David Commins

It is certainly not going to be a surprise to anyone reading this that one of the biggest problems facing most Americans today is the pervasive inflation that has been dominating the economy. This has pushed up the cost of living and has been particularly devastating to those on the low end of the economic scale due to the fact that it has been concentrated on food and energy, which are necessities for daily life. This has forced many people to take on second jobs or perform other odd tasks in order to obtain the extra money that they need to cover their bills or other expenses. Others have been forced to rely on debt, with credit card balances increasing by 15% over the past twelve months.

Fortunately, as investors, we have better solutions available to us to obtain the extra money that we need to cover our additional expenses. One of the best of these options is to purchase shares of a closed-end fund that specializes in the generation of income. These funds offer easy access to a professionally-managed portfolio that can, in most cases, deliver a higher yield than pretty much anything else in the market.

In this article, we will discuss the Madison Covered Call & Equity Strategy Fund (NYSE:MCN), which currently yields an attractive 9.24%. I have discussed this fund before but more than a year has passed since that time so obviously, a great many things have changed. This article will therefore focus specifically on those changes as well as provide an updated analysis of the fund’s finances. Therefore, let us continue on and see if this fund could prove to be a good addition to a portfolio today.

About The Fund

According to the fund’s webpage, the Madison Covered Call & Equity Strategy Fund has the stated objective of obtaining a high level of current income and current gains. This is not exactly surprising since the covered call strategy is a commonly used options strategy for investors that are looking for income. The primary objective of the strategy is to have the sold option expire worthless so that the fund can keep the premium. It then writes another option, collects the premium, and then hopes it expires worthless as well. This provides a steady source of income in the form of option premiums.

Of course, the covered call strategy also requires that the fund appropriately choose equity securities to write the options against. It does not provide any specifics about how it chooses these securities, but it does specifically state that it aims to purchase large-cap or mid-cap securities that are reasonably priced given their forward growth rates. This implies that it is using a value investing strategy, but there are certainly some people that would consider a growth stock like Alphabet (GOOG) to be “reasonably priced with respect to its growth rate,” so the fund’s description of its strategy does not really appear to be saying anything. Despite being an income-focused fund, it is not focusing specifically on investing in dividend stocks, as its income is coming from the covered call strategy.

The fact that the fund is using an options strategy is something that may be concerning to some risk-averse investors. After all, we have all heard horror stories about funds blowing themselves up with option strategies. However, the risks of the covered call strategy that is used by this fund are quite minimal. This is because the fund already owns the stocks that the options are being written against. Therefore, the worst-case scenario is that the fund is forced to sell securities that it already owns. If the strategy is executed well, the fund might even be selling the securities at a profit so the worst thing that can happen is that the fund does not get as large of a capital gain as if it had sold the stocks in the open market. The goal, of course, is for the option to expire worthless as this allows the fund to keep the option premium and the stock. Once the option expires worthless, the fund can then sell a new option and collect another premium. It thus acts much like a synthetic dividend payment.

The fund does not have the risks that it would with a naked call option, which could require it to purchase the stock at any price in the market and then sell it to the option buyer at a loss. The covered call strategy is actually a pretty good way to generate a high positive return in flat markets, such as the one that we have today.

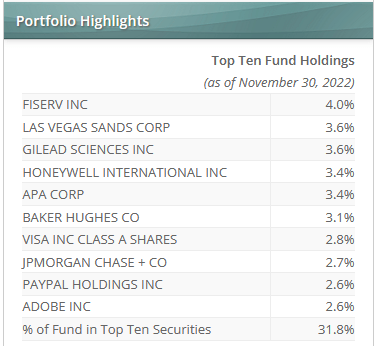

As mentioned earlier, the Madison Covered Call & Equity Strategy Fund’s description implies that it invests mostly in value stocks. This appears to be the case when we look at the largest positions in the fund. Here it is:

Madison Funds

The majority of these are certainly not companies that we would find in most growth funds. With that said, PayPal Holdings (PYPL) and Adobe (ADBE) are arguably not value stocks. However, they also do not have the very expensive valuation of growth stocks like Tesla (TSLA). There were significant changes in the largest positions list over the past year, though. These include the removal of Comcast (CMCSA), CVS Health (CVS), Range Resources (RRC), Baxter International (BAX), T-Mobile US (TMUS), and TJX Holdings (TJX) in favor of Las Vegas Sands (LVS), APA Corp. (APA), Baker Hughes (BKR), Visa Inc. (V), JPMorgan Chase (JPM), and Adobe. It is hard to complain about some of these changes, although I would have preferred to see Range Resources remain instead of the addition of Las Vegas Sands. Considering that most of the inflation has been in energy and food and that many people will opt to heat their homes this winter instead of going on vacation, Range Resources seems like a better company to own in today’s environment.

The fact that such a sizable number of securities were changed compared to what we saw last year would lead one to assume that the fund has a very high turnover rate. This is certainly the case as the Madison Covered Call & Equity Strategy Fund has a 178.00% annual turnover, which is one of the highest turnover rates that I have ever seen with a closed-end fund. The reason that this matters is that trading stocks or other assets costs money, which is then billed to the fund’s shareholders. This creates a drag on the fund’s returns that management needs to work to overcome in addition to their task of delivering a return that satisfies the investors. This is a difficult task to accomplish and it is one of the reasons why most actively-managed funds fail to beat index funds over time. With that said, the management of this fund is not exclusively focusing on total return due to the covered call strategy that provides income. Thus, the investors might accept a slightly lower return here if it results in higher income.

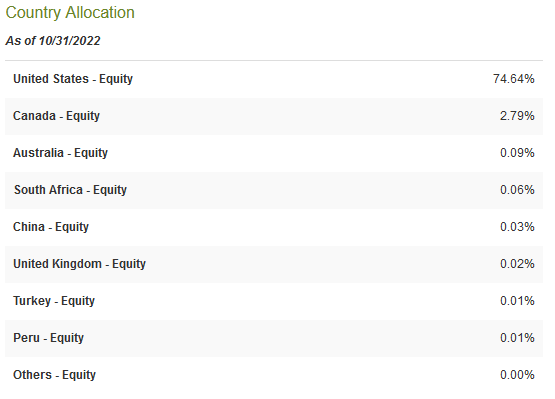

A look at the largest position in the fund may lead one to believe that the fund only invests in American companies. However, this is not actually the case. In fact, only 74.64% of the portfolio is invested in the United States:

CEF Connect

At this point, an eagle-eyed reader might point out this these figures do not total 100%. This is because this chart only considers the securities in the fund. Fully 22.34% of the fund is in cash today, which accounts for the remaining percentage that is missing from the chart above. Despite having some foreign investments, the fund is still very much overweighted to the United States as that country only accounts for a little less than 25% of the global gross domestic product. In addition, we can see that the fund’s exposure to foreign countries is basically negligible. As such, this fund will not help us diversify a portfolio that is otherwise heavily invested in the United States. With that said, it also does not advertise itself as a global fund so we do not expect much in the way of international diversification. Any investor in this fund should ensure that they have enough international diversification across their portfolio from other sources before buying into this fund.

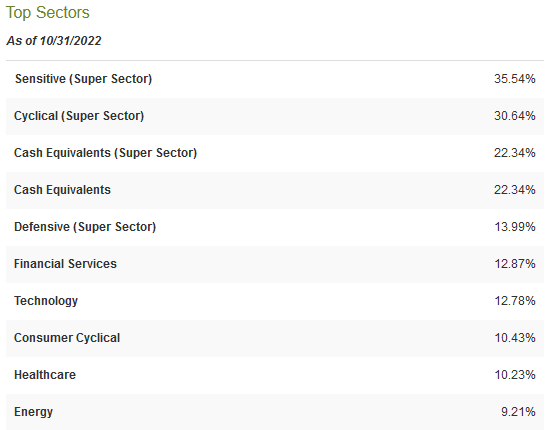

Another thing that we notice by looking at the largest positions in the fund is that the Madison Covered Call & Equity Strategy Fund appears to be quite well-diversified across sectors. This is the case across the entire portfolio, as we can see here:

CEF Connect

This is something that is quite nice to see because each of these sectors has different fundamentals. For example, technology has suffered much more over the past year than healthcare or energy. This is because the rising costs have hurt the ability of consumers to spend money on discretionary items. Consumer cyclical has been in the same situation as it is heavily dependent on consumers having a discretionary income. The fact that the fund is invested in all different sectors generally provides us with the best of all worlds, which is always a good thing as strong performance in one sector helps to balance out weak performance in other sectors.

Distribution Analysis

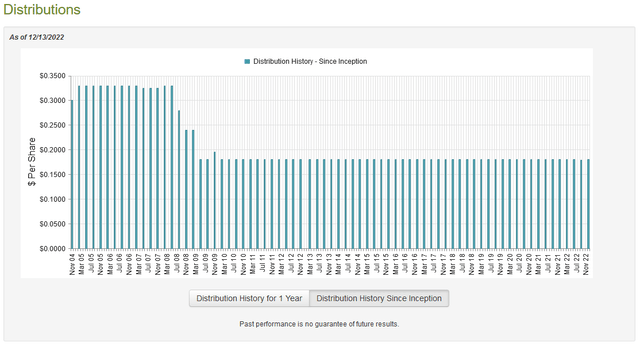

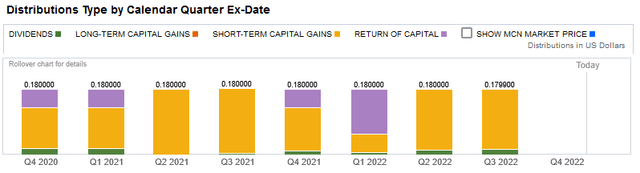

As stated earlier in the article, the Madison Covered Call & Equity Strategy Fund has the stated objective of providing its investors with a high level of current income and gains. In order to achieve this objective, it uses a covered call strategy, which when well-executed tends to result in a fairly large amount of income. Thus, we might assume that the fund pays out a fairly high distribution itself. This is certainly the case as it currently pays a quarterly distribution of $0.1800 per share ($0.72 per share annually), which works out to a 9.24% yield at the current price. The fund has been consistent about this payout since 2009, although it did have a higher distribution prior to that:

It is difficult to fault the fund for cutting its distribution back in 2009 as that was the time of one of the worst market crashes and recessions that we have experienced since the Great Depression. The fund has still managed to maintain its current distribution for more than a decade, which is a better track record than most closed-end funds possess. This seems likely to appeal to those investors that are looking for a stable source of additional income from their portfolios to pay their bills or cover other expenses. However, these same investors might be concerned with the relatively large return of capital distributions that are being made in certain quarters:

The reason why this might be concerning is that a return of capital distribution can be a sign that the fund is returning the investors’ own money back to them. This is obviously not sustainable over any sort of extended period. However, there are other things that can cause a distribution to be classified as a return of capital. In the case of this fund, the distribution of money generated through covered call sales can be considered a return of capital or a capital gain depending on the situation. That is probably the source of most of the money being distributed here but we should still investigate the fund’s finances in order to determine how sustainable the distributions are likely to be.

Fortunately, we have a fairly recent document that we can consult for that purpose. The fund’s most recent financial report corresponds to the six-month period ending June 30, 2022. As such, it will not include data for the past few months but it should still give us a good idea of how well the fund handled the market volatility that dominated the first half of the year. During the six-month period, the Madison Covered Call & Equity Strategy Fund received a total of $24,510 in interest and $1,185,933 in dividends from the investments in its portfolio. After we net out foreign withholding taxes and add in a small amount of securities lending income, the fund had a total income of $1,200,182 during the period. It paid its expenses out of this amount, which left it with $371,518 available for investors. This was obviously nowhere close to enough to cover the $7,554,729 that the fund paid out in distributions.

While that may be somewhat concerning, the fund does have other methods to obtain the money that it needs to pay the distributions. One of these methods is receiving capital gains. It generally failed at that during the period. The fund did manage to achieve net realized gains of $7,415,566 but this was more than offset by net unrealized losses of $15,977,607 during the period. However, we also have to consider the money that the fund received from option premiums as that may not be included in capital gains. The best way to do this is to compare the amount that the fund had under management at the start of the period. Overall, over the six-month period, the fund’s assets declined by $15,687,614 over the six-month period after accounting for all inflows and outflows. Thus, the fund failed to cover its distribution over the first half of the year. It did, however, have enough net realized gains and net investment income to cover it, but the decline in assets is still worrying. This is because the lower the fund’s assets, the more difficult it is to earn the capital gains that are needed to cover the distribution. Thus, we do want to keep an eye on this, especially because the fund’s assets at the end of the period were actually lower than they were at the end of 2020.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of the fund’s assets minus any outstanding debt. This is therefore the amount that the fund’s shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a scenario implies that we are buying the fund’s assets for less than they are actually worth. This is unfortunately not the case with this fund today. As of December 13, 2022 (the most recent date for which data is currently available), the Madison Covered Call & Equity Strategy Fund had a net asset value of $7.26 per share but the shares actually trade for $8.01 per share. This gives the shares a 10.33% premium at the current price. This is substantially higher than the 6.18% premium that the fund’s shares have averaged over the past month so it certainly looks very expensive today. While I generally do not like to buy any closed-end fund at a premium, this seems like a remarkably high price to pay for a fund that is not even covering its distribution. It may be best to wait on this one until the price falls to a reasonable level.

Conclusion

In conclusion, the Madison Covered Call & Equity Strategy Fund could be a good pick for a flat market. This is because the fund’s options strategy can generate positive returns even if capital gains are very hard to come by. The fund boasts a very well-diversified portfolio with exposure to many different industries, which likewise should prove to be a good thing today as economic conditions are uncertain, to say the least. Unfortunately, Madison Covered Call & Equity Strategy Fund is currently failing to cover its distribution and is trading for an incredibly expensive price. Due to those two negatives, it may be best to sit on the sidelines for now until the outlook is more certain or the price of Madison Covered Call & Equity Strategy Fund declines to a more reasonable level.

Be the first to comment