.

The growing non-performing loans are the most glaring risk for the company. However, the total allowance for doubtful accounts covers 124% of non-performing loans over 30 days, so the risk is already covered on the balance sheet.

Mercado Credito Loan Performance (Q2 FY22 Earnings Slides)

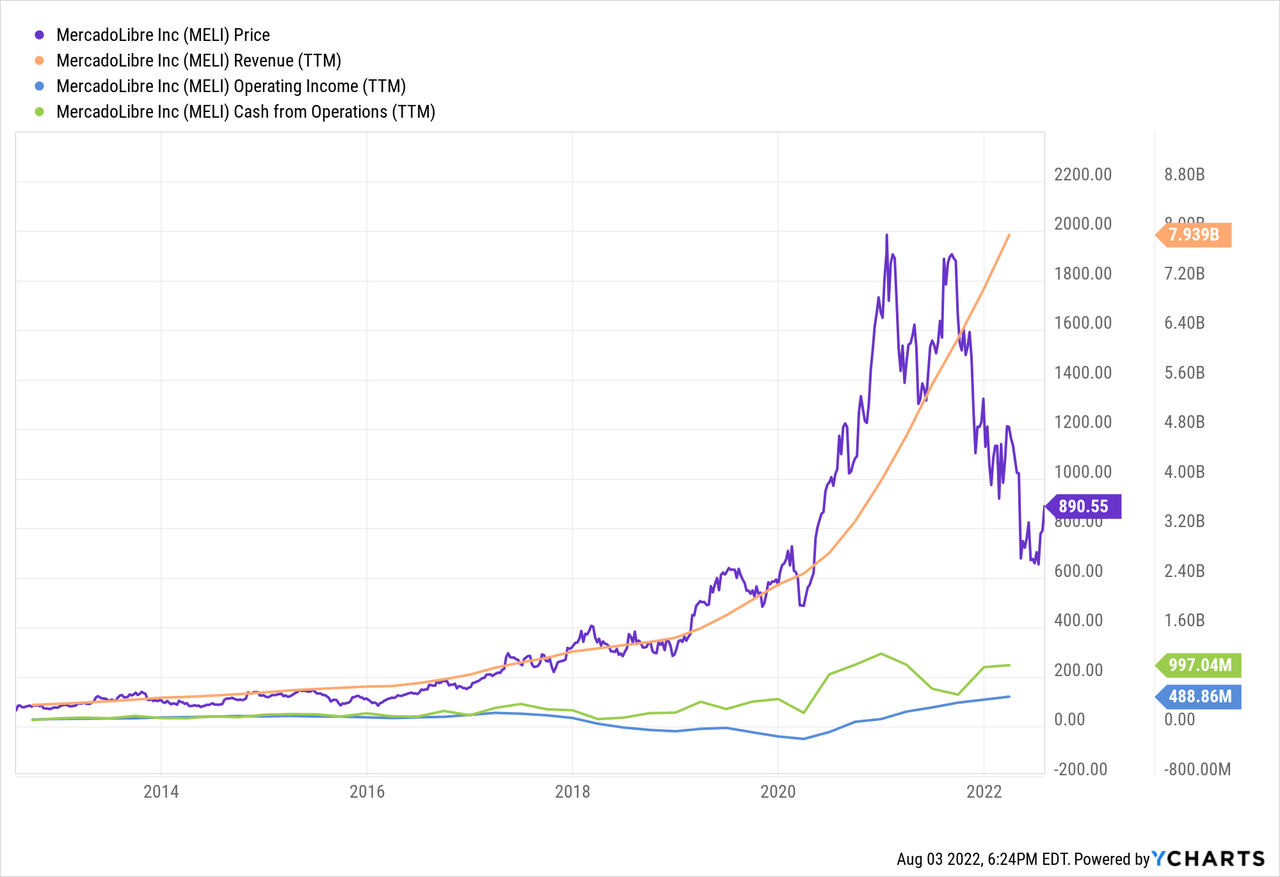

MELI Stock: Why Is This Opportunity Timely?

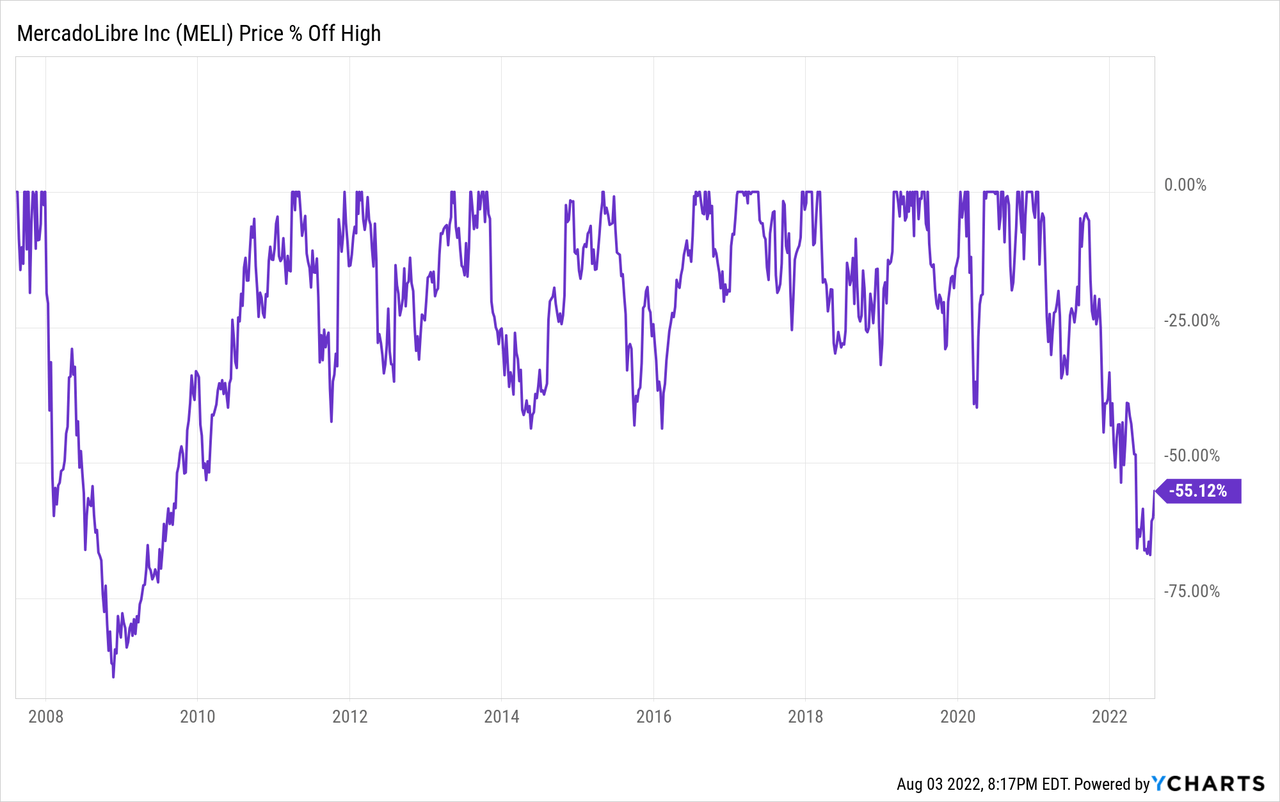

For one thing, MELI rarely trades more than 50% down from its previous high. We would have to go back to the Great Recession 14 years ago.

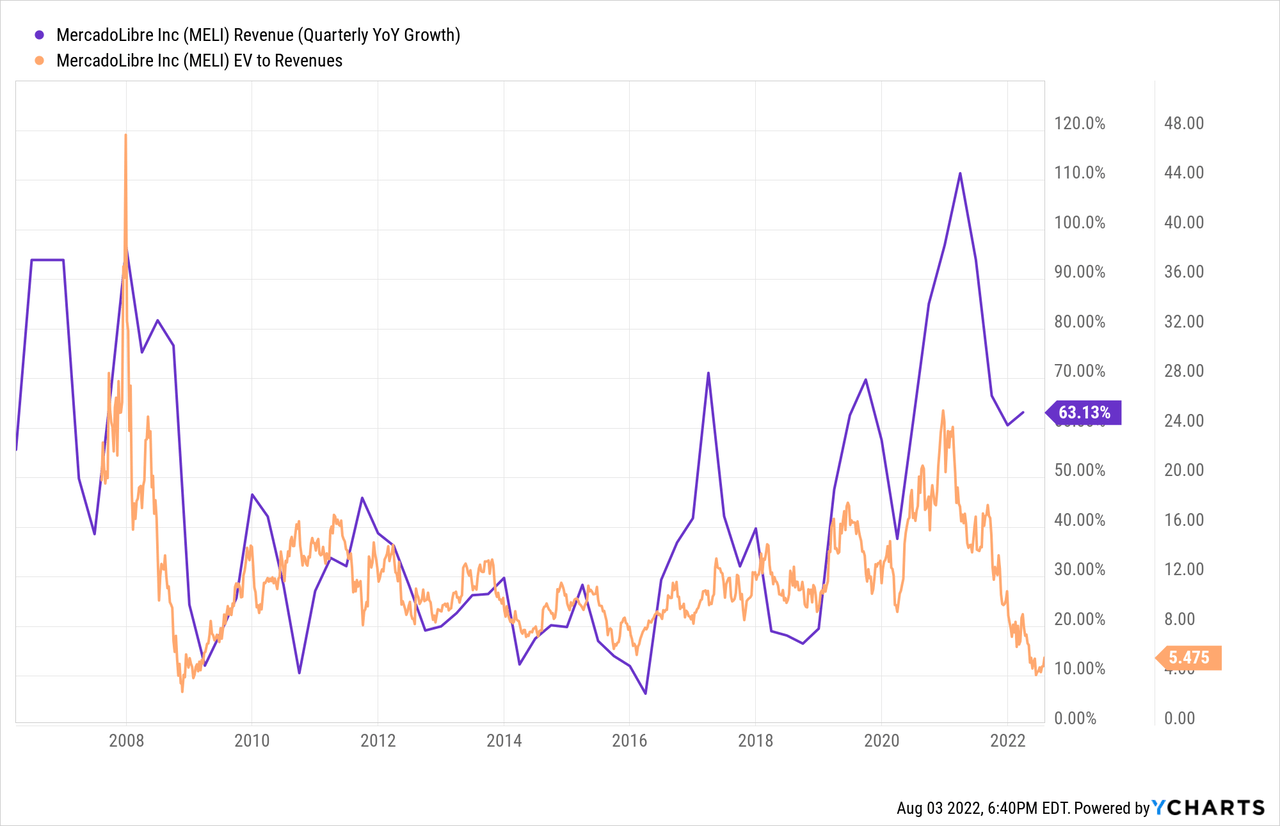

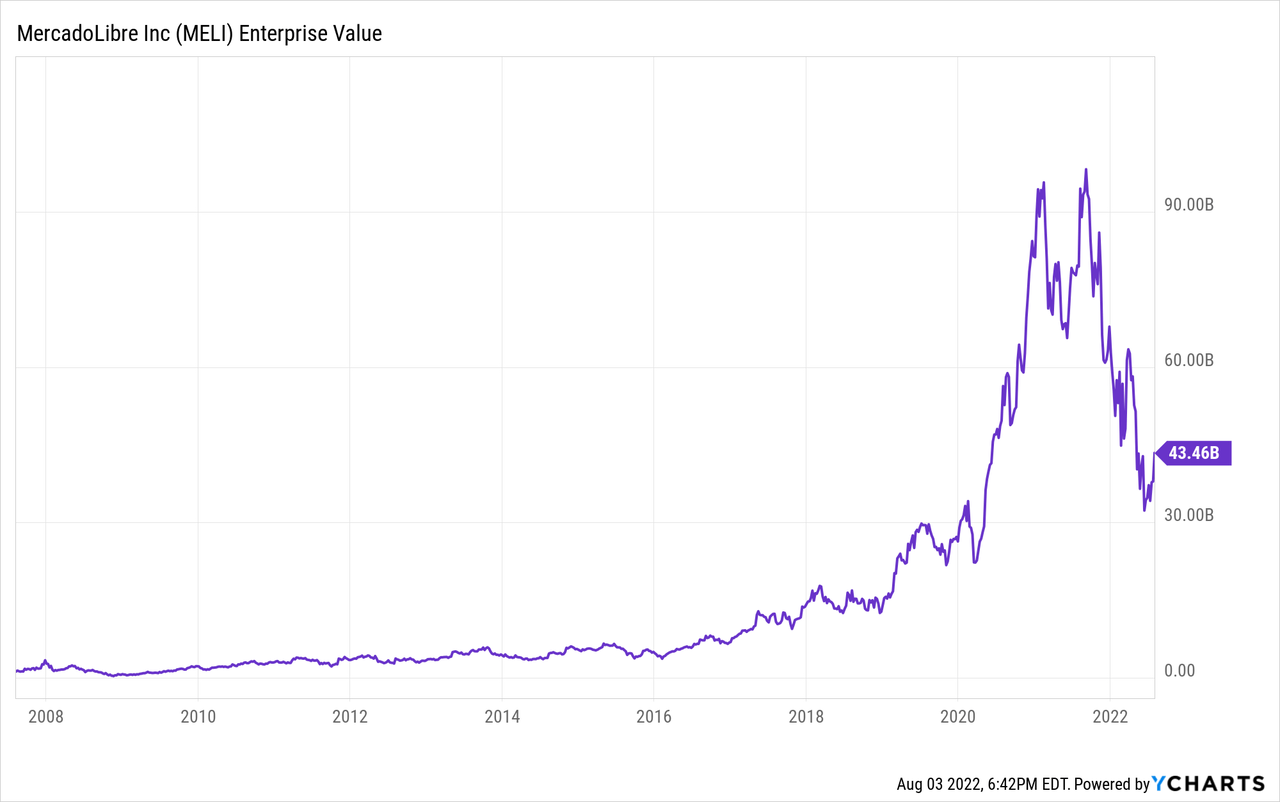

Despite a high-growth profile boosted by the fintech segment, MELI is trading at its lowest revenue multiple since the bottom of the Great Financial Crisis, around 5 times trailing revenue (see orange line below).

However, we don’t have to use revenue multiple here. With a $43B enterprise value, MELI is trading at about 37 times trailing operating cash flow, which appears undervalued given its growth profile and the potential for future margin expansion.

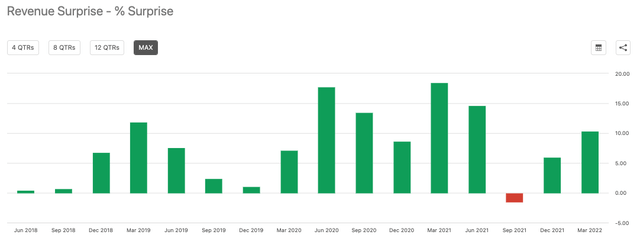

The company has beaten expectations by 8% on average in the past four years, illustrating the exceptional execution.

MELI Revenue Surprise Quarterly (Seeking Alpha)

Based on Wall Street’s estimates, the company is expected to grow revenue by more than 25% annually over the next six years.

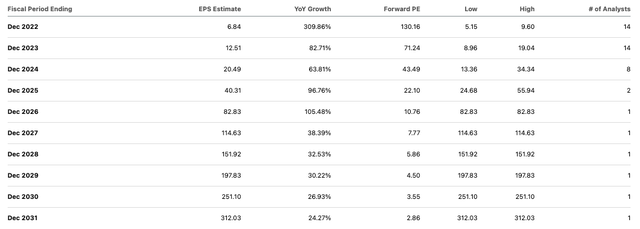

Even assuming MELI merely meets these estimates moving forward, the stock is currently trading at about 8 times FY27 earnings per share, illustrating the margin of safety.

Again, these estimates could prove very conservative based on this management team’s track record of outperformance.

MELI Earnings Estimates (Seeking Alpha)

Wall Street analysts tend to project linear growth deceleration in their financial models, but the company has repeatedly proven that there is still a long runway ahead and potential for re-acceleration.

Bottom Line

While we could see a more challenging environment ahead, the company has the balance sheet and cash flow to withstand potential short-term challenges.

Management has demonstrated they can deliver improvements across all business units and run a tight ship.

The opportunity appears as timely today as it did in January 2009, the last time the company traded at 5X trailing revenue. And the stock returned a whopping 5,000% since then.

While I have no idea where MELI might be trading in the next few quarters, I believe those investing with a multi-year time horizon will be handsomely rewarded.

What about you?

- What did you think of MercadoLibre’s quarter?

- Do you see the current opportunity as timely?

- What are other risks to consider before investing in MELI?

Let me know in the comments!

Be the first to comment