MPW rejected requests for Steward’s 10-K. Instead, they loaned Steward even more money. We’re rejecting MPW. This stock is too dangerous. triocean/iStock via Getty Images

As I’ve often told subscribers, I search for views that contradict my own. Understanding the other side makes it much easier to evaluate the strength of your own argument. Occasionally this process results in writing a “rebuttal” argument where we dismantle a poorly designed thesis.

Note: Those rebuttal articles rarely make it to the public side in full.

However, on rare occasions, we’ve come across an exceptional argument that forces us to reevaluate our entire thesis.

This is one of those rare occasions.

I changed my view from bullish on MPW to bearish.

Rob Simone from Hedgeye has been bearish on Medical Properties Trust (NYSE:MPW) for several months. In a recent Twitter session (two hours before they start to go more off-topic), he expanded on those views. He also provided all of his slides detailing the bearish thesis.

Between the session and the presentation, he provided some powerful claims and backed them up. Congratulations to Rob for changing my mind. It’s rare for me to come across an argument good enough to ditch my prior view.

Clearly an Opinion

To be clear, this article contains my opinion. My opinion should not be viewed as a statement of fact. I could be wrong, despite my best efforts. I sent a longer version of this article on MPW to subscribers on the evening of August 2nd, 2022. Using Eastern time, it was early morning of August 3rd, 2022.

I added a couple of updates for the public release using information from the Q2 2022 earnings. Those updates are included at the bottom of this article.

Steward Exposure: Worse Than It Looked

One particularly powerful claim is that MPW still has not provided the 2021 financial statements for Steward (their largest tenant). This puts MPW in violation of a disclosure rule. Specifically,

SEC Topic 2, Section 2340: Properties Subject to Triple Net Lease.

MPW attempted to avoid this reporting requirement by providing a pro-forma statement for Steward in their 10-k, even though the deal was many months away. This was clearly wrong but could’ve been argued. However, the deal was rejected by the FTC. It never went through. I can see no room for doubt that MPW’s exposure to Steward was high enough to trigger the disclosure rule. The fact that MPW has still chosen not to comply with the SEC rule counts as a huge red flag.

Either management is simply failing in a very easy task OR they believe the consequences of providing the data are worse than any penalties for failing to provide it. That’s a bad sign either way.

The Comparable Stock

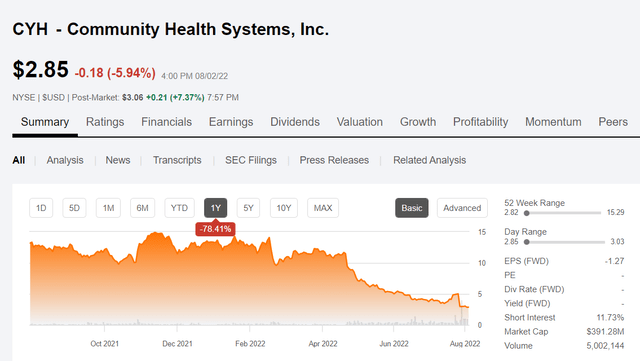

During Rob’s Twitter session, he went on to highlight a comparable for Steward. A company he claims is actually managed better than Steward. Is it actually managed better? I can’t tell for sure yet, but I think it’s quite possible. The problem is that the company is now down about 78% over the last year:

In April, this would’ve only been a minor concern. Community Health (CYH) was still trading over $10. It was down, but it wasn’t really getting wrecked more than the market. However, it has been demolished since then. Based on the performance of CYH, I’m inclined to believe that the hospital operators are in a terrible position.

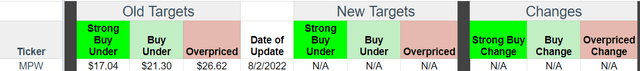

Pulling Targets and Rating, Raising Risk Rating

In my view, MPW is dramatically exposed to Steward.

Steward is their largest tenant, has taken out loans from MPW, and MPW owns some of the equity.

That is 3 different types of exposure and each is significant. That could’ve been overlooked if the tenant was strong. If a REIT had that exposure to Costco, we wouldn’t be concerned. However, given the weak performance of Steward previously, MPW’s refusal to provide the legally required documents, and the collapsing price of CYH, it creates too much downside risk.

If Steward fails, something which seemed far less likely a few months ago, I believe the impact to MPW would be dramatic. If it happened, it could create a permanent loss in shareholder value (and easily trigger a dividend cut).

While most risk factors for MPW would favor a 3.0 or 3.5 risk rating, the combination of signs pointing to a potential Steward failure are too great to ignore.

As of tonight (08/02/2022), MPW no longer has price targets. The risk level at 4.5 is above the level we like to see on long-term investments. I will still be listening to the earnings call and plan to provide at least one additional report on MPW. If MPW dramatically reduces exposure to Steward, there is a possibility of reducing the risk rating and reintroducing targets. Currently, there are plenty of other places to invest.

Alternatives

What could investors own as an alternative to MPW? Three other equity REITs that are at least 10% within our target ranges are Sun Communities (SUI) at $161.87, Terreno (TRNO) at $62.19, and Crown Castle (CCI) at $177.85. Granted, they each have lower dividend yields than the 6.9% on MPW.

If investors are trying to get more dividend yield they could look at DX-C (DX.PC) at $23.42, AGNCP (AGNCP) at $21.96, MFA-C (MFA.PC) at $19.85 or NRZ-C (NRZ.PC) at $20.31. That’s about to be RITM-C (RITM.PC).

What We Want to Hear

The best thing investors could hear tomorrow (this was written 08/02/2022) is that MPW structured a deal to dramatically reduce their exposure to Steward. Anything less would be disappointing in my view. Given the magnitude of this risk, we’re pulling targets from MPW and moving the risk rating from 3.0 to 4.5. This is a very unusual shift in risk ratings. Any shift greater than 0.5 in a single update is unusual. However, the risk factor coming from Steward is too great to ignore. If things play out correctly, MPW has some respectable upside. However, it also has significantly more downside risk than the other equity REITs we cover.

The Lone Bear

In the last 365 days, there has only been one other bearish article on MPW. That article was actually focused on swapping MPW for a different stock based on technical analysis. Consequently, there are zero bearish articles based on MPW’s fundamentals in the last year.

Putting that one article aside, there have been 4 neutral articles, 21 buy ratings, and 14 strong buy ratings. Clearly, I’m going against the crowd.

Updates

After we sent this article to subscribers, the MPW Q2 2022 earnings release and MPW Q2 2022 conference call came out.

Rather than reducing exposure to Steward, MPW provided Steward with another $150 million. That’s the exact opposite of what we wanted to see. Rather than providing transparency about the loan, MPW responded to analyst questions by saying:

It has a nominal and escalating interest rate that would be equivalent to a lease.

And as you know, we don’t disclose specific terms on those.

One reason for curiosity about the loan is because it wasn’t included in the supplemental. It was closed in June, so it should’ve been on there. However, management said:

And it’s not a long-term sustained investment kind of like what’s our bread and butter. That’s really the only reason we didn’t put it on there.

Rather than announcing that they were filing the 10-K for Steward, management stated that they were following the SEC’s rules by not releasing the 10-K. It is my opinion, and the opinion of other analysts, that Steward should be providing that 10-K based on their exposure as of the end of 2021. It is unclear how management came to that interpretation of the rule. The math they used to reach this conclusion was not provided.

The latest earnings release reaffirmed our view that MPW is too dangerous to be a long-term investment and the potential downside risk outweighs potential gains. I have no confidence in MPW after witnessing:

- Management’s decisions to increase loans to Steward.

- The loan being excluded from the supplemental.

- A refusal to provide details about the loan.

- A refusal to provide Steward’s 10-K.

- No math to demonstrate why the 10-K for Steward is not required.

There are much better opportunities for investors.

I went into even greater depth breaking down the Q2 2022 earnings call in a special MPW update for members of The REIT Forum.

Be the first to comment