da-kuk

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on October 28th, 2022.

Most readers will know that I’m a pretty big fan of utility and infrastructure investments. We know they aren’t going away as they are essential to everyday life. Around a year ago, a new closed-end fund hit the market. That was the MainStay CBRE Global Infrastructure Megatrends Fund (NYSE:MEGI).

We originally wrote up a piece earlier in March to better explore the fund’s basics more in-depth. That includes the limited-term structure that has become standard in the market since around 2018. It also included a lengthy description of how the fund will invest in much greater detail.

Since the launch, the overall market has been quite bleak. So, unfortunately, this fund is off to what would appear to be a weak start. The fund has also been punished by the new closed-end fund discount we see emerge most of the time.

That being said, now that we are a year in, at a deep discount – and the market has come down across the board – I think this is exactly where an opportunity could be.

The Basics

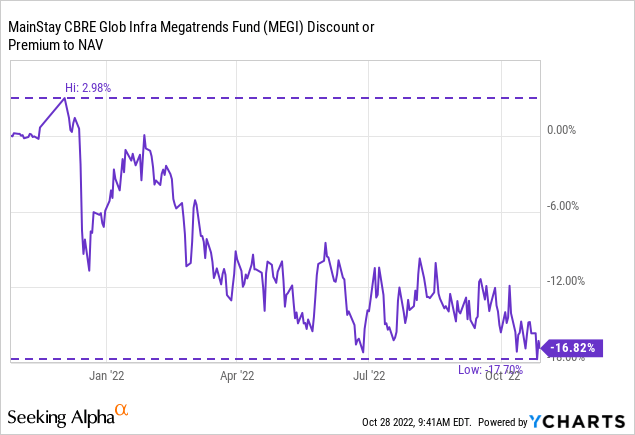

- 1-Year Z-score: -1.36

- Discount: 16.82%

- Distribution Yield: 8.18%

- Expense Ratio: 1.56%

- Leverage: 33%

- Managed Assets: $1.1 billion

- Structure: Term (anticipated liquidation date, December 15, 2033)

MEGI is your fairly standard closed-end fund, with the fund “seeking a high level of total return with an emphasis on current income.”

To set this fund apart, the fund’s twist compared to other infrastructure or utility funds is a “thematic theme.” They are “focused on the investment megatrends of decarbonization, digital transformation, and asset modernization, which are reshaping the demand for infrastructure assets and driving income and growth potential.”

The fund is quite large, at over $1 billion at the end of September 2022. Helping out the size of the total managed assets is the fund’s leverage. Of course, a bit theme for 2022 is interest rates. Interest rates rising rapidly are having a negative impact on leverage costs.

Since MEGI utilizes a credit facility, they are subject to variable interest rates. They aren’t the only fund that is in this situation, though, as the majority of CEFs are leveraged. For MEGI, their interest charges are based on the Overnight Bank Funding Rate plus 0.75%. As interest rates rise, the expenses will rise here. When including interest rate expenses, the fund’s total expense ratio came to 1.92%.

Performance – Recent Laggard

MEGI doesn’t necessarily have an exact peer to compare to in the closed-end fund space due to the fund’s different focus on looking for thematic trends. This generally includes decarbonization, digital transformation, and asset modernization.

While one could automatically assume it is an “ESG” fund, when looking at the holdings, it really isn’t going in that specific direction. They hold several midstream companies that transport good old-fashioned fossil fuels. Though they also do have some renewable-focused holdings too. The flexibility to invest across the spectrum is more attractive to me, but I know that doesn’t work for everyone.

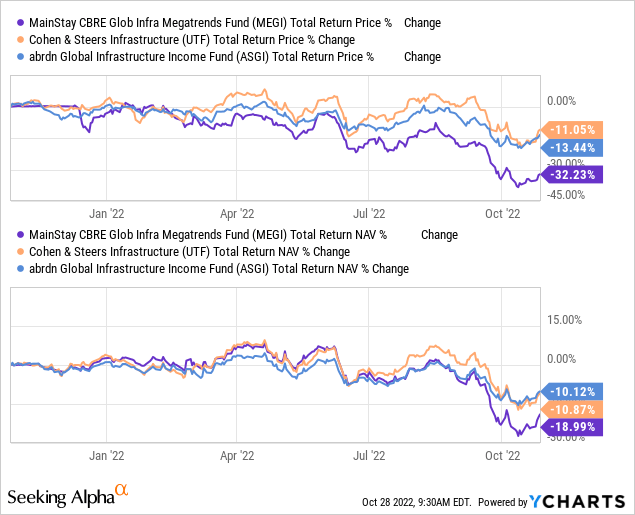

That being said, we can look at the performance relative to other global infrastructure funds. In this case, I’m looking at Cohen & Steers Infrastructure Fund (UTF). This is also a popular infrastructure fund that invests globally and includes some preferred/corporate bond holdings, similar to MEGI. Additionally, I’ve also included Aberdeen Standard Global Infrastructure Income Fund (ASGI). This is a non-leveraged globally focused infrastructure CEF.

YCharts

One thing we can see is that MEGI was holding up well relative to these barometer-type funds. It was really only recently that the underperformance in MEGI really pushed them lower on a total NAV return basis. Of course, we can see the general struggle that the total share price change has been going through since its launch.

That difference in NAV and share price performance is what has opened up the attractive discount at this time. As we can see, this is near the lowest since the launch.

YCharts

In general, utilities and infrastructure-type positions were holding up well for most of the year. It was recently that all began to take a relatively larger hit with the broader market in September, though some recovery has been made more recently.

MEGI had posted a quarterly conference call where they noted that, in particular, it was global utility names that really took a hit. UTF and ASGI have some global utility names, but when we look at MEGI’s portfolio, it appears they are even more weighted to these global utility names.

Those familiar with ASGI can recall that nearly 30% of their portfolio is invested in industrial stocks, which is certainly a big difference between ASGI and MEGI. Hence, why I continue to remain invested in a handful of infrastructure and utility funds. On the surface, they might be all thrown into the same basket, but there can be some meaningful differences when looking deeper.

Distribution – Double-Digit Rate But Watch Coverage

One thing that has happened since the fund launched is that the fund’s yield has been driven up due to the falling prices. At the same time, they’ve continued to maintain the $0.1083 monthly payout. We are now seeing a distribution yield on the fund at 10.15%. This elevated level is thanks to the large discount as the NAV distribution rate comes in at a more moderate 8.44%.

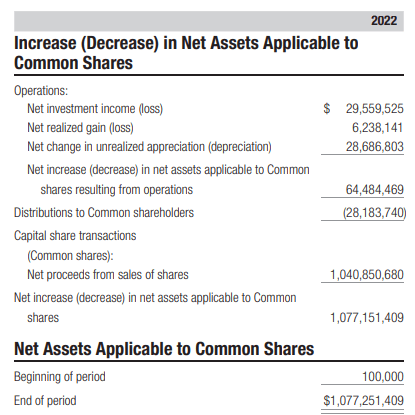

Additionally, the coverage of the distribution is quite strong. This is primarily an equity fund, though it does have some fixed-income exposure. That being said, what we see in net investment income coverage is quite unusual for this type of fund. As of their latest annual report, the distribution was entirely covered by NII.

MEGI Annual Report (MainStay)

The caveat here is this isn’t for an entire year; it is for about 7 months. The timing of the initial distributions and the NII generated have all skewed these figures. Based on the outstanding shares of 52,049,534 – we should expect annual distributions to shareholders to come to $67,640,975.

If they earned $29,559,525 in 7 months, annualized, that should work out to around $50,673,471. So we already see that coverage should slip going forward. That also doesn’t include another hit that they’ll take from interest expenses on the leverage.

Interest expenses came to $2,198,776 in the latest report. Again, annualizing that out would come to $3,769,330. The OBFR was last at 3.07% and is set to rise higher. That would mean the borrowings for MEGI should be around 3.82% at this time, meaning that the interest payment on the $427 million they had in outstanding debt would be costing them around $16.311 million for the next 12 months.

Unfortunately, it isn’t likely that the distribution and dividend boosts they see in their underlying portfolio will be able to outpace the increased interest expenses.

That being said, if in the next 12 months, based on the last reported NII and subtracting out what interest expenses could be, we would see NII coverage of around 50%. And to be honest, that is still quite high.

UTF, as an example, last reported NII coverage of 29%. That’s without even factoring in any interest rate changes going forward. Bearing in mind, the impact of higher interest rates on UTF is reduced due to their 85% in fixed borrowings.

To summarize, the distribution coverage was strong but is expected to weaken materially. Relative to “peers,” it still remains one of the highest NII-covered payouts.

MEGI’s Portfolio

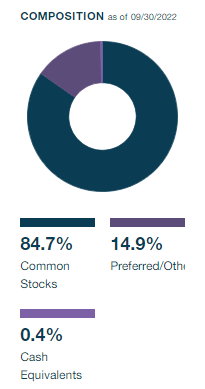

Looking at the portfolio more broadly, we see that the bulk is invested in common stocks. A meaningful amount is still allocated to a preferred/other allocation.

MEGI Asset Exposure (MainStay)

They also show a large allocation in the Americas, at around 53% of the portfolio. They have a 29.4% sleeve in Europe and another 17.6% in the Asia Pacific. This gives a fairly heavy weight to U.S. holdings but is still carrying a fair bit of weight outside the U.S. too. As a global fund, this would be expected, but we have seen other “global” funds invest 70% or even more in U.S. holdings.

Assuming you wanted to invest in a global infrastructure fund, as the name would suggest, this higher allocation around the world could be welcomed. I also see it as another strength of the fund, considering that it adds yet more flexibility to invest where they see the best opportunities.

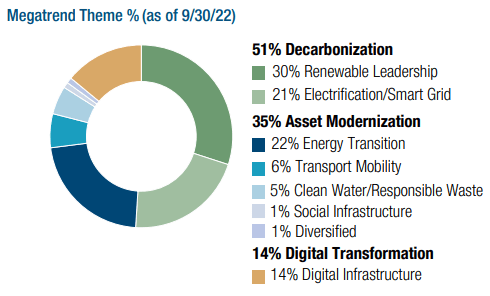

In looking at their megatrend theme exposure, we have decarbonization as the largest weighting of 51.2%. This is followed by material exposures in both asset modernization and digital transformation. They provide a more thorough breakdown in their latest fact sheet on the types of exposure you are getting.

MEGI Exposure (MainStay)

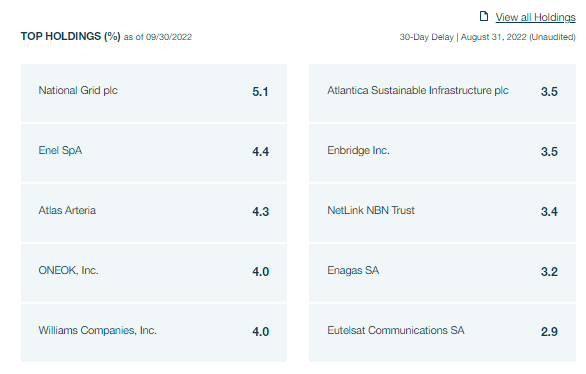

With weightings such as that, it might be surprising to look at the top ten holdings.

MEGI Top Ten (MainStay)

Arguably, only one position is actually positioned specifically for “clean” energy. That would be Atlantica Sustainable Infrastructure (AY).

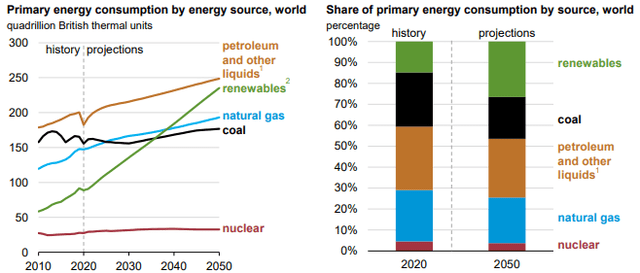

However, most utility names are investing a lot of capital into cleaner energy, whether they want to or are pushed to by the government. These sorts of shifts…or megatrends…are seen in the energy production estimates going forward. Renewable growth is expected to continue rapidly growing, which is outpacing growth from other sources.

Projected Energy Consumption (EIA)

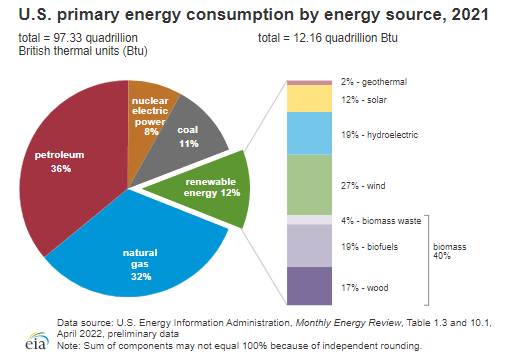

They also have exposure to several midstreams here that are focused on natural gas. As we can see above, natural gas consumption is also expected to grow and maintain its status as a significant source of energy production. Natural gas was also a leading energy source in the U.S. in 2021. This is why these midstream companies play such an essential role in our everyday lives.

U.S. Primary Energy Consumption (EIA)

In the end, the energy demand will only grow further through 2050. That will require all energy sources to contribute to the demands of the populations around the world. Investing with MEGI, you can take advantage of shifting trends.

Conclusion

MEGI is a fairly unique utility/infrastructure fund. It focuses on megatrends, which can be a play in renewables. However, that isn’t their sole focus, and they have the flexibility to invest where they see fit. That includes anywhere around the globe and not only equity positions but preferred and other fixed-income positions. The distribution coverage was incredibly strong but is set to weaken. Even as it weakens, it appears it should remain rather robust compared to other infrastructure funds in terms of its stronger NII coverage.

The fund launched around a year ago, and that was certainly a rough time to launch heading into 2022. At the same time, the fund’s discount has widened considerably, making it a fairly attractive name to consider.

Be the first to comment