Khanchit Khirisutchalual

Introduction

In March 2022, I wrote a bearish article on SA about non-fungible token (NFT) game developer Mega Matrix (NYSE:MTMT) in which I said that interest in its first product seemed low and the company looked overvalued.

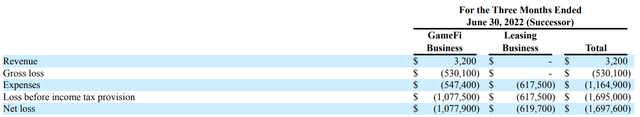

Well, revenues in Q2 2022 came in at just $3,200 and I expect they could be even lower in Q3 as there hasn’t been a single transaction on the NFT marketplace at alSpace for 4 months now. Considering the share price of the company has doubled since mid August and the short borrow fee rate has dropped below 7%, I think this could be a good moment to open a small short position. Let’s review.

Overview of the recent developments

In case you haven’t read my previous articles about Mega Matrix, here is a brief description of the business. The company used to be a small aircraft lessor that was went bankrupt in March 2021 and was bought by a group of Chinese investors in August 2021, thus becoming a cash shell. In December, Mega Matrix announced that it was entering the GameFi business with an NFT game named Mano. It was set in the popular player-versus-player (PVP) competitive arena format with a play-to-earn model, and to me it looks like Axie Infinity (AXS-USD) with robots.

Mega Matrix

The idea was that players could collect and create fighting bots and sell or trade them for other digital assets on Mega Matrix’s own metaverse universe platform named alSpace. There was an airdrop at the end of March in which each player that took part in the reservation and censored test could receive up to 3 robots. However, the popularity of the game seems insignificant considering Mega Matrix distributed juts 66 Genesis alBots to early reservation holders according to its H1 2022 financial report (page 21 here). In addition, the official Telegram channel has just 36 members while the official Discord server has only 51 members and there are barely any messages.

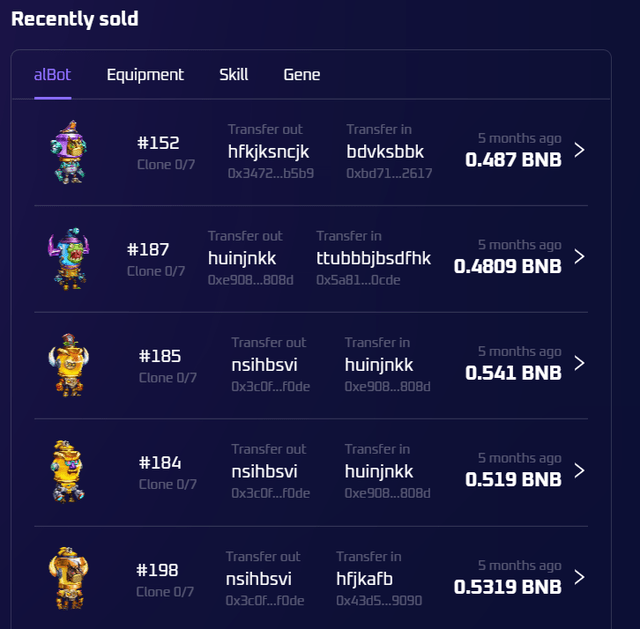

Turning our attention to the marketplace for Mano NFTs on alSpace, we can see that several bots were sold for 10 Binance Coins (BNB-USD) each around 7 months ago, but prices started dropping soon after and the last transaction was at just 0.487 Binance Coins about 5 months ago. Some equipment NFTs also changed ownership but the latest deal there was 4 months ago.

Mega Matrix

Considering that alSpace has also been inactive on twitter since early July, Mano looks like an abandoned project at the moment.

Mega Matrix earns revenue from Mano in three ways:

1) fees for resetting the energy of bots

2) transaction fee for each purchase of virtual equipment and tools from the online store.

3) synthesis fees for each time a player clones or converts bots

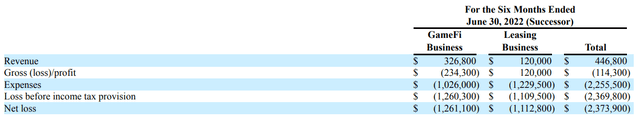

In H1 2022, the company generated revenues of $326,800 but just $3,200 of that amount come from Q2 as it seems interest in Mano became almost non-existent shortly after the game’s launch at the end of March. Considering there have been no transactions on the NFT marketplace for 4 months now, I expect Q3 revenues to be even lower than Q2.

Mega Matrix

Mega Matrix

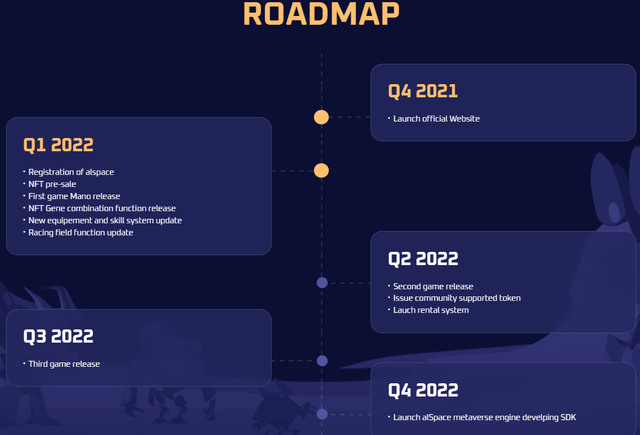

Mega Matrix was planning to release two more NFT games in 2022 but there have been no updates about that, and I think it’s likely the plans were scrapped considering how poorly Mano is performing. As operating expenses are above $1 million per quarter, the situation is dire.

Mega Matrix

Turning our attention to the balance sheet, Mega Matrix had $3.97 million in cash and cash equivalents at the end of June. In October, the company completed a $4.4 million private placement at $1.00 per share so it’s unlikely to run into liquidity issues anytime soon.

In light of the company’s recent woes and the fact the private placement was carried out at just $1.00 per share, I find it surprising that the share price has doubled since mid August and stands at $2.23 as of the time of writing. So, what is the reason behind this rapid increase in the market valuation? Well, I don’t really know. It certainly doesn’t seem like Mega Matrix is a meme stock as it’s barely being mentioned on platforms like twitter, reddit, or StockTwits at the moment. It doesn’t appear to be a short squeeze either as data from Fintel shows that the short interest is just 0.67% of the float and it takes less than a day to cover.

Overall, I think that the fundamentals of the business look underwhelming and that the share price should return to around $1.00 sooner rather than later. Considering the short borrow fee rate stands at just 6.52% as of the time of writing, opening a short position is tempting. However, this could be dangerous as there are no options available to hedge the risk at the moment.

Looking at the risks for the bear case, I think that the major one is that the share prices of microcap companies can increase for spurious and unknown reasons, and it seems this is happening with this one at the moment. It seems impossible to predict when the market valuation of Mega Matrix will stop rising.

Investor takeaway

Mano is currently the only NFT game in the alSpace metaverse universe and all signs point to a severe lack of interest from players. Mega Matrix has been inactive on social media for a few months now and the last transaction on the alSpace marketplace was 4 months ago. The revenues of Mega Matrix dropped to just $3,200 in Q2 and Q3 is likely to be even worse.

In my view, the fundamentals of the business look bad, and the share price should return to about $1.00 sooner or later. The short borrow fee rate is relatively low but considering there are no put options and a clear catalyst that could push down the market valuation, I rate Mega Matrix as a speculative sell. Risk-averse investors could be better off staying away from this stock.

Be the first to comment