PeopleImages/iStock via Getty Images

In my 15 August article “3 Stocks for Income and Growth Investors“, I covered Medifast (NYSE:MED) to some extent, focusing on its role as an Income Compounder. This article is a deep dive into the company, warts and all.

This article is written in four parts. Under “Preamble”, I discuss 5 possible reasons that attracted many different types of investors to Medifast. Then in part 2, I used Chuck Akre’s “3-legged stool” investment framework to evaluate MED to determine if it can pass the stringent standards of this successful value investor. Part 3 is a discussion on the issues – both potential as well as real ones – facing the companies that are depressing the stock price. And finally, I conclude with my take on MED while laying out the concerns that have depressed the stock price.

I understand that the commission for contractors of various MLM companies is always an issue that comes up. I have been corresponding with the media person from MED head office to get more information. I will also be speaking to a MED Coach in a few days to find out more. Updates will be made in the comments section when/if they are available.

Part 1: Preamble

What draws investors to Medifast, this small $1.3 billion market cap company? Isn’t it just a company selling weight-loss products?

5 reasons why investors of different stripes and colours flock to MED.

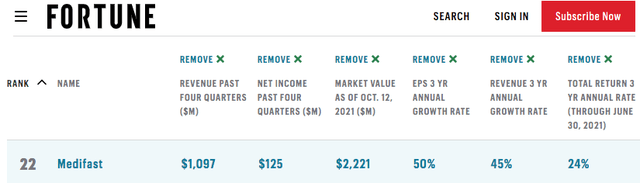

1a. Perhaps MED’s recognition as a Fortune 100 Fastest-Growing Companies three years in a row from 2019 to 2021 played a part.

Growth investors with a healthy risk appetite would have studied this list from Fortune every year to scour for investment candidates, and if a company manages to stay on it three years in a row (like MED), and even reached the 2nd ranked position in 2020, that would make anyone’s head turn.

Fortune 100 Fastest Growing Companies 2021 (Fortune)

Note: MED was ranked 2nd in 2020, and 34 in 2019.

1b. Perhaps MED’s recognition by Forbes played a role too.

It won other accolades over the years as well. In February 2022, Forbes recognised MED as “one of America’s best mid-sized companies“, ranking 23rd out of 100. That is a move up from their 18th ranked spot in Forbes “America’s 100 best small companies“.

Despite operating in an industry full of companies of dubious repute and headline grabbing litigations (think Herbalife), MED has been recognised among the “100 most trustworthy companies in America” list on Forbes for two consecutive years.

2. Perhaps MED almost always appears when growth investors screened for fast-growing companies.

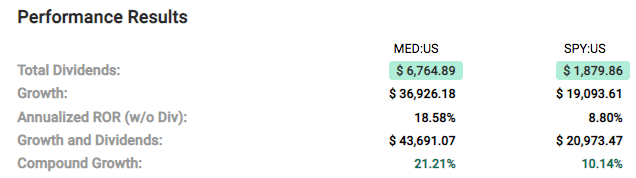

Looking at the past 7-8 years’ performance, MED’s 18.58% annualized rate of return crushed S&P 500’s 8.8%. And that is before accounting for dividends.

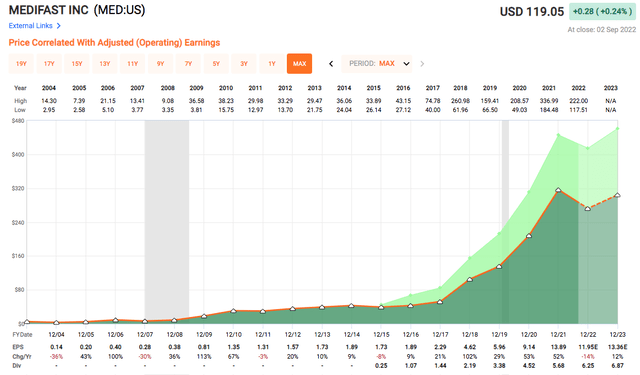

F.A.S.T. Graph (MED)

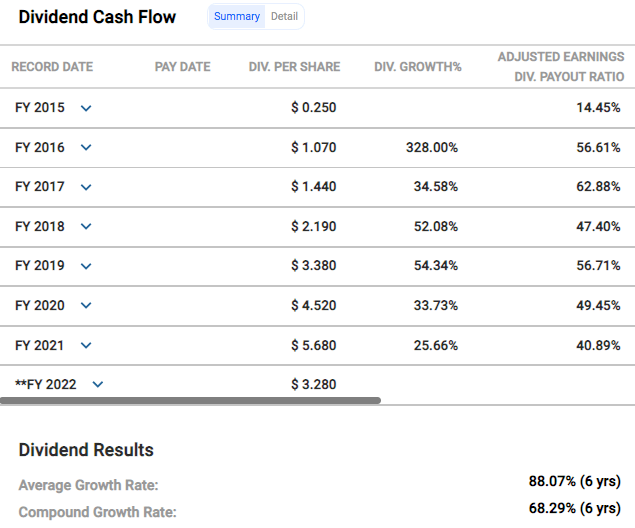

3. Perhaps MED appears when dividend-growth investors screen for companies increasing dividends at a high rate.

Since MED instituted dividends in 2015, the dividend growth rate has been astounding. The dividend compound annual growth rate has been 68.29%. Yet, the dividend payout ratio remained at a healthy 40-60% for the most part. The dividend growth rate has declined but that is to be expected, and so long as it remains in the double-digit range, MED will continue to pop up when dividend growth investors hunt for dividend compounders.

F.A.S.T. Graph (MED)

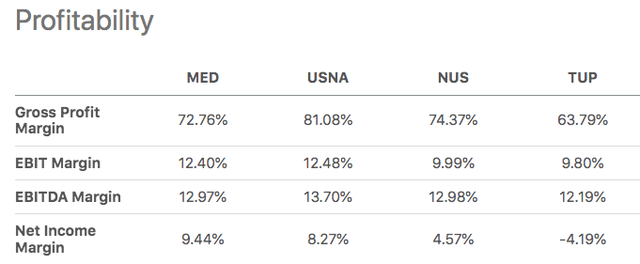

4. MED appeals to growth-oriented investors who are also looking for profitable businesses.

2022 has been brutal for investors, especially growth investors. The time of investing in companies that can boast of revenue growth but has no clear path to profitability is over (for now). MED is a business with high gross profit margins and compared to other companies with the direct-sales model, it boasts of the highest net income margin.

Seeking Alpha (Profitability comparison)

MED has generated positive adjusted operating earnings for the past 20 years, even through the Great Recession.

Medifast positive earnings for 20 years (F.A.S.T. Graphs)

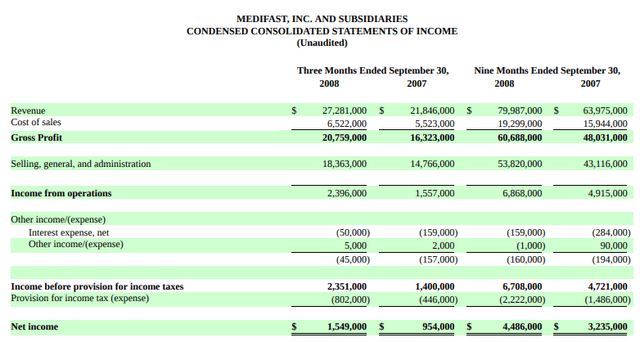

How would MED perform in a high inflationary environment like now? There is no way to know for sure. In the company’s history of submitting SEC filings, from 1996 to 2021 (excluding 2022), the year with the highest inflation rate was 2008 at 4.38%. And MED was still very profitable. As you can see from the consolidated statement of income below, net income increased 62% from September 2007 to the same period in 2008.

5. Perhaps MED appeals to investors seeking hypergrowth in businesses that they can understand easily.

Harvard Business Review first coined the term “hypergrowth“. According to Forbes, a company is described as “hypergrowth” when its compound annual growth rate (CAGR) exceeds 40%. As you have probably guessed, such hypergrowth companies are usually found in the technology sector. Not all tech-related companies are hypergrowth. They are unlikely to be found in the likes of legacy tech companies like INTC (1.16% growth in the past 5-years), Cisco (6.67%), and SAP (7.09%). Even the past 5-years growth rates of respectable mature tech companies like MSFT (24.54%) and AAPL (23.53%) do not qualify them as “hypergrowth“.

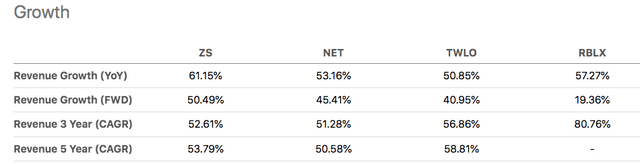

“Hypergrowth” will be better represented by companies like Zscaler (NASDAQ: ZS), Cloudflare (NASDAQ: NET), Twilio (TWLO) and Roblox (NYSE: RBLX), all with past 3-year revenue growth at CAGR exceeding 50%.

Comparing Growth (Seeking Alpha)

However, these companies are not easy for the average retail investor, especially older souls like me, to understand. Terms often used to describe and compare hypergrowth companies such as SaaS, cloud, ARR, MRR, NRR, GRR, churn rates, CLV, rule of 40, etc. are not used to describe more traditional brick-and-mortar companies. I am more used to studying price-to-earnings, price-to-book, you?

In the immortal words of Peter Lynch at the National Press Club in 1994,

“I made money in Dunkin Donuts; I can understand it… I made 10 to 15 times my money in Dunkin Donuts. If you don’t understand it, it doesn’t work. This is the single biggest principle”.

Therefore, when a company that basically sells meal replacements (a gross oversimplification of the business model, I know) comes along with hypergrowth-like characteristics (see table below), this category of investors naturally takes notice.

MED’s CAGR (Data from F.A.S.T. Graphs)

In the next leg (pun intended) of this article, I will examine MED through Chuck Akre’s “three-legged stool” investment framework.

Part 2: The Three-legged Stool

Chuck Akre is the Chief Executive Officer and Chief Investment Officer of Akre Capital Management, an asset management firm with more than $15 billion under management. He may not be a household name like Warren Buffett but his investment success is undeniable. His Akre Focus Fund (the retail class) has achieved an annualized return of 16.72% since its inception in August 2009. The fund’s return easily outpaces the 14.14% annual gain of the S&P 500 over the same time frame. Put differently, a $10,000 investment in his fund in 2009 would have quadrupled in 9 years and become a 10-bagger in 15 years.

Chuck describes his investment framework in this way:

This metaphoric three-legged stool describes what we look for in an investment:

(1) extraordinary business,

(2) talented management and

(3) great reinvestment opportunities and histories.

Through Chuck’s lens, I shall examine the quality of MED’s business, the management, and the reinvestment opportunities, and peel back the fundamentals in greater detail. To ensure that I do not misunderstand Chuck, I will be quoting him extensively to better understand how this successful investor explains his three-legged stool. My thanks to this website MasterInvest for collating Chuck’s quotes.

My focus will also be from the years 2016 onwards because that is the period helmed by the current CEO and Chairman Dan Chard and his refreshed management team.

Leg Number 1: Extraordinary Business

What does Chuck consider to be an extraordinary business? He considers business quality from the perspective of

A) book value growth

B) rate of return

C) return on equity

D) paying a below-average multiple drives long-term returns

Let’s look at each of these 4 qualities in turn.

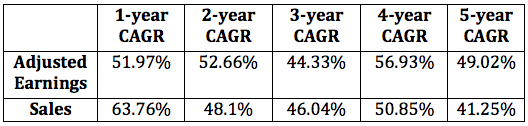

A) Book Value Growth

I became the best student of Buffett I could and first bought Berkshire Hathaway shares when it had a $100 million market cap. From that happy experience, it became clear to me that the best way to see if a business is adding shareholder value is by the growth in its book value per share.

Book Value (Author’s with data from Morningstar)

MED’s book value (total assets – total liabilities) has increased from $2 million in 2012 to $104 million in 2019 (pre-pandemic). The pandemic fueled demand for MED’s products and services and boosted book value in 2020 and 2021 to $157 million and $202 million respectively, and even into Q1 of 2022. Even after the decline in book value in Q2 2022, that is still higher than any year before 2020.

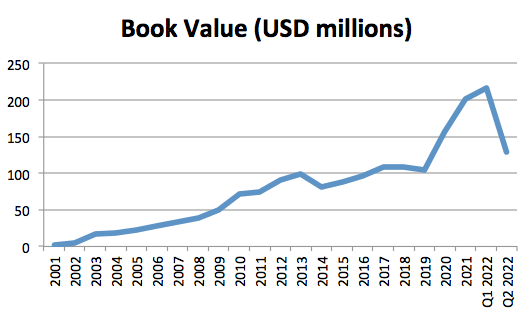

B) Rate of Return

We believe that all investing is ultimately about rate of return.

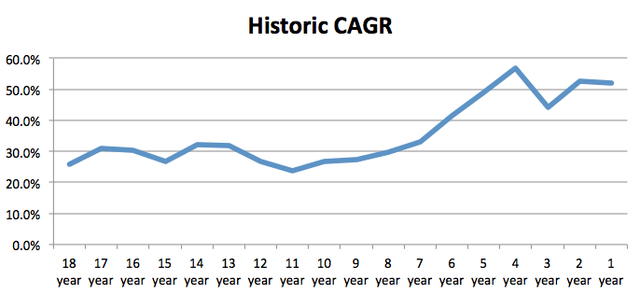

Historic CAGR (Author’s with data from F.A.S.T. Graphs)

MED has a proven track record of consistently generating a CAGR of between 20-30%. In the recent 6 years, CAGR even accelerated to above 40%.

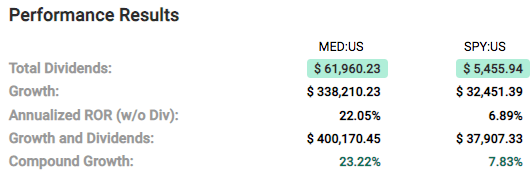

If an investor had invested $10,000 in MED’s shares at its lows in 2004 at $3.52 a piece and held it till today, this will be one happy investor who understood the magic of compounding. That $10000 would have turned into $400,170.

Total Returns since 2004 (F.A.S.T. Graphs)

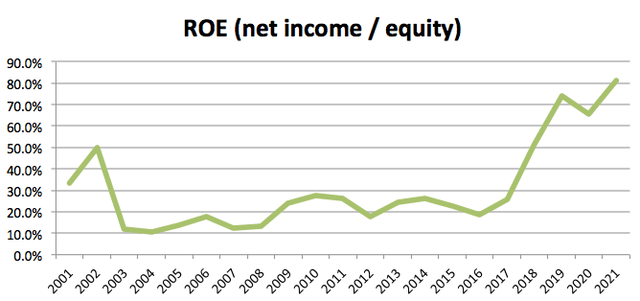

C) Return on Equity (ROE)

Our conclusion is that a stock’s return will approximate the company’s ROE over time, given a constant valuation and absent distributions. So we choose to swim in the pool of companies where the returns are a whole lot better than average, in the 20% range.

From 2003 to 2008, ROE was in a decent range of 11.8% to 17.9%. From 2009 to 2017, ROE improved dramatically to an average of 23.7%. And from 2018 to 2021, the period under the current management, ROE averaged 68.1%. Clearly, MED met Chuck’s 20% ROE benchmark more than adequately.

D) Paying Below Average Multiple drives return long-term returns

If we buy companies in which shareholders’ capital compounds at a 20% rate of return over a reasonable time period and we pay a below-average multiple for it, our investors will do extremely well.

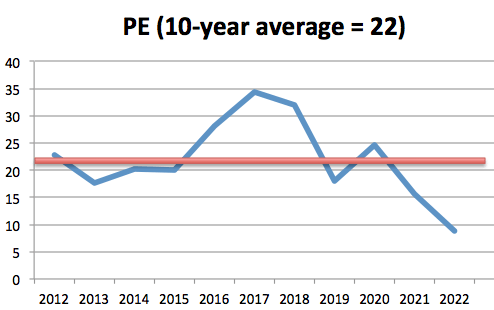

PE 2012 – 2022 (Author’s)

Having established that MED has had a consistently high CAGR for the past 20 years, let’s look at its PE. MED’s past 10-year PE averaged around 22. As of close on 2 September 2022, it is trading at a PE of 8.83. The last time it ever traded that low valuation was probably in the throes of the Great Recession in March 2009 at a PE of 8.83. I think it is a fair statement to say that the current valuation of MED from a PE perspective is very compelling.

Leg Number 2: Talented Management

Although the focus is on the management team, I will devote some focus on the CEO with the understanding that the CEO sets the tone, culture, and direction of the company.

A) How has management treated shareholders?

B) How is the CEO treating his employees and coaches?

C) Are his interests aligned with shareholders?

D) How is he paid, compared to other companies in the same industry?

A) How has management treated shareholders?

We’re looking for managers who have demonstrated they are ‘killers’ at business execution, and who have a history of always acting in the best interests of all shareholders.

We can see shareholder-friendly practices in 4 ways.

1. The Company has a clear dividend policy

Although management has not explicitly stated the exact percentage of earnings that it intends to pay out to shareholders every year, since that first dividend payout in 2015, management has been consistently returning 40-60% of earnings per year to shareholders. The company has been issuing a quarterly dividend of $1.64 per share for the past 2 quarters, and if the company maintains that it will be paying a total of $6.56 per share by Q4 of 2022. And if the adjusted earnings per share come to analysts’ consensus estimate of $11.95, that means MED would have returned 54.9% of earnings to shareholders this year, well within the 40-60% range in the past.

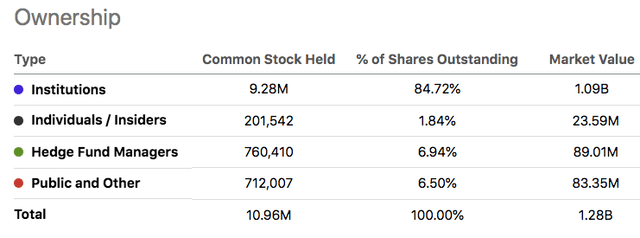

2. Management has some skin in the game

I would hope to see more than the 1.84% ownership from insiders but it is something. And the CEO just bought some shares recently.

3. Management has been communicating honestly

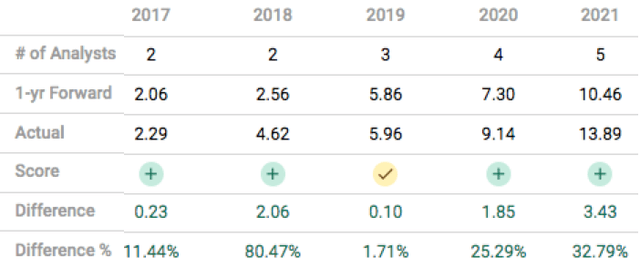

During conference calls, top management shared openly about their successes and struggles and spoke candidly with analysts. The current management has been giving conservative and reasonable guidance for analysts to model. As a result, MED has been able to not just meet earnings expectations but has beaten them 80% of the time for the past 5 years.

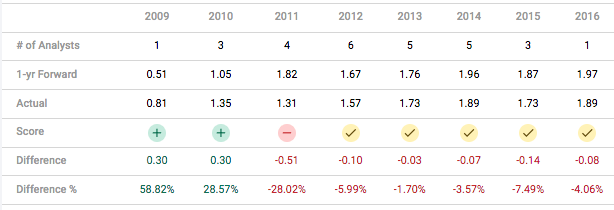

Earnings Expectations (F.A.S.T. Graphs)

That kind of record has not always been the case with MED’s management. Prior to the joining of the current CEO in October 2016, the company missed earnings expectations most of the time.

Earnings Expectations (F.A.S.T. Graphs)

4. CEO Quality and Management Quality

And all the above lead us to the leadership at MED, specifically the CEO Daniel Chard. An Investors.com article gave a glowing review of this CEO. As investors, we should be more critical and dig deeper.

He has relevant industry experience and is well-regarded in his company

Mr. Chard has served as the Chief Executive Officer of the Company since October 2016. Prior to joining the Company, Daniel served as President and Chief Operating Officer at PartyLite, a portfolio company of The Carlyle Group, from October 2015 to October 2016. He also served as the President, Global Sales & Operations at Nu Skin Enterprises, Inc. (Nu Skin) from February 2006 to September 2015, and as President of Nu Skin Europe from July 2004 to January 2006. He certainly has relevant industry experience as well as experience in managing operations internationally (more on this later).

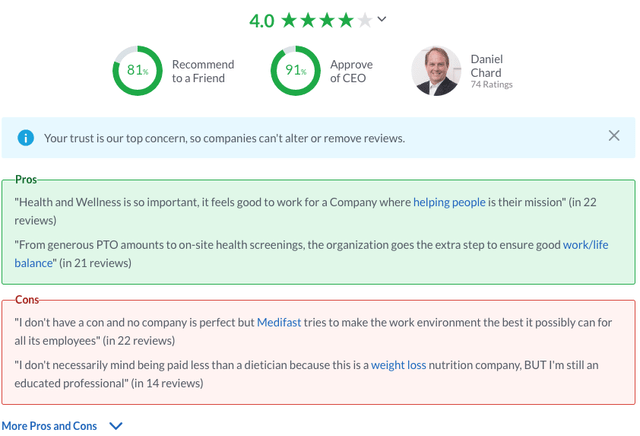

His employees seem to have good things to say about him, giving him 91% approval as a CEO.

He is well-respected by his subordinates

Other than the experienced CEO, there is also a refreshed management team in place. This management team has experienced industry veterans who worked in either MNCs like Johnson and Johnson or in the direct-sales industry like Amway and Nuskin.

New Management (Medifast Website)

More importantly, most of his management team is new. Other than Jason Groves, everyone else joined the management team after the CEO Danial Chard joined. That is significant to me as it points to the CEO’s efforts to start afresh with a team that is not held back by past MED’s baggage or practices be it good or bad.

B) How is the CEO treating his employees and coaches?

I’m not interested, for example, in CEO’s who appear personally greedy. I frequently ask CEOs how they measure success. They often speak about meeting the needs of their various constituencies, including shareholders, employees, customers and the community. Many have said they measure their success by the rise in the share price. The closer they get to saying they measure success by growth in the company’s real economic value per share, the more interested I am.

MED pays Coaches well

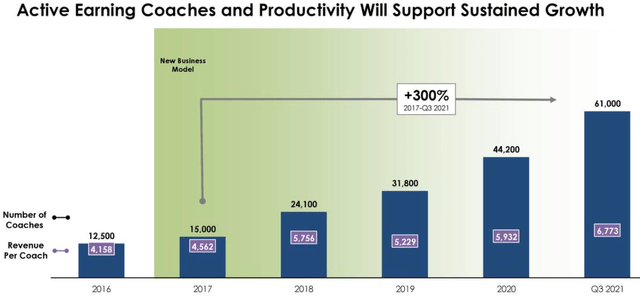

Under the leadership of the CEO from 2017, MED’s coaches have been getting paid more every year. According to the Q4 2021 Investor Presentation slide below, as of Q3 2021, MED’s coaches in 2021 are earning 62% more than they did in 2016. With 5 times as many coaches now than in 2016, that means MED has been paying increasingly more to an increasing number of coaches. In other words, MED has been investing heavily in its coaches.

MED’s Coaches’ Compensation (Q4 2021 Presentation)

In the latest earnings call, the CEO stressed the continued increase in coaches’ compensation:

Second quarter results were strong with revenue up 15% to $453 million, another company record, driven by continued growth in the number of OPTAVIA Coaches. Active earning coach numbers reached 68,000 in the second quarter, a 14.9% increase versus a year ago, and up 6.4% sequentially from the first quarter of 2022. Revenue per active earning coach, which is a measure of productivity of coaches supporting customer’s was $6,667, slightly above levels in the prior year period and up 2% sequentially.

The CFO Jim Maloney added:

Non-GAAP adjusted SG&A increased $31 million to $263.3 million, and non-GAAP adjusted SG&A as a percent of revenue decreased 84 basis points year-over-year, to 58.1%. The increase in non-GAAP SG&A was primarily due to higher OPTAVIA Coach compensation expense, incremental costs related to the continued investment in information technology and distribution, and increased credit card fees resulting from higher sales.

Paying more to reduce coach churn and to attract new coaches may hurt the balance sheet in the short term but it generates value in the long term. That to me is really strategic and necessary. Strategic because coaches drive revenue, and the more coaches MED recruit, the more sales is generated, and greater profits. Necessary because if the coaches are serious about making a decent amount from this side hustle, MED better pay more than other MLM operators. This is a very competitive industry and when word gets around that MED pays better, guess what? More coaches join MED.

C) Are his interests aligned with shareholders?

We look for managers who are owners, and who have always acted in the best interest of ALL shareholders. This leg is the trickiest: our experience shows us that we must follow what these managers have actually done, rather than what it is that they have said they have done. (You know, just the reverse of our parents’ admonition: “do as I say, not as I do”).

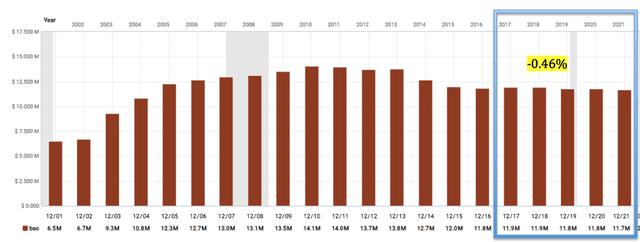

Unlike the previous management that either diluted shareholders from 2001 to 2010 by more than 100%, or spent money on share buybacks from 2012 to 2016 barely moved the ROIC (it was 18% in 2012 and 19% in 2016), the current management team only did share buyback strategically, like when the stock price was hit by a short report in September 2018 and crashed 50% over the next three months. Management took this chance and reduced the share count from 11.95 million in September 2018 to 11.62 million by December 2019. It also started buying back shares from June 2021 when MED’s share price started its slide, reducing the share count from 11.8 million to 11.35 million by June 2022. As a result, the share count decreased by 0.46% from 2017 to 2021.

Shares Outstanding (F.A.S.T. Graphs)

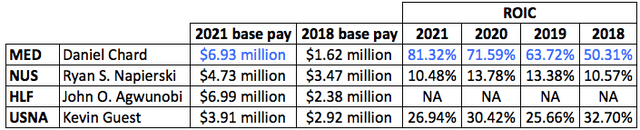

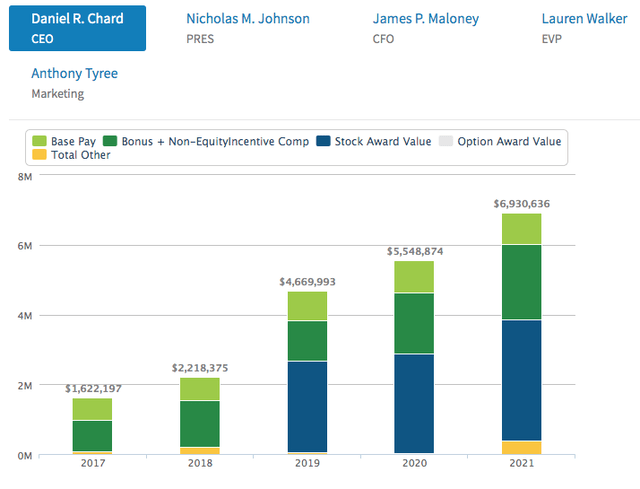

D) How is he paid, compared to other CEOs in the same industry?

A company’s shareholders are often anonymous to its managers. Do managers nonetheless feel an obligation to treat those shareholders fairly? A close reading of the proxy statement can be instructive. We look at both the size of the pay packages as well as the incentives that trigger cash and equity bonuses. We love to find managers that have “skin in the game” through outright ownership of common stock. – Chris Cerrone, Akre Capital Management

CEO Daniel Chard is paid well, the second highest in this group of CEOs in the same industry.

Author’s (Data from Morningstar)

However, it is interesting to note two things.

One, his base salary in 2018, slightly over a year after he was hired, was the lowest among all these CEOs at $1.62 million.

Two, MED’s return on invested capital greatly outclassed the other 3 companies. I use ROIC to compare them because it determines how efficiently a company puts the capital under its control toward profitable investments or projects as ROIC gives a sense of how well a company is using the money it has raised externally to generate returns.

And from the CEO’s pay structure below, you will see that half of his pay (dark blue) comprise of stock award. He has to meet certain conditions before he can benefit from these and this bizjournal article explains some aspects of those conditions.

CEO Daniel Pay Structure (salary.com)

Next, we look at the final leg – how have management allocated resources to maximize returns.

Leg Number 3: Great Reinvestment Opportunities

Does the company have the capital-allocation skills necessary and the market potential to invest all the excess cash generated by the business in projects that can earn above-average returns? In my experience this is perhaps the single most important issue facing any CEO, and is also the area in which management can create or destroy value most quickly and permanently.

I have already mentioned the allocation of more money towards coaches’ compensation is a strategic and necessary move. Resources were also spent to strengthen product knowledge and coaching methods through the annual convention.

Previous CEOs never did spend any money on R&D. Under Daniel’s leadership, MED started investing in Research and Development. Just in May 2022, MED opened a new product innovation centre so it can “integrate state-of-the-art office, lab and pilot plant spaces and enhances research and development, packaging engineering, quality assurance and food regulatory efforts“.

Part of the R&D spend includes funding efficacy studies done by third-party researchers. A skeptical reader may be tempted to dismiss the positive results from the study since the research was funded by Medifast. I see this as a chicken-and-egg situation. Who else other than Medifast would want to fund research into the efficacy of OPTAVIA® 5&1 Plan® or Medifast® 4&2&1 self-guided plan?

MED also invested in digital technology, developing the OPTAVIA app (which targets clients and features Lean And Green Recipes, self-service options related to OPTAVIA premier orders and returns and other key information to stay engaged) and the Connect app (which is for coaches on the go who needs data and insights to help them manage their business efficiently).

MED invested in physical infrastructure like fulfillment centers and expanded manufacturing capacity to better manage product shortages caused by supply chain issues.

Part 3: Issues that may or may not blow up

Wonderful businesses do not come cheap when they are flawless and problem-free. It is only when trouble hits or threatens to hit the fan that stocks price plunge into value territory. Fear, uncertainty, and doubt will create opportunities, and MED is facing both potential issues that could materialize or real issues that could worsen. You have to decide if these uncertainties will be resolved amicably or blow up in shareholders’ faces.

Possible issues that could materialize

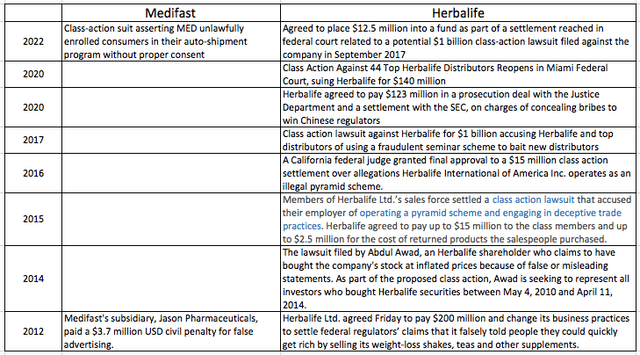

- MED is lumped in together with companies with poor reputation like Herbalife (NYSE: HLF).

- MED was hit by a short report by Gotham in 2018 that caused its share price to plunge by 63% over a 14-month period. That could very well happen again. The high amount of short interest (8.92%) is evident.

- Business Opportunity Rule requires sellers of small business opportunities to provide certain written disclosures regarding earning opportunities, references, legal actions, and refund policies at least seven days before any contract for such a business opportunity is signed. Former FTC Commissioner Rohit Chopra noted that the business opportunity rule was originally intended “to ensure that would-be entrepreneurs are not cheated through deceptive earnings claims and other forms of fraud, and it allows the Commission to seek civil penalties, damages, and other relief against violators”. The FTC began its periodic 10-year review of the FTC Business Opportunity Rule in 2021. According to this blogger,

Although the process is just beginning at the FTC, businesses that sell small business opportunities to individuals should be on the lookout for changes to the Business Opportunity Rule coming the near future.

Real Issues that are happening

- Currently, MED is facing a class-action suit asserting that the company has “unlawfully enrolled consumers in their auto-shipment program for weight loss products and services without proper consent to do so”. This lawsuit, if successful, can have a material impact on the company’s top and bottom line, as MED’s business is driven by Optavia Premier, the automatically renewing product subscription program which reportedly accounts for 92 percent of Optavia’s total revenue.

- MED’s products are not exactly mission-critical, life-sustaining kind. It is a direct-to-consumer product that many consider being discretionary, and that is less resilient than a business-to-business-type product like cloud services, payment systems, and freight services.

- And because the products are seen as discretionary, with rampant inflationary fears, MED’s clients definitely would consider cutting down on their renewal of MED’s meal replacements when their subscription ends.

- MED just received an analyst downgrade by Jefferies from a Buy to Hold and a drop in price target from $345 to $150.

- MED announced plans to expand internationally in 2018 and 2019, setting their Asia office in Singapore. However, there was no specific mention of any successes in the international markets in their 2021 and 2022 earning calls.

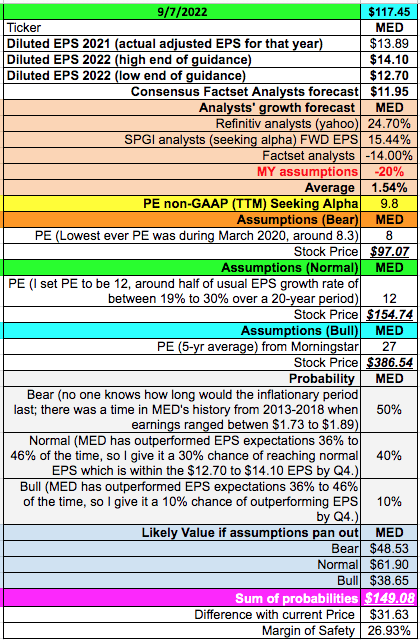

- Management foresees lower customer retention, and a slow-down in sales for the coming quarters, and has lowered its guidance. I discussed that aspect in an article (3 Stocks for Income and Growth Investors) that covered MED. To quote me,

When management projected a lower $12.70 to $14.10 adjusted earnings range, which means management is projected either a best case scenario of 1.5% year-on-year non-GAAP EPS growth ($14.10 – $13.89 = $0.21) or a worse case scenario of 8.57% year-on-year non-GAAP EPS loss ($13.89- 12.70 = $1.19).

That is certainly not the same rosy picture that was painted 2 quarters ago. However, to put matters in perspective, even if earnings come in at the lower end of $12.70, that will still be higher than earnings received in any year from 2020 and prior.

Besides, management has proven itself capable of producing EPS surprises (36%-46% of the time) versus analysts’ 1-yr and 2-yr projections. Put together with the company’s impressive track record since 2005, I have confidence that MED will do well over time.

My Take On Some of these Issues

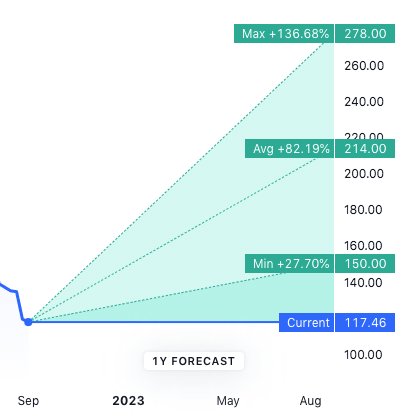

Despite the recent downgrade by the Jefferies analyst, the remaining analysts’ price targets are still quite bullish with the consensus estimate at $214 by the Q3 of 2023.

TradingView Analysts Price Forecast

The class action lawsuit sounds serious. Which does not? However, to my untrained legal eyes, the plaintiffs are suing on technicalities. Some of the stuff that MED is accused of such as pre-selecting the auto-renewal check box is prevalent in so many other cases. And giving subscribers who want the cancel their subscriptions the merry-go-round? That happens all the time in big organizations, and it is called “bureaucracy”. As I do not have legal training whatsoever, please do not take my word for this. What I can say is MED is one of the few companies in this industry that does not face a mountain of lawsuits. To put this into perspective, compare Medifast with Herbalife, and look at both the size of the settlements, the nature and frequency of the lawsuits:

Lawsuits against MED and HLF (Author’s from various websites)

Do be clear that I am not trivializing the lawsuits brought against MED. I am simply putting those in context to better understand the type and severity of these lawsuits.

Part 4: Conclusion

I have a “Strong Buy” call. However, you will need to weigh your risk appetite and make your own decision. MED is not an investment for the faint-hearted. Huge price fluctuation is a normal occurrence for MED. Just take a look at the highest and lowest stock price for each year over the past 10 years.

High and Low Price of MED (F.A.S.T. Graphs)

The Main Reason for Upgrading from Buy to Strong Buy is the larger Margin of Safety

Fundamentally, nothing material changed since my previous article on MED. The only thing that changed is the share price; at the lower price of $117.45 at the time of writing on 7 September 2022, the margin of safety has widened from 8.99% to 26.9% in just 3 weeks, prompting this updated article.

Author’s

The Bullish Thesis is Reinforced Despite Potential and Real Issues

In the short term, stock prices can fluctuate to no end, just like how MED’s stock price has fallen by 64% since it peaked in May 2021. I have no crystal ball and I cannot tell you when will the stock price recover. What I can tell you is I have faith in the current management, and in the strength of the business even after factoring in the lower guidance. That is not blind faith but one that is earned through the turnaround efforts of the CEO and his team. Using Chuck Akre’s investment philosophy to examine MED really helped me to appreciate the strength of its business from the perspective of its extraordinary business, talented management, and great reinvestment opportunities.

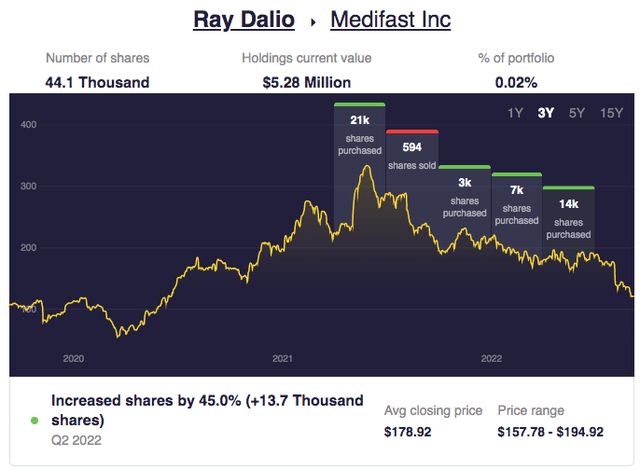

And clearly, I am not the only one to think that MED is deserving of some positive attention. Billionaire investors like Ray Dalio and Ken Griffin both bought more shares of MED in Q1 and Q2 of 2022. Although MED constitutes just a fraction of a percent in these big boys’ portfolios, they must have seen value in MED that others do not.

Ray Dalio buys MED (Stockcircle)

In my opinion, the chance to buy into a quality company that passes Chuck Akre’s 3-legged-stock at a depressed multiple is an opportunity to accumulate shares. Personally, I think that MED will pull through this slump as it has always done so, based on the strength of the business and the quality of the leadership. Earnings are still strong and dividend growth is still in the double digits at a reasonable payout ratio. I think that many of the issues are less severe than they appear; when analysts do not consider some of these issues to be worth asking, it sends a clear message that there are more pressing matters at hand.

Having said that, I will caution that MED is not a buy-and-forget SWAN stock. Investors should keep an eye on the abovementioned issues in Part 3. Also, a thesis-changing event for me will be a management change, namely a CEO change. In the case of MED, the three-legged stool will collapse without the second leg – talented management. Weight-loss management services and meal replacements are a dime a dozen so there is no moat in this business. It is not the kind of “wonderful business that any idiot can run” that Warren Buffett likes. MED’s current management has improved the efficiency of the business. The total asset turnover ratio (how effectively companies are using their assets to generate sales) has increased steadily from 2.3 in 2016 to 4.72 in the last twelve months, more than doubled in 6 years. Net profit margin increased 65% from 6.5% in 2016 to 10.75% in 2021 in spite of spending more money on research and development, coaches, and new production and fulfillment facilities. In comparison (sorry, Herbalife), HLF’s total asset turnover ratio was 1.78 in 2016 and 1.90 in the trailing twelve months, and the net profit margin increased 33% from 5.79% in 2016 to 7.71 in 2021. The above demonstrates the critical importance of having an excellent management team that can allocate capital well in a no-moat business.

Hopefully, the above can help investors interested in MED make a more informed decision.

Be the first to comment