Antonio_Diaz/iStock via Getty Images

Anyone who has ever tried losing weight or getting fit understands that burning unwanted body fat isn’t just about following the right diet, getting sufficient exercise, or changing certain aspects of your lifestyle.

For many people on this journey, long-term success also depends on getting the right support from an experienced and empathetic person who can play the dual role of coach and buddy. This is basically someone who is somewhat of an expert and somewhat of a friend, can hold you accountable, is non-judgmental, and can help you work through the difficult steps of the weight loss journey such as when the initial enthusiasm wanes, discipline falters, or desired results delay after so much effort and sacrifice.

This “buddy system” model of weight loss management is the main idea behind Medifast Inc. (NYSE:MED), the Baltimore, Maryland based company that operates the OPTAVIA health and wellness brand.

The OPTAVIA brand is known for its healthy snacks and its army of independent coaches who provide clients with individual support and guidance through their wellness journey.

According to the company’s description of its business model in recent SEC filings, “OPTAVIA Coaches are independent contractors, not employees, who support customers and market our products and services primarily through word of mouth, email and social media channels such as Facebook, Instagram, Twitter and video conferencing platforms.”

MED’s revenues are primarily derived from sales of its healthy snacks and nutritional products to clients. The company markets the snacks as clinically proven and scientifically developed meal plans, called “Fuelings,” backed by dietitians, scientists and physicians. The products serve as meal replacements for clients trying to manage their weight. Here’s a screenshot of some of these meals on its website.

Some of the meals marketed on the website (OPTAVIA)

While a significant cost to the company, OPTAVIA coaches act as a guerilla salesforce that recruits new customers who buy the meal plans. The coaches help retain these clients as repeat customers by “walking with them” through the journey and offering education and support to build a holistic lifestyle. Many coaches happen to be former customers, with the company putting this figure at around 90% of coaches.

It’s important to clarify that the company sells its meal plans directly to clients and the coaches do not hold or handle inventory at any time. They are, however, key to the sales process and form a key part of the client experience.

MED’s business model depends on the inflows from customers ordering its meal plans exceeding the payout to coaches who get these customers to sign up to the program. The coaches earn a variable income based on successful sales efforts. So far, this business model which is essentially multilevel marketing has been working fairly well. MED is a profitable business that raked in net income of $164 million in FY2021 against revenue of $1.52 billion.

The case of a strong business and weak stock

MED has grown rapidly in the past five years. In FY2017 it had revenues of $300 million vs the $1.52 billion for FY 2021 and the estimated $1.59 billion for FY22.

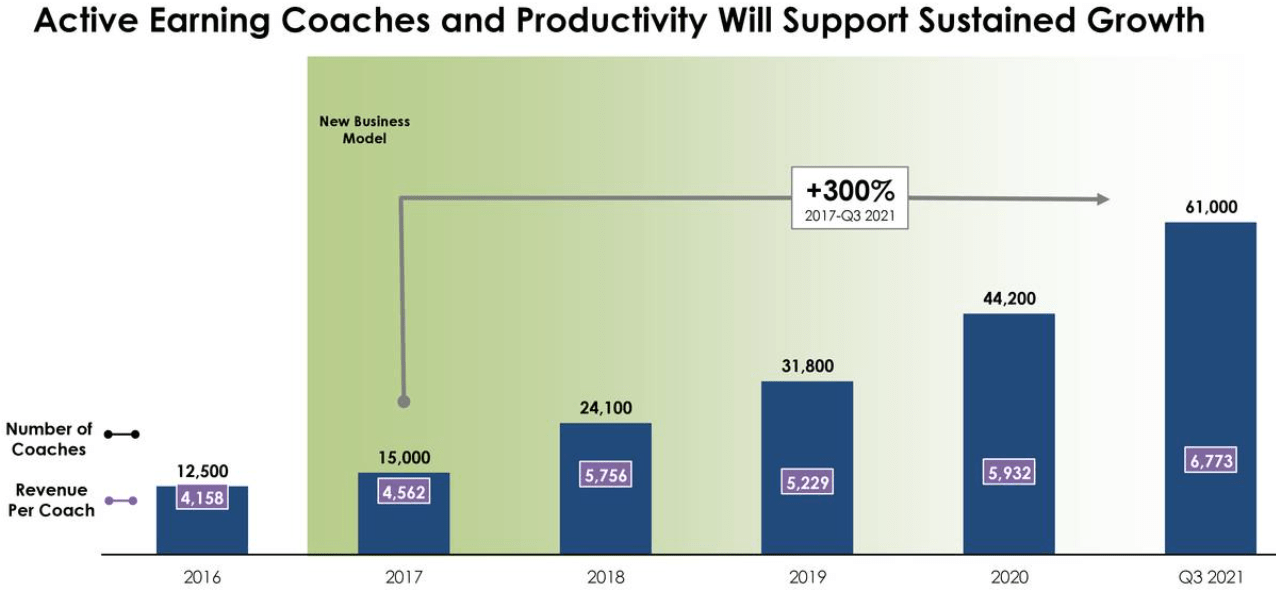

The number of coaches and the revenue per coach has also grown astronomically over this period, as per the screenshot below, which compares the number of coaches and revenue per coach as at Q3 2021 with similar metrics in 2016. The company notes in its latest 10Q that the total number of actively earning coaches increased to 66,200 as at September 30, 2022, an 8% year on year jump and fivefold increase from 2016.

Number of coaches has exploded (Medifast)

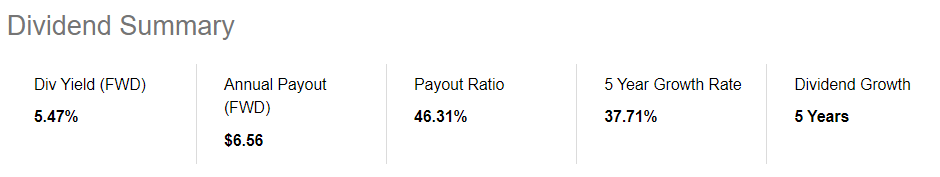

Thanks to its profitable growth, MED has been able to return capital to shareholders through dividends, with payouts growing for five consecutive years.

Seeking Alpha

While the stock had a decent run in 2020 (after Covid) and for much of 2021, reaching a market cap of around $4 billion, it has lost all of the gains from this period and currently trades at a market cap of around $1.3 billion, which is lower than its pre pandemic market cap as the chart below shows.

Current market cap lower than pre pandemic levels (Medifast)

MED is down close to 40% in 2022 against the S&P 500’s 15% decline. Part of the reason for this is that sales growth is cooling off after the strong triple digit growth seen in the past five years. Analysts expect revenues of $1.59 billion for FY22 and $1.60 billion in FY23 vs $1.52 billion in 2021, suggesting growth has plateaued.

MED’s margins are also coming under pressure due to the broader inflationary environment that has impacted cost of raw materials for its nutritional products, with the CEO Daniel Chard noting on the Q3 earnings call that the company is implementing price increases in Q4 to manage this problem. It remains to be seen how this will impact sales and whether volumes will drop. These are some of the fears keeping the stock price low.

Patience will be rewarded

While MED is likely to grow less rapidly in the next two to three years relative to the past five, its stock performance reflects an overly pessimistic picture. Despite slower growth in the short-term, it is in no immediate danger of reversing its strong financial and operational performance.

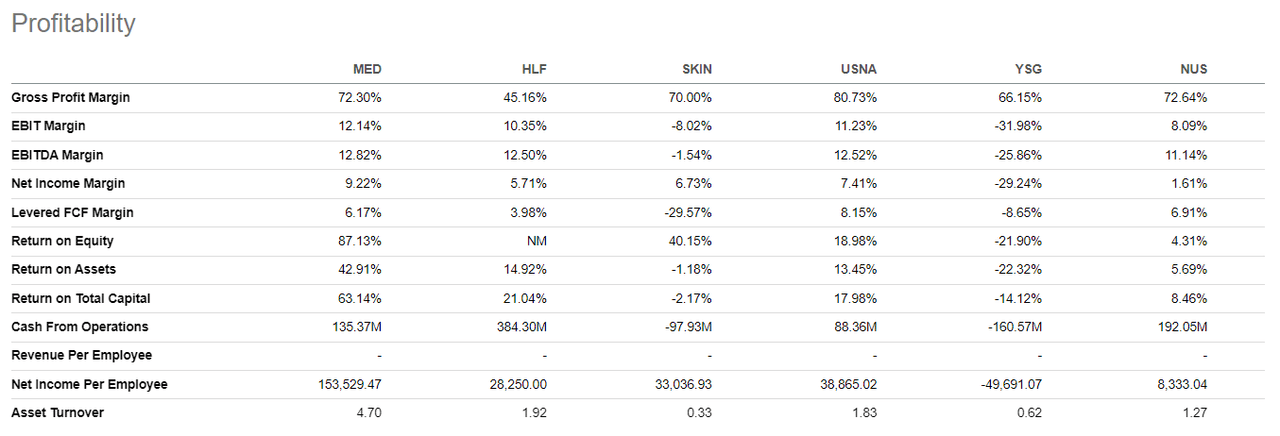

It’s also worth noting that, while margins are coming under pressure, MED still has impressive profitability compared to some of its peers. These include Herbalife Nutrition (HLF) and the Beauty Health Company (SKIN), among others.

MED profitability vs peers (Seeking Alpha)

Importantly, MED has grown responsibly over the past five years. It has not increased leverage recklessly to fund its growth, which is important for an asset light business model where reckless borrowing increases future risk of stock dilution.

The company’s last reported total debt was just $27 million against total cash of $69.7 million. The company has zero accounts receivable as it is a cash business. It also has limited capex needs, though it has been spending money in R&D and in building its digital and ecommerce capabilities. Moreover, the total number of outstanding shares has reduced from 13.8 million shares in 2012 to 10.9 million in 2022, a 21% decline. This, coupled with no debt repayments, has helped boost EPS and dividend per share.

MED’s model of low debt and limited physical assets ensures that most of the excess cash it generates goes towards rewarding investors. It has done a good job in this regard through dividends, with a current payout ratio of 46.31% which is high.

Thanks to the stock’s sharp fall this year, it is cheap compared to historical averages by as much as 60%. Its P/E (‘fwd’) is 9.56x vs a 5 year average of 21.20x while its EV/EBITDA (‘fwd’) is 5.88x vs 5 year average of 13.68x.

These factors make the stock a buy despite the ugly chart and slower short-term business growth that analysts expect for FY23. Investors who patiently accumulate the stock at current levels are getting a great bargain for a compelling business.

Conclusion

There are several downside risks worth mentioning before signing off. The first is that MED is in the multilevel marketing industry, where one controversy is enough to spook investors given the well documented history of MLM companies like Herbalife and many others.

Another risk is key-man risk. CEO Daniel Chard has been largely responsible for the turnaround since 2016 when he joined. If he leaves without grooming a better successor, there could be uncertainty about the company’s future given it has not enjoyed this scale of success since its founding in 1980.

These risks, however, have too many “what ifs” and are not enough to nullify the bull case given how the business has profitably built scale and the fact that it is grossly undervalued. Bullish investors who look past the fears and patiently accumulate the shares are likely to be generously rewarded once this stock falls back in favor. It may be a long waiting game before this happens, but at least you get a dividend yield of above 5% as a reward for your patience.

Be the first to comment