hxdbzxy/iStock via Getty Images

Those who follow my work closely know that I run a very concentrated portfolio. Of the eight firms currently in my portfolio, the biggest pain point has been, by far, Medical Properties Trust (NYSE:MPW), an owner of medical properties that leases them out in exchange for recurring cash flow. Although I am still up for the year at a time when the market is down materially, my overall loss on this particular company so far has been about 31.7%, making a big dent in my returns. Fortunately, I and other investors in the firm are now experiencing a reprieve from some of this pain. After reporting impressive financial data covering the third quarter of its 2022 fiscal year, the company saw a nice surge in price, with shares climbing by almost 7% for the day as of this writing. Given how cheap shares are, I do see further upside around the corner. And as a result, I still feel comfortable with the ‘strong buy’ rating I have on the stock.

Impressive results

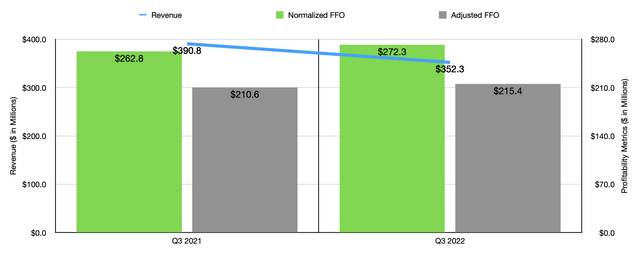

Before the market opened on October 27th, the management team at Medical Properties Trust announced financial results covering the third quarter of the company’s 2022 fiscal year. Compared to what analysts anticipated, headline results were somewhat mixed. For instance, on the positive side, FFO (funds from operations) per share came in at $0.45 on a normalized basis. This fell in line with what analysts anticipated. On top of that, the company also increased guidance for the year for FFO per share of between $1.80 and $1.82. That compares to the prior expected range of between $1.78 and $1.82.

At first glance, this data looks solid. But on the downside, revenue came in lower than expected at $352.3 million. In addition to representing a decline from the $390.8 million reported in the third quarter of 2021, it also missed expectations by almost $36.7 million. There were multiple contributors to this decline. First and foremost, rent billed fell by 4% from $242.2 million to $232.4 million. The largest decline though involved straight-line rent. This number plunged year over year by 58.9%, dropping from $64.6 million to $26.6 million.

Despite this pain, overall results on the bottom line for the company remained strong. Normalized FFO, for instance, went from $262.8 million in the third quarter of 2021 to $272.3 million at the same time this year. And adjusted FFO rose from $201.6 million to $215.4 million. Unfortunately, because the company has not yet released its 10-Q or any other more detailed data, we don’t know what other profitability metrics like operating cash flow and EBITDA were. But more likely than not, they also would have posted an increase during this window of time.

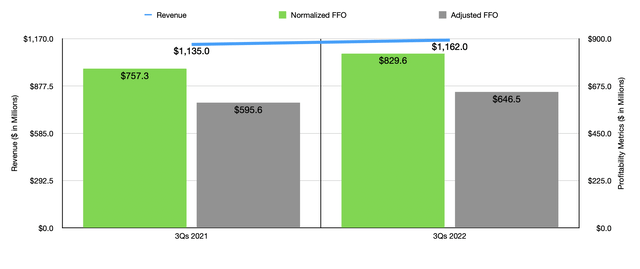

Despite revenue falling in the latest quarter, revenue for the first three quarters of the 2022 fiscal year as a whole is still up year over year, coming in at $1.16 billion. This stacks up favorably against the $1.14 billion reported the same time last year. What profitability metrics we have are also up. For instance, normalized FFO came in at $829.5 million. That’s 9.5% higher than the $757.3 million generated the same time only one year earlier. Meanwhile, adjusted FFO rose from $595.6 million in the first nine months of its 2021 fiscal year to $646.5 million the same time this year. That translates to a year-over-year increase of 8.5%.

Beyond any doubt, it’s important to note the impact that recent portfolio changes likely had on the company. So far in the first three quarters of this year, the company has sourced $1.8 billion in cash from selling off various assets. On top of this, the company is also anticipating another $650 million in proceeds during the 2023 fiscal year from other binding asset sale agreements. So naturally, as the company completes these transactions, investors should expect other volatility on both the top and bottom lines to take place.

In my most recent article about Medical Properties Trust, I pointed out some of the concerns that investors had. One, in particular, involved its relationship with and exposure to Steward. Between a loan the company gave to Steward, the significant amount of rent exposure the firm has to the enterprise, and other factors, and the precarious financial situation that Steward has been interpreted as facing, I understand why the market might be skittish. Having said that, the management team at Medical Properties Trust made some interesting announcements regarding Steward. The biggest of these involved the ability of Steward to complete the accelerated repayment of amounts due related to $450 million in COVID-related funds. On top of that, it also has collected around $70 million of past-due reimbursements. Management then went on to say that with these calf strains now in the past, positive revenue trends, reduced contract labor utilization, and anticipated annual savings related to cost-cutting plans, it now anticipates that Steward will be able to generate positive and sustainable free cash flow moving forward. This should take a significant amount of weight off the shoulders of investors who were worried about it. But of course, only time will tell how accurate this statement is.

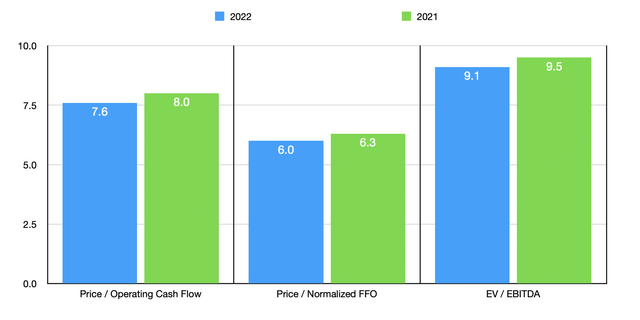

Since we don’t know what the other profitability metrics for Medical Properties Trust look like, we can only guess what the future might hold. Using midpoint guidance for normalized FFO, we end up with normalized FFO this year of $1.09 billion. If we apply the same year-over-year growth rate to other profitability metrics as we would to that, then we would anticipate operating cash flow of $850.9 million and EBITDA of $1.72 billion. Based on these figures, shares of this REIT are trading at a forward price to operating cash flow multiple of 7.6, at a forward price to normalized FFO multiple of 6, and at a forward EV to EBITDA multiple of 9.1. Using instead the data from 2021, we would get multiples of 8, 6.3, and 9.5, respectively.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Medical Properties Trust | 7.6 | 9.1 |

| Healthcare Realty Trust (HR) | 12.3 | 28.2 |

| Omega Healthcare Investors (OHI) | 12.1 | 12.3 |

| Physicians Realty Trust (DOC) | 13.0 | 16.3 |

| Sabra Health Care REIT (SBRA) | 9.0 | 16.8 |

| National Health Investors (NHI) | 13.2 | 19.3 |

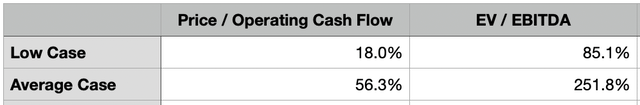

To put in perspective how shares are priced today, I compared two of these three metrics to the metrics of five similar firms. On a price to operating cash flow basis, with these companies ranged from a low of 9 to a high of 13.2. And using the EV to EBITDA approach, the range was between 12.3 and 28.2. Averaging out these figures and assuming that Medical Properties Trust should trade at that average, we would end up with upside potential, using the price to operating cash flow approach, of 56.3%. And when it comes to the EV to EBITDA approach, upside would be 251.8%. If, instead, we were to say that Medical Properties Trust should only trade at a level that matches the cheapest of the five companies, then upside would be between 18% and 85.1%.

Takeaway

Based on all the data provided, it seems to me as though Medical Properties Trust is looking healthier than it has in a while. The risk profile of the company is most certainly improving. On top of that, shares are also trading at incredibly low levels, both on an absolute basis and relative to similar firms. Absent something changing for the worse, I see only upside potential for the company in the long run, enough to warrant a ‘strong buy’ rating on its stock for now.

Be the first to comment