hxdbzxy

Medical Properties Trust Inc. (NYSE:MPW) has seen what I think is an unfair decrease in its valuation this year. The trust’s stock is down 45%, which, considering the underlying strength of the real estate investment trust’s hospital portfolio, is undeserved.

Now, with MPW dipping yet again, I doubled my investment in Medical Properties since the trust covers its dividend with funds from operations and passive income investors may exaggerate the risks associated with higher interest rates.

Furthermore, MPW’s chart situation has improved lately and the stock’s valuation contains a higher margin of safety.

Stable Hospital Portfolio, Healthcare Expenditures

Medical Properties, as I recently explained, is a compelling value proposition in terms of diversification, dividend pay-out, and yield.

Furthermore, Medical Properties provides inflation protection because its leases include automatic rent escalators, all of which I discussed in my previous article.

Importantly, due to the very strategic direction of its real estate portfolio, I believe Medical Properties’ hospital portfolio is particularly suited to maintain a strong cash flow position and robust dividend coverage during a recession.

Medical Properties had 434 properties in 30 U.S. states and 10 countries, primarily in Europe and Australia, as of September 30, 2022.

Because patients rarely (if ever) adjust their healthcare spending when they require medical assistance, hospital REITs have the potential to provide stable and predictable dividend income to passive income investors during a recession.

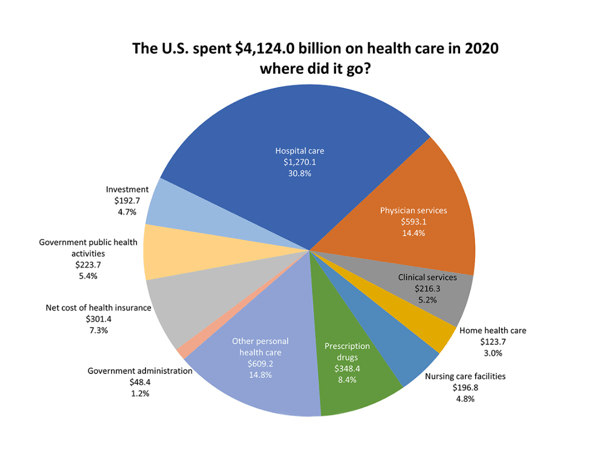

The United States will spend more than $4 trillion on healthcare in 2020, and healthcare spending will only increase as expenditures rise with age. A third of all healthcare spending in the United States is spent solely on hospital care, which is a non-discretionary expense category.

MPW Portfolio Summary (AMA)

Non-discretionary healthcare spending not only stabilizes hospital REITs but also strongly suggests that, even during a recession, Medical Properties will continue to earn a relatively predictable level of funds from operations.

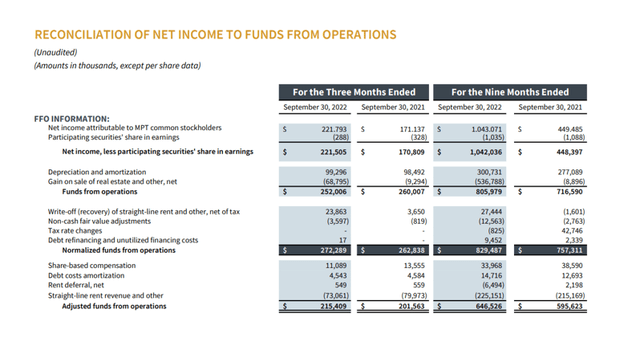

Medical Properties generates approximately $250 million in funds from operations per quarter, the majority of which is distributed to trust shareholders as dividends.

Net Income From FFO (Medical Properties Trust)

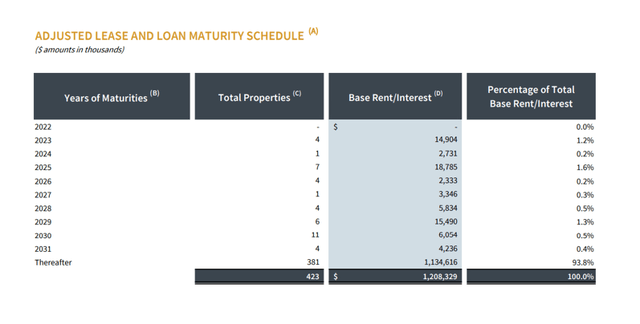

The long-dated nature of the underlying leases, in my opinion, is an undervalued asset in Medical Properties’ portfolio. The trust has a lot of security because the majority of its leases (93.8%) expire after 2031.

Adjusted Lease And Maturity Schedule (Medical Properties Trust)

The Market Potentially Misjudges The Impact Of Higher Interest Rates

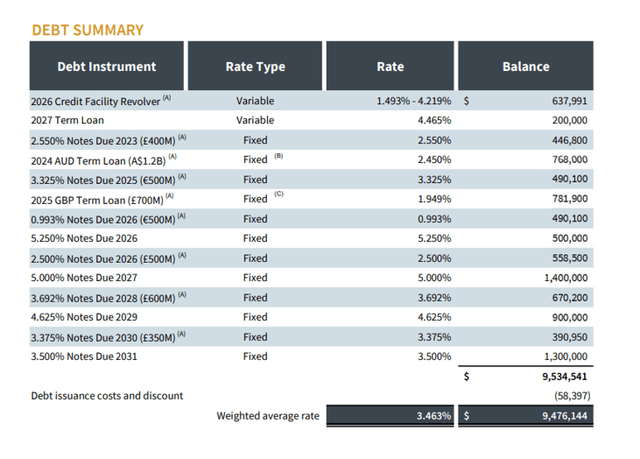

Medical Properties is a well-diversified hospital real estate investment trust with a significant portion of its debt anchored in fixed-rate debt. Only a small portion of the trust’s liability base is subject to floating loan rates (9% or a total of $838 million), shielding the trust from the 2022 interest rate increase.

Debt Summary (Medical Properties Trust)

Guidance And Update Valuation

The trust’s current guidance for 2022 is $1.80 – $1.82 per share in funds from operations. Because MPW has recently returned to $12, the guidance gives Medical Properties a price-to-FFO ratio of 6.6x, implying a very high margin of safety.

MPW’s stock price is expected to rise to $20 in the next 12-24 months, implying a 67% gain and an FFO multiple of 11x. I believe that MPW’s portfolio strength, diversification, and dividend coverage would be fully reflected in the trust’s valuation at this multiple.

MPW: Technical Analysis

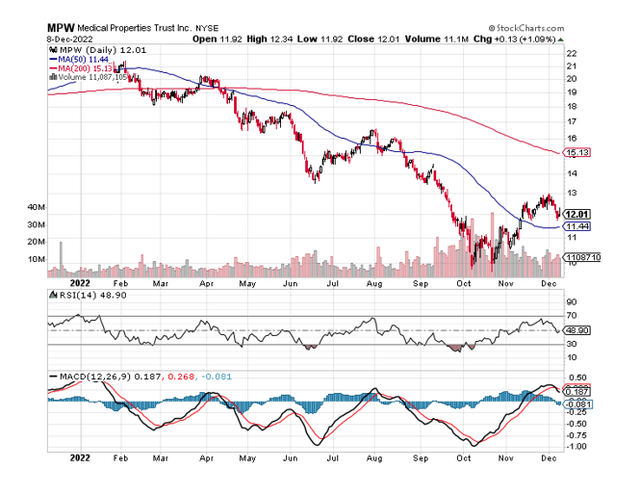

MPW has recently dropped from $13 to $12 as part of a broader market pullback that has extended beyond the (hospital) REIT sector. Having said that, the stock has been in a short-term uptrend since October, when MPW completed a double-bottom formation.

Importantly, from a technical standpoint, MPW recovered its 50-day moving average in November, which is a bullish sign that the stock is regaining strength. This is especially encouraging after MPW recovered from its October lows.

Given the positive chart setup as well as the very attractive FFO valuation, I believe MPW offers investors a significant rebound opportunity from both a fundamental and a chart standpoint.

MPW Share Price (Stockcharts.com)

Why Medical Properties Could See A Lower Valuation

If market weakness persists, Medical Properties may face another valuation cut, but I believe it will be unrelated to the trust’s actual operating performance and potential funds from operations.

Investors may avoid trusts because interest rates are on the rise, but it would be a mistake to believe that Medical Properties’ performance will suffer as a result.

Rising interest rates are unlikely to have a significant impact on hospital REITs with large fixed-rate liability bases, such as MPW.

My Conclusion

On Thursday, I doubled my position in Medical Properties, and this time I did so not because the trust covers its dividend with funds from operations, or because the trust has a diverse real estate portfolio that can be expected to perform reasonably well during a recession, but because investors are underestimating the impact of inflation and rising interest rates on the trust’s performance outlook.

At the risk of repeating myself, the dividend is adequately covered by funds from operations, and the current valuation multiple of 6.6x FFO implies a very high margin of safety.

Furthermore, I believe MPW has the potential to recover significantly over the next 12-24 months, as the chart completed a double-bottom formation in October and successfully recovered the 50-day moving average.

Be the first to comment