MagicVova/iStock Editorial via Getty Images

Note: Amounts are in CAD unless otherwise stated.

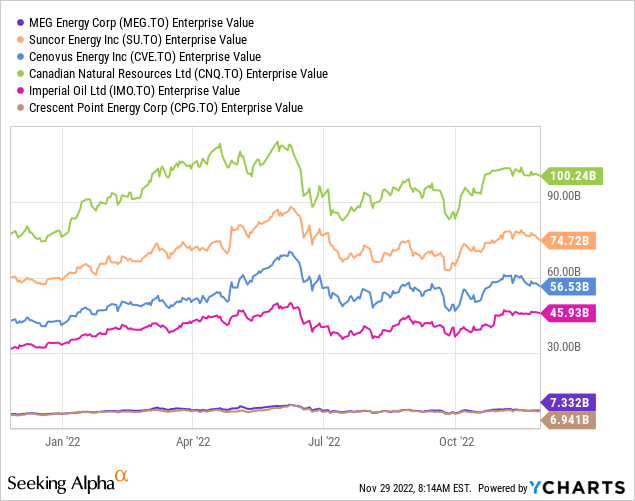

MEG Energy Corporation (TSX:MEG:CA) (OTCPK:MEGEF) is an oil sands company focused on in-situ (bitumen) development and production in the southern Athabasca region of Alberta, Canada. The company looks relatively tiny compared to the other oil sands focused giants like Suncor Energy Inc. (SU), Imperial Oil Limited (IMO), Cenovus Energy Inc. (CVE) and Canadian Natural Resources Limited (CNQ). It sports an enterprise value of just $7.3 billion, which is actually about in line with mid-cap E&P Canadian companies like Crescent Point Energy Corporation (CPG) and Whitecap Resources Inc. (OTCPK:SPGYF).

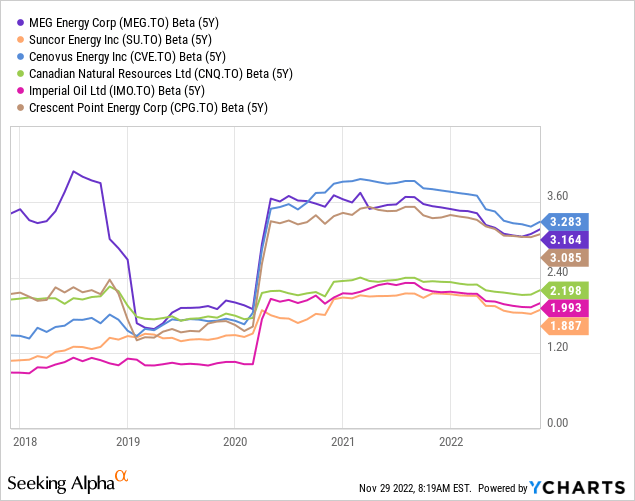

It also lacks refinery assets like three out of the top four and has historically been the most volatile of all of these companies. The trailing 5 year beta shows that even Pre-COVID-19, MEG shares were not for weak stomached mortals.

The purpose of this article is to tell you why that realized beta is now going to be a thing of the past and why MEG should offer some great risk-adjusted returns going forward.

The MEG Of Christmas Past

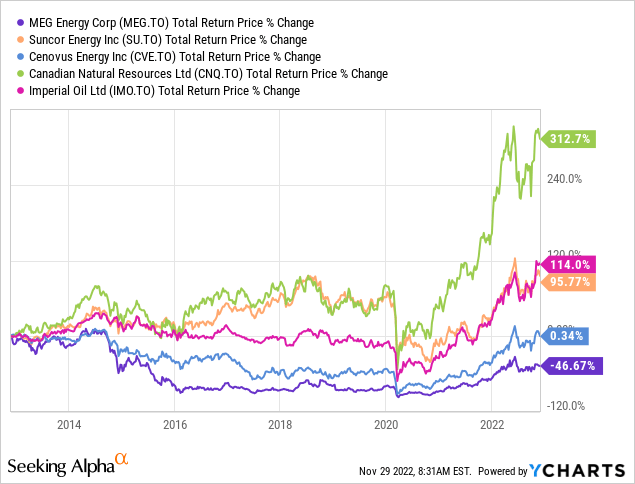

The biggest reason to own MEG has always been the large reserves in place. 2P reserves of 55 years, alongside a very modest market capitalization, has always attracted speculation during up-cycles. Unfortunately, MEG has not been able to convert those reserves into shareholder returns. With 10-year total returns of negative 46.67%, it’s easy to dismiss the company as a failed strategy.

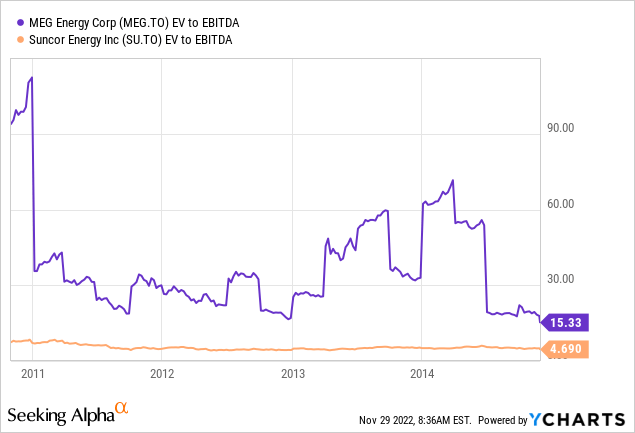

There were three reasons for this. The first being the lack of refinery exposure made MEG far more vulnerable to oil price swings as it could never pick up any extra margins downstream. It also made the company extremely vulnerable to WCS-WTI (Western Canada Select-West Texas Intermediate) spread swings. The second reason was that the company sported an extremely huge multiple at the start of this timeframe. You can see below in the 2010-2014 timeframe. MEG was very richly valued compared to all its peers (only Suncor shown).

The final reason was that MEG was built for $80/barrel oil. It carried extraordinarily large debt in relation to its cash flow and that large debt only made sense if you expected a floor of $80-$100/barrel. This makes sense if you examine the commentary in 2013-2014 where every investor was convinced that $80 USD/barrel would be a floor and OPEC would defend it at all costs. Reality was of course far uglier, and we saw $26 USD/barrel in 2016. MEG’s debt load weighed on it hard during low price points. In 2018 for example, it carried $3.6 billion in net debt at year end, producing just $543 million of EBITDA and conducting $620 million of capex. Those are scary numbers considering that they happened with $65 USD/barrel WTI prices.

Current Setup

You tend always get warm fuzzy feelings when you go through any investor presentation and MEG is no different. The company’s first slide brings into focus the 1.0X Debt to EBITDA at $50 USD/barrel.

MEG Energy Presentation

1.0X Debt to EBITDA at $50 USD/Barrel? From a company that ran 6.6X in 2018 at even higher prices? The good news for investors is that MEG is not just invoking warm fuzzy feelings but actually delivering on this promise. In fact, the company already had got the idea correct way back in 2019 when it reduced debt by about $0.5 billion. COVID-19 unfortunately threw a wrench in the works, but it actually managed to deleverage even further in 2020 albeit marginally. Net debt dropped by $0.5 billion in 2021 and 2022 should see a whopping $1.0 billion drop.

Why You Should Be Positive On MEG

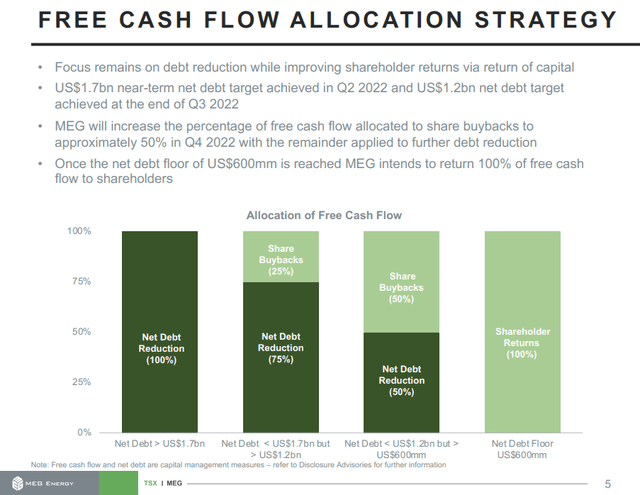

MEG has started balancing debt reduction with share buybacks. So far in 2022, these have been modest as in the first half it was still over the $1.7 billion net debt mark.

MEG Energy Presentation

MEG’s recently released budget confirmed that there was no change to the plan. The company plans to spend about $450 million in 2023. While that number was a 20% increase over the expected final numbers for 2022, keep in mind that MEG will be delivering an approximate 10% increase in production growth. Like all companies, MEG is experiencing high inflation and supply chain constraints. These account for about 7% of the total budget increase. All in all, MEG is controlling costs best it can, while delivering solid growth.

Valuation and Verdict

MEG is not extraordinarily cheap if you apply the current EV to EBITDA multiples. On 2023 numbers we’re looking at 5.0X EV to EBITDA if you assume about $70/barrel oil. That falls to about 4.3X if you raise your projections to $80/barrel. These are of course, far cheaper than the broader market, but at present very few believe that oil and gas should command greater multiples. This disdain works in your favor as the buybacks tend to create far more value at lower multiples. At $80/barrel we would see about $850 million of free cash flow and that’s a 15% free cash flow yield. Of course, only half will flow back to you in terms of buybacks, but the debt reduction journey is necessary and will pay dividends down the line. MEG also has relatively limited projects for expanding production. This also gives it few choices to take on ambitious projects. It also lacks the size to buy any other major players. This makes MEG one of the best setups for investors looking for a pure crude oil proxy with low to moderate risk. As investors continue to see capital discipline and lowered volatility, we believe multiples are likely to expand to perhaps 6X EV to EBITDA within two years. While that may not get MEG back to its 2014 multiples, it would spell an upside of 60% from here over the next two years adjusting for debt reduction and buybacks. We rate the shares as a buy, while noting that its complete lack of hedges will likely make it more volatile than the average oil company.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment