24K-Production

Thesis

Medical Properties Trust, Inc. (NYSE:MPW) has continued to underperform the broad market, as recent developments over the bankruptcy of its tenant Pipeline Health worsened the fears surrounding the sustainability of its rental base.

Before the recent collapse from its August highs, the market was already concerned with one of its key tenants, Steward. Therefore, we deduce that the market has decided to de-rate MPW significantly to de-risk unknown forward execution risks that could harm its operating performance.

We believe the battering is appropriate, as the market often prices in the worst outcomes in capitulation moves. However, another significant steep selloff occurred after our previous article, sending more investors fleeing in panic.

Our analysis suggests that the recent move has markedly de-risked the current entry levels for investors. Consequently, we assess that the selling downside from the current levels should be well-contained, even though there could still be near-term downside volatility.

Notwithstanding, we explain why we believe the current levels have likely de-risked its tenant risks significantly, even as the Fed continues its aggressive rate hikes, putting further pressure on REITs.

As such, we reiterate our Buy rating on MPW.

MPW’s Valuation Is Now Significantly Undervalued

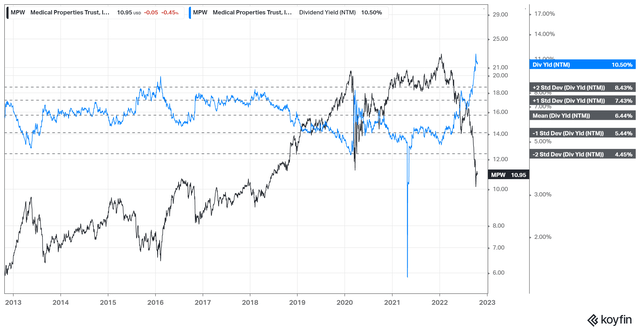

MPW NTM Dividend yields % valuation trend (koyfin)

The recent selloff has sent MPW’s NTM dividend yield of 10.5% surging well above the two standard deviation zone over its 10Y mean of 6.44%. Therefore, we postulate that a significant level of damage has been inflicted on MPW, as the market needed to de-risk further uncertainty over its tenant base.

Furthermore, MPW’s NTM AFFO per share multiple of 7.7x is well below its peers’ mean of 10.6x (according to S&P Cap IQ data), indicating a significant discount to peers.

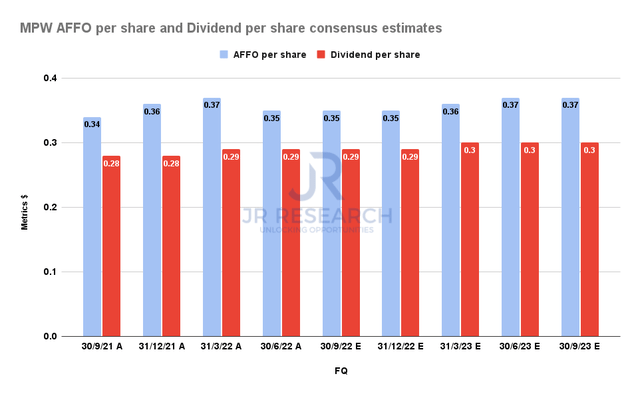

MPW AFFO per share and Dividend per share consensus estimates (S&P Cap IQ)

Despite that, Street analysts are unperturbed by Pipeline Health’s recent bankruptcy filings, as the forward estimates on its AFFO per share and Dividend per share have generally been maintained.

Therefore, we believe some investors could have been stunned by the recent selloff as MPW fell more than 40% from its August highs to its October lows.

Furthermore, MPW had not indicated that Pipeline Health is a critical tenant to watch out for, even though it noted that bankruptcy risks could impact its operating performance. MPW accentuated:

Any adverse result to our tenants (particularly Steward, Circle, Prospect, Swiss Medical Network, and HCA) in regulatory proceedings or financial or operational setbacks may have a material adverse effect on the relevant tenant’s operations and on its ability to make required lease and loan payments to us. Any bankruptcy filings by one of our tenants could bar us from collecting pre-bankruptcy debts from that tenant or their property, unless we receive an order permitting us to do so from the bankruptcy court. We may recover none or substantially less than the full value of any unsecured claims, which would harm our financial condition. (MPW 10-Q)

MPW will be reporting its upcoming FQ3 earnings release on October 27. Therefore, we believe the market likely needed to de-risk MPW’s execution risks heading into its report card. Also, we urge investors to pay attention to management’s commentary and revisions to its AFFO per share guidance.

Is MPW Stock A Buy, Sell, Or Hold?

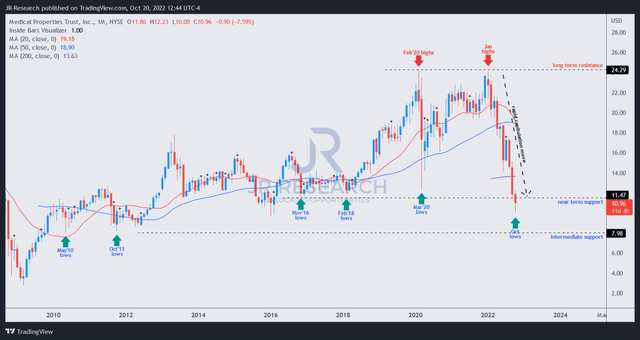

MPW price chart (monthly) (TradingView)

In times like this, investors must remain level-headed when the market goes into a selling frenzy to force capitulation.

We assessed that capitulation was an extension from its June lows on MPW’s long-term chart. As a result, it sent MPW further down to its near-term support, breaking lows last seen all the way back in November 2016.

However, we also gleaned a potentially solid opportunity for a significant mean-reversion move if MPW could form a sustained bullish reversal at the current levels.

Our analysis suggests that the selling downside should subside after taking out those lows, which likely freaked out many investors, given the pace and extent of its decline.

While a potential re-test of its intermediate support (down 30% from the current levels) cannot be ruled out, we believe the current valuations are attractive as MPW seems significantly undervalued.

However, more conservative investors can wait for a validated bullish reversal before adding exposure.

We reiterate our Buy rating on MPW.

Be the first to comment