LUMIKK555

Introduction

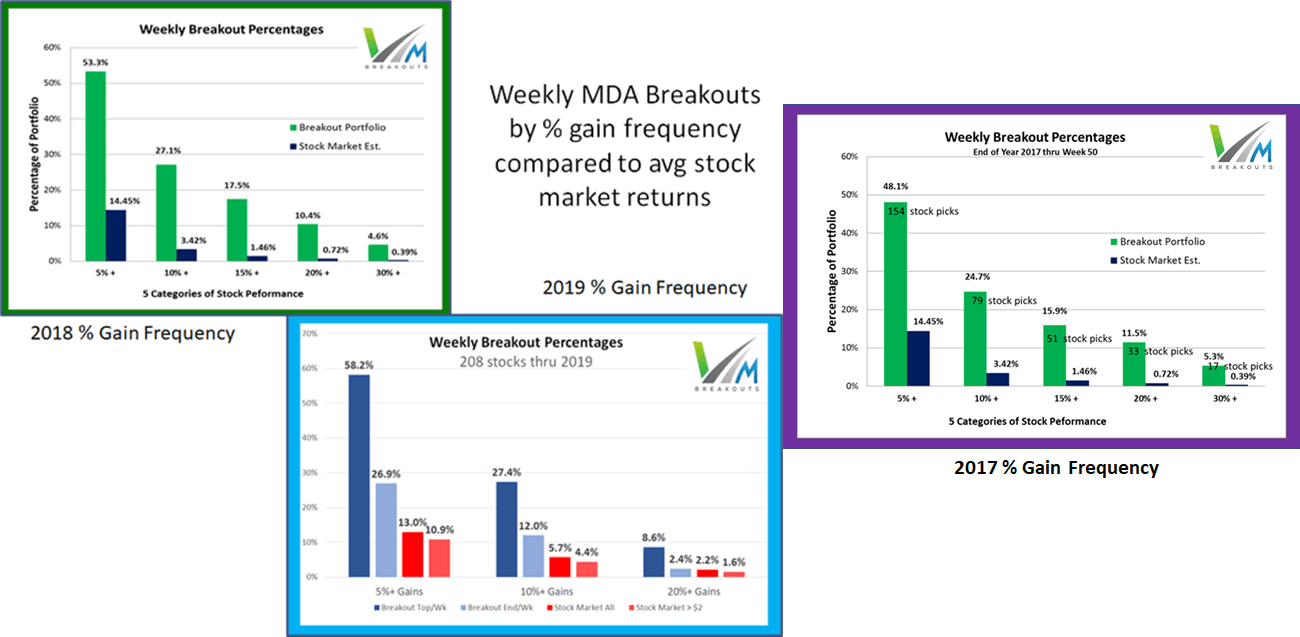

The Weekly Breakout Forecast continues my doctoral research analysis on MDA breakout selections over more than 8 years. This high frequency breakout subset of the different portfolios I regularly analyze has now reached 290 weeks of public selections as part of this ongoing live forward-testing research. The frequency of 10%+ returns in a week is averaging over 4x the broad market averages in the past 5+ years.

In 2017, the sample size began with 12 stocks, then 8 stocks in 2018, and at members’ request since 2020, I now generate only 4 selections each week. In addition, 2 Dow 30 picks are provided using the MDA methodology, but I highly recommend the monthly Growth & Dividend mega cap breakout portfolios if you are looking for larger cap selections beyond only 30 Dow stocks.

2023 Market Outlook

All new portfolio selections for 2023 begin now!! We have reached the end of an extremely difficult trading year that has given all my models their most challenging tests ever. The schedule of reports and forecast article for 2023 are here for your benefit.

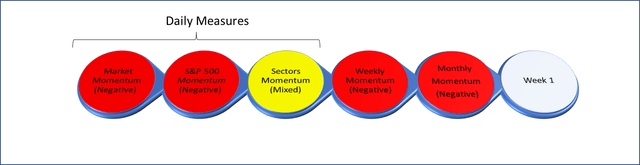

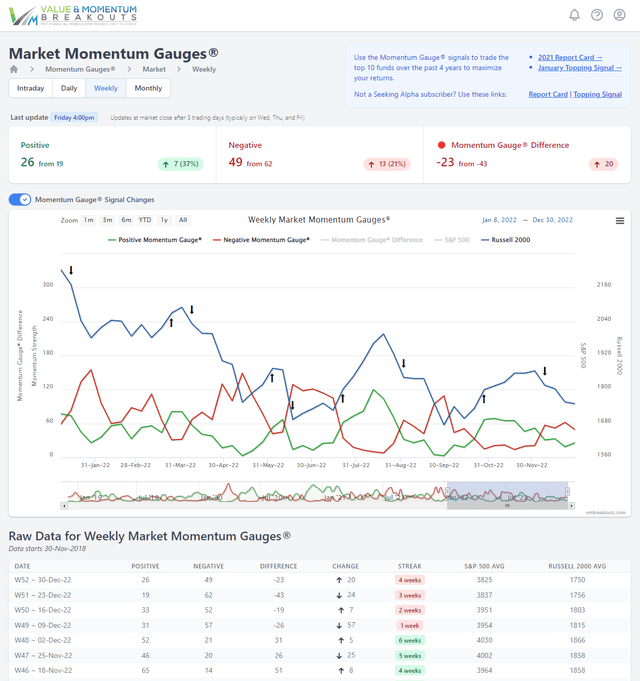

Momentum Gauges® Stoplight ahead of Week 1

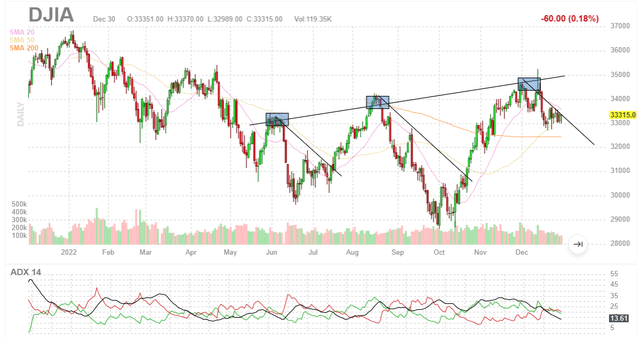

All the Momentum Gauge trackers turned negative starting December 5th ending the longest positive streak in a year. Sectors are mixed but still mostly negative and the gauges continue to signal caution to start the new year.

As a reminder much greater detail is covered live every day in the Chat Rooms with current charts and signals. If you are not reviewing the latest charts and updates you could be missing out.

Weekly Momentum Gauges continue negative for the past 4 weeks after the longest positive signal for 2022 of 6 consecutive weeks.

Current Breakout Returns

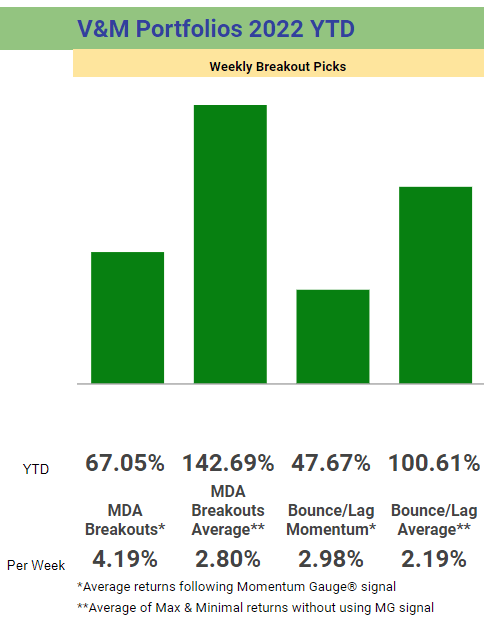

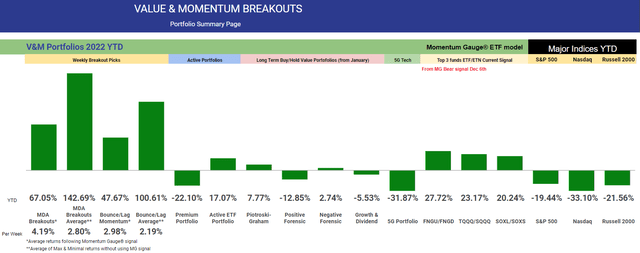

The weekly breakout portfolios are shown below with their final 2022 returns. The ongoing competition between the Bounce/Lag Momentum model (from Prof Grant Henning, PhD Statistics) and MDA Breakout picks (from JD Henning, PhD Finance) are shown with/without using the Momentum Gauge trading signal. The per-week returns equalize the comparison where there was only 16 positive trading weeks this past year using the MDA trading signal (negative values below 40).

VMBreakouts.com

For 2022, there were 125 MDA breakout picks in 52 weeks that beat the S&P 500. 103 picks beat the S&P 500 by over 10%+ in double digits. Final top performing MDA stock picks over 30% for the year:

| Week of Selection | Stock Symbol | Gain from Selection |

| Week 2 | (TDW) | 213.62% |

| Week 10 | (TDW) | 137.90% |

| Week 8 | (WVE) | 131.02% |

| Week 28 | (VRDN) | 126.79% |

| Week 36 | (TUSK) | 101.63% |

| Week 1 | (RES) | 94.96% |

| Week 24 | (ZYXI) | 76.08% |

| Week 31 | (ZYXI) | 68.61% |

| Week 46 | (VIPS) | 56.60% |

| Week 18 | (CLFD) | 52.03% |

| Week 33 | (TGTX) | 49.56% |

| Week 40 | (NUVL) | 46.99% |

| Week 2 | (NE) | 39.51% |

| Week 40 | (ZYME) | 35.28% |

| Week 21 | (COCO) | 32.00% |

| Week 25 | (PDD) | 31.74% |

For 2022, the worst market since 2008: 113 MDA picks gained over 5%, 52 picks over 10%, 22 picks over 15%, and 13 picks over 20% in less than week. These are statistically significant high frequency breakout results despite many shortened holiday weeks.

V&M Multibagger List

Longer term many of these selections join the V&M Multibagger list now at 113 weekly picks with over 100%+ gains, 49 picks over 200%+, 18 picks over 500%+ and 11 picks with over 1000%+ gains since January 2019 such as:

- Celsius Holdings (CELH) +2,113.6%

- Enphase Energy (ENPH) +1815.8%

- Northern Oil and Gas (NOG) +1,054.3%

- Trillium Therapeutics (TRIL) +1008.7%

More than 300 stocks have gained over 10% in a 5-day trading week since this MDA testing began in 2017. Frequency comparison charts are at the end of this article. Readers are cautioned that these are highly volatile stocks that may not be appropriate for achieving your long-term investment goals: How to Achieve Optimal Asset Allocation

Historical Performance Measurements

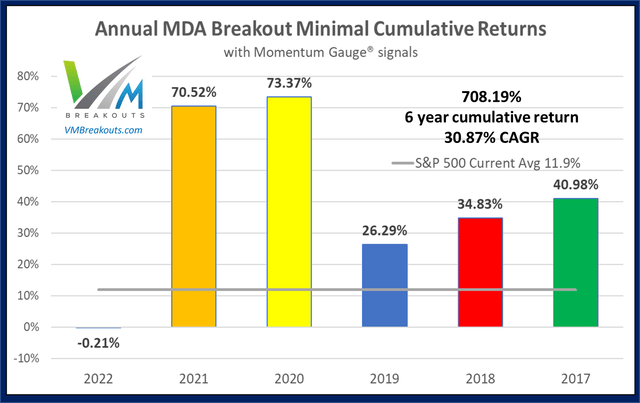

Historical MDA Breakout minimal buy/hold (worst case) returns have a compound average growth rate of 30.87% and cumulative minimum returns of +708.19% from 2017. The minimal cumulative returns for 2022 were -0.21%, average cumulative returns were +67.05%, and the best-case cumulative returns were +360.25%. The chart reflects the most conservative measurements adding each 52 weekly return in an annual portfolio simulation, though each weekly selection could also be compounded weekly.

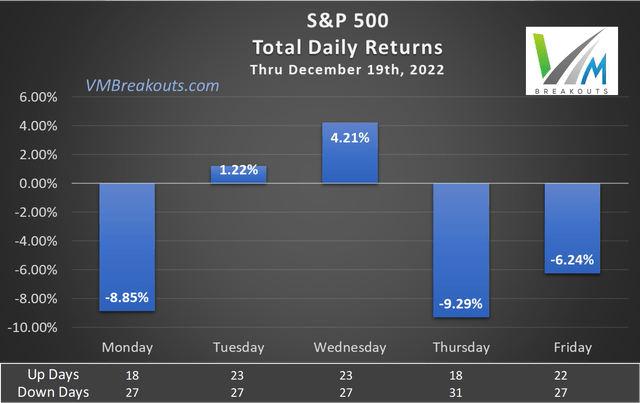

2022 saw the highest volatility levels since the 2008 Financial Crisis with frequent mid-week selloffs from the peak. This was also the first year I can ever remember where every day of the week had more down days than up days. Recognizing these patterns AND following the gauges can greatly enhance your returns above my fixed, equal-weighted, buy/hold measurement without adjusting to adverse stock news or market patterns.

The Week 1 – 2023 Breakout Stocks for next week are:

The picks for next week consist of 1 Energy, 2 Healthcare, and 1 Technology sector stocks. These stocks are measured from release to members in advance every Friday morning near the open for the best gains. Prior selections may be doing well, but for research purposes I deliberately do not duplicate selections from the prior week. These selections are based on MDA characteristics from my research, including strong money flows, positive sentiment, and strong fundamentals — but readers are cautioned to follow the Momentum Gauges® for the best results.

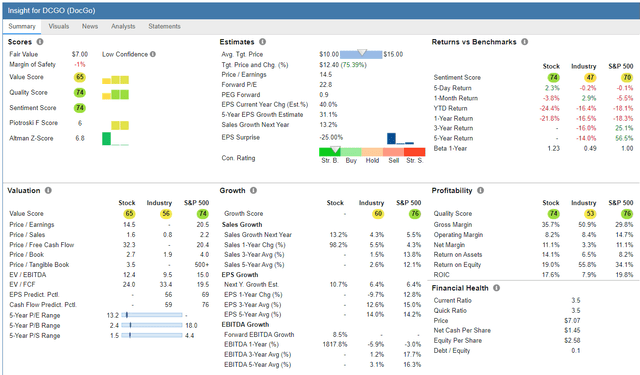

- DocGo Inc. (DCGO) – Healthcare / Medical Care Facilities

- Permian Basin Royalty Trust (PBT) – Energy / Oil & Gas E&P

DocGo Inc. – Healthcare / Medical Care Facilities

FinViz.com

Price Target: $11/share (Analyst Consensus + Technical See my FAQ #20)

(Source: Company Resources)

DocGo, Inc. provides mobile health and medical transportation services for various health care providers in the United States and the United Kingdom. The company’s transportation services include emergency response services; and non-emergency transport services comprise ambulance and wheelchair transportation services.

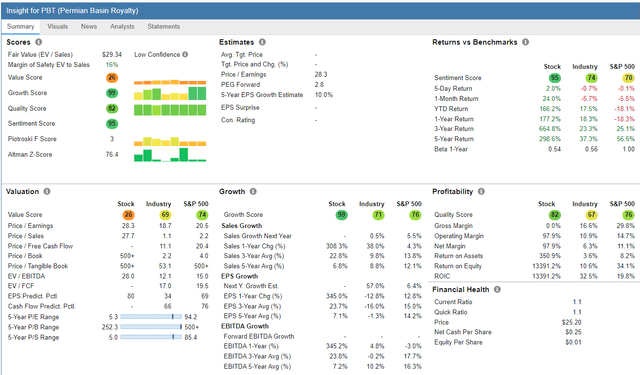

Permian Basin Royalty Trust – Energy / Oil & Gas E&P

FinViz.com

Price Target: $32/share (Analyst Consensus + Technical See my FAQ #20)

(Source: Company Resources)

Permian Basin Royalty Trust, an express trust, holds overriding royalty interests in various oil and gas properties in the United States. The company owns a 75% net overriding royalty interest in the Waddell Ranch properties comprising Dune, Judkins, McKnight, Tubb, Devonian, and Waddell fields located in Crane County, Texas.

Top Dow 30 Stocks to Watch for Week 1

First, be sure to follow the Momentum Gauges® when applying the same MDA breakout model parameters to only 30 stocks on the Dow Index. Second, these selections are made without regard to market cap or the below-average volatility typical of mega-cap stocks that may produce good results relative to other Dow 30 stocks. The most recent picks of weekly Dow selections in pairs for the last 5 weeks:

| Symbol | Company | Current % return from selection Week |

| (CAT) | Caterpillar Inc. | +1.03% |

| (CVX) | Chevron Corporation | +3.28% |

| (BA) | Boeing | +3.13% |

| CAT | Caterpillar Inc. | +2.94% |

| (MCD) | McDonalds | -3.13% |

| (MRK) | Merck & Co. | +1.99% |

| (V) | Visa Inc. | -4.55% |

| MRK | Merck & Co. | +0.83% |

| V | Visa Inc. | -2.82% |

| (VZ) | Verizon | +0.97% |

Technical conditions continue negative for the 30 stocks on the DJIA as all the Momentum Gauges turned negative in December.

If you are looking for a much broader selection of large cap breakout stocks, I recommend these long-term portfolios. The new 2023 selections have been released in the links below to start the New Year:

New 2023 Piotroski-Graham enhanced value –

- July midyear up +5.62%

- 2022 January portfolio beat the S&P 500 by +32.54%

- July midyear down -15.55%

- January 2022 Positive Forensic beat S&P 500 by +6.59%

- July midyear down -29.12%

- January 2022 Negative Forensic beat S&P 500 by +22.18%

Growth & Dividend Mega cap breakouts –

- July midyear up +0.02% (not including high dividends)

- January 2022 portfolio beat S&P 500 by +13.91%

These long-term selections are significantly outperforming many major Hedge Funds and all the hedge fund averages since inception. Consider the actively managed ARK Innovation fund down -66.97% YTD, Tiger Global Management -58% YTD.

The Dow pick for next week is:

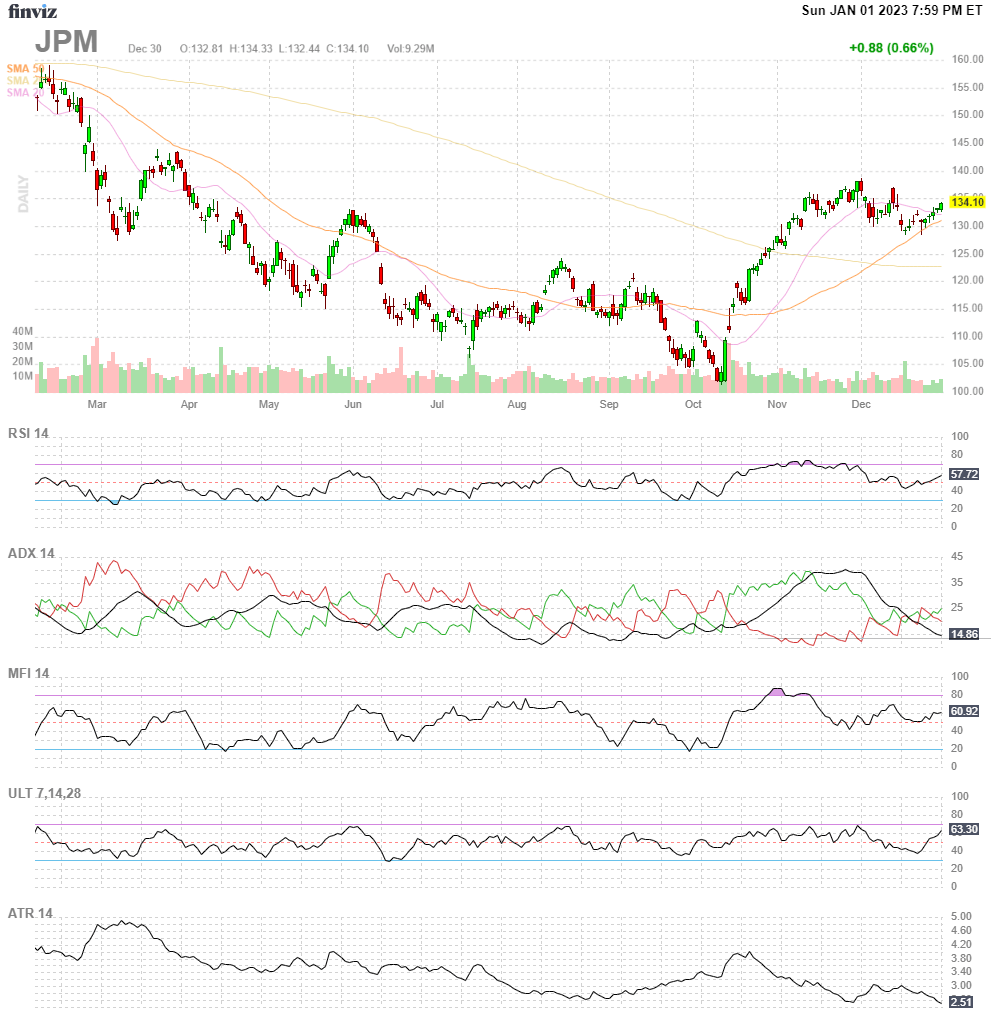

JPMorgan Chase & Co. (JPM)

JPMorgan is in early breakout conditions across all the technical indicators ahead of Q4 earnings January 13th. Net MFI inflows are strong with institutional buying increasing toward a consensus price target around 143/share.

FinViz.com

Background on Momentum Breakout Stocks

As I have documented before from my research over the years, these MDA breakout picks were designed as high frequency gainers.

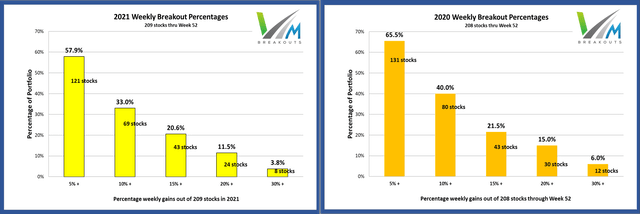

These documented high frequency gains in less than a week continue into 2020 at rates more than four times higher than the average stock market returns against comparable stocks with a minimum $2/share and $100 million market cap. The enhanced gains from further MDA research in 2020 are both larger and more frequent than in previous years in every category. ~ The 2020 MDA Breakout Report Card

The frequency percentages remain very similar to returns documented here on Seeking Alpha since 2017 and at rates that greatly exceed the gains of market returns by 2x and as much as 5x in the case of 5% gains.

VMBreakouts.com

The 2021 and 2020 breakout percentages with 4 stocks selected each week.

MDA selections are restricted to stocks above $2/share, $100M market cap, and greater than 100k avg daily volume. Penny stocks well below these minimum levels have been shown to benefit greatly from the model but introduce much more risk and may be distorted by inflows from readers selecting the same micro-cap stocks.

Conclusion

These stocks continue the live forward-testing of the breakout selection algorithms from my doctoral research with continuous enhancements over prior years. These Weekly Breakout picks consist of the shortest duration picks of seven quantitative models I publish from top financial research that also include one-year buy/hold value stocks. Remember to follow the Momentum Gauges® in your investing decisions for the best results.

All the V&M portfolio models beat the market indices through the worst 6 month start since 1970 and through the worst market year since the 2008 financial crisis. All new portfolios are starting for 2023!!

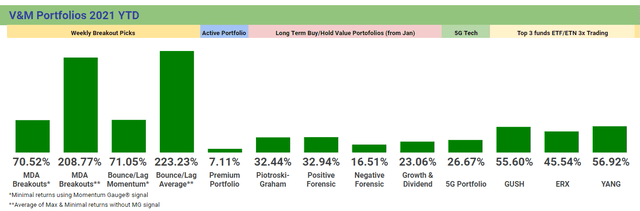

The final 2021 returns for the different portfolio models from January of last year are shown below.

All the very best to you, stay safe and healthy and have a Happy New Year!!

JD Henning, PhD, MBA, CFE, CAMS

Be the first to comment